In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/01 Report--

After more than two months, Jia Yueting's Letv Building was finally sold out. On November 30, the real estate on Floor 1-14, Building 3, No.105 Yaojiayuan Road, Chaoyang District, Beijing City was successfully auctioned. According to Ali auction information, the starting price is still 573 million yuan two months ago, but compared with 678 million yuan for the first auction in two years, the auction price dropped by more than 100 million yuan.

According to reports, the entire auction process was less than an hour, although there were more than 10,000 people watching but only one person signed up, unexpectedly, the only bidder was a company registered only five days ago, leading many people to speculate: this company or specially established for the auction.

According to the confirmation letter of successful online bidding, Beijing Hengying Property Management Co., Ltd. was established on November 25, with Zhang Hongming as its legal representative, Wen Caiyun as its actual controller and a registered capital of RMB 10 million yuan.

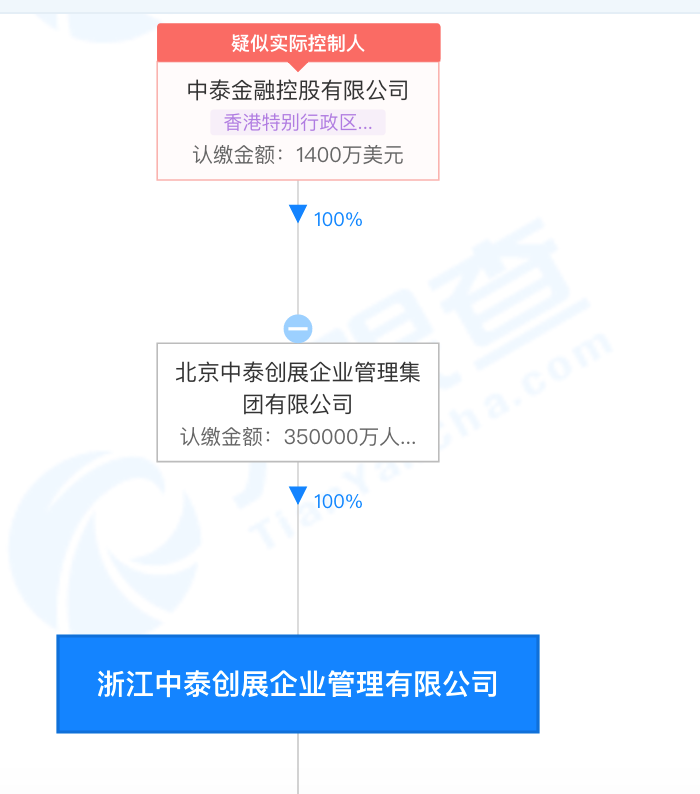

The executor of the judicial auction is Zhejiang Zhongtai Chuangzhan Enterprise Management Co., Ltd., which is 100% owned by Beijing Zhongtai Chuangzhan Enterprise Management Group Co., Ltd. and the ultimate beneficiary is a Hong Kong company.

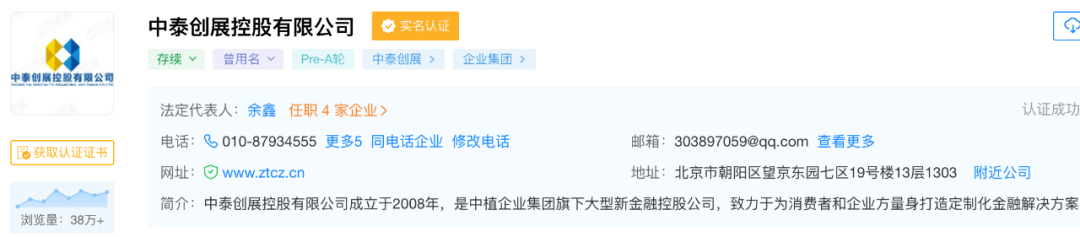

In addition, Yu Xin, chairman of Beijing Zhongtai Chuangzhan Enterprise Management Group, and several directors are senior executives of Zhongzhi Group. According to the App information, Zhongzhi Enterprise Group has another Zhongtai Chuangzhan Holding Co., Ltd., whose chairman is also Yu Xin.

Four months ago, a subsidiary of Zhongzhi took over Shimao Gongsan, another commercial real estate project of Letv Holdings in Beijing.

It can be seen from the above information that there is no equity relationship between the bidder and the applicant executor of this LeEco Building. However, according to 36kr and interface news reports, a senior person in the field of disposal of non-performing assets said: It is not excluded that the creditors of the building may hold the offer through non-related parties. Perhaps the receiving party of LeEco Building is still the planting system of the non-performing assets disposal party. However, in response to this news, the relevant parties did not make any response.

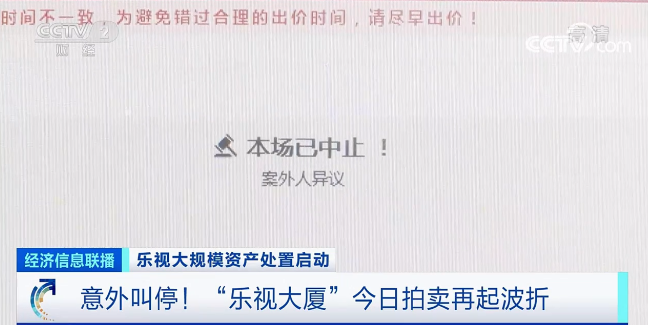

As mentioned at the beginning of the article, LeEco Building has undergone two public auctions before. In May 2019, the court asked Le.com to vacate from Le Rong Building for subsequent real estate auction. On November 18,2019, Le Shi Building was auctioned for the first time with a starting price of 678 million yuan. Later, due to "the outsider raised objection to the auction property", the first auction was suspended. On September 9 this year, Letv Building entered the second auction procedure. Ali auction information showed that the evaluation price of the building dropped to 818 million yuan, and the starting price also dropped to 573 million yuan. However, the auction was still unsuccessful after the price was reduced by 100 million yuan. On the day of auction, the auction was suspended again due to no bidder signing up for the auction and objection from outsiders. It is worth noting that earlier in 2017, LeEco tried to sell LeEco Building for 1.4 billion yuan, but no one took over due to debt disputes, and now the third auction price has shrunk significantly.

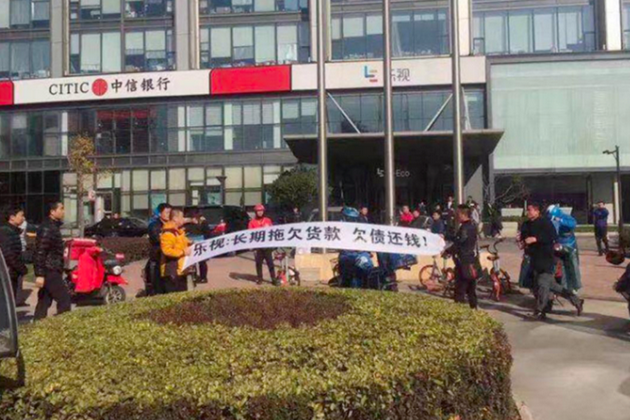

Letv Building is another important asset of Jia Yueting after Shimao Gong III. It can be said that it witnessed the new decline of Letv and was also Jia Yueting's highlight moment. According to public information, Letv was founded in November 2004 and listed on China's Growth Enterprise Market on August 12, 2010. In 2014, Jia Yueting bought Letv Building to become the headquarters building of Letv Group. In the second year after moving into Letv Building, Letv's share price reached its highest point, with a market value of more than 170 billion yuan, becoming the leader of the Growth Enterprise Market. On April 20, 2016, Letv's LeSEE concept car made its debut, but the good times did not last long. By the end of 2016, LeEco had a capital crisis. Since then, suppliers owed by LeEco often gathered downstairs to collect debts from LeEco. In order to repay debts, LeEco began to sell assets. LeEco Building was also used as an asset pledge, thus obtaining a loan fund of 1.4 billion yuan, but this did not improve LeEco's financial situation.

In January 2017, Jia Yueting introduced Sunac China to take over Letv. com, and Letv Building was renamed Le Rong Building in 2018. In May of the same year, Letv carried out major layoffs and was also urged by a large number of suppliers for debt. Later, Jia Yueting also left for the United States.

In July 2017, Jia Yueting left the United States to help Faraday raise funds in the future, and the mass production listing of Letv cars was put on hold. In October 2017, China Evergrande and Jia Yueting signed an investment agreement of US $2 billion to sell Faraday's future 45% equity, but in the end they only got US $800 million from Evergrande. Faraday, who has difficulty in financing, tried to obtain sufficient cash flow through listing in the future. In order to ensure a smooth listing, Jia Yueting adopted personal bankruptcy reorganization in the United States and did not announce the completion of the reorganization until 2020. On July 22 this year, Faraday FF will appear on NASDAQ market in SPAC mode, but Faraday will be short soon after listing. Not long ago, Faraday FF was accused of failing to comply with NASDAQ listing rules due to delay in submitting the third quarter financial report. It was delisted only four months after listing. However, Faraday Future also responded that it was maintaining close communication with NASDAQ Exchange and striving to submit quarterly reports as soon as possible. It returned to the regular announcement process. At present, Faraday's future market value is less than US $2 billion. So it's unlikely that Faraday's future assets will pay off his debts.

It is understood that the funds successfully obtained from this judicial auction will be used to repay the corresponding debts. In fact, LeEco Building is not the only asset recently auctioned by LeEco. Earlier this year, Jia Yueting and his ex-wife Gan Wei's 30 million yuan property was forced to auction to repay arrears. On July 28, Jia Yueting's most valuable asset in China, Shimao Sangong, was also auctioned. Shimao Sangong was purchased by Letv Holdings at a price of 2.972 billion yuan in 2016, but almost 50% off at auction, and finally auctioned by Beijing Zhuorui Property Management Co., Ltd. at a price of 1.645 billion yuan.

At present, LeEco and Jia Yueting are still heavily indebted, and the assets sold are only a drop in the bucket for LeEco's debts. Industry insiders point out that Jia Yueting needs to sell at least 40 LeEco buildings if he wants to pay off LeEco's debts, but 40 LeEco buildings are only assuming that LeEco does not have so many assets, and it is almost impossible to pay off debts with Faraday's future assets.

According to Le.com's financial report data for the first half of 2021 released on August 30 this year, Letv's existing assets total 4.021 billion yuan, total liabilities 21.638 billion yuan, asset-liability ratio as high as 538.13%, in the face of huge debts, Jia Yueting will solve, at present is still a big question mark.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.