In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/15 Report--

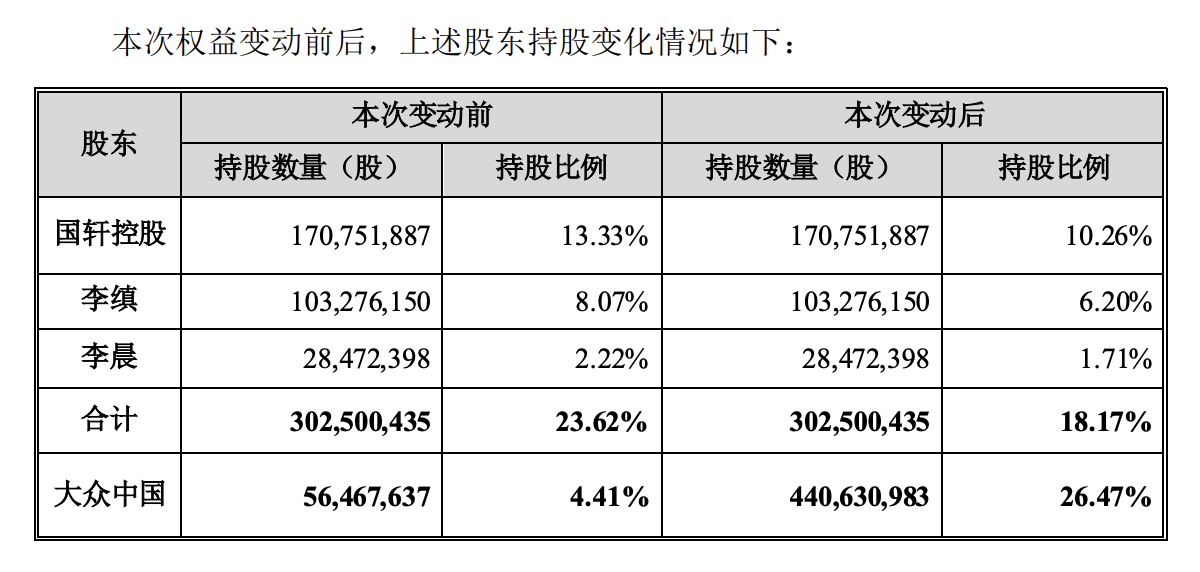

This evening, Guoxuan Hi-Tech announced that it had issued 384 million A-shares to Volkswagen China, which was listed on the Shenzhen Stock Exchange on December 15. After the completion of the non-public offering, the total share capital of the company increased to 1.665 billion shares. as a result of the above equity changes, the shareholding ratio of Li Gong, the company's actual controller, and his co-actors changed from 23.62% to 18.17%. Volkswagen China's shareholding ratio increased from 4.41% to 26.47%, becoming the largest shareholder of the company.

It is understood that the non-public offering of shares began in May 2020. On May 28, 2020, Guoxuan Hi-Tech announced that Volkswagen China Investment will make a strategic investment in the company as a strategic investor in two ways. First, it will subscribe in accordance with the terms and conditions agreed in the "shareholders Agreement". Subscribe for the shares that Guoxuan Hi-Tech issued to it, which is equivalent to 30% of the total number of shares issued by Guoxuan Tech before this issue. Second, in accordance with the terms and conditions agreed in the share transfer Agreement, a total of 56.4676 million shares of Guoxuan Hi-Tech will be transferred from Zhuhai Guoxuan Trading Co., Ltd and Li Wei.

According to the previous commitment of Volkswagen China Investment, in order to ensure the steady development of Guoxuan Hi-Tech, Volkswagen China Investment will give up some of its voting rights in at least the next three years. As a result, Li Gong and his actors are still the shareholders holding the largest voting rights of listed companies.

Materials show that Guoxuan Tech was founded in 1995, is a lithium battery cathode materials research and development company, its main products include lithium ion battery wet separator, lithium battery cathode materials, power battery cathode materials, lithium iron phosphate battery pack, BMS management system, etc., widely used in pure electric passenger vehicles, pure electric commercial vehicles, microgrid energy storage systems and other fields. According to the data released by the China Automotive Power Battery Industry Innovation Alliance, from January to November this year, Guoxuan Hi-Tech ranked fourth in the country in terms of 6.6Gwh loading, with a market share of 5.1%, second only to Ningde Times, BYD and China New Airlines.

Since the new energy vehicle has become the tuyere, the sales and market value of the electric vehicle enterprises headed by Tesla have continued to soar, as well as the positive and pressure of relevant policies, more and more traditional car companies have begun to transform to new energy vehicles. Volkswagen also had to follow suit and threatened to "replace Tesla as the leader of the electric vehicle industry by 2025". Just a few days ago, Volkswagen announced a new electrification transformation plan, which will invest 89 billion euros ($101 billion) in research and development such as electric vehicles and digital in the next five years, which will account for 56% of the group's total investment. it is also one of Volkswagen's transformation plans.

At present, the development of Volkswagen in the new energy vehicle market has just improved. Take the Chinese market as an example, Volkswagen China's layout of new energy to ID. Family-based, which is produced and sold by FAW-Volkswagen and SAIC-Volkswagen respectively, the current monthly sales are stable at more than 10,000 vehicles, including ID in November. The family delivered 14167 new cars. However, the planned target of selling 80,000 vehicles a year may be difficult to achieve.

It is worth mentioning that Anhui, where Guoxuan high-tech is located, will be the core area of Volkswagen's in-depth layout of China's new energy vehicle market in the future. Volkswagen also has an important layout in Anhui, that is Volkswagen (Anhui) Co., Ltd., that is, the former Jianghuai Volkswagen, its brand is Sihao. According to Tianyan Cha, Volkswagen China Investment holds a 75% stake in Volkswagen (Anhui) as the largest shareholder and owns the management of the company. Volkswagen Group has promised to award 4-5 Volkswagen Group branded products to the joint venture, with the goal of producing 20-250000 vehicles by 2025 and 35-400000 vehicles by 2029.

Guoxuan Hi-Tech and Volkswagen Anhui will be the right-hand men to achieve this goal, the acquisition of Jianghuai or its choice to expand production capacity and achieve electrification strategy, while ownership of electric car battery manufacturer Guoxuan Hi-Tech is likely to be its supporting project. According to Volkswagen Group, 11.6 million pure electric vehicles will be produced in China in 2028.

It is worth mentioning that the fact that Volkswagen China has become the largest shareholder of Guoxuan Hi-Tech does not mean it has become a German company. According to the previous commitment of Volkswagen China Investment, in order to ensure the steady development of Guoxuan Hi-Tech, Volkswagen China Investment will give up some of its voting rights in at least the next three years. As a result, Li Gong and his actors are still the shareholders holding the largest voting rights of listed companies.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.