In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-05 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/28 Report--

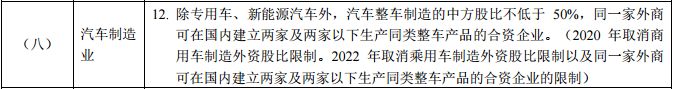

On December 27, 2021, the National Development and Reform Commission and the Ministry of Commerce issued the Special Management measures for Foreign Investment access (negative list) (2021 edition) and the Free Trade pilot Zone (negative list) (2021 edition). Starting from January 1, 2022, China will abolish the restriction of foreign equity ratio in passenger car manufacturing and the establishment of only two or less car enterprises by the same foreign businessman.

The current policy restriction on foreign-invested automobile enterprises stems from the "Automobile Industry Policy" issued by China in 1994. During the specific historical period of "market for technology", the policy made clear provisions on investment in the automobile industry, including that the proportion of shares held by foreign investors should not be higher than the 50% upper limit. In addition, foreign enterprises are required not to establish more than two joint ventures and cooperative enterprises in China for the same category of vehicle products. The above-mentioned document was revised in 2004 and 2009, but the above limitations are still retained and are still applicable today. The negative list of December 27 specifically put forward: "in the field of automobile manufacturing, the restrictions on the ratio of foreign investment in passenger car manufacturing and the restrictions on the same foreign investors can set up two or less joint ventures producing similar vehicle products in China." this protective policy, which has been implemented for more than 20 years, has come to an end.

In 2013, the Ministry of Commerce proposed that foreign investment restrictions on cars would be liberalized in the future. Subsequently, the national leader also proposed in a German newspaper that "the Chinese side will actively consider the request of Volkswagen of Germany to increase its stake in the FAW-Volkswagen joint venture." At the closed-door summit of the China Automobile Forum in 2016, Miao Wei, then minister of industry and information technology, revealed that the stock ratio had entered the countdown stage, ranging from eight years to three to five years. Miao Wei also said that local car companies should seize the time to enhance brand competitiveness and cope with the competition from foreign-owned and even wholly-owned car companies in the future.

The sound of opening up the stock ratio has just come out, which will naturally cause a great deal of controversy, and most domestic car companies protest against it. Dong Yang, executive vice president of the China Association of Automobile Manufacturers, said that local brands still need to be protected, blaming the liberalization of the stock ratio, "who liberalizes the stock and who is a big traitor." but a small number of private car companies, including Li Shufu, chairman of Geely Motor, openly expressed their support. he said that he would use market techniques to really form competition between Chinese enterprises and foreign enterprises, rather than foreign enterprises and state-owned enterprises to hold groups to compete with the people. Compete with users. In response to the above different views at a media meeting in 2013, Li Shufu asked, "are they patriots and are Geely traitors?"

Now it is only six years from the timetable issued by Miao Wei, the former minister of industry and information technology, and the time is not too urgent. I believe that the relevant enterprises have already made preparations for the relevant competition. This is not the first time that the policy of the automobile industry has been liberalized. On June 28, 2018, the National Development and Reform Commission issued the "Special Management measures for Foreign Investment access (negative list) (2018 version)" to liberalize new energy vehicle companies. The policy was implemented on July 28, 2018, and the revision still maintains the protection of traditional car companies.

Tesla Shanghai was established on May 10, 2018, because of the above policy, the business scope at that time did not include "whole vehicle manufacturing" until one month after the negative list was updated. Tesla officially added the electric vehicle and parts "production, sales, maintenance and other after-sales service", thus Tesla officially opened the prelude to the competitive game in China to build a wholly-owned factory. This is described in the industry as the introduction of a disruptive catfish. The catfish received not only policy liberalization, but also loans from several banks totaling nearly 20 billion yuan, and in May, Tesla announced that the loan had been repaid in advance.

According to the latest figures from the Federation of passengers, Tesla's wholesale sales again exceeded 50, 000 in November, reaching 52859, compared with 54391 in October. An increase of 111% over the same period last year. This is the third month in a row that Tesla has exceeded 50, 000 vehicles. As of November, the delivery volume of Tesla Shanghai Super Factory had exceeded 400000 vehicles in 2021, reaching 413283 vehicles, an increase of 242% over the same period last year. Overall sales of new energy passenger vehicles reached 429000 in November, up 17.9% from the previous month and 131.7% from a year earlier.

BMW, the first beneficiary of the policy loosening, took a 25 per cent stake in brilliance China on January 18, 2019, raising its stake in brilliance from 50 per cent to 75 per cent. As part of the deal, BMW agreed to introduce X5 models and future BEV models for local production. Because the open policy has laid the groundwork for many years, or it will not have a far-reaching impact as when Tesla was introduced, but it will certainly have some impact on joint ventures with poor stock and poor performance. in the past, a brand did not perform well in the market. the easiest reason to find is that there are running-in problems between the two sides of the joint venture but cannot be eradicated. the liberalization of the policy may provide a new way to solve these problems.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.