In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)12/28 Report--

Yesterday, the exclusive product of commercial insurance for new energy vehicles was officially launched. In the past, there were no special terms for new energy vehicles, so the car insurance of traditional fuel vehicles has been used for new energy vehicles in the past. According to the latest statistics of the Ministry of Public Security, by the third quarter of 2021, the number of new energy vehicles in the country has reached 6.78 million, and some accidents are unique to new energy vehicles. To this end, the China Insurance Industry Association issued the exclusive provisions of Commercial Insurance for New Energy vehicles (for trial implementation) on December 14th.

There is no difference between new energy vehicles and traditional fuel vehicles in daily traffic accidents, but the liability for compensation caused by the problems of the product itself has not been clear, such as battery spontaneous combustion, or battery, motor, the problem of electronic control is also clearly defined as the responsibility of insurance claims in the implementation of the commercial insurance of new energy vehicles. At present, the exclusive car insurance for new energy vehicles of 12 property insurance companies, such as PICC property Insurance, Ping an property Insurance and Taibao property Insurance, can be purchased, and users who have purchased car insurance need to apply special insurance at the expiration of the current car insurance.

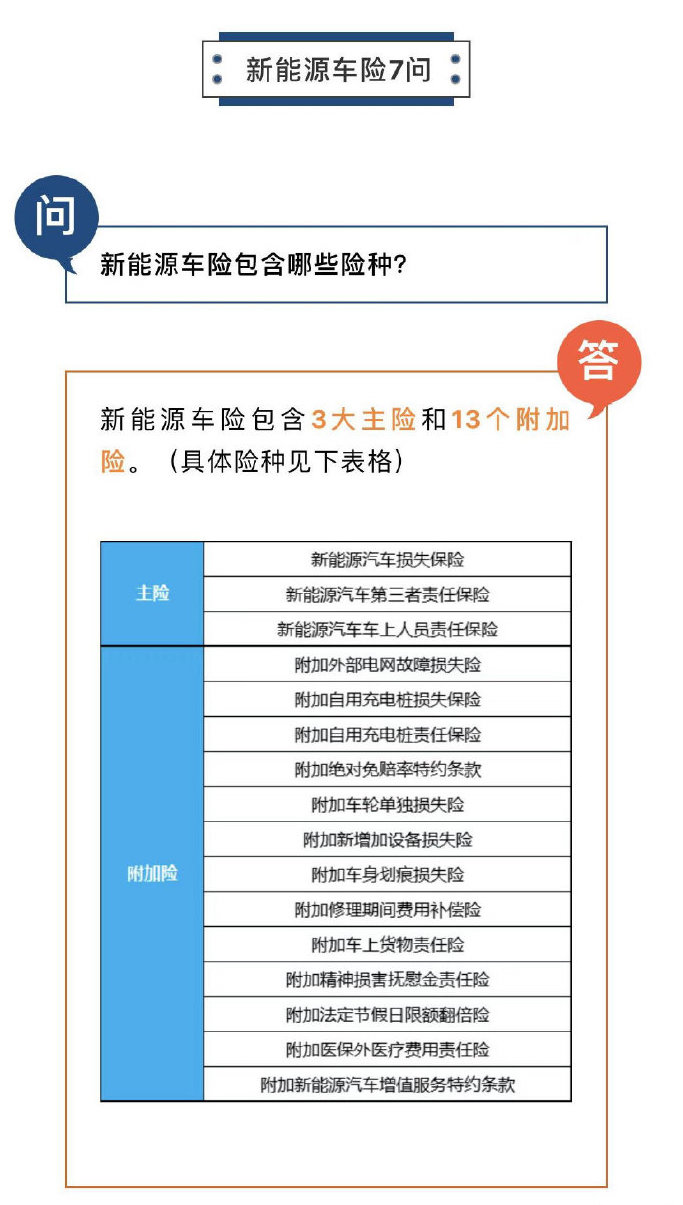

In the new energy vehicle insurance clause issued by the China Insurance Industry Association, it lists the use scenarios in which the driving, parking, charging and operation of the vehicle are all insured, including 3 major insurances and 13 additional insurances. the main insurance includes new energy vehicle loss insurance, new energy vehicle third party liability insurance, new energy vehicle personnel liability insurance, traffic compulsory insurance has not changed. New energy vehicles such as pure electric vehicles, hybrid vehicles and fuel cell vehicles can be insured.

The insurance liability of new energy vehicle damage insurance covers the unique structure of new energy vehicles such as the "three electricity" system, which clearly lists the liability of "fire and combustion" as insurance payment. at the same time, it also expands the risk factors such as charging pile and external power grid through additional insurance. Under the framework of this insurance agreement, there is no need for car owners and manufacturers to wrangle over the accidents and losses caused by the product itself, and most of the problems are borne by insurance companies, which will play some role in promoting the development of new energy vehicles.

In principle, the liability is clearly attributed to the insurance company, which to a certain extent means that the compensation expenditure of the insurance company is bound to increase, while the insurance company has different premiums according to different products and car owners, and will not lose money. Some insurance companies responded that 80% of car owners' benchmark premiums would fall. However, it is specially emphasized that the influence will be changed according to the traffic violation record, the number of times out of insurance and other factors, and the actual premium shall prevail.

Some netizens released a comparison of premiums before and after the new energy car insurance came into effect. According to this insurance quotation, the price of the same car is also 363900, and the premiums of the two almost doubled, which attracted netizens' attention. According to the quotation, the total price of the car insurance purchased by Tesla Model Y on December 23 is 8278 yuan, the car damage insurance is 363900 yuan, and the premium is 5797 yuan; the three liability insurance is 2 million yuan, the premium is 1106 yuan, and the compulsory insurance is 950 yuan. And the same insurance items and rights and interests, on December 27th, after the launch of new energy vehicle insurance, the premium price was guaranteed to 14902 yuan / year, of which the most important factor was the largest increase in motor vehicle loss insurance, which soared from 5759 yuan to 12736 yuan, which led to a direct doubling of car loss insurance. It is not clear whether this gap is affected by the number of times the driver himself comes out of the insurance.

The auto industry's concern through the insurance calculation function of Tesla's official website shows that the premium on the official website of Sila Model3 P has also risen from 8000 to 18000, and the quotations of many insurance companies are not much the same.

Regardless of the owner's own insurance conditions, a similar performance was seen from another comparison of the old and new terms and charges circulated on the Internet. According to the comparison table, the insurance premiums of most common electric models in the market have increased to varying degrees, of which the vehicle losses of many of Tesla's models have increased by 114%, of which the total standard premiums of car Xiaopeng and NIO will increase by 27.63% to 37.31%. The two models of BYD remain the same or decrease, which may represent the insurance company's view of the compensation cost of different products. Usually, the standard premium of an insurance company is based on nothing more than the probability of getting out of danger and the cost of maintenance.

Both of the above two labels show that Tesla's premium has increased significantly in the special insurance for new energy vehicles, and the change in premium may not have much impact on most Tesla users, and the price factor is not a factor for consumers of the Tesla brand to consider. On the other hand, Musk said in the third quarter of last year that insurance would become Tesla's main product, and the insurance business would account for 30% of the vehicle business. In August last year, Tesla registered Tesla Insurance Brokerage Company in China, and that would be another big war.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.