In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/09 Report--

For a car company that does not have much sales, the general public's evaluation of the success or failure of a car company is its market capitalization. The stock price of the US electric pickup brand Rivian fell back to its offering price two days ago. It set a record in the highlight moment on the fifth day of listing, with a market capitalization of more than 100 billion, surpassing the traditional automakers GM and Ford to become the third largest car company in the world after Tesla and Toyota. Ironically, both GM and Amazon invested in Rivian in 2019. In the past 2021, GM significantly reduced delivery in the US market because of a shortage of chips. at the same time, its electric car products were recalled and halted directly because of battery defects. Only 26 electric vehicles were sold in the fourth quarter.

Rivian announced its listing on NASDAQ on November 10, 2011. it was priced at $78 on the day of its offering, and during trading last Wednesday, the price fell below 75.13 to an all-time low. The previous session was at 86.28, but the market capitalization was only $77.68 billion.

Founded in 2009 and headquartered in Irvine, California, Rivian plans to include electric SUV, pick-up trucks and trucks, focusing on electric pick-up vehicles Rivian R1T and electric SUV Rivian R1SRivian. Positioned as an electric pickup truck with shareholders GM, Ford and Amazon, Amazon ordered 100000 electric vans in 2019, the first of which will be delivered in 2022, with money, orders and future sales guaranteed. This is the strength of Rivian, also known as the killer Tesla.

With this in mind, Rivian shares peaked at $179.47 on November 16, 2021, with a market capitalization of $161.523 billion, making it the third largest car company in the world by market capitalization. Investors are immersed in the imagination of the future of Rivian, while in reality, Rivian launched its first model R1T electric pickup truck in September 2021 and began to deliver another model, the R1S electric SUV, in December 2021. Rivian reported that as of September 30, 2021, it had produced 12 R1T electric pickups and delivered 11. As of December 15, 2021, Rivian has produced 652 vehicles and delivered 386 R1 vehicles.

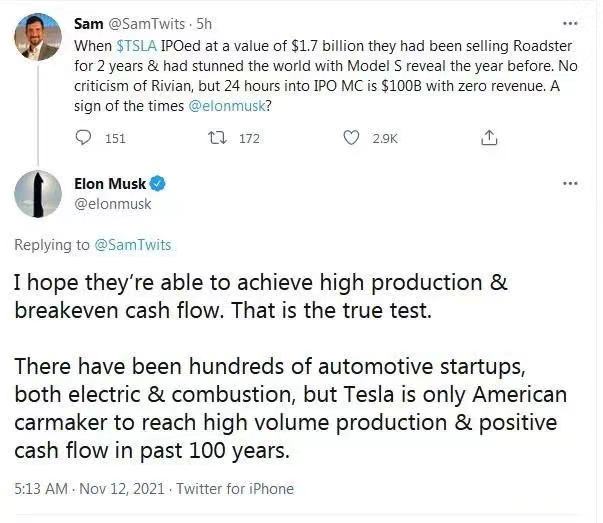

At the beginning of the listing, contrary to the enthusiasm of investors, Musk, the veteran driver of market capitalization, gave advice to Rivian as soon as he went public: "I hope Rivian can achieve mass production and positive cash flow, this is the real test that the company is facing." Tesla is the only American car company that has achieved mass production and positive cash flow in the past 100 years, whether it's fuel or electric cars. " Previously, he also commented that Rivian opened a second production line before the first production line was in normal operation, and did not focus on large-scale mass production and handing over sales results, and he first magnified the probability of failure. Now it seems that Musk's new energy car-building and market-building is worthy of his predecessor, and Jiang is still old and hot.

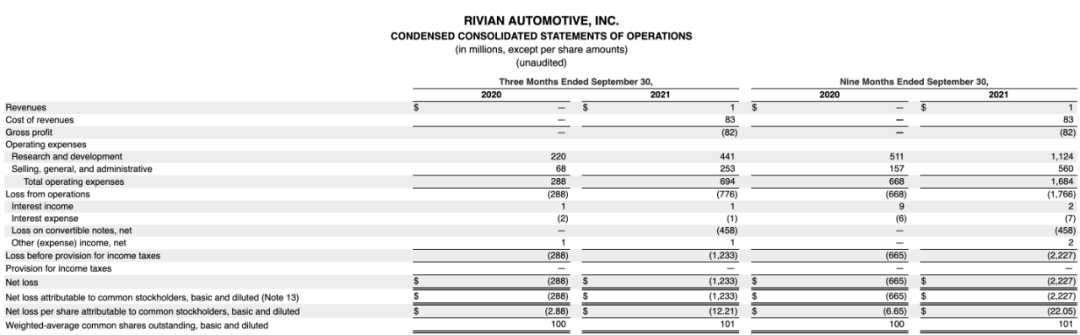

In December 2021, Rivian said that due to the supply chain, it could not meet the expected production target for 2021, and Rivian could only deliver a few hundred vehicles in 2021, compared with the previous plan of 1200. In addition, Rivian's market capitalization has shrunk significantly, in addition to the basic reason that there is no increase in delivery performance, there are also a number of reasons. After the US stock market traded on December 16, 2021, Rivian took a knife on its own one month after its listing, and its third-quarter earnings report of huge losses dealt a heavy blow to the stock price. In the third quarter of 2021, Rivian posted a loss of $1.233 billion, a sharp increase compared with a loss of $288 million a year earlier. From January to September of 2021, the net loss of Rivian was as high as $2.227 billion, which was also significantly higher than the loss of $665 million in the same period in 2020. Rivian shares fell as much as 10.26% the next day, and by the 20th, Rivian shares fell to an all-time low of $88.40.

Investors were bewildered on Wednesday when Stellantis, a veteran European manufacturer, announced that it would sell its electric Ram ProMaster vans to Amazon from 2023. At the beginning, the rapid advance of the listing of Rivian was due to the fact that it was backed by Amazon, the second largest shareholder, and the order for 100000 electric trucks, which brought Rivian to the altar. Now, only two months later, Carlos Tavares, Stellantis's chief executive, said he had tens of thousands of vehicles on hand to be delivered to Amazon in the next few years. "this is a conservative figure," the CEO stressed. In addition, the two sides will work together on cloud computing, and Amazon and Stellantis will work together to develop STLA SmartCockpit software, which will be available on millions of vehicles from 2024. The service will integrate Amazon's Alexa voice assistant, e-commerce, maintenance, navigation and other car functions. Stellantis said that the company will transfer vehicle data to the cloud system, and Amazon will become its preferred vehicle platform cloud provider. Amazon is not only a seller, but also the world's largest cloud computing service provider. Who knows what it is thinking about the future of electric vehicles, Rivian will not be the only choice for this plan. Amazon chooses to work with traditional car factories with delivery volume, not Amazon's face anyway. It's the face of Rivian and investors. Stellantis competes directly with Rivian for Amazon's business, prompting investors to sell Rivian. Shares of Rivian, an electric truck company, plunged last Thursday, falling 16% to $75.13, a moment in history that fell below the offering price was directly created by the two shareholders.

In fact, at this time when the stock price of Rivian fell, both the US market and the Chinese market lowered their expectations for new energy vehicles at the same time, so that the share prices of relevant car companies and raw materials companies fell one after another. Tesla, BYD and Ningde era all fell to varying degrees. The market believes that earlier gave the industry too high market value expectations. The most representative of these is the view of the Federal Reserve, which released its minutes on January 6th, explicitly mentioning that in the face of the currency caused by high-speed money printing in recent days, it would raise interest rates earlier and faster, cut back on bond purchases and shrink the government's balance sheet. Cutting back on bond purchases would slow the flow of money to the market, raising interest rates to bring money back to the financial system, and shrinking government balance sheets would make printed money disappear. So, where is the money that flowed out earlier? Stock market! Where is the stock market? Fast-growing technology stocks, such as Rivian, and raising interest rates will also directly reduce corporate profitability. The follow-up of Rivian may need to solve the problem of delivery volume first. after the market has digested a system of economic information, it remains to be seen whether it can rise wave after wave like Tesla.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.