In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/23 Report--

Recently, Chinese Express has frequently gone out of circles. On January 17, Chinese Express officially signed a cooperation agreement with Qingdao City. The project includes that Chinese Express will set up China headquarters in Qingdao and establish Gaohe Automobile Sales Service Corporation to build a world-class R & D technology center facing the world. On January 19, Gaohe Automobile, an automobile brand owned by Chinese Express, announced that the 5000th luxury intelligent SUV Gaohe HiPhi X was officially launched. On the same day, according to market sources, Chinese Express is considering a $500 million Hong Kong IPO, working with UBS and Morgan Stanley on the IPO. Chinese Express did not respond to market news.

According to the data, Chinese Express is an innovative travel technology company founded by Ding Lei in 2017 and focusing on the future intelligent transportation industry. Ding Lei, founder of Chinese Express, has a complicated background. He once served as vice president of SAIC Group, general manager of Shanghai General Motors Co., Ltd., secretary of the Party committee and general manager of Shanghai Zhangjiang (Group) Co., Ltd., and deputy district chief of Shanghai Pudong New District. In September 2015, Jia Yueting invited him to join Letv as co-founder of Letv Automobile and global vice chairman of Letv Automobile. In March 2017, Ding Lei left LeEco, which happened to be the year when the capital chain crisis broke out in LeEco system. Jia Yueting left the United States in July 2017 to help Faraday Future (FF) finance. In the same month, Ding Lei established Chinese Express and released the automobile brand Gaohe in July 2019.

In May 2020, Jia Yueting's personal bankruptcy reorganization was finally confirmed and approved by the Central California Bankruptcy Reorganization Court. In July 2020, Jia Yueting posted a letter of apology titled "Working to start a business, restarting life, with my apology, gratitude and commitment" on Weibo. Two months later, Gaohe HiPhi X, the first production car of Gaohe Automobile, was officially launched. At that time, two models were launched, priced at 680,000 yuan and 800,000 yuan respectively. From the price point of view, Gaohe HiPhi X is the highest selling price pure electric vehicle among domestic independent brands at present. When it was just announced for listing, it also caused hot discussion on the Internet because it was "too expensive", and was once not favored by the market. After all, the last domestic new force model sold so expensive-Future K50 has been in deep trouble.

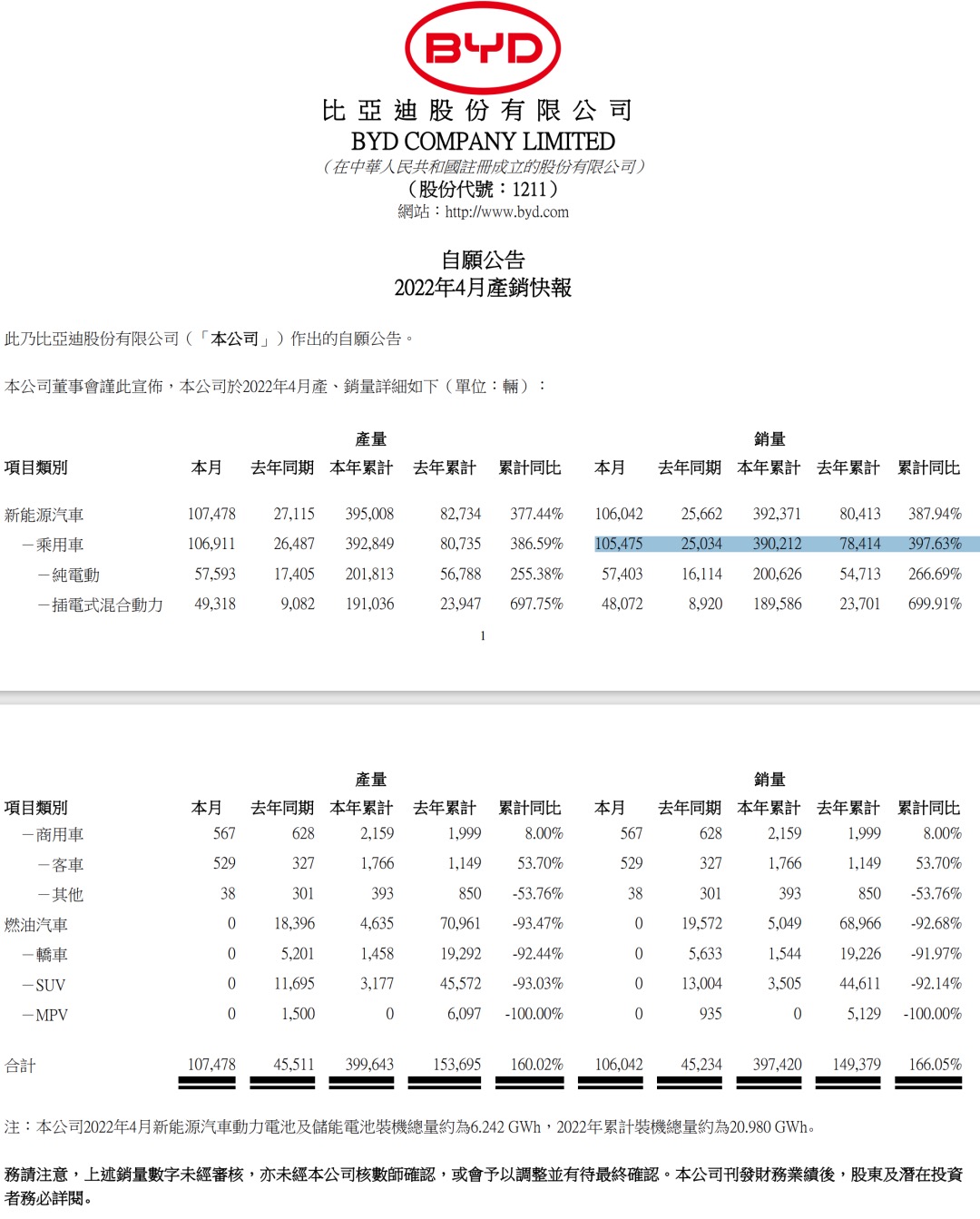

According to the data released by Gaohe, the accumulated sales volume of 4237 vehicles in 2021, including 3724 vehicles from July to December, successfully won the sales champion of luxury brand electric vehicles with more than 500,000 yuan in the second half of the year. According to a ranking of luxury electric vehicle sales of more than 500,000 yuan, Gaohe HiPhi X won the first place with 919 vehicles in December 2021, followed by Porsche Taycan and Mercedes-Benz EQC. According to the automobile industry attention statistics, in recent months, Gaohe HiPhi X has been out of the circle in this way, by comparing the luxury electric vehicles with the price of more than 500,000 yuan, in order to highlight the positioning of Gaohe HiPhi X in the luxury electric vehicle market. From the comparison of data, in the electric vehicle market of more than 500,000 yuan, Gaohe HiPhi X is indeed excellent, but there are not many electric vehicles of more than 500,000 yuan. In addition. If placed in the new energy vehicle market, this data can only be said to be flat. According to the number of new car insurance purchases, BYD sold 525,800, Tesla 322,500, Xiaopeng 96,600, ideal 91,300 and NIO 90,800.

On January 17, Chinese Express officially announced the signing of a cooperation agreement with Qingdao City, where it will set up its headquarters in China and establish Gaohe Automobile Sales Service Corporation. At the same time, there is news that Chinese Express plans to list on the Hong Kong Stock Exchange to raise $500 million. From the side, it may indicate that there is certain financial pressure on Chinese Express. According to Sky Eye Inspection, Chinese Express has only raised funds once since its establishment. In November 2021, it reached strategic cooperation with Bank of Communications Shanghai City Branch, and obtained 5 billion yuan strategic support from Bank of Communications Shanghai City Branch to actively provide financial services for the company's economic activities such as production, sales, reserves, product development, technological transformation, etc. In contrast, Xiaopeng has Alibaba behind him, ideally ByteDance and Meituan, NIO has Tencent investment. Financially, NIO Automobile's revenue in the third quarter was RMB 9.805 billion yuan, ideal automobile revenue was RMB 7.78 billion yuan, Xiaopeng Automobile revenue was RMB 5.72 billion yuan, and Wei Xiaoli's cash flow in a single quarter had exceeded the total financing amount of Chinese Express.

Li Bin, founder of NIO Automobile, has a famous saying: "20 billion is the threshold for building cars," and recently Li Bin raised this figure to 40 billion. Li Bin explained that 40 billion is not an accurate number, but an intuitive judgment. "It's not that there's no chance, I'll never say that, but the risk will be much higher," he said. 40 billion refers to the capital reserve needed to truly become a competitive, sustainable and risk-resistant enterprise. If you don't have that much money in reserve, you have to take a lot of risk. In other words, in Li Bin's view, it does not necessarily need 40 billion yuan to build a car, but if you want to live well, 40 billion yuan is a guarantee.

Back to the IPO of Chinese Express, even if Chinese Express can successfully complete the IPO, but the $500 million financing in front of the car is just a drop in the bucket. Take NIO as an example, up to now, it has accumulatively completed 11 financing times, and the total financing amount has reached RMB 70 billion yuan. However, even so, NIO has not realized self-early hematopoiesis, with accumulated losses of RMB 1.874 billion yuan in the first three quarters of 2021. When it was on the verge of delisting in 2019, it only obtained RMB 7 billion yuan of support from Hefei City in 2020. Li Bin of NIO dared to say "out of ICU."

According to the data of 2021, the annual sales of NIO, Xiaopeng and Ideal are close to several times of 100,000 vehicles, but the three companies are still in the state of loss, and the reasons for the loss mainly come from R & D investment, sales channel construction and operation cost. For the positioning of luxury high-end, Chinese Express obviously needs to invest more capital and energy in R & D investment, sales channel construction and operation cost, etc., and its ability to realize self-hematopoiesis is difficult to predict in a short time. In other words, before turning losses into profits, Gaohe still needs continuous capital injection and blood transfusion to maintain the normal operation of the company.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.