In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/30 Report--

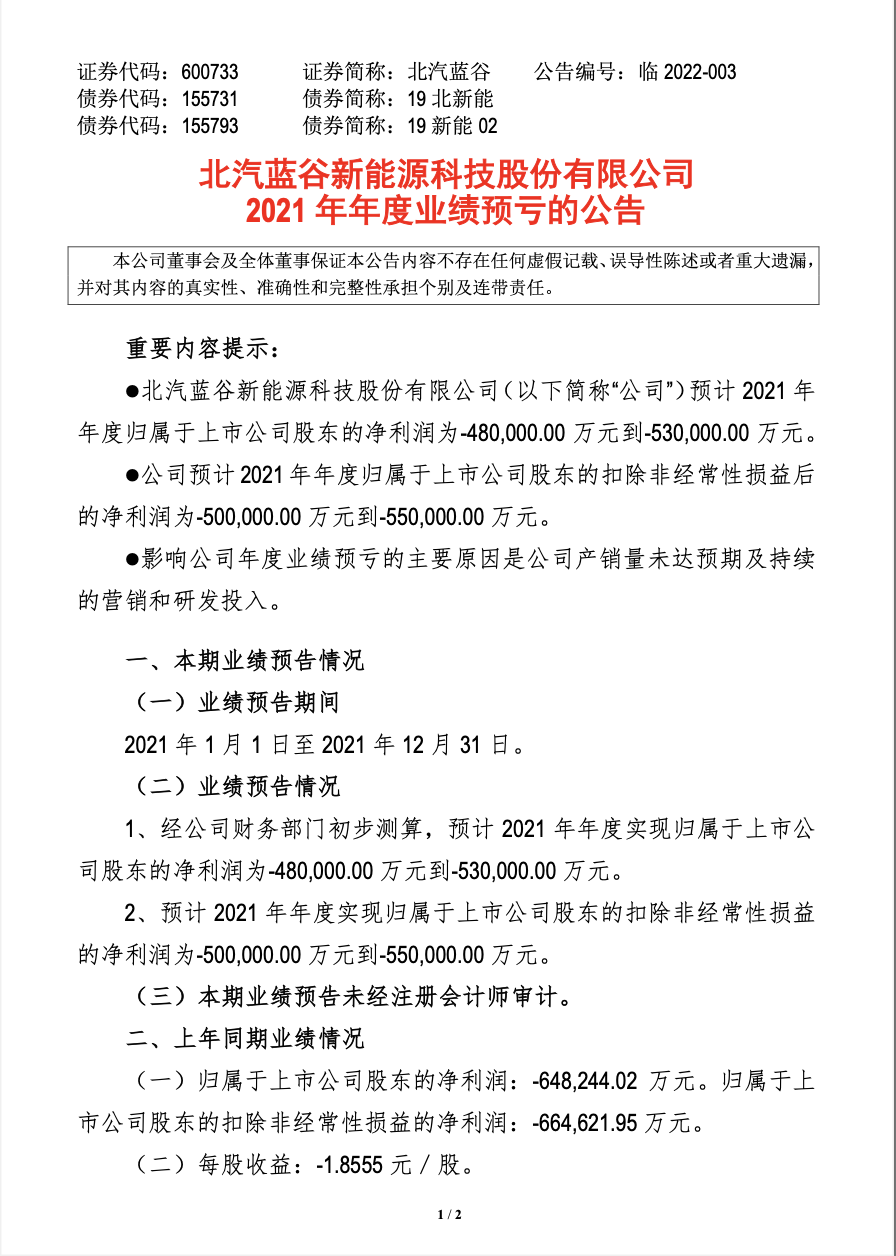

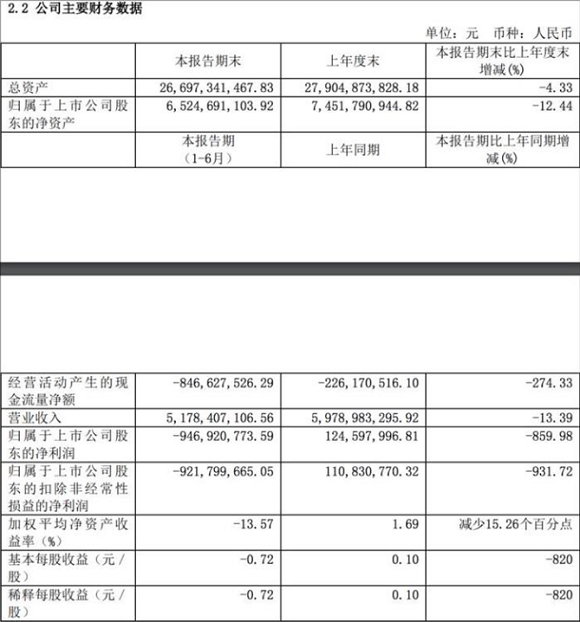

Beiqi Blue Valley, a subsidiary of Beiqi New Energy, released the performance forecast. It is estimated that Beiqi Blue Valley will lose RMB 4.8 - 5.3 billion yuan in 2021, while after deducting extraordinary profit and loss of RMB 5 - 5.5 billion yuan, Beiqi Blue Valley will be in serious losses for two consecutive years.

In 2020, the operating income of Beiqi Blue Valley is RMB 5.272 billion yuan, with a year-on-year decline of 77.65% and a net loss of RMB 6.482 billion yuan. In the good direction, Beiqi Blue Valley will realize a loss of RMB 1.2 billion yuan. BAIC New Energy once won the first place in pure electric market for seven consecutive years before, but with the enlargement of electric vehicle market, its performance has suffered losses for many consecutive years, including net loss of 729 million yuan in 2018 and net loss of 874 million yuan in 2019.

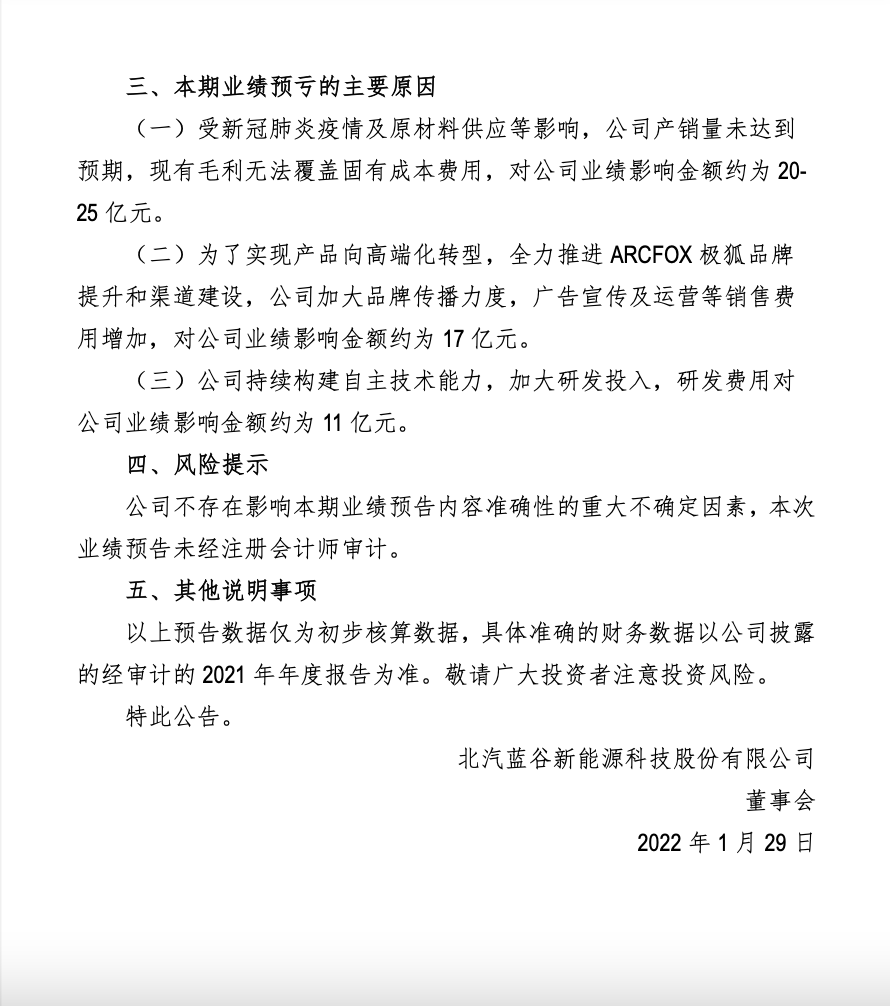

According to Beiqi Blue Valley explanation, the reason for the huge loss is mainly affected by the epidemic situation, production and sales data failed to meet expectations. In 2021, its total output was 6369 vehicles, down 51.84% year-on-year, and its total sales volume was 26127 vehicles, up 0.82% year-on-year. In other words, the sales volume increased by 200 vehicles compared with the previous year, so the coverage cost could not be effectively shared. According to the data of the same period, in 2021, the sales volume of new energy vehicles in China was 3.521 million, with a year-on-year growth of 160%. Beiqi Blue Valley seems to have become an alternative.

Beiqi Blue Valley also said that in the past year, it has spent nearly 1.7 billion yuan to increase the reputation and related operating expenses of its Beiqi Polar Fox brand. Beiqi launched the Polar Fox brand in the face of electrified competition. Previously, Liu Yu, chairman of Beiqi New Energy, said,"It will take three years to bring Beiqi New Energy back to the first camp. The sales target of ARCFOX in 2021 is 12,000 vehicles." It can be seen that Beiqi expects a lot from Polar Fox and invests a lot in publicity and channels, but it has not reached the expected sales volume.

Polar Fox currently has two models on the market, including the Alpha S and Alpha T. Alpha S went on sale in April 2021 at a price of 251,900 - 344,900, positioned as a high-end electric vehicle. Its cruising range is 525km, 603km and 708km respectively, which belongs to the mainstream data level in the current market.

Polar Fox also participated in Huawei's car-building project, jointly launched Alpha S Huawei HI production version with a pre-sale price of 38.89- 429,900 yuan. From the product price point of view, it is the first high-end pure electric production car equipped with Huawei intelligent cockpit Hongmeng car OS. However, Polar Fox did not specifically emphasize cooperation with Huawei in its recent activities. In terms of volume, Polar Fox has a larger stake than Huawei's other partner, Xiaokang, which may also be the reason why Huawei is more willing to promote well-off shares that can be effectively controlled at present. Huawei also needs to create a successful case matching its execution power. At that time, when Huawei announced cooperation with a number of manufacturers, the stock prices of relevant manufacturers appeared several trading limits, and it took some time to fall into specific product sales performance. Alpha S Huawei HI production version could be launched in June this year.

Like most electric vehicle brands, sales of Polar Fox increased significantly in December, with 1186 units delivered in December, up 76% month-on-month and 696% year-on-year, which seems more like a low sales base. Time seems to be Beiqi Blue Valley's biggest enemy. At first, the elephant turned around, and Beiqi Blue Valley had no financing demand pressure for new forces to build cars, but it did not launch products to meet market demand to form basic sales volume, missing the general trend of new energy; subsequently, although it was online with Huawei's hot spots, it did not form an effective market scale to effectively promote channels and realization, virtually missing one window after another.

Some investors asked Blue Valley Secretary, Blue Valley public claimed 22 years of full marketing, also known as polar fox car awards countless, why and other new forces when competing with car enterprises performance without confidence? Secretary Dong replied that the company will continue to strengthen the construction of marketing system and improve the marketing level.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.