In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/31 Report--

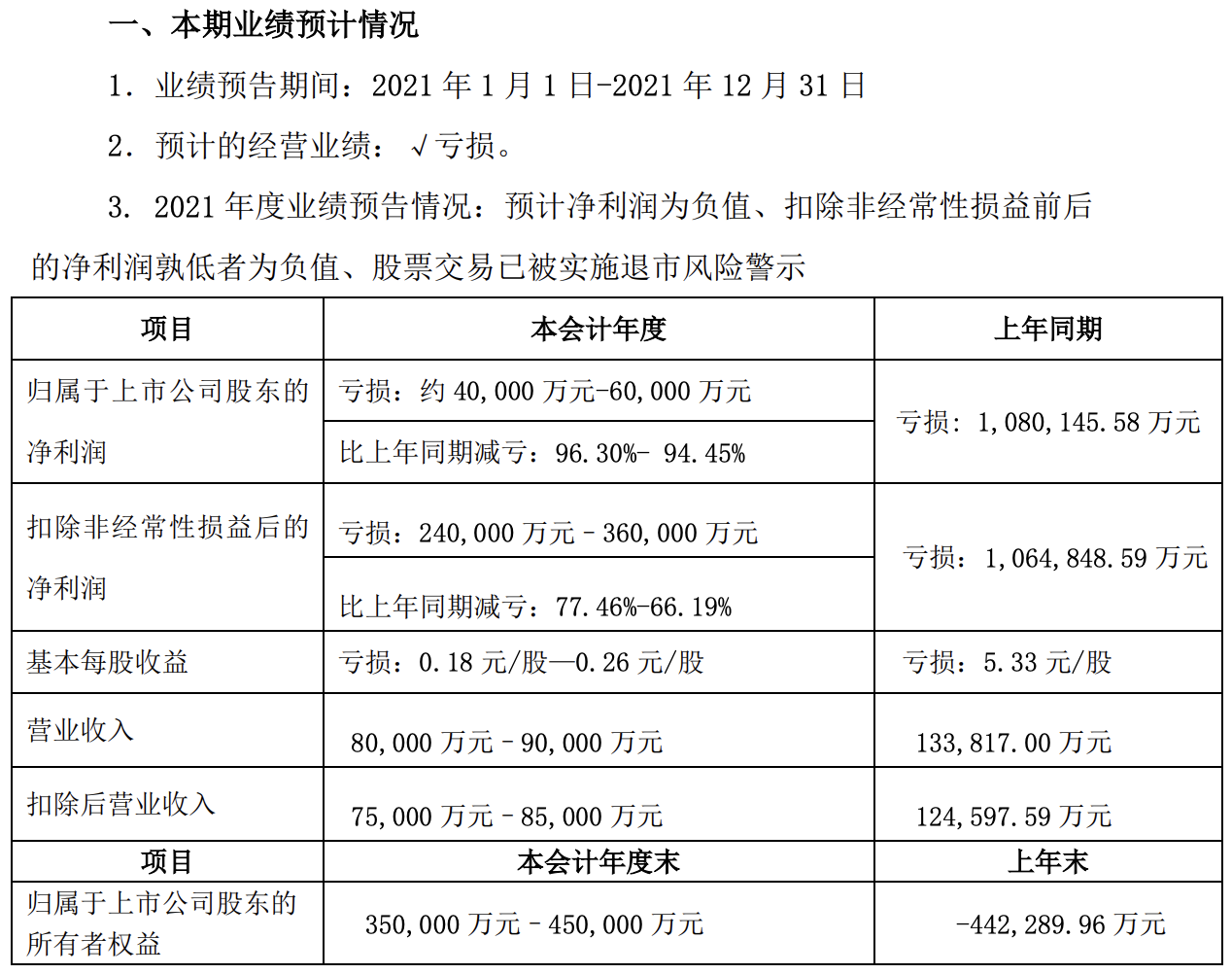

Recently, Zhongtai Motors disclosed its 2021 performance forecast that it is expected to achieve an operating income of 800 million to 900 million yuan in 2021 and a net profit loss of 400 million to 600 million yuan. From the performance forecast, although 2021 is still in a state of loss, but compared with the 2020 loss of more than 10 billion yuan, Zhongtai Motor has achieved a substantial loss reduction.

Zhongtai Automobile said in the performance forecast that the 2021 restructuring plan has been completed and is expected to generate restructuring revenue of 20-2.4 billion yuan. However, because the subordinate automobile production bases are basically in a state of suspension, the production and sales volume of the whole vehicle is not large, and the total sales revenue is low, resulting in operating performance is still a loss. At the same time, the main business vehicle business is in a state of suspension, the company intends to provide a large amount of asset impairment provision and bad debt provision totaling about 13-1.9 billion yuan, so the company's overall performance loss in 2021. In addition, Zhongtai Motor said that the net assets at the end of 2021 are expected to be about 35-4.5 billion yuan. If the net assets are positive at the end of 2021, it will apply to the Shenzhen Stock Exchange to revoke the delisting risk warning. In other words, Zhongtai Motor, which was once on the verge of delisting, is expected to keep its "shell" this year.

Zhongtai Motors also had a highlight moment. Zhongtai is an independent automobile brand in Zhejiang, which not only has the dual production qualification of "traditional fuel vehicles + new energy vehicles", but also has a production base in Zhejiang, Hunan, Hubei, Shandong, Chongqing and other places, and its products cover sedan, SUV, MPV and new energy vehicle market segments. As one of the independent car companies, it is famous for launching a number of models in 2016, such as the T600 sports version, the SR9, the New Damai X5 and so on. In particular, SR9 has become Zhongtai's "star" product after its launch. Thanks to this, Zhongtai Automobile's cumulative sales reached 333100 vehicles in 2016, an increase of 50% over the same period last year, which is also the peak of Zhongtai Automobile sales. However, the good times did not last long, due to the subsequent outbreak of quality problems, word of mouth plummeted, Zhongtai car sales have been declining, after a decline in 2017, sales fell to 154800 in 2018, only 116600 in 2019, and hit rock bottom in 2020.

From October 2020 to June 2021, eight Zhongtai companies were successively accepted by the people's court because of their debt crisis. They are Zhongtai Manufacturing, Jiangnan Manufacturing, Yongkang Zhongtai, Zhongtai New Energy, Zhongtai Auto Sale, TieNiu car body, Hangzhou Yiwei, Hangzhou Jiereng. On June 9, 2021, because Zhongtai Motor was unable to pay off its due debts and had the possibility of losing its ability to repay, the Jinhua Intermediate people's Court ruled to accept the reorganization according to law on the application of creditors, and appointed the manager to carry out all kinds of reorganization work. On September 30, 2021, according to the results of the review vote, Jiangsu Shenshang holding Group Co., Ltd. (hereinafter referred to as "Jiangsu Shenshang") was finally determined as the restructuring investor. On October 9, the investors of Zhongtai Automobile restructuring were finally identified as Jiangsu Shenzhen Merchants, Shanghai Tianqi and Hunan Zhibo as the second-ranking investors of the company. On October 27th, Zhongtai announced that 2 billion yuan of restructuring funds have been put in place, the funds will be used to pay restructuring costs, pay off debts, and take advantage of industrial synergy to help Zhongtai Automobile restore the national sales network as soon as possible. On December 28, Zhongtai received the Civil order of Jinhua Intermediate people's Court, which confirmed the completion of the implementation of Zhongtai Automobile restructuring Plan. On the same day, seven subsidiaries of Zhongtai Automobile received a "civil order" served by the Yongkang Court, confirming that the restructuring plans of the seven companies had been implemented. On December 31, the company received the Civil order of Changsha Intermediate people's Court, which confirmed the completion of the implementation of the subsidiary Jiangnan manufacturing restructuring plan.

It is worth mentioning that the history of Jiangsu Shenzhen business is not small. The company is a large private enterprise jointly invested by 79 key private enterprises in Shenzhen, mainly engaged in large-scale project investment and high-tech development and production. mainly to expand the financial industry and real estate development, the actual controller is Huang Jihong. Another identity of Huang Jihong is the real controller of the huge group. He successfully managed the restructuring of the huge group in 2019 and became the intended investor in the restructuring of the huge group. Later, Pang Qinghua, then chairman of the giant group, ceded his stake to the giant. Huang Jihong became the actual controller of the huge group. However, whether Jiangsu Shenshang can help Zhongtai Motor out of its predicament, there are still some variables.

Before confirming the receiver, although Zhongtai was in crisis, its performance in the capital markets was unusually strong. After years of huge losses, the share price of Zhongtai is depressed, and the share price has been stable at around 1 yuan for a long time from July 2020 to January 2021. Zhongtai shares have risen sharply since 2021, rising more than fivefold from 1.36 yuan on January 4 to a peak of 9.48 yuan this year. However, with the end of the restructuring, coupled with the uncertain future development and other reasons, Zhongtai shares have been declining, closing at 4.81 yuan on January 228. Of course, from the perspective of capital investment alone, the latest market value of the stocks obtained by Jiangsu Shenzhen Merchants with an investment of 2 billion yuan has reached 10 billion yuan. However, whether Zhongtai's share price will fall back to the range of 1 yuan will ultimately depend on whether Zhongtai's restructuring plan can help Zhongtai return to the track.

According to the restructuring plan previously released by Zhongtai Automobile: in the traditional business, Zhongtai Automobile will gradually adjust the brand strategy and build a characteristic strategy system for Zhongtai, Junma and other national automobile brands. committed to building the most influential national automobile enterprises. Short-term plans to reorganize its brands, concentrate resources and boost sales through strategies such as merging homogenized models, optimizing product sequences, optimizing cost structure and restructuring dealer networks; long-term plans to build a brand matrix in the form of acquisitions and joint ventures to lay out the mid-and high-end new energy vehicle market. In addition, the business plan shows that customized network travel has become a trend, Zhongtai Automobile will make use of the resource advantage of restructuring investors to quickly layout the ride-hailing market and expand Zhongtai's development space. At the same time, focus on consumer hot spots and promote mini electric vehicles to the countryside.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.