In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)01/31 Report--

In April 2021, Xiaokang shares announced a partnership with Huawei to build cars. The share price of Xiaokang shares soared from more than 22 yuan before the announcement to about 79 yuan, nearly tripling until the release of the new brand M5. According to the official release of M5 on December 23, the Huawei car-building concept did not make the share price of well-off rise further, but became the beginning of a series of falls in the share price of well-off shares.

As of the Spring Festival holiday, the share price of well-off shares was 45.81 yuan per share, with a cumulative decline of nearly 40% compared with its peak in just over a month. It seems that Huawei's car-building concept is not the only positive direction.

The annual results forecast for 2021 issued by Xiaokang shares expressed a similar view in terms of figures. Compared with the statutory disclosure data in the same period last year, Xiaokang shares are expected to suffer a loss, with a net profit loss of 1.55 billion yuan to 1.95 billion yuan, while only looking at the main business, the loss of Xiaokang shares excluding non-recurring profits and losses will be 2.91 billion yuan to 2.51 billion yuan. According to Xiaokang, the loss was caused by new energy cars.

In the traditional automobile business section, the well-off society lost 350 million. In the Selis new energy vehicle business section, although the sales volume of Selis new energy vehicles in 2021 increased compared with the same period last year, the sales were still in the climbing stage, the amortization of fixed assets and intangible assets increased, and the R & D investment, labor costs, and marketing channel construction expenses continued to increase, resulting in a loss of about 1.4 billion for shareholders of listed companies. According to its 2020 annual report, Xiaokang shares lost 1.729 billion in 2020, that is, in that year, Xiaokang's traditional automobile business changed from a net profit of 1 billion to a loss of 500 million, while the new energy vehicle business lost 940 million and 1.2 billion, and then became 1.4 billion in 2021. With the decrease in revenue and the sharp drop in gross profit, it can be seen that it has no choice but to turn well-off shares from the traditional automobile industry to new energy car-making.

Half a month ago, the news in the financial circle that "Chen long, the former chief strategist of Sino-Thai Securities, was lost and arrested" was rapidly fermenting on major social media networks, precisely because the gang had mastered the news of Huawei's car building. then the advance layout of joint hot money and institutions to jointly speculate stocks was investigated for speculation in Huawei car-building concept stocks. Zhongtai Securities immediately responded that Chen long had left the company on November 12 last year and that the company had no knowledge of the information about Chen long posted online.

Xiaokang shares also issued an announcement in the evening that they were not involved in the matter and were not aware of it. The announcement did not deny the above rumors, if this is true, then if the team entered the well-off shares in advance and led to its high price, combined with Huawei's statement when the M5 was released on December 23, then the pullback of the well-off share price is to be expected.

In April 2021, Huawei and Xiaokang were in the same boat, contrary to the previous downturn. In the announcement of the cooperation between the two, the first model, Cyrus SF5, sales rose sharply compared with the same period last year, and the share price of Xiaokang shares gained a total of 28 limit boards, an increase of 249% during the year. However, despite taking advantage of Huawei's east wind, Huawei's sales channel was not used and its subsequent sales performance was mediocre. On January 8th, the well-off side explained that because SF5 was developed in the United States and used chip technology in the US market, it was greatly affected by the shortage of chips and led to poor sales performance. Data show that from April to November 2021, Selis SF5 sales were 129,204,507,507,715,1117, 2205 and 1446 respectively.

With the launch of the new brand AITO and the first model, the M5, the market view of the well-off society is moving in another direction. Compared with Cyrus SF5, the Huawei pedigree of the M5 seems to be more pure. "in addition to providing key automotive hard parts, Huawei's industrial design team, software team and user experience team are also involved in the cooperation," Yu Chengdong, managing director of Huawei and CEO of consumer business, said at the M5 conference. It is precisely with these words that the market has become a discussion about whether well-off shares are Huawei car contract factories, and on the question of whether well-off shares are contract manufacturers, Xiaokang shares made it clear that they did not do contract factories before and now, let alone contract factories. It also said that it did not work as a contract manufacturer in cooperation with Dongfeng Group 18 years ago. According to the agreement with Huawei, the two are long-term partners. But also from this day on, the well-off stock price became the beginning of the decline.

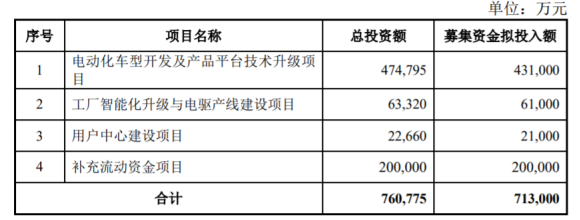

The revenue is not enough to raise funds. Last week, the total amount of funds raised by the well-off non-public offering did not exceed 7.13 billion yuan. Of this amount, more than 4 billion will be spent on the development and platform transformation of six new electric vehicles, including three high-end intelligent electric vehicles and three practical electric vehicles. It is worth noting that 2 billion yuan is used to supplement liquidity.

In June last year, Xiaokang shares have already carried out a round of fixed increase of 2.59 billion yuan, which is also used for upgrading the vehicle development platform and replenishing liquidity, which shows that the liquidity in the hands of Xiaokang shares is tight.

With Huawei's announcement of a partnership to build cars, the snowball of well-off shares is getting bigger and bigger. In order to sustain this growth, the well-off society can only catch up with these inputs in terms of output and sales. From the forecast of the financial report, the deficit is gradually magnifying while the market has not changed much. It seems to be full of too much unpredictability for the future.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.