In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/05 Report--

At present, the global automobile market is still affected by the shortage of chips, and the impact of the COVID-19 epidemic continues, but many car companies still maintain high prospects and confidence for the development in the coming year. To this end, the automobile industry pays attention to statistics of a number of car companies' sales targets in 2022.

Geely cars: annual target of 1.65 million units

As a leader of its own brand, Geely Automobile's performance in the Chinese market is obvious to all. Data show that Geely sold a total of 1328029 vehicles in 2021, winning the top spot for Chinese brand car companies for five consecutive years. However, Geely failed to meet its sales target of 1.53 million vehicles due to a shortage of parts during the year.

Of course, not only Geely, but many car companies have been hampered by a shortage of parts in the past year, and the situation in 2022 is not optimistic. Even so, Geely still has a sales target of 1.65 million vehicles in 2022, a 24 per cent year-on-year increase from 2021. In terms of the current market environment, this sales target is also challenging.

BYD car: annual sales target of 1.2 million vehicles

As the leader of new energy vehicles, BYD's performance in 2021 is impressive. According to official data, BYD sold 730093 vehicles in 2021, an increase of 75.4 percent over the same period last year, of which sales of new energy passenger vehicles reached 593745, up 231.6 percent from the same period last year. Although the global car market is affected by the supply of spare parts, BYD, as a company that is self-sufficient in semiconductors and power batteries, is not affected by the market at all.

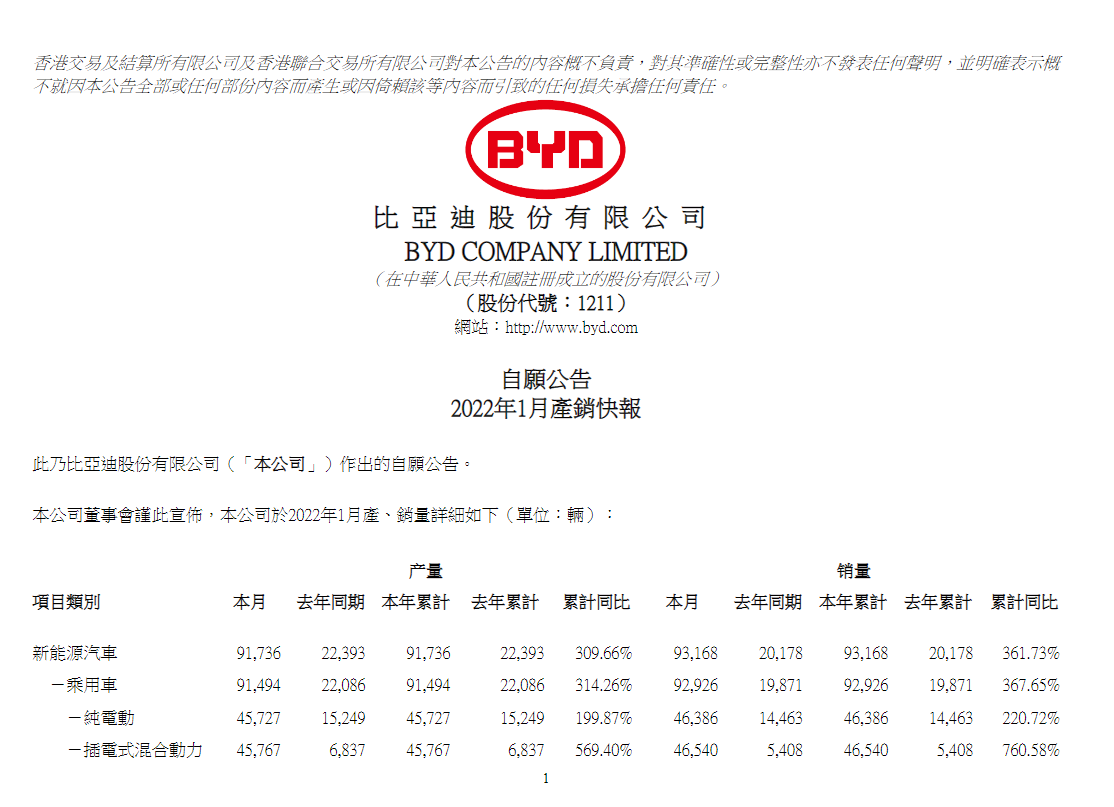

Given its performance in 2021, BYD has set an annual sales target of 1.2 million units, an increase of 60.8 per cent from 2021. In terms of BYD's sales structure, new energy vehicles account for 80% of BYD's total sales, and if BYD wants to achieve its sales target of 1.2 million vehicles by 2022, it must also rely on new energy vehicles. It is understood that BYD will launch a number of new new energy vehicles in 2022, such as BYD DM-i, seals and so on. In addition, BYD will launch high-end brands this year, but it is not expected that high-end brands will contribute much to BYD. To some extent, 1.2 million vehicles is BYD's confidence and extremes in the field of new energy vehicles, allowing it to target this sales target, but this goal still puts great pressure on BYD. According to BYD's latest data, it sold 95422 vehicles in January, up 125.05% from a year earlier, of which 92926 new energy passenger vehicles were sold, up 365.65% from a year earlier, achieving the target of 7.9%.

Great Wall Motor: annual sales target of 1.9 million vehicles

Among its own brands, Great Wall is also among the best performers. According to the data, the cumulative sales of Great Wall cars in 2021 was 1280993, up 15.2% from the same period last year. In terms of specific brands, the source of sales of Great Wall in 2021 is still the Harvard brand, with a cumulative year-on-year increase of 2.64% to 770008 vehicles. The Eula brand is the biggest increase under the Great Wall brand, with an annual sales increase of 140% to 135028 vehicles. The independent tank brand sold 84588 vehicles for the whole year, while the high-end WEY became the only brand that declined, falling 25.65% to 58363 vehicles.

Great Wall Motors has changed a lot in 2021, such as the independent launch of a new high-end off-road tank brand in April 2021, the launch of a new high-end brand salon in November 2021, and the official launch and limited launch of the first model, the Robot Kelon. In addition, Harvard brand, WEY brand launched a number of new models during the year, including Harvard's first love, Harvard Red Rabbit, WEY Mocha, WEY macchiato and so on.

When Great Wall announced its equity incentive plan in May 2021, it set a sales target for 2021-2023-1.49 million in 2021, 1.9 million in 2022 and 2.8 million in 2023. However, when setting sales targets, Great Wall did not take into account the impact of the market. Although Great Wall performed well in 2021, it did not meet its 2021 target, and for 1.9 million units in 2022, the year-on-year growth reached 48.32%. What measures should Great Wall take to achieve this goal?

FAW Group: sales of 4.1 million vehicles in 2022

At the beginning of this year, FAW Group proposed to achieve the target of selling 4.1 million vehicles in 2022, an increase of 17.1% over the same period last year, including 2 million FAW-Volkswagen, 1 million FAW Toyota, 45-500000 Red Flag and 100000 Pentium.

For FAW-Volkswagen, if the impact of the chip shortage improves, the sales target of 2 million vehicles should not be difficult. It is understood that FAW-Volkswagen accumulated a total of 1857777 new cars sold in 2021, of which 988677 were sold by Volkswagen, 700088 by Audi and 169012 by Jetta.

Compared with FAW-Volkswagen, FAW Toyota is more interesting in 2022. In early 2021, FAW Toyota set a goal of reaching 880000 vehicles and challenging 920000 vehicles, but due to market reasons, FAW Toyota sold a total of 860019 vehicles in 2021, an increase of 8% over the same period last year, but failed to meet its target. Facing 2022, FAW Toyota has set a target of 1 million vehicles, and the market performance of the Corolla Ruifang, Lingfang HARRIER and other models launched this year will directly determine whether the company's goal can be achieved.

FAW Group's own sector still depends on the Red Flag brand, which plans to sell 45-500000 vehicles in 2022, up only 50, 000 from 2021. According to the latest data released by FAW Red Flag, sales in January 2022 were 42100, up 30% from the same period last year, while 42100 were sold in the first month of the year, which may indicate that Red Flag will do well this year.

Dongfeng Automobile Group: sales target of 3.471 million vehicles

As one of the large domestic automakers, Dongfeng Automobile Group also relies on joint ventures. The first is Dongfeng Honda, whose full-year sales fell 10.40% year-on-year to 761879 vehicles in 2021 due to irresistible reasons, and it will not be difficult to recover in 2022. However, Dongfeng Honda will launch a number of blockbuster models in 2022, such as the new CR-V/XR-V and the new all-electric e:NS1, which may boost Dongfeng Honda's sales performance to some extent. The second is Dragon Motors, although French cars only occupy 0.6% of the domestic market share, but the performance of DPCA in 2021 is commendable, with annual sales exceeding 100000 vehicles. The biggest boost behind this result is the newly launched Versailles C5X, which sold more than 5000 vehicles for two months in a row. To a certain extent, Versailles will directly affect the performance of DPCA. After all, Versailles is currently the highest-selling model of DPCA.

Of course, in November last year, Dongfeng Motor Group listed to sell 25% of Dongfeng Yueda Kia Motor Co., Ltd., and Dongfeng Yueda Kia will withdraw from Dongfeng Group in the future. Looking back in 2021, the Kia brand sold 163400 vehicles in China. Although sales have declined for many years in a row, how Dongfeng Group, which lost Kia, can fill this gap is also a big attraction in 2022.

In addition to the above car companies, GAC GROUP Chery Group and other car companies also announced annual targets. Judging from the sales targets announced by the major car companies, they are still very confident about the market performance this year, and if the overall market maintains a stable development during the year, some car companies are still very likely to achieve their goals.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.