In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/13 Report--

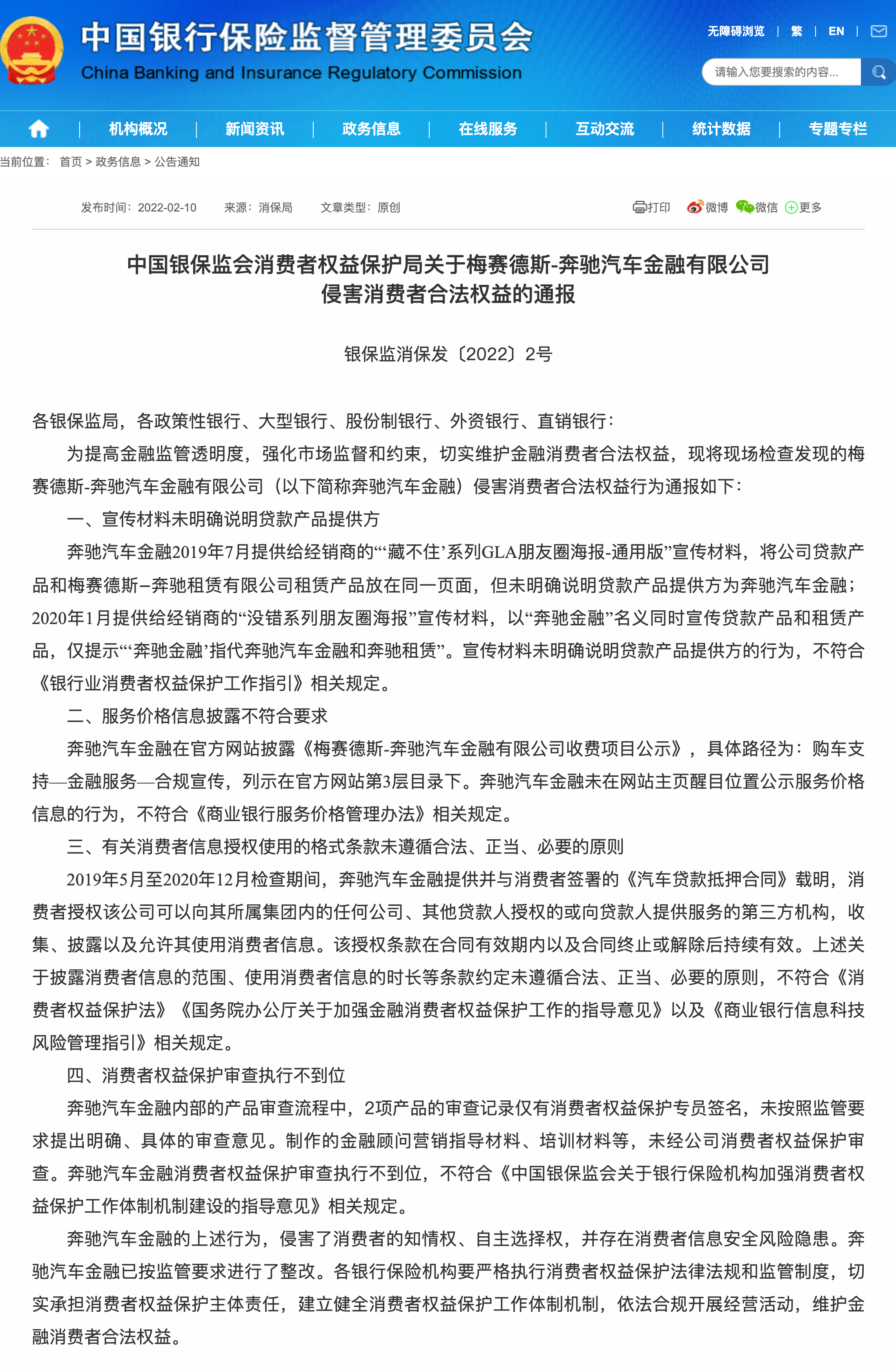

A few days ago, the Consumer Rights Protection Bureau of the China Banking and Insurance Regulatory Commission (hereinafter referred to as the "Bancassurance Regulatory Bureau") issued a circular on the infringement of the legitimate rights and interests of consumers by Mercedes-Benz Auto Finance Co., Ltd. The investigation of the Bancassurance Regulatory Bureau shows that Mercedes-Benz Auto Finance Co., Ltd. (hereinafter referred to as Mercedes-Benz Finance) has a number of tort acts such as "publicity materials do not clearly specify the provider of loan products" and "service price information disclosure does not meet the requirements". Subsequently, Mercedes-Benz responded by modestly accepting the advice and guidance put forward by regulators.

For ordinary consumers, buying a car is a happy thing, but it often leads to transaction disputes because of some fees and services. So, what are the "tricks" when buying a car?

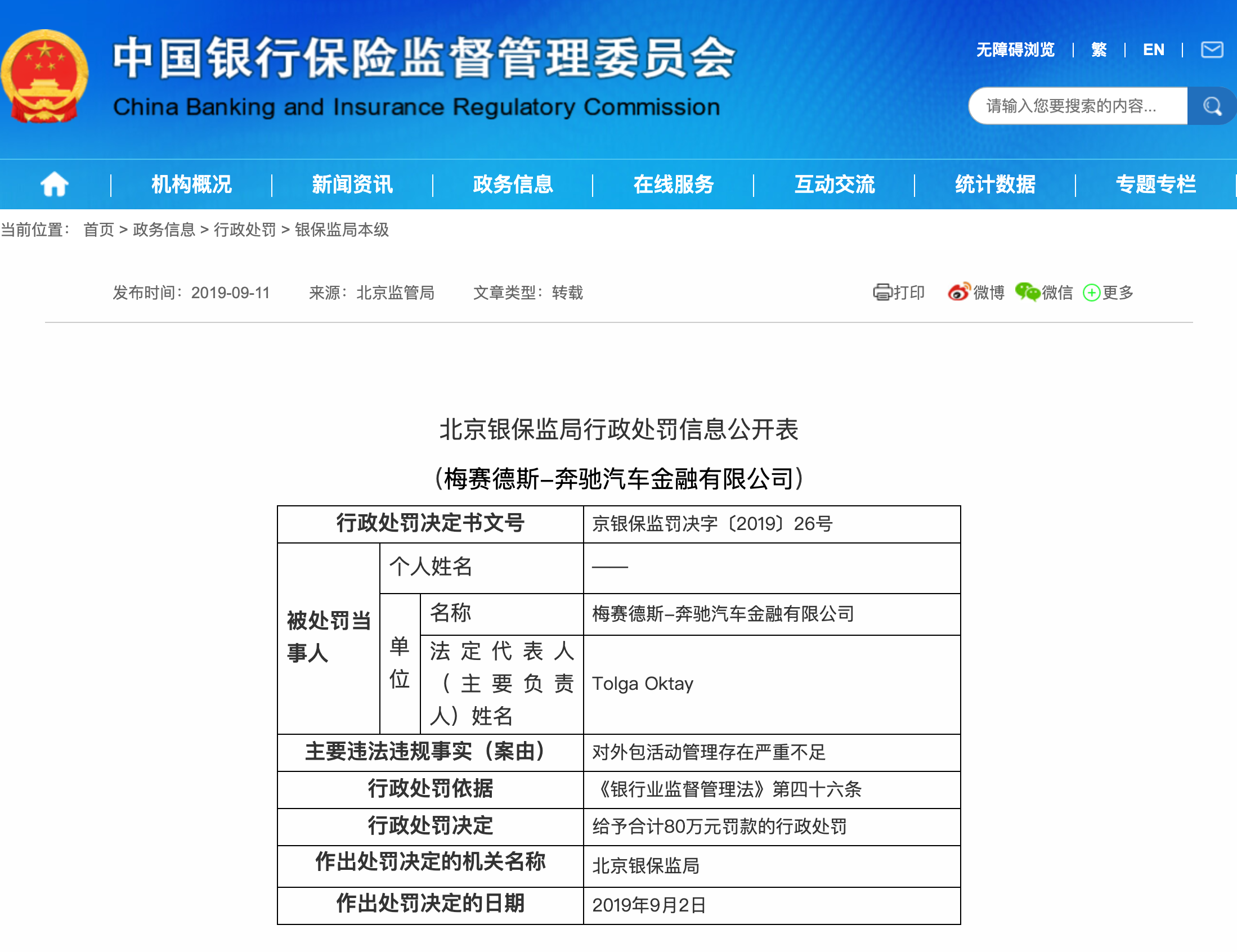

The first is the charge for financial services. Consumers who have bought a car should have a feeling that buying a car with a full car does not seem to be popular with 4S stores compared with loans, because collecting financial service fees through loans has become an important source of profit for 4S stores. On April 15, 2019, Xi'an Mercedes-Benz owners' rights protection conversation was exposed, in which the female car owner mentioned that she could have bought it in full, but the 4S store was forced to pay 15200 financial service fee after being induced to use Mercedes-Benz finance. immediately caused the tax bureau, the bank insurance supervision bureau to attach great importance to. Afterwards, Xi'an Lizhixing Automobile Co., Ltd. was fined 1 million yuan, and Mercedes-Benz Auto Finance Co., Ltd. was also fined 800000 yuan by the Beijing Banking and Insurance Regulatory Bureau. At the same time, the State Administration of Market Supervision interviewed Mercedes-Benz to urge the effective implementation of the main responsibility of consumer rights.

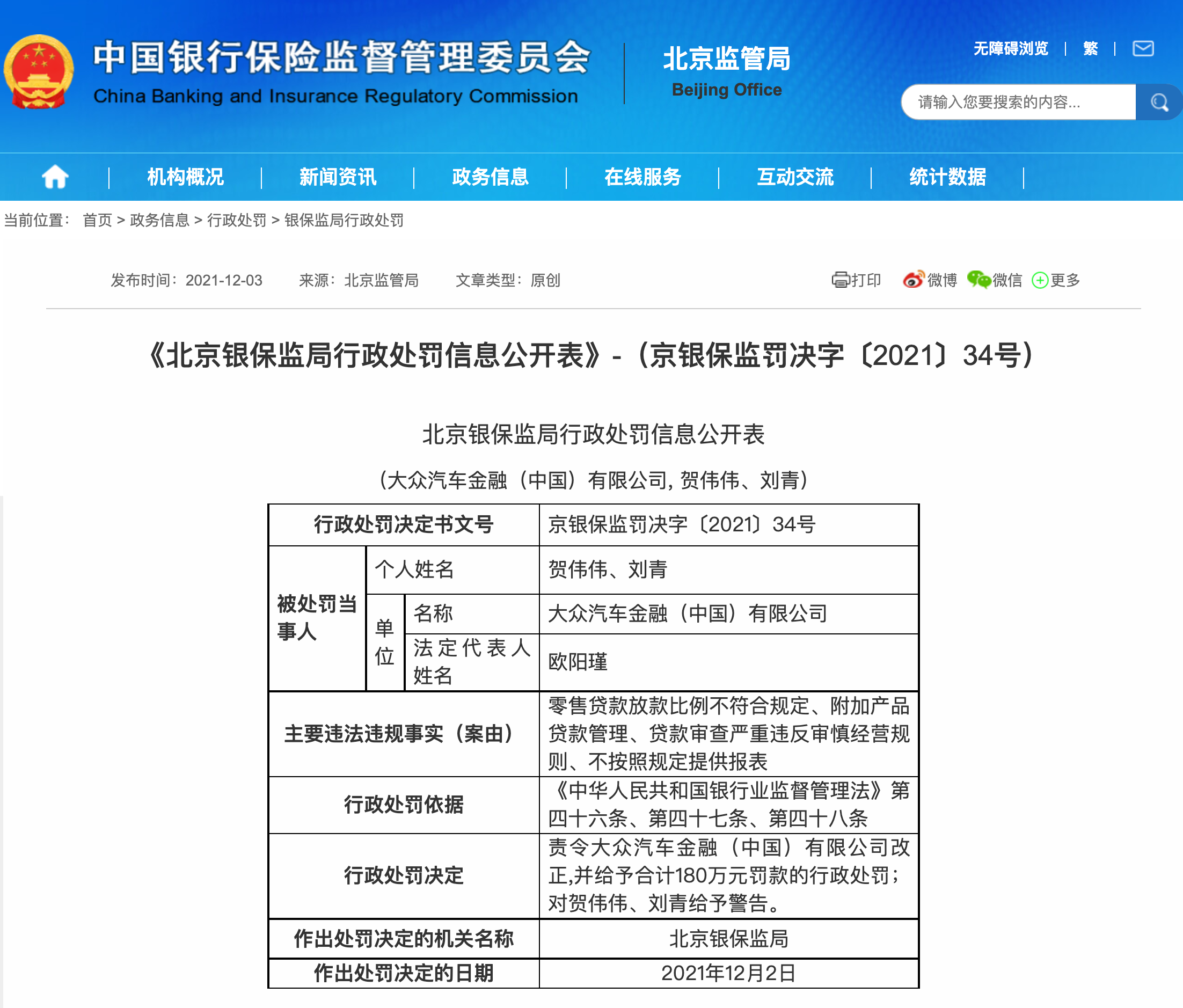

In addition to Mercedes-Benz, there are many cases of punishment for violations in the field of auto finance. For example, in January 2019, Shanghai Dongzheng Auto Finance Co., Ltd. was fined 500000 yuan by the Shanghai Banking and Insurance Regulatory Bureau for "charging for loans when handling part of the loan business". In December 2021, Volkswagen Automotive Finance (China) Co., Ltd. was fined 1.8 million yuan by Beijing Banking and Insurance Regulatory Bureau because "the proportion of retail loans did not comply with the regulations, the loan management of additional products, and the loan examination seriously violated the prudent operating rules and failed to provide statements in accordance with the regulations".

Can the financial service fee be charged or not? Xi'an Market Regulatory Bureau has said that financial service fees charged by financial institutions are regulated by financial departments, while 4S stores are not allowed to charge fees if they do not have related business projects.

Financial service fees are charged for car loans, and some 4S stores cooperate with insurance companies and require car buyers to buy car insurance at designated companies. In fact, there is no requirement to buy insurance at the company designated by the 4S store, but many consumers accept it for convenience, but this kind of transaction actually violates the principle of free buying and selling.

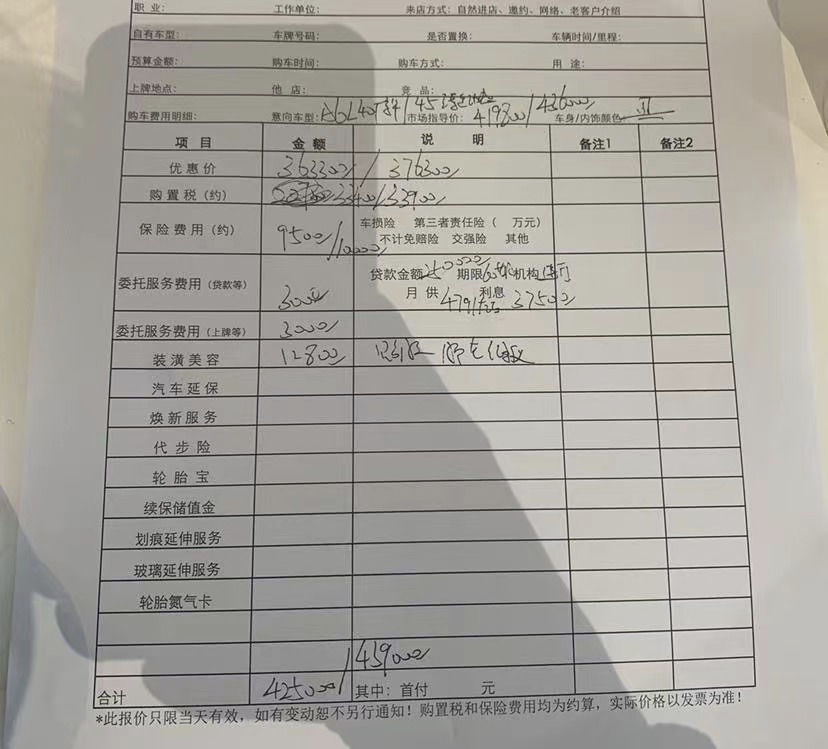

In addition to the above, it is also a common phenomenon for 4S stores to charge high licensing fees. When buying a car, some car owners are worried that the process of getting a new car is too tedious, so they will hand over the business to the 4S store for the whole process, while the license fee charged by the general 4S store is not low, and the general fee is about 500-2000 yuan. of course, the charging standards of different 4S stores are different, which need to prevail according to the actual situation.

In the process of buying a car, the "routine" charges such as financial service fees are far more than this one, and more include "exportation fees", "PDI testing fees" and so on, which range from 100 yuan to 300 yuan. Some 4S stores will inform consumers of the above charges in advance, of course, there are cases that consumers know about the matter or after the fees have been collected, and the fees in the whole car purchase process are not transparent. It has also become the most common situation in the process of safeguarding consumers' rights.

Industry insiders point out that the chaos of auto financial services is particularly likely to occur in the process of selling high-end cars and luxury cars. Because this kind of car owners are not particularly sensitive to price, and the time from choosing a car to buying a car is relatively short, but the whole process of auto financial services is often complicated and involves many departments, so it is easy for some businessmen to exploit loopholes and breed chaos in all kinds of industries.

As for how to avoid the pit? When buying a car, consumers had better know the price of the market where they buy a car, whether it is a full car purchase or a loan to buy a car. When negotiating the price, we must first talk about the naked car price, and then talk about the car purchase discount by stages. Because the landing price contains so many things, it is difficult for consumers to distinguish the rationality of these items' charges, but they should question and retain evidence for projects that charge too much. Before choosing auto financial services and products, you must have a clear understanding of the loan model, lenders, repayment, interest calculation methods and other information in advance, as well as the whole process. At the same time, take the initiative to require sales and service personnel to inform the price of financial services and related elements, and can also confirm whether it is consistent with the financial relevant customer service personnel of the host factory to avoid being cheated.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.