In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/22 Report--

Production at the Hyundai Chongqing plant in Beijing may have been suspended, according to China Finance and Economics, citing people familiar with the matter. A source familiar with the situation in Beijing Hyundai told the media, "there is no production at the Beijing Hyundai Chongqing factory. Most of the workers are on holiday and have stopped production since December last year." In response to the above reports, Beijing Hyundai responded that it had not received any internal documents about the suspension of production.

Data show that South Korea's Hyundai Motor Group entered the Chinese market in 2002 and successively set up three vehicle manufacturing enterprises, namely, Beijing Hyundai, Dongfeng Yueda Kia and Hyundai commercial vehicles, which fell short of the annual output of one million in only five years. In the passenger car market, Beijing Hyundai and Dongfeng Yueda Kia are responsible for the development of Korean brands in China, but the current development of Beijing Hyundai and Dongfeng Yueda Kia is not smooth.

Until 2016, Beijing Hyundai dominated the domestic passenger car market with high performance-to-price ratio, with sales of 1.03 million, 1.16 million, 1.06 million and 1.14 million respectively from 2013 to 2016, and reached an all-time peak in 2016. It was also one of the joint ventures with a strong sense of existence at that time.

At that time, as the annual sales of Hyundai in Beijing had been maintained at more than 10,000 vehicles, it began to speed up the construction of factories to meet market demand. It is understood that Beijing Hyundai has the first, second and third factories in Beijing Shunyi, as well as five major passenger car production bases in Cangzhou and Chongqing, Hebei Province, with an annual output of 1.65 million vehicles, of which the Chongqing factory was completed in 2017, with a total investment of 839000 yuan and an annual production capacity of 300000 vehicles, mainly producing Renault, Anchino, Festa and ix25 models, while Beijing Hyundai began to decline in this year. Since 2017, Beijing Hyundai sales have continued to decline, with sales of 755659 vehicles, 782163 vehicles, 685126 vehicles, 384782 vehicles and 359851 vehicles respectively from 2017 to 2021.

The cumulative sales of 359851 vehicles in 2021 means that Beijing Hyundai's capacity utilization rate is only 22%. To this end, Beijing Hyundai began to optimize production capacity, selling a factory in Shunyi, Beijing, to ideal cars, a new power car company. In October 2021, ideal Automobile Beijing Green Intelligent Factory has officially started construction in Shunyi District, Beijing, with a total investment of 6 billion yuan. It is expected to be completed and put into production in September 2023. After it is put into production, it will achieve an annual production capacity of 100000 pure electric vehicles. Of course, even with the sale of a factory in Shunyi, Beijing Hyundai still has serious overcapacity, so there is news that Hyundai will sell other factories, including the second factory in Beijing.

In order to reverse the decline, Beijing Hyundai launched a number of new cars, including the Elantra, the new Sonata, Tusheng L, ix35, Kusto and other models, but from the current situation, only Elantra has achieved phased success, with monthly sales basically stable at more than 10,000 vehicles, including 14657 in January this year, making it the highest-selling model for Hyundai and even Korean car companies in China. In addition, ix35 sold 8626 vehicles in January, Tusheng L sold 5076 vehicles, and other models sold only moderately. The industry believes that Beijing Hyundai does not innovate in strategy and models according to changes in the market, and the process of localization is relatively slow, while introducing too many similar models, resulting in uneven distribution of marketing resources. unable to respond quickly to changes in the market, which made Beijing Hyundai miss the opportunity for self-innovation.

It is worth mentioning that Hyundai Motor Group occupies a leading position in the global market, but it is very weak in the Chinese market in recent years. Figures show that Hyundai's global sales in 2021 were 3.891 million vehicles, an increase of 3.9% over the same period last year. Together with Kia's market sales, Hyundai Motor Group ranks fourth in the global market, second only to Toyota, Volkswagen Group and Renault-Nissan-Mitsubishi Alliance, but its performance in China is very weak, falling 23.3% year-on-year to 385000 vehicles. The industry believes that the game between China and South Korea will cause internal friction in management, which makes Beijing Hyundai unable to keep up with the changes in the pace of the market.

According to media reports, Beijing Hyundai may be considering a change in the joint venture stock ratio, and Hyundai Motor Group is working to increase its shareholding in Beijing Hyundai, a Chinese joint venture, or to emulate Kia's role in the new joint venture. to seek more dominance. However, Beijing Hyundai said Hyundai had no plans to adjust its joint venture share ratio and that the joint venture contract between China and South Korea would not expire until 2032, while Hyundai China said it was "not aware of the matter".

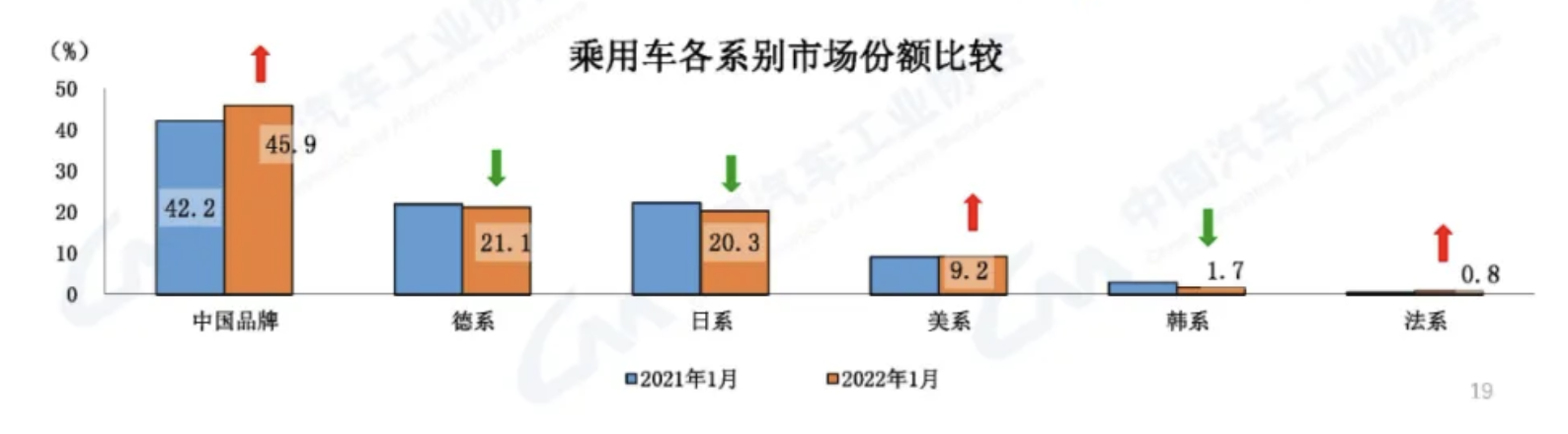

Due to the continued decline in sales of Korean brands, the market share in China is less than 2%. According to data released by the China Association of Automobile Manufacturers, the market share of Korean cars in China from 2016 to 2021 is 7.35%, 4.63%, 4.98%, 4.7%, 3.8% and 2.4%, respectively, compared with 1.7% for Korean brands in January this year.

No matter how big the Chinese market is, there is no room for hundreds of car companies, both independent brands and joint venture brands will face a severe market test. The market is also fair, and in the end, only those car companies with technology and capital will remain. The collapse and withdrawal of some brands are the result of the survival of the fittest in the market, which is also conducive to the merger and reorganization of China's automobile industry. and the most important thing at this stage is change.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.