In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/12 Report--

According to the data, the sales of new energy vehicles in China was less than 20, 000 in 2013, and now it has exceeded 3.5 million in 2021. In a short period of a few years, the total production and sales of new energy vehicles in China has become the first in the world for seven consecutive years. According to statistics, domestic sales of new energy vehicles in 2021 were 3.521 million, an increase of nearly 1.6 times compared with the same period last year, while domestic sales of new energy vehicles reached 765000 from January to February this year, of which 334000 were sold in February, an increase of 1.8 times compared with the same period last year.

It is worth noting that under the continuous popularity of new energy vehicles, many new energy vehicle companies are facing huge cost pressure because of the global shortage of chips and spare parts and the decline of new energy vehicle subsidies. In this regard, a number of new energy vehicle companies have raised the price of their vehicles, but the price increase does not hinder the continued popularity of new energy vehicles.

According to data released by CCTV Finance, nearly 20 new energy car companies have announced price increases since March, involving nearly 40 models, ranging from thousands of yuan to tens of thousands of yuan. According to the sales staff of new energy vehicles in Beijing, the price increases of new energy vehicles at the beginning of this year, including car-building new forces, Chinese brands, joint venture brands and imported brands, have all appeared and the price increases vary, ranging from 1% to 10%. The reasons for the price increase of new energy vehicles include simple product price increases and improved product configuration and higher prices.

In addition, according to a CCTV financial report on March 12, a responsible person of a lithium carbonate raw material production enterprise in Yichun, Jiangxi Province, said: the price of lithium carbonate has been rising all the way since the end of 2020, and the price of lithium carbonate has basically remained at around 50, 000 yuan per ton at the end of 2020. After more than a year, the price of lithium carbonate has risen to 500000 yuan per ton.

It is understood that the rapid rise in the price of lithium carbonate is caused by the shortage of upstream non-ferrous metal lithium raw materials, and one of the raw materials of the power battery, the core component of new energy vehicles, is lithium carbonate. The rapid rise in the price of lithium carbonate is one of the reasons for the price increase of new energy vehicles. In addition, nickel and cobalt are also important components of new energy vehicle batteries. New energy vehicle lithium-ion batteries have a total of three layers, of which the lithium cathode is made of lithium mixed with nickel and other minerals such as cobalt, manganese or aluminum. On the morning of March 8, the price of nickel also rose sharply. Up to now, the prices of lithium, nickel (ternary cathode) and aluminum (structural parts, parts) for new energy vehicles are all at an all-time high, especially lithium carbonate, which has risen from 50, 000 yuan per ton to 500000 per ton in just one year. Nickel and cobalt also rose by more than 60%.

Due to the current upsurge of raw materials, the cost of building new energy vehicles has risen sharply, and there has even been a phenomenon of upside-down prices of new energy vehicles on the market, that is, a loss of about 10,000 yuan per car sold. In this environment, in order to alleviate the pressure of rising costs, a number of new energy car companies choose to raise prices and stop taking orders for some "loss-making" models. On February 23 this year, Euler CEO Dong Yudong announced that it would stop taking orders for Euler's best-selling new energy models, Euler Black Cat and Euler White Cat, due to a sharp rise in the price of raw materials. Euler Black Cat lost more than 10,000 yuan every time it sold, and the more it sold, the more it lost.

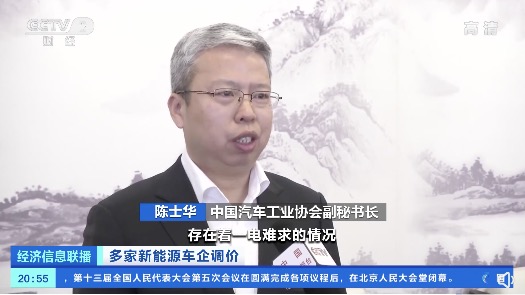

According to the China Nonferrous Metals Industry Association, although China is the world's largest producer of lithium batteries and lithium salts, with the explosive growth of new energy vehicles and energy storage around the world, there is still a lack of electricity in the power battery of new energy vehicles. However, in addition to the rise in the price of raw materials, the global shortage of chips and other reasons are also the reasons for the rise in the price of new energy vehicles.

According to incomplete statistics concerned by the automobile industry, up to now, a number of new energy vehicle brands, including Tesla, Xiaopeng Automobile, Nahan Automobile, GAC Eian, Zero run, Eula Automobile, and so on, have announced increases in the prices of some models, with model prices ranging from 100000 yuan to more than 300000 yuan. Among them, the increase of models under 100000 yuan is relatively high, with an average price increase of about 4800 yuan. Of course, the concern of the automobile industry has repeatedly pointed out in previous articles that the price increase of new energy vehicles is not affected by the global shortage of chips and parts, and the decline of subsidies for new energy vehicles is also an important factor. New energy vehicles licensed after December 31, 2022 will no longer enjoy new energy subsidy policy, when the price of new energy vehicles will rise across the board.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.