In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/19 Report--

On March 18, Beijing Automobile announced on the Hong Kong Stock Exchange that subsidiary Beijing Automotive Investment Co., Ltd. and Hyundai Automotive Co., Ltd. entered into an amendment agreement. It is agreed to increase the capital of Beijing Hyundai by US $942 million (about RMB 5.993 billion) according to its proportion of the current registered capital of Beijing Hyundai, and the two sides will inject US $471 million respectively. When the capital increase is completed, Beijing Hyundai's registered capital will increase to $2.978 billion, with both parties still accounting for 50 per cent of Beijing Hyundai's stake.

The announcement said that the main purpose of the transaction is to strengthen the safety of the operation of Beijing Hyundai funds, and to effectively respond to the further investment needs in the face of the electrification of China's automobile industry. Beijing Hyundai is expected to raise the level of working capital and guard against liquidity risks, and will cooperate with shareholders to further increase strategic resources input, so as to improve business conditions and enhance market position. It will also provide financial guarantee for the introduction of new products, increase the layout of new energy vehicles, expand exports and other businesses.

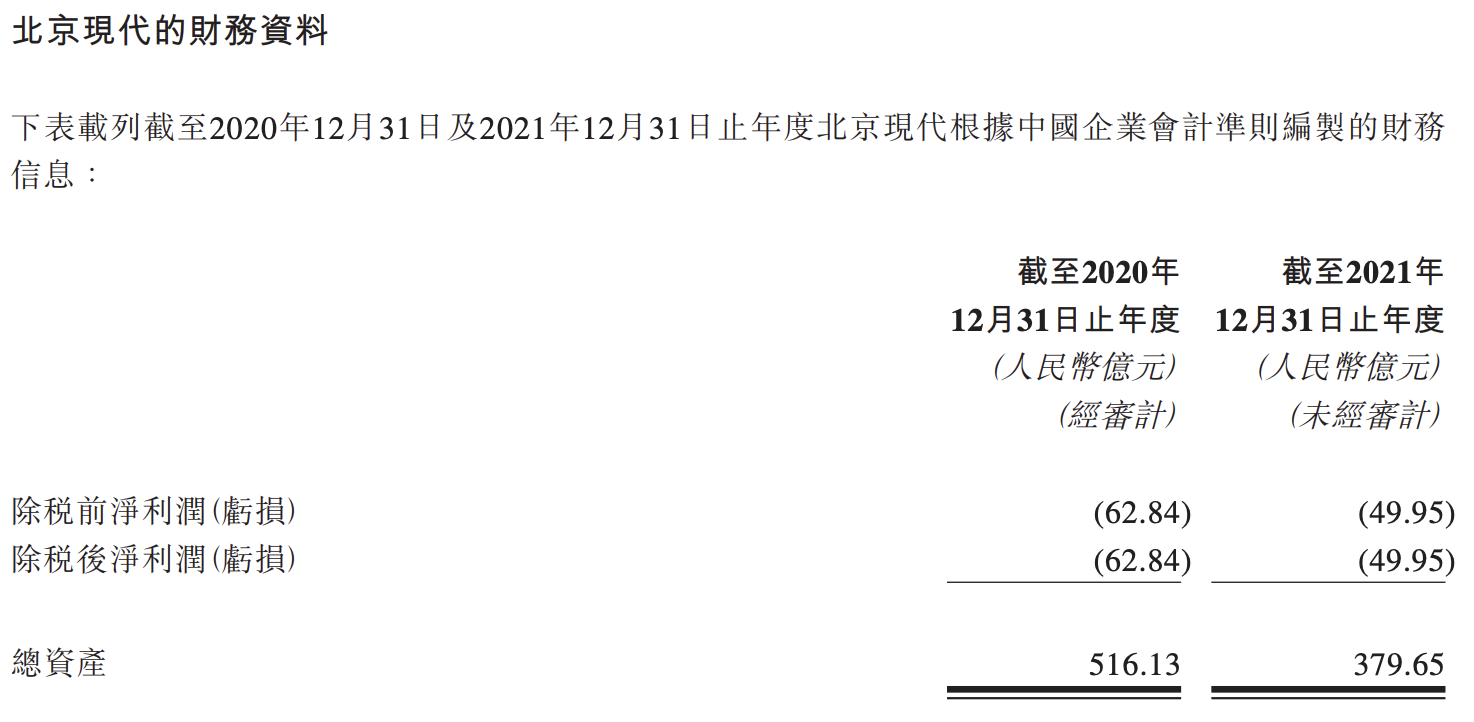

Data show that Beijing Hyundai was established on October 18, 2002, jointly funded by Beijing Automobile Investment Co., Ltd. and Korea Hyundai Automotive Co., Ltd., with a registered capital of 2.036 billion US dollars, 50% each of China and South Korea, and a joint venture term of 30 years. According to the announcement, Beijing Hyundai has a net loss of 4.995 billion yuan after tax in 2021 and 6.284 billion yuan in 2020, with a current net asset of 37.965 billion yuan.

As one of the joint venture car companies, Beijing Hyundai has had a highlight moment, but the current sense of existence is getting lower and lower. Before 2016, Beijing Hyundai dominated the domestic passenger car market because of its cost-effective performance, with sales of 1.03 million, 1.16 million, 1.06 million and 1.14 million respectively from 2013 to 2016, and reached an all-time peak in 2016. However, after entering 2017, Hyundai sales in Beijing have been declining. The cumulative sales of Hyundai in Beijing from 2017 to 2020 were 756000, 782000, 685000 and 385000 respectively, with only 360000 left in 2021. This is a far cry from the 560000 annual sales set at the beginning of the year, with a completion rate of only 55.4 per cent. In other words, 2021 is the fifth consecutive year of decline in Hyundai sales in Beijing.

Due to the continuous decline in sales, it has directly led to a serious underutilization of production capacity in Hyundai's factories in Beijing. It is understood that Beijing Hyundai has five major passenger car production bases in China: the first, second and third factories in Beijing Shunyi, as well as the Cangzhou and Chongqing factories in Hebei Province, with an annual output of 1.65 million vehicles. After the first factory in Beijing was resold to ideal cars, the total design capacity of the current factories in Beijing, Chongqing and Hebei is 1.35 million vehicles. Based on the sales volume of 360000 vehicles in 2021, its capacity utilization rate is only 26.7%.

Of course, Beijing Hyundai has also made a lot of efforts. In the past two years, Beijing Hyundai has launched a number of new models, including the seventh generation Elantra, the new Sonata, the brand new Tusheng L, ix35, Kusto and so on. But judging from the performance of the subdivided models, only Elantra has won in stages, and the current monthly sales are basically stable at more than 10,000 vehicles, including 14657 in January and 6453 in February. It is obvious that Beijing Hyundai cannot rely on Elantra alone. As for why Beijing Hyundai has been reduced to this point, the automotive industry is concerned that from a product point of view, the current consumer car purchase does not only consider the ratio of performance to price, including brand awareness, after-sales service, etc. these Beijing Hyundai's advantages are not strong, especially in the context of independent brands, the survival pressure of the second-line joint venture brand, taking Beijing Hyundai as an example, is becoming more and more obvious. From the market point of view, Beijing Hyundai does not innovate in strategy and models according to the changes in the market, and the process of localization is relatively slow, and it has launched too many similar models at the same time, resulting in uneven distribution of marketing resources. unable to respond quickly to market changes, which made Beijing Hyundai miss the opportunity for self-innovation.

According to Beijing Hyundai's plan, this year it will improve the overall utilization of capacity by adjusting the product mix and planning to turn its factories in China into an export base. In addition, increasing the launch of new energy models has also become the main measure for Beijing Hyundai to keep up with the pace of the market.

According to the plan, Hyundai hopes to achieve global sales of 1.87 million electric vehicles by 2030, equivalent to about 7 per cent of the market share, an increase of 234 per cent from the previous target of 560000 by 2025. This ambitious plan is underpinned by the launch of 17 all-electric models worldwide by 2030, including six new cars from Hyundai's luxury brand Denisys and 11 Hyundai models. Among them, the Hyundai brand pure electric model will launch three hatchback cars, six SUV, one light commercial vehicle and a new model. Hyundai is scheduled to start selling IONIQ 6 this year, followed by IONIQ 7 in 2024.

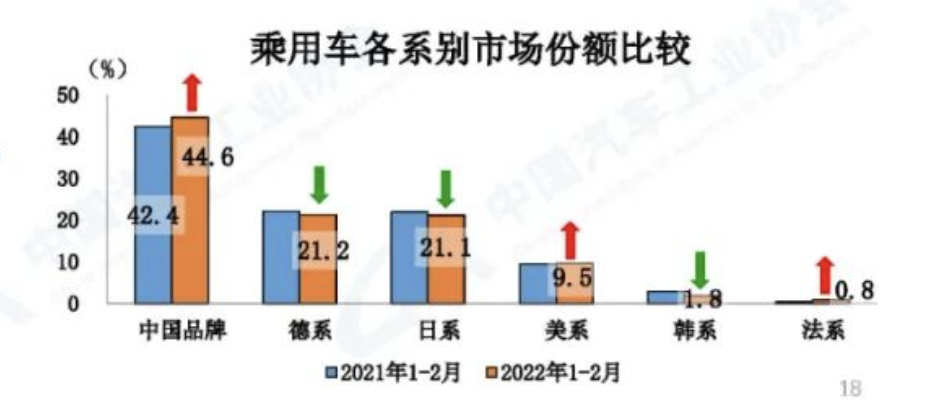

Due to the continued decline in sales of Korean brands, the market share in China is less than 2%. According to data released by the China Association of Automobile Manufacturers, the market share of Korean cars in China from 2016 to 2021 is 7.35%, 4.63%, 4.98%, 4.7%, 3.8% and 2.4%, respectively, compared with 1.8% for Korean brands in February this year.

No matter how big the Chinese market is, there is no room for hundreds of car companies, both independent brands and joint venture brands will face a severe market test. The market is also fair, and in the end, only those car companies with technology and capital will remain. The collapse and withdrawal of some brands are the result of the survival of the fittest in the market, which is also conducive to the merger and reorganization of China's automobile industry. and the most important thing at this stage is change.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.