In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/25 Report--

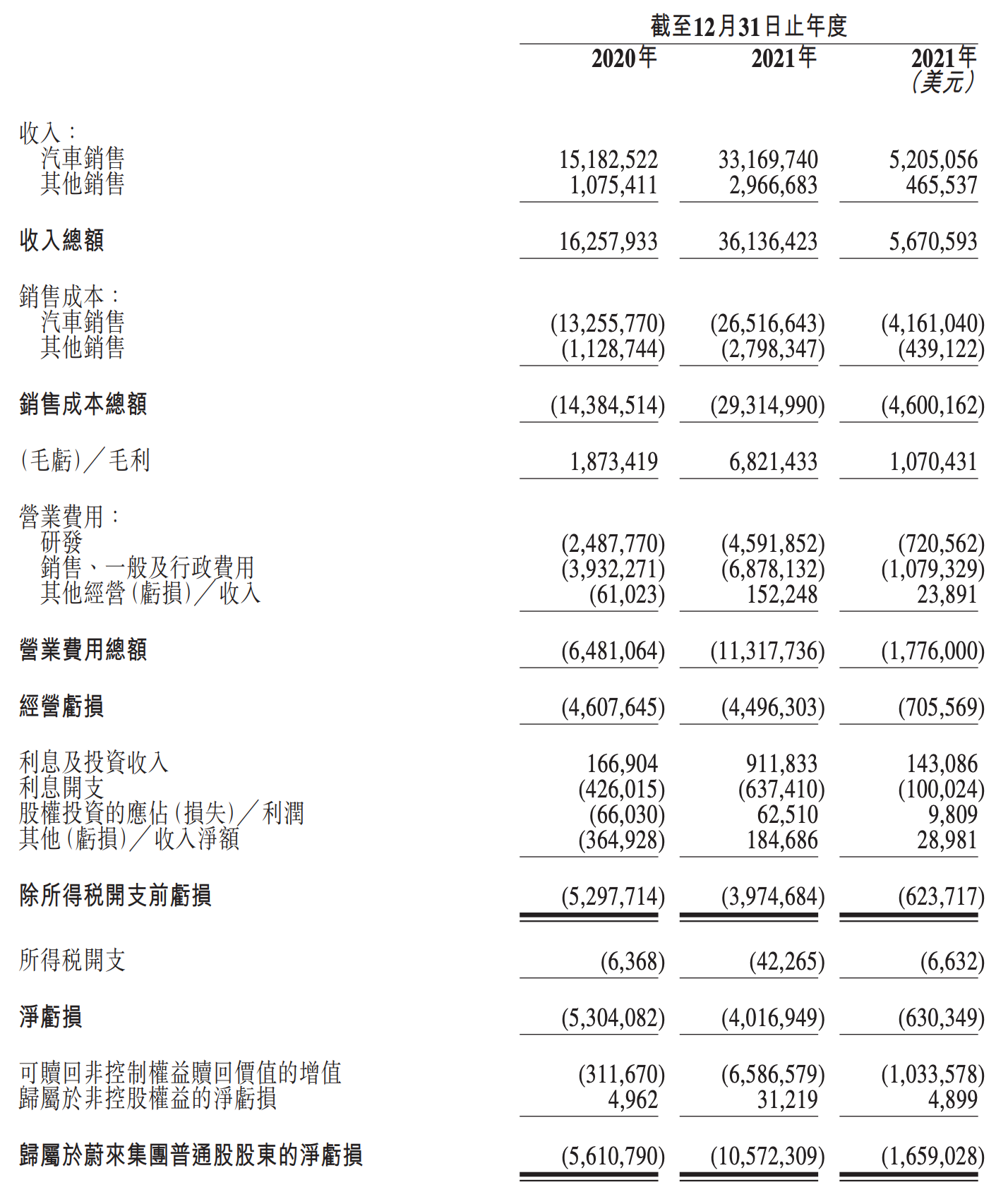

On March 25, Xilai released its 2021 results. According to the financial report, the total revenue of Lulai Automobile in 2021 was 36.1364 billion yuan, an increase of 122.3 percent over the same period last year, of which car sales were 33.1697 billion yuan, an increase of 118.5 percent over the same period last year. The net loss of NIO in 2021 was 4.0169 billion yuan, down 24.3% from the same period last year. In 2021, the net loss of ordinary shareholders belonging to NIO was 10.5723 billion yuan, an increase of 88.4% over the same period last year. In addition, the gross profit in 2021 is 6.8214 billion yuan, the gross profit margin is 18.9%, and the gross profit margin for cars is 20.1%.

The gross profit margin of the new power car companies is still quite amazing! In 2021, for example, the gross profit margins of Ultimate and ideal cars were 20.1% and 20.6% respectively, surpassing ultra-luxury brands such as Porsche and Ferrari, while Toyota, which is known for its high profit margins among traditional car companies, had a gross profit margin of only 19.07% in the second quarter of fiscal 2022. It is understood that the current gross profit margin performance of the automobile industry is the best Tesla. According to the financial report, Tesla's total revenue in 2021 was US $53.823 billion, an increase of 71% over the same period last year, of which the annual revenue of the automobile business was US $47.232 billion, an increase of 73% over the same period last year. In addition, the gross profit of the auto business was US $13.839 billion, with a gross profit margin of 29.3%.

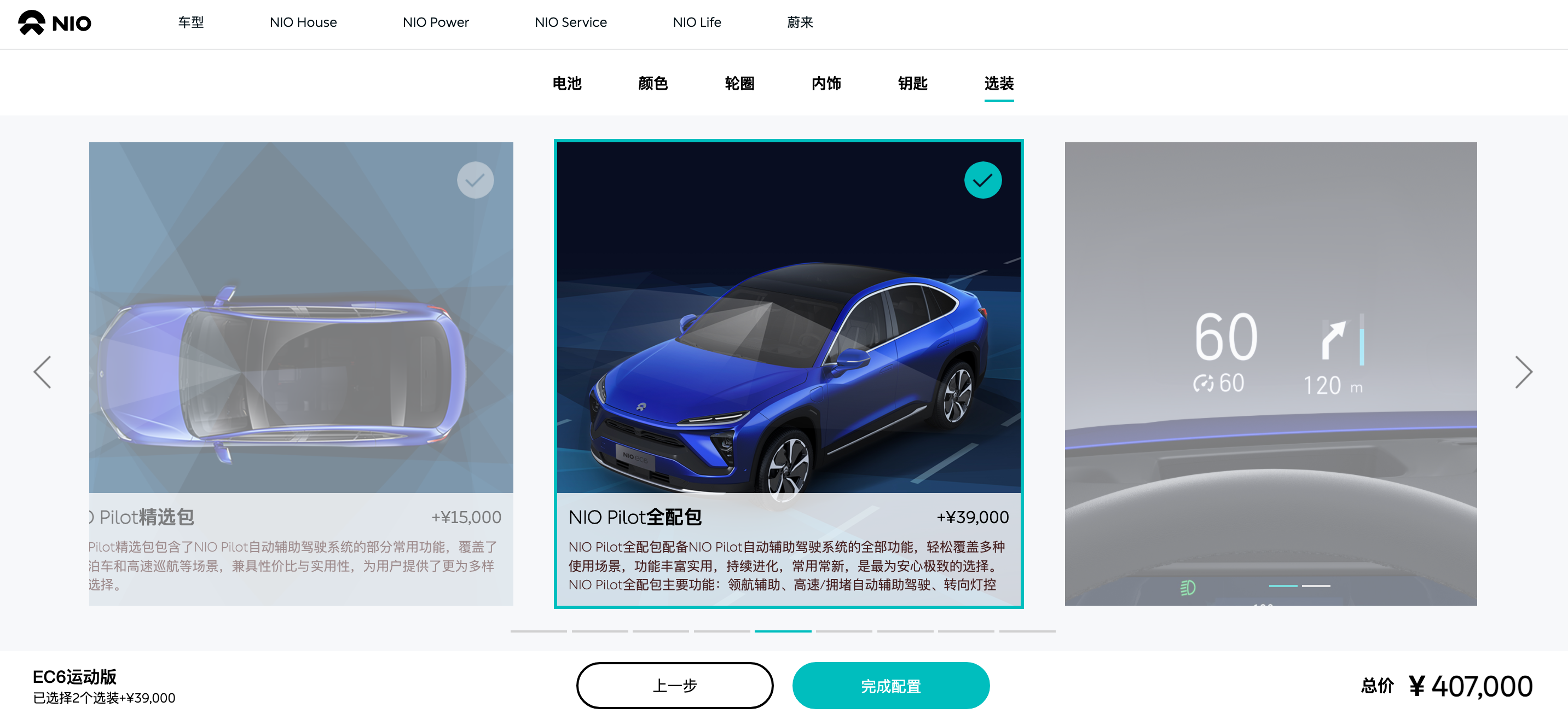

Tesla's secret book of making money is related to the sales model that turns complexity into simplicity, and software charges are an important source for Tesla to make a profit, while new forces such as NIO and ideal car companies are basically the same as Tesla's model, of which the full matching package of Lulai NIO Pilot is 35000 yuan. The more NIO sells, the more income it gets by relying on auxiliary driving services.

Li Bin said that taking into account the rising supply chain and raw materials and other problems, NIO vehicle gross profit target is between 18% and 20%. As for the reasons for the losses, Li Bin said that most of them came from R & D investment, which will continue to be maintained this year, while Ulai is expected to make a profit in 2024.

In terms of delivery volume, a total of 91429 new cars were delivered in 2021, an increase of 109.1% over the same period last year, of which 20050 were delivered by ES8, 41474 by ES6 and 29905 by EC6. However, although the delivery volume of NIO has doubled compared with 2020, the performance of Wei in the second half of the year has been uneven, either by ideal cars or by Xiaopeng. In terms of annual delivery, Xilai was overtaken by Xiaopeng, which delivered a total of 98155 new cars in 2021, leading it to win the annual sales title.

Since the third quarter of 2021, the delivery volume of NIO has been falling behind Xiaopeng and ideal. In this regard, Li Bin said that in 2022, we will see the result of great investment in research and development. It is understood that the delivery of three new cars will begin next, of which the ET7 based on the NT2.0 platform will be officially delivered on March 28th, and the second ES7 based on NT2.0 will be released in April, targeting the medium and large pure electric SUV and the domestic BMW X5, which is expected to start delivery in the third quarter. In addition, ET5, released by NIO Day in 2021, will be officially put into production in the third quarter. The auto industry has learned from the official website that the current products launched by Yulai include ES6, ES8, EC6, ET7 and ET5, including the ES7, which will be released in April, with a basic price of more than 300000 yuan.

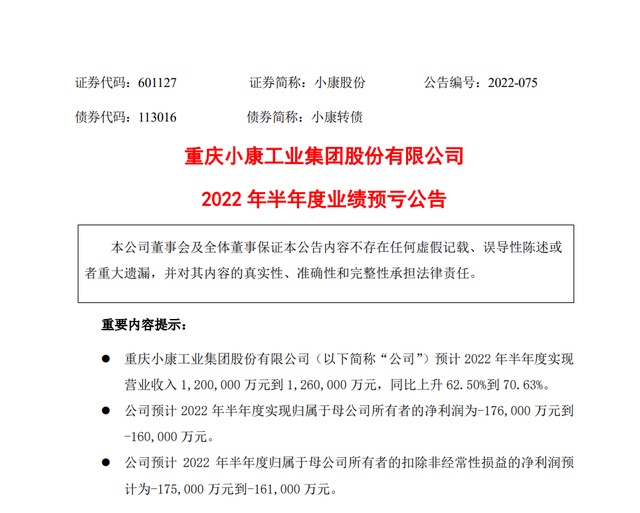

In the earnings call, Li Bin also revealed the progress of new brands that have attracted much attention from the industry. Li Bin said, "the business of our new brand for the mass market is progressing smoothly, the core team has been built, the strategic direction and development plan have been clearly defined, and the first batch of products have entered a critical stage of research and development." Li Bin said that the general rule of the auto industry is that the models and prices that a brand can support are limited, so Xilai will choose to use a new brand to enter the $30, 000 to $50, 000 market. He believes that there is still a large market for $30, 000 to $50, 000, and the premise is that a reasonable gross margin range will be set to enter the market without sacrificing gross profit.

As we all know, recently, new energy vehicles ushered in two price increases, including Tesla, BYD, ideal, Xiaopeng, Weima, Nezha and so on have announced increases in the prices of their new energy vehicles. When asked whether the prices of existing products will rise due to the problem of raw materials, Li Bin said that at present, there is no price increase in NIO, there is no idea of a price increase at present, and there is still some time to observe the price trend of raw materials. The price of the new model will be evaluated at the right time. However, NIO said that it will launch 2022 ES8/ES6/EC6 models with 8155 chips and 5G communication modules, when the price of the products will be adjusted.

For the first quarter of this year, the company said in its financial report that its delivery guidance for the first quarter of 2022 was 2.5-26000 vehicles, an increase of 24.6% to 29.6% compared with the same period last year. Revenue is expected to range from 9.63 billion yuan to 9.99 billion yuan, an increase of about 20.6% to 25.1% over the same period last year. By the end of February, a total of 15783 cars had been delivered in the first two months, of which 6131 were delivered in February.

As of march 24, u.s. stocks closed up 0.5% at $21.98 per share, with a total market capitalization of $36.278 billion.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.