In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/30 Report--

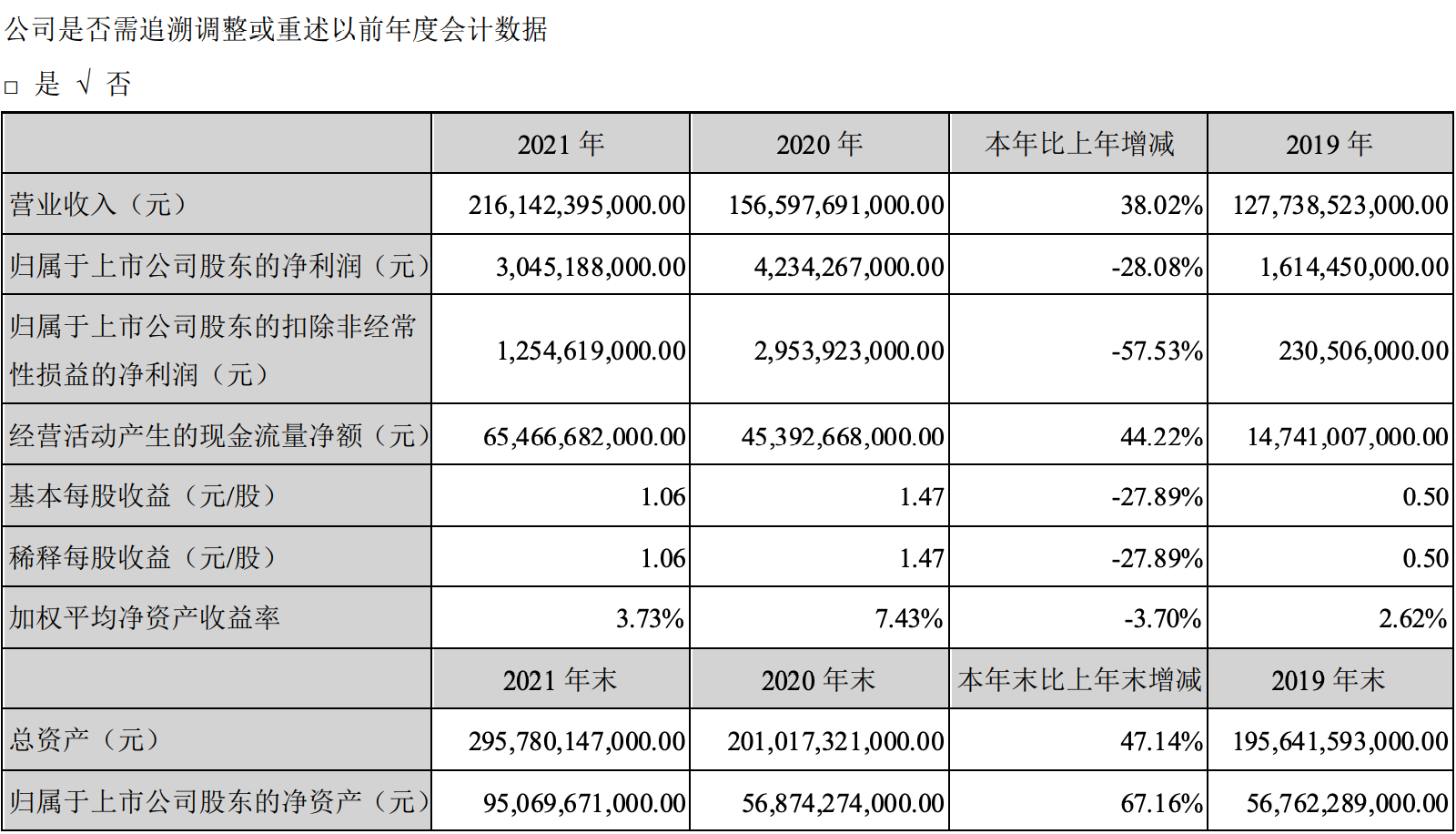

New energy vehicles are selling very well, but BYD has fallen into a strange circle of increasing income without increasing profits. On March 29th, BYD Co., Ltd. (hereinafter referred to as "BYD") realized an operating income of 216.142 billion yuan, an increase of 38.02% over the same period last year, and a net profit of 3.045 billion yuan belonging to shareholders of listed companies, a decrease of 28.08% over the same period last year. 1.255 billion yuan was deducted from non-net profit, down 57.53% from the same period last year.

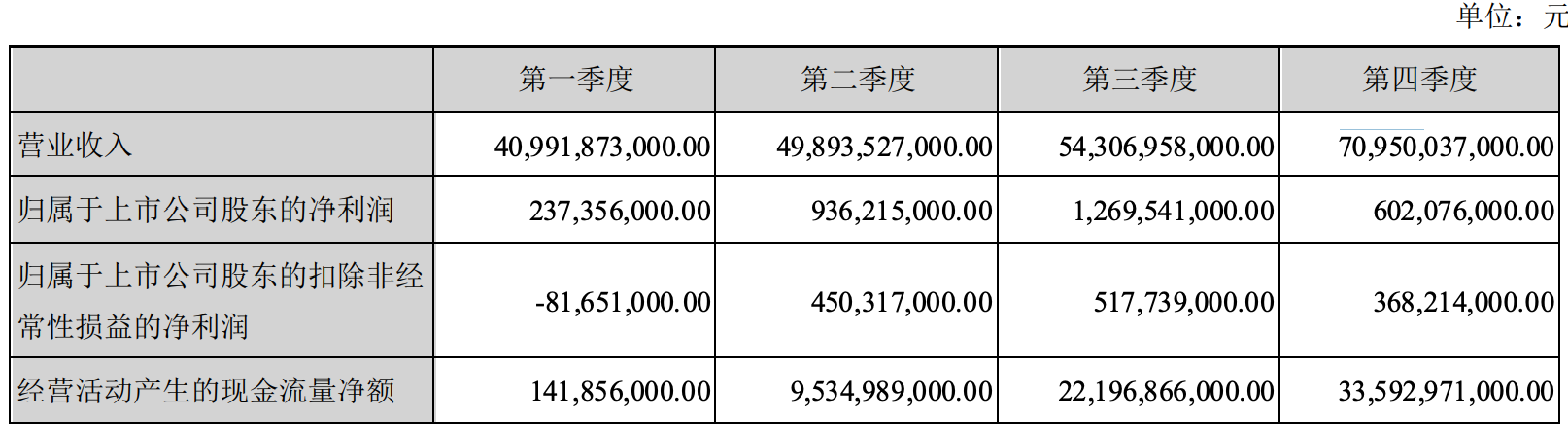

Quarter by quarter, from the first quarter to the fourth quarter of 2021, BYD's operating income increased quarter by quarter, from 40.992 billion yuan in the first quarter to 70.95 billion yuan in the fourth quarter, while the net profit increased from 237 million yuan in the first quarter to 1.27 billion yuan in the third quarter, but plummeted to 602 million yuan in the fourth quarter. In other words, while BYD's revenue grew by 30.65% month-on-month in the fourth quarter of 2021, net profit fell 52.58% from the previous quarter.

According to data, BYD was founded in 1995, listed on the Hong Kong Stock Exchange in 2002 and listed on the Shenzhen Stock Exchange in 2011. BYD started as a battery business, acquired Qinchuan Automobile in 2003 and officially entered the automobile industry, launching its first model, the F3, in 2005. Before 2010, with the development of China's automobile industry, BYD's car sales also rose, and the automobile business ushered in a highlight moment of development. After 2010, BYD began to enter a bottleneck and did not surpass 2010 sales for the first time until 2021.

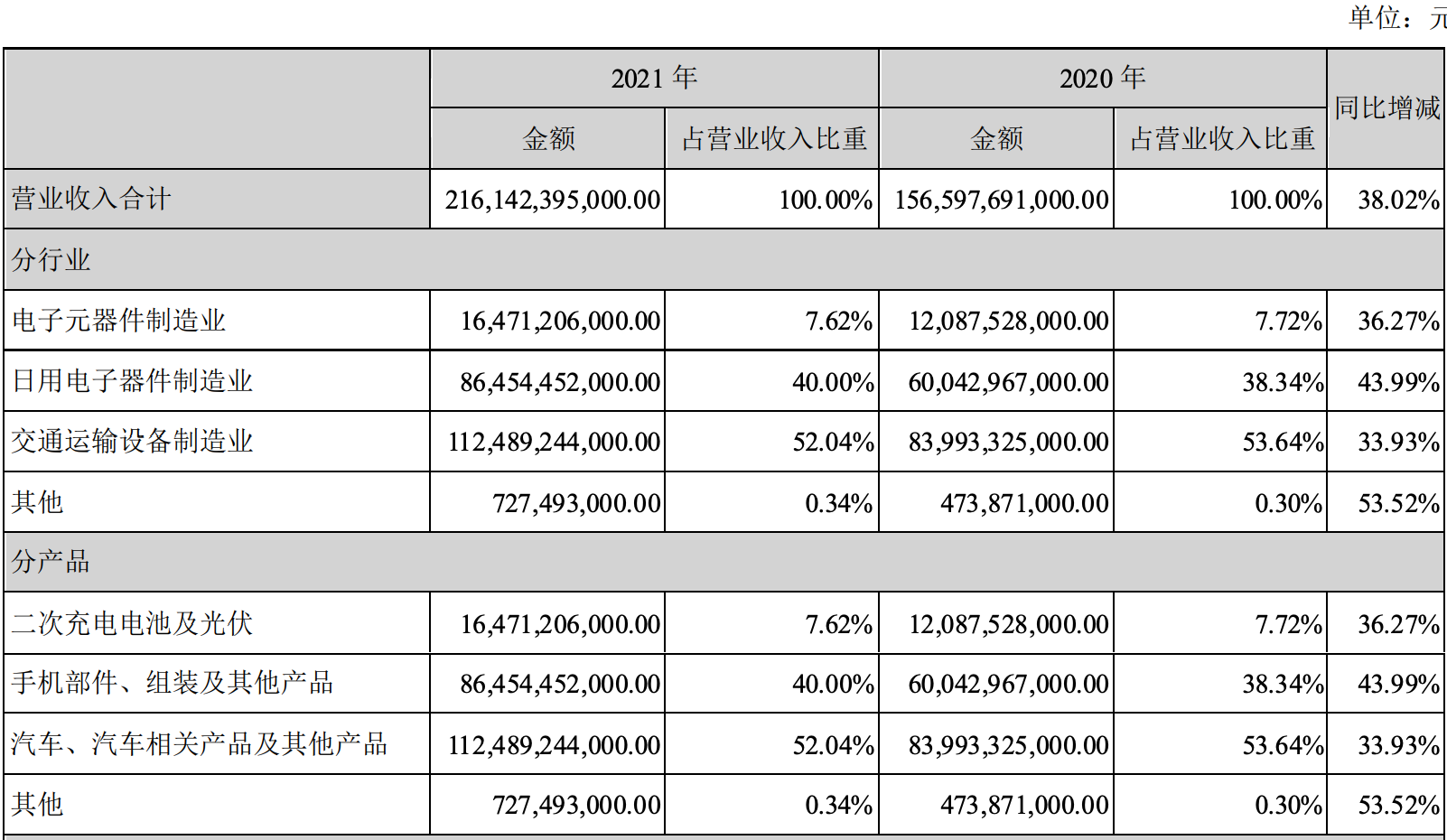

BYD is a very complex company with three business segments: automobile business, mobile phone parts and assembly business, rechargeable battery and photovoltaic business, which accounted for about 52%, 40% and 8% of the company's total revenue in 2021, respectively. In terms of the development of major business sectors, BYD's total revenue in 2021 was 216.142 billion yuan, an increase of 38.02% over the same period last year. Of this total, revenue from automobile, automobile-related products and other products business was 112.489 billion yuan, up 33.93 percent from the same period last year; revenue from mobile phone parts, assembly and other products business was 86.454 billion yuan, up 43.99 percent from the same period last year; revenue from rechargeable batteries and photovoltaic business was 16.471 billion yuan, up 36.27 percent from the same period last year.

From the above data, it is not difficult to see that the automobile business is an important source of revenue for BYD, and the revenue growth is mainly due to the increase in sales of new energy vehicles. According to the data, BYD sold 740100 vehicles in 2021, an increase of 73.34 percent over the same period last year, including 593700 new energy passenger vehicles, an increase of 231.60 percent, and 10000 new energy commercial vehicles, down 5.61 percent from the same period last year. From the perspective of 2021, BYD's newly launched Qin PLUS DM-i, Song PLUS DM-i, Tang DM-i and other DM-i super hybrid models are widely sought after by the market, but the sharp increase in sales has not brought a good profit level to BYD, resulting in an embarrassing situation of "incremental non-profit increase".

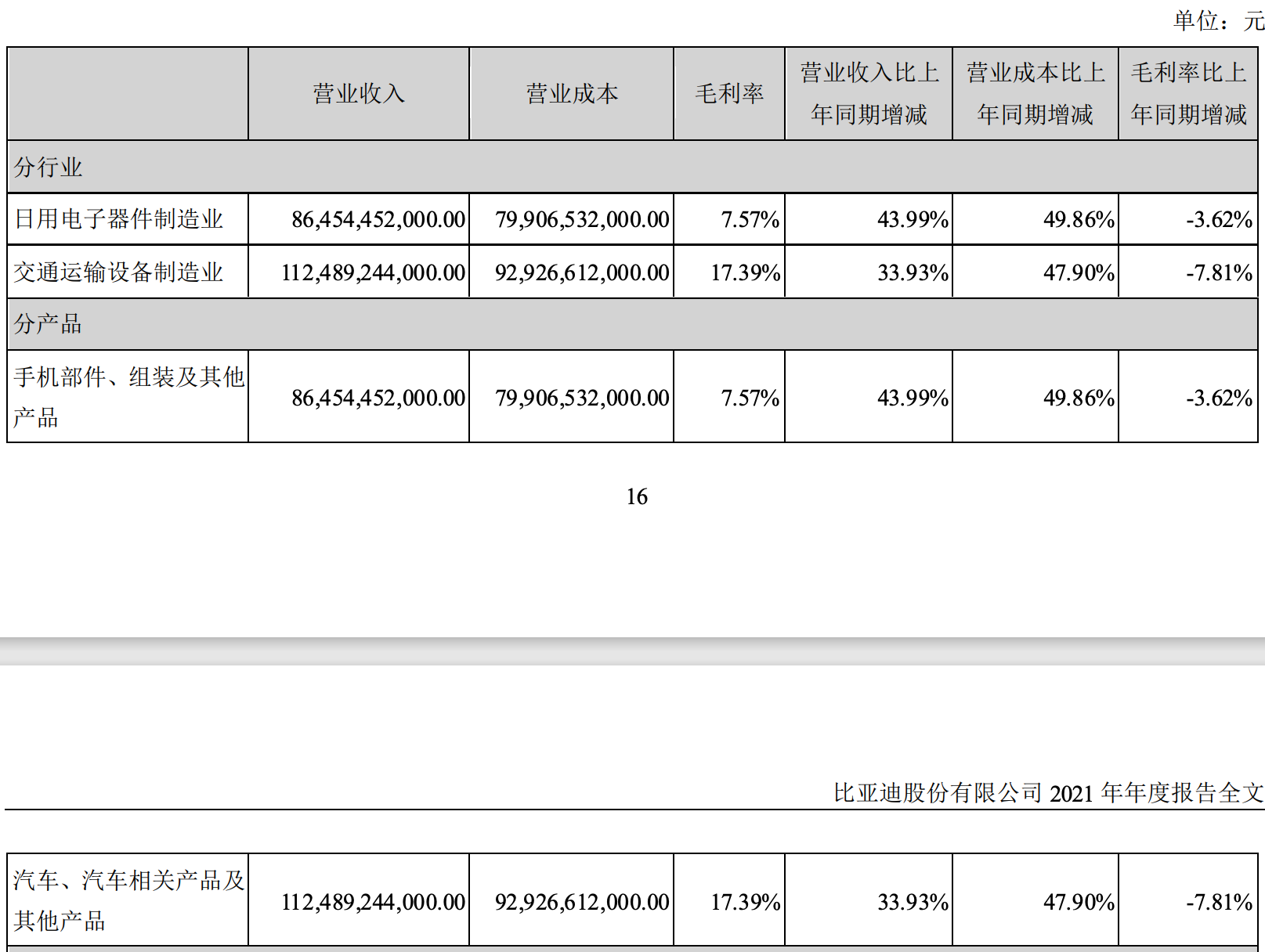

According to the annual report, the gross profit margin of BYD cars and related products in 2021 was 17.39%, down 7.81% from the same period last year and the lowest gross profit margin in 14 years. From the perspective of the first half of the year, the gross profit margin fell sharply to a record low in the first half of the year, and continued to decline in the second half of the year on the basis of the first half of the year. It should be noted that BYD's auto business covers the whole vehicle and batteries, all the batteries needed for the whole vehicle are self-supplied, and due to capacity constraints, BYD produces almost all internal batteries, which makes it impossible for BYD to make additional profits through external supply. Therefore, the gross profit margin of the automobile sector is actually the gross profit margin generated by vehicles, batteries and other parts, and the reason for the decline is, on the one hand, the change in the structure of models on the revenue side and the aggressive pricing strategy. on the other hand, the price of upstream raw materials comes from the cost side. Previously, BYD admitted in its interim report that the main raw materials needed for the company's production include steel, plastic and other metal raw materials, such as lithium and cobalt, and that fluctuations in raw material prices directly affect the production costs of the main business, which in turn have a certain impact on business performance.

For comparison, the gross profit margin of BYD's auto business is only 17.39%, including vehicle, battery and other parts and other related gross profit margin, while the Ulay and ideal gross profit margin of only the whole vehicle are maintained at about 20%. The larger Tesla even reached 20%, so BYD's auto business really doesn't make much money.

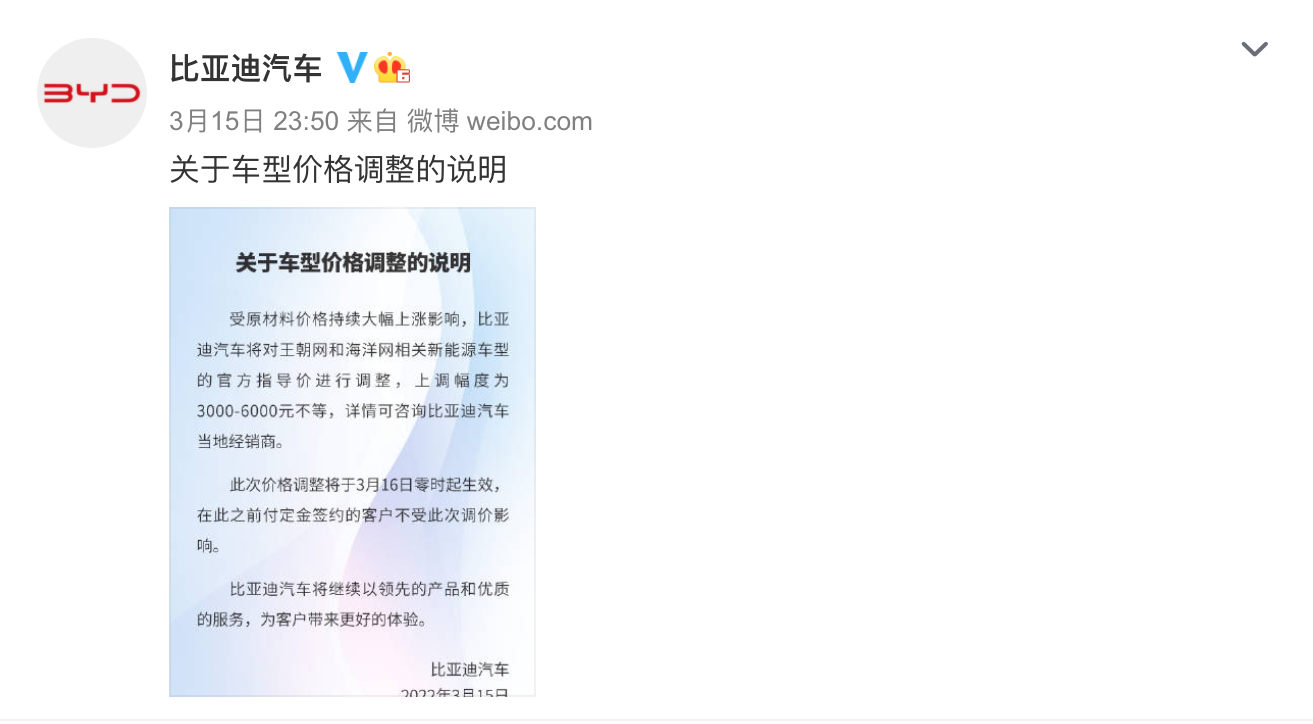

To this end, BYD raised the price of its products to transfer the cost pressure. On January 21, BYD announced that due to the sharp rise in raw material prices and the decline of subsidies for new energy car purchases, the prices of models related to BYD Dynasty and Ocean Network will be raised by 1000 yuan to 7000 yuan on February 1. On March 15, BYD again issued a notice of price increase: affected by the continued sharp rise in raw material prices, the prices of new energy models related to BYD Dynasty and Ocean Network will be adjusted on March 16, ranging from 3000 yuan to 6000 yuan. However, the profitability of BYD's auto products is still under pressure in the face of continued adjustment in raw material prices.

It is worth mentioning that BYD is also a major player in new energy subsidies. According to the financial report, the total subsidy income of BYD's new energy vehicles in 2021 is 5.867 billion yuan, and the government subsidy included in the current profit and loss is 2.263 billion yuan. In other words, after deducting government subsidies, BYD's actual profit in 2021 is only 782 million yuan. According to reference data, from 2018 to 2020, BYD received government subsidies of 2.073 billion yuan, 1.484 billion yuan and 1.678 billion yuan respectively, and the company's net profit of returning to its mother was 2.78 billion yuan, 1.615 billion yuan and 4.234 billion yuan respectively. It is not difficult to see that BYD is more dependent on government subsidies.

It is worth mentioning that subsidies for new energy vehicles will end in 2022, which also means that BYD's profitability will face more challenges. Since 2009, the central government began to subsidize the promotion and application of new energy vehicles, and has enjoyed a 12-year subsidy dividend by 2021, and 2021 will be the last year of the implementation of new energy vehicle subsidy policy.

BYD's share price has also been adjusted as a result of market turmoil. Since the record high of 333.33 yuan set at the end of October 2021, it has fluctuated all the way down, the latest closing price is 237.02 yuan, so far the share price has fallen 28%, and the market value has lost 290 billion yuan. However, as of press time, BYD is still the highest market capitalization of car companies in China, with a total market capitalization of 689.999 billion yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.