In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/10 Report--

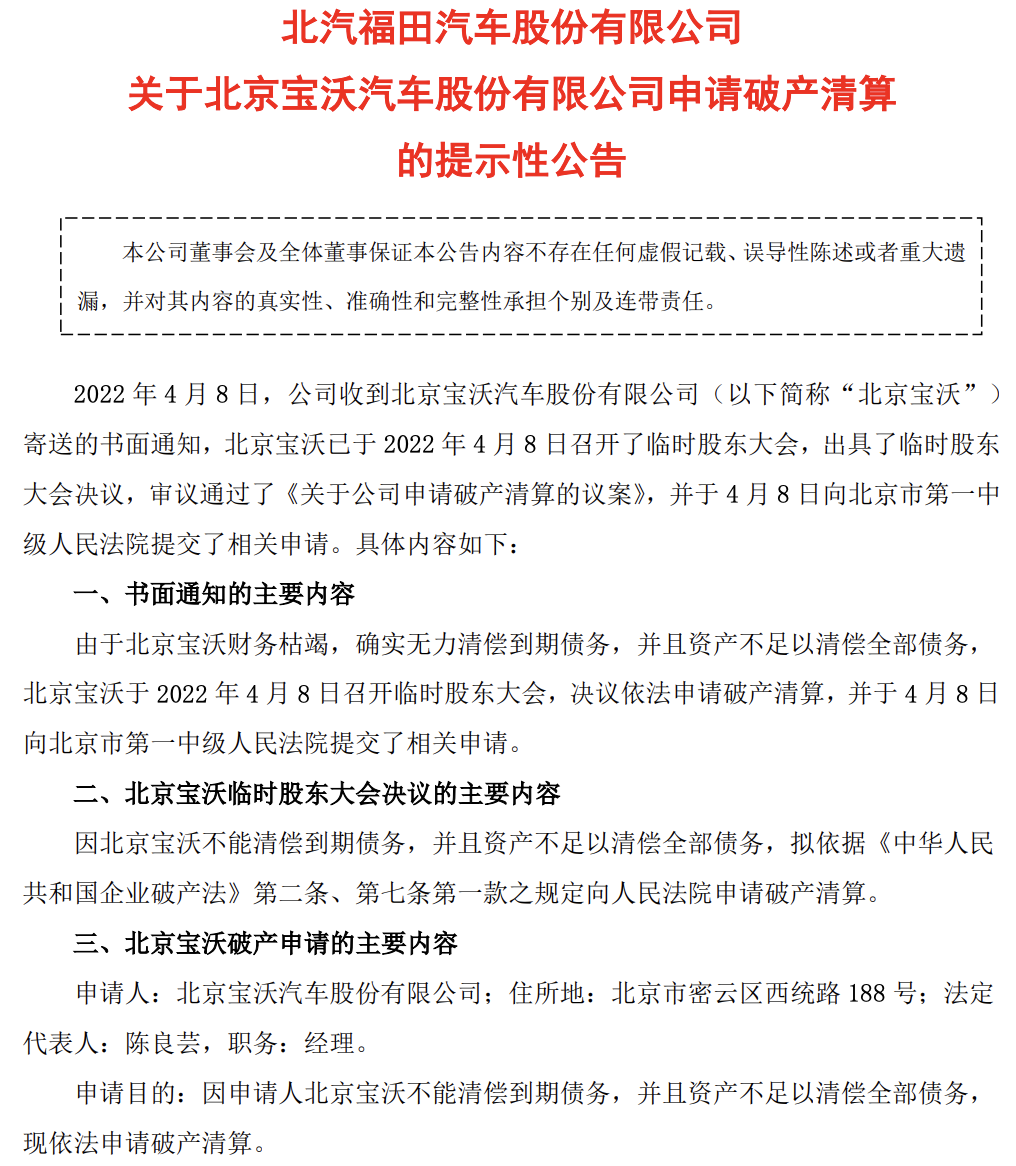

Beijing Baowo, which lost its operational capacity, finally filed for bankruptcy liquidation, and Foton Motor, as one of its shareholders, was also deeply affected. On the evening of April 8, Futian Motor announced that due to the financial exhaustion of Beijing Baowo, it was indeed unable to pay off its maturing debts, and its assets were not sufficient to pay off all its debts. Beijing Baowo held an interim shareholders' meeting on April 8, 2022. The resolution filed for bankruptcy liquidation in accordance with the law, and submitted the relevant application to the Beijing No. 1 Intermediate people's Court on April 8.

It should be noted that bankruptcy liquidation and bankruptcy reorganization are essentially different. Bankruptcy reorganization is a procedure for debtors who have or may have bankruptcy conditions and hope for regeneration to introduce external funds to protect their continued business and save their survival. Bankruptcy liquidation means that after declaring the bankruptcy of a joint stock limited company, the liquidation group will take over the company and liquidate, evaluate, dispose and distribute the property. In other words, once Beijing Baowo's bankruptcy liquidation application is allowed, the company will eventually be deregistered and the company will be terminated.

Futian said that the bankruptcy liquidation of Beijing Bowo will not affect the company's existing main business and will not have a significant impact on the company's continued operation, but on the principle of prudence, a large amount of impairment provision will be made for Beijing Bowo's loans, arrears, guarantees and the recovery of the company's equity holdings in Beijing Baowo. The above impairment is expected to affect the total profit of 2021-4.704 billion yuan. In addition, it is estimated that the total profit of 2021 will be about 5.326 billion yuan due to the recognition of investment income due to the company's equity holding in Beijing Baowo.

In fact, Beijing Baowo has long shown signs of bankruptcy. As early as June 2021, the market suddenly reported that Beijing Baowo would enter bankruptcy proceedings, and then the relevant reports were urgently deleted. In December 2021, Futian Motor announced that the assets related to Beijing Baowo had been seized by the Beijing No. 3 Intermediate people's Court, with a book value of 2.209 billion yuan, all of which were necessary for the production and operation of Beijing Baowo. In January 2022, Foton Motor once again announced that Beijing Baowo had entered a shutdown because it was unable to maintain its operation due to the depletion of funds. The assets deposited in the Miyun factory have been seized by the court as a whole, the foreign liabilities are basically overdue, and Beijing Baowo has become insolvent.

According to Tianyan check, Beijing Baowo Automobile Co., Ltd. was established on January 18, 2016. its business scope includes automobile manufacturing, engine production, automobile sales, auto parts, etc., the product pedigree is divided into fuel vehicle BX series and new energy vehicle BXi series, products include fuel car BX7, BX7 TS, BX5, BX6 and new energy vehicle BXi7. Equity penetration shows that Shenzhou Youche holds 75.2%, while BAIC Foton holds 24.8%. At present, the legal representative of Beijing Baowo is Chen Liangyun and the chairman is Lu Zhengyao.

In fact, Beijing Baowo has long been the "abandoned son" of BAIC Futian. Data show that Bowo was founded by German engineer Karl Bowo in 1919 and was the first to complete 1 million cars off the line in 1961, ahead of Mercedes-Benz and BMW, but it was also in this year that Bowo went bankrupt because of poor management. fixed assets were acquired by Mercedes-Benz and BMW and officially retired from the historical stage.

After half a century of leveling, Chinese commercial vehicle brand Foton Motors bought Bowo for 5 million euros in 2014 and established Beijing Baowo Automobile Co., Ltd. in 2016. Foton Automobile claims to be of "German" blood and uses the slogan of "German brothers", known as "BBBA".

Bowo Motor is more like a "hot taro", and the loss of Futian Motor continues to expand after its acquisition of Bowo. According to the financial report, the net losses of Beijing Baowo from 2016 to 2018 were 484 million yuan, 985 million yuan and 2.54 billion yuan respectively, with a cumulative loss of 4.014 billion yuan over three years. In May 2018, Foton issued a "three-year Action Plan", determined to spin off the loss-making passenger vehicle business and focus on the main business of commercial vehicles. In October of the same year, Foton Motor listed the transfer of 67% of Beijing Baowo's shares to Changsheng Xingye, which needs to repay 4.271 billion yuan of shareholder loans owed to Foton Motor in instalments within three years from the date of completion of the equity transfer. In March 2019, Shenzhou Youche was granted a 67 per cent stake in Beijing Baowo held by Sheng Xingye, which was transferred at a price of about 4.11 billion yuan. After the completion of the transaction, Shenzhou Youche directly became the largest shareholder in Beijing Baowo.

It was originally thought that Beijing Baowo could shine after entering the "Shenzhou system", but it was more like falling into another quagmire. Affected by Luckin Coffee's financial fraud, coupled with the long-term sluggish performance of the "China Department", the relevant companies fell into a financial crisis and it was difficult to repay the remaining equity transfer and loans to Foton Motor. According to the announcement of Foton Motor, as of December 31, 2021, Foton Motor had not collected 1.671 billion yuan and interest from Beijing Baowo's equity transfer on time, and there was a risk that it could not be recovered. In order to safeguard its legitimate rights and interests, it applied to the Beijing Arbitration Commission for arbitration and preservation. The relevant arbitration case has been accepted by the court, and Lu Zhengyao has become one of the respondent.

Bowo Automobile has come to the current stage, the result of stock competition in the domestic automobile market, but also the result of market competition and consumer choice. Perhaps, for such a brand, even if it falls down, there is nothing wrong with it, but for those car owners who have bought Bowo, the decline and collapse of a company is undoubtedly a fatal blow, in addition to daily maintenance and repairs can not be carried out normally, the promised lifetime warranty turned into a bubble.

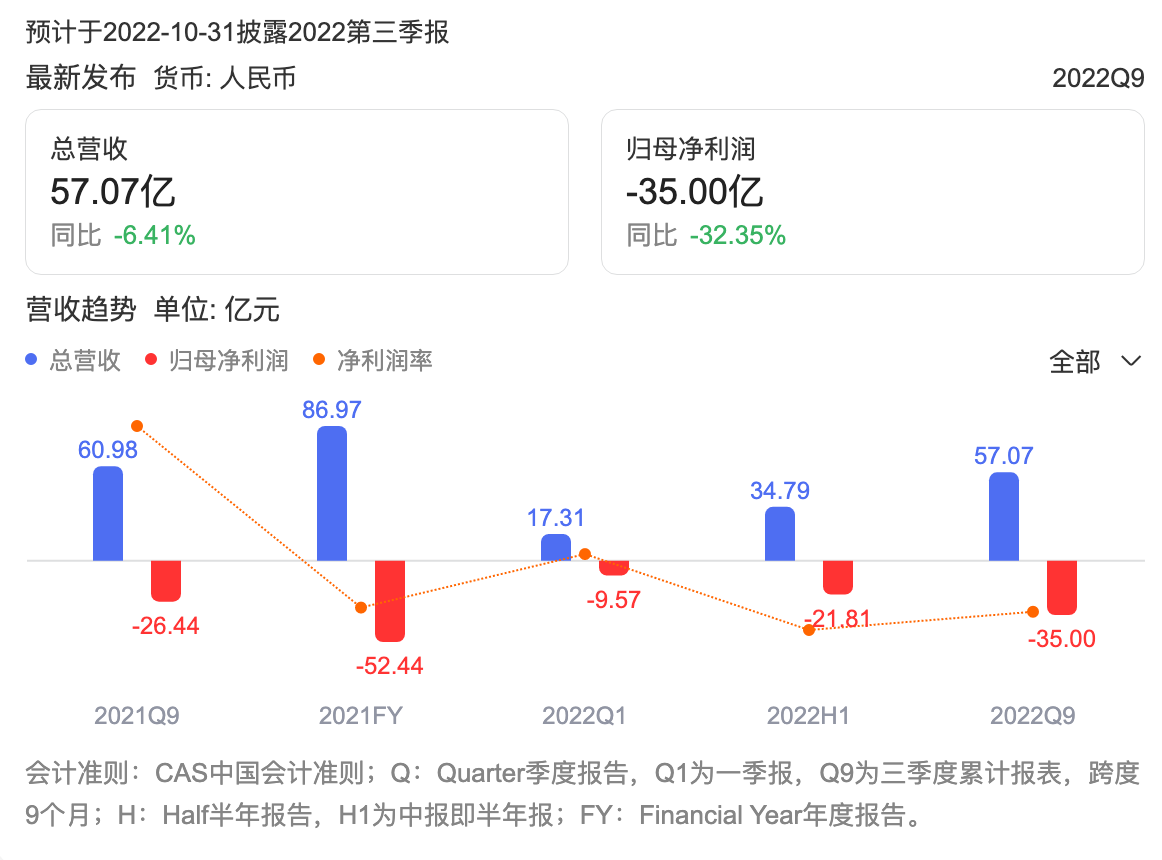

For Fukuda Motor, entering the passenger car market through the acquisition of Bowo is more like an empty dream. In fact, it is not advisable for Futian Motor to spend a lot of money to acquire Bowo. Baowo, which has been lying flat for half a century, has no German culture and cutting-edge technical strength. After being acquired by Futian Motor, Bowo has actually become a domestic brand, while playing "German brothers" and "BBBA" seems to be able to achieve good market popularity in a short period of time. But without the selling point of the core products, it has already become a "German pseudo-brand". Of course, there is no denying Foton's determination to enter the passenger car market, but Foton has suffered heavy losses in investing in Bowo, and even if it transfers its stake in Beijing Bowo in 2018, it has not been able to avoid the aftermath. According to the Forecast of Futian Automobile Annual report, the net profit of shareholders belonging to listed companies in 2021 is expected to be-5.035 billion yuan, of which the total profit of the company is expected to be-5.326 billion yuan due to the recognized investment income of holding shares in Beijing Baowo.

Perhaps, for Beijing Baowo, whether or not bankruptcy liquidation may soon be the result. But what about the owners or dealerships who bought Bowo?

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.