In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/15 Report--

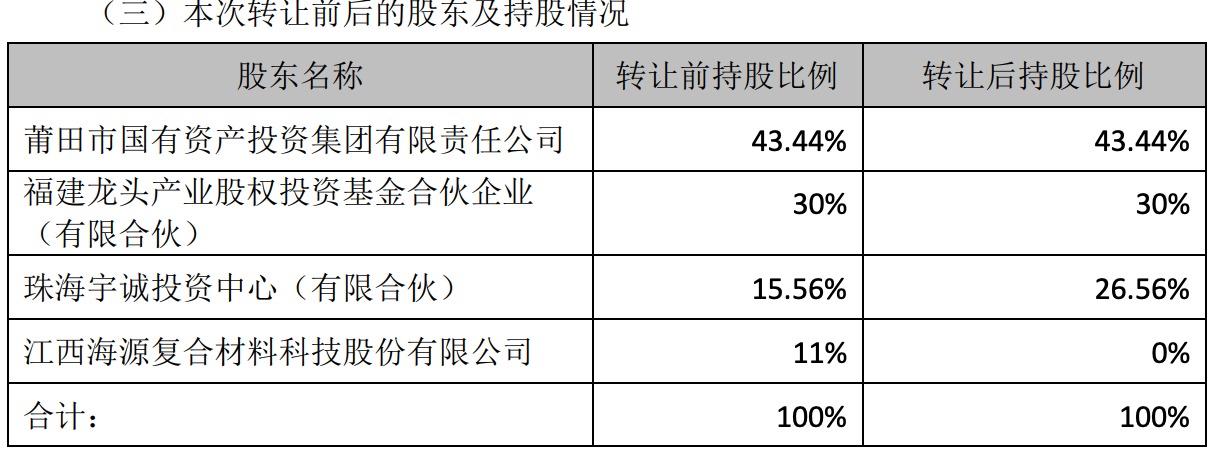

Founded more than 6 years, Yundu Motor seems to have been unable to support! Recently, Haiyuan compound material announced that the company will transfer 11% of its shares in Yundu New Energy Automobile Co., Ltd. (hereinafter referred to as "Yundu Automobile") to Zhuhai Yucheng Investment Center Co., Ltd. (hereinafter referred to as "Zhuhai Investment"). The transfer price is 22 million yuan. After the completion of this transaction, the company no longer holds a stake in Yundu.

Since its establishment, its ownership structure has undergone many changes, but Haiyuan compound material's shareholding ratio has not changed, and now Haiyuan compound material has decided to transfer its stake in Yundu Automobile, a move intended to stop losses. Haiyuan compound material said in the announcement that Yundu New Energy Automobile Co., Ltd. and its subsidiaries consolidated statement of each year's net profit is negative, and the loss situation is more and more serious. At present, Yundu Motor has been out of production since February 2022 because of a broken capital chain. Data show that as of March 31, 2022, Yundu Automobile has total assets of 1.652 billion yuan, total liabilities of 1.682 billion yuan and net assets of-30.7964 million yuan, which is insolvent.

The auto industry noted that Zhuhai Yucheng, the receiver, had previously held a 15.56 per cent stake in Yundu Motors, which would rise to 26.56 per cent after the deal, but remained the third largest shareholder. Tianyan Cha shows that Zhuhai Yucheng was established in August 2020, and its major shareholder is Shenzhen Qianhaitian Investment Management Partnership (hereinafter referred to as "Qianhaitian Investment Management Partnership"). Lin Mi holds a 0.9% stake, and its Zhuhai Yucheng executive partner is also the CEO of Yundu Automobile.

Data show that Yundu New Energy Automobile Co., Ltd. was established on December 4, 2015 by Fujian Automotive Industry Group Co., Ltd., Putian State-owned assets Investment Co., Ltd., management team (individual shareholders), Fujian Haiyuan Automation Machinery Co., Ltd., Sifang jointly contributed 900 million yuan to establish a mixed ownership new energy vehicle production enterprise. Tianyan survey shows that Yundu Automobile is mainly engaged in the design, research and development, production, processing, sales and after-sales service, consulting service, new energy vehicle rental and other business of new energy vehicles and auto parts.

In January 2017, Yundu Motor obtained the new energy vehicle production license issued by the National Development and Reform Commission, becoming the tenth domestic enterprise to obtain the qualification for the production of new pure electric vehicles. It has also become the second manufacturer of new energy passenger vehicles approved by the Ministry of Industry and Information Technology. Yundu Automobile, which obtained the production qualification in just over a year, officially launched the Yundu new energy vehicle brand in February 2017, and unveiled Yundu π 1 and Yundu π 2 at the Shanghai International Auto Show in April of that year. The first model, Yundu π 1, was launched in October 2017, and Yundu π 3 was launched in March 2018. From the perspective of the development process of Yundu Automobile, it has walked in the front end of the new power of car-building. However, the development of Yundu Automobile in the domestic new energy vehicle market is not optimistic. Yundu Automobile product system is relatively simple. In addition, the marketing promotion has not been vigorously promoted, resulting in a persistent downturn in sales. The previously planned Yundu X- π concept car and Yundu π 7 have never been born.

In addition to the poor market performance, Yundu Motors is not optimistic in terms of performance. Data show that the net losses of Yundu Motor from 2017 to 2020 are 95 million yuan, 138 million yuan, 177 million yuan and 204 million yuan respectively. According to the financial report, Yundu Motor had a revenue of 67.7632 million yuan and a net loss of 213 million yuan in 2021, compared with a revenue of 6.6025 million yuan and a net loss of 56 million yuan in the first quarter of this year.

It is worth mentioning that Yundu held a grand strategy conference in 2020. Yundu Motors said it plans to become one of the top three domestic pure electric car brands in 2025. Although Yundu Motor has a state-owned background, it seems it is difficult to go bankrupt and delisted, and it also hopes to achieve brand promotion through a new strategic layout, but Yundu Automobile has no sense of existence in the market, and its development goal for 2025 is still empty talk. More directly, if Yundu is unable to launch a product with sufficient advantages, it is actually no different from delisting, and there is not much time left for Yundu.

In fact, there are many new energy car companies with a bumpy fate. More than a dozen companies, including Changjiang Automobile, Future Automobile, Singularity Automobile and Green Chi Automobile, have been exposed that they are in arrears with their employees' salaries or payments, and some of them have even announced that they have withdrawn from the market. It is not easy for Yundu Automobile to maintain production.

According to the concerned statistics of the automobile industry, the top three car companies in sales of new energy vehicles in March 2022 are BYD Automobile, Tesla China and SAIC GM Wuling. A total of 12 car companies sold more than 10,000 new energy vehicles, only Tesla is a foreign brand, and the rest are independent brands. In other words, there are still great opportunities for independent brands in the new energy vehicle market, but these car companies are relatively perfect in terms of brand awareness and product camp. At the same time, more and more car companies begin to announce the timetable for stopping the production of fuel vehicles. Traditional car companies such as FAW, SAIC and Geely clearly take 2025 as the time node as the critical moment of electric transformation. at that time, the competition in the new energy vehicle market will be very fierce. In addition, including Baidu, Xiaomi, Ali and so on have entered the market to build cars, will also intensify competition in the industry. Therefore, take Yundu Automobile as an example, when the brand awareness of these car companies is general, it is actually very difficult to survive in the market. Maybe it's only a matter of time before you get eliminated.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.