In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/15 Report--

On April 14, according to documents issued by the Securities and Exchange Commission, the board of directors of FF adjusted the position of Jia Yueting, founder of FF. Jia Yueting will no longer serve as executive officer, but will retain his post of chief product officer, focusing on products and mobile ecosystems and the Internet, artificial intelligence and advanced research and development technologies.

As early as March, Faraday Future acknowledged that some members of the company's management team and employees had received security notices and subpoenas from SEC staff in the United States, according to FF filings with the U.S. Securities Commission. The reason for the investigation is that Faraday Future is suspected of publishing inaccurate information to investors. Faraday said in the future that he is fully cooperating with the SEC investigation. At present, the investigation into the incident may have been concluded. This is not the first time that Faraday has adjusted the duties of those responsible in the future. In February, a special committee of Faraday's future independent board admitted that only a few hundred people had paid for Faraday's future 14000 orders, misleading investors. Subsequently, a number of future responsible persons of Faraday were demoted or suspended. Faraday CEO Bi Fukang and Jia Yueting will both cut their annual base salary by 25 per cent.

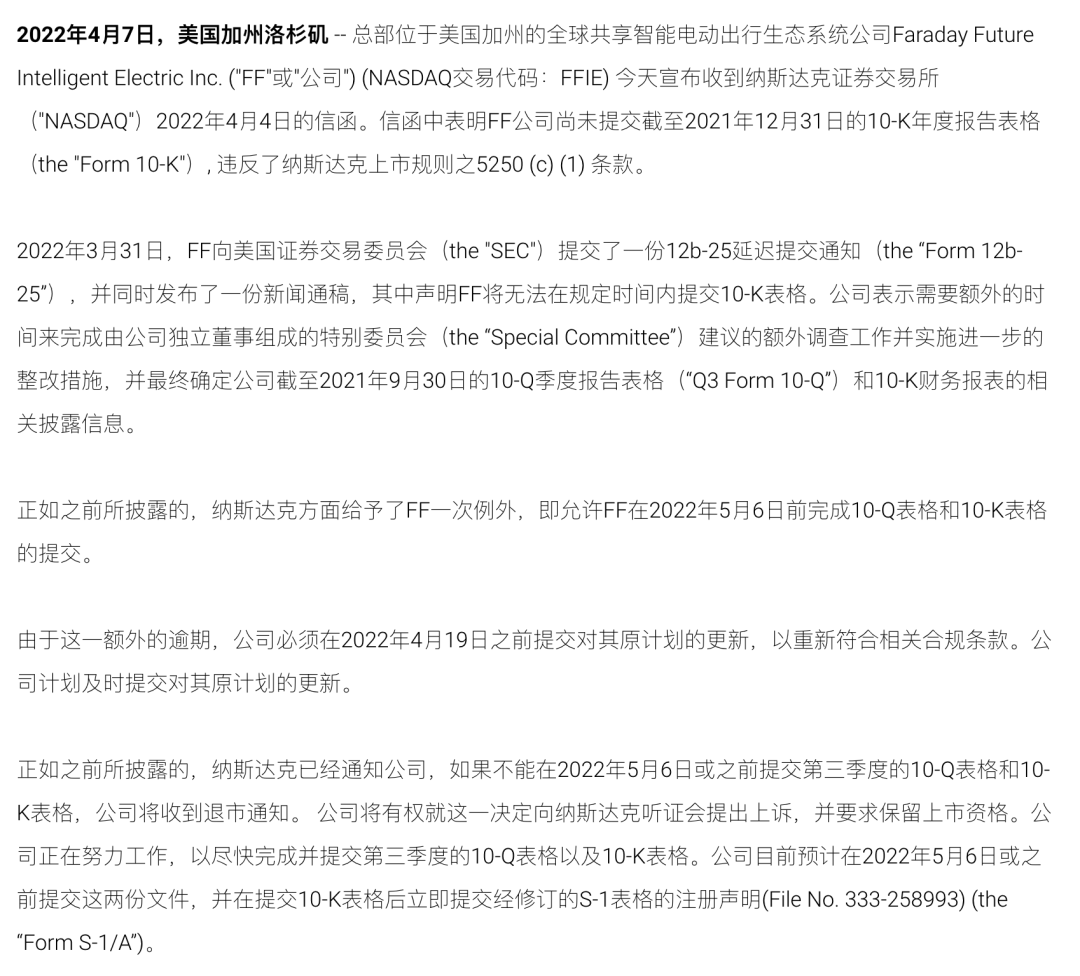

It is worth noting whether with the end of the investigation into the incident, it also means that Faraday will be on time for the annual report of December 31, 2021 in order to avoid being forced to delist. On April 8, Faraday Future said it had received a notice from the NASDAQ Stock Exchange that it did not comply with the NASDAQ continued listing rules because of its delay in submitting its annual report as of December 31, 2021 in the form of 10Muk documents. If Faraday wants to continue to list in the future, the exchange hopes that Faraday will meet compliance standards by April 19, and Faraday is working towards that goal in the future. In November last year, FF received a Nasdaq warning letter that Faraday would need to submit the report within 60 natural days in the future. According to Nasdaq rules, if Faraday fails to submit the relevant report within the prescribed time limit in the future, then Faraday may be delisted in the future.

In response, FF also issued a clarification, saying that receiving the NASDAQ warning letter is only related to the delay in the submission of Q3 financial statements by FF, which is a normal procedure. Within 60 days after receiving the NASDAQ warning letter, FF will submit a compliance plan to NASDAQ. As long as the company returns to normal SEC documents and submits them on time, there will be no real risk of stock delisting. At present, it seems that there is not much time left for FF to submit its annual report, and if the report is not submitted within the specified time, it will be a fatal blow for FF.

Less than a year after listing, it is not difficult to see Faraday's future twists and turns. Reviewing Jia Yueting's process of founding Faraday's future FF, there are also twists and turns. Jia Yueting founded Faraday Future in 2014 and has since harvested a lot of attention. In December 2015, FF said it would spend $1 billion to build a 3 million-square-foot manufacturing plant in North Las Vegas, Nevada, but a year later FF had funding problems and the project was suspended. Jia Yueting unveiled in Singapore with FF's first car, the FF91, in 2017, and the delivery date has been uncertain since then. In February 2018, Evergrande Group Xu Jiayin became the largest shareholder in FF with HK $6.7 billion. Evergrande had no choice but to withdraw because of the struggle for dominance, retaining only 20 per cent of FF's pre-IPO stake. Finally, FF went public on July 22, 2021, raising more than $1 billion, but Faraday was shorted in the future shortly after its listing, and J Capital Research Mechkin Investment, a US short seller, said bluntly that Faraday was unlikely to sell a car in the future.

At present, FF faces the risk of being forced to delist. According to the latest data disclosed by Faraday in the future, the annual operating loss will be between $345 million and $385 million as of December 31, 2021. The annual operating loss for the same period in 2020 was $65 million, and the operating loss in 2021 expanded by at least 431 per cent year-on-year. Raising funds is particularly important for FF, and if forced to delist, it also means that the fund-raising channel is closed. Then for FF, the later fund-raising will be even more unsatisfactory.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.