In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/18 Report--

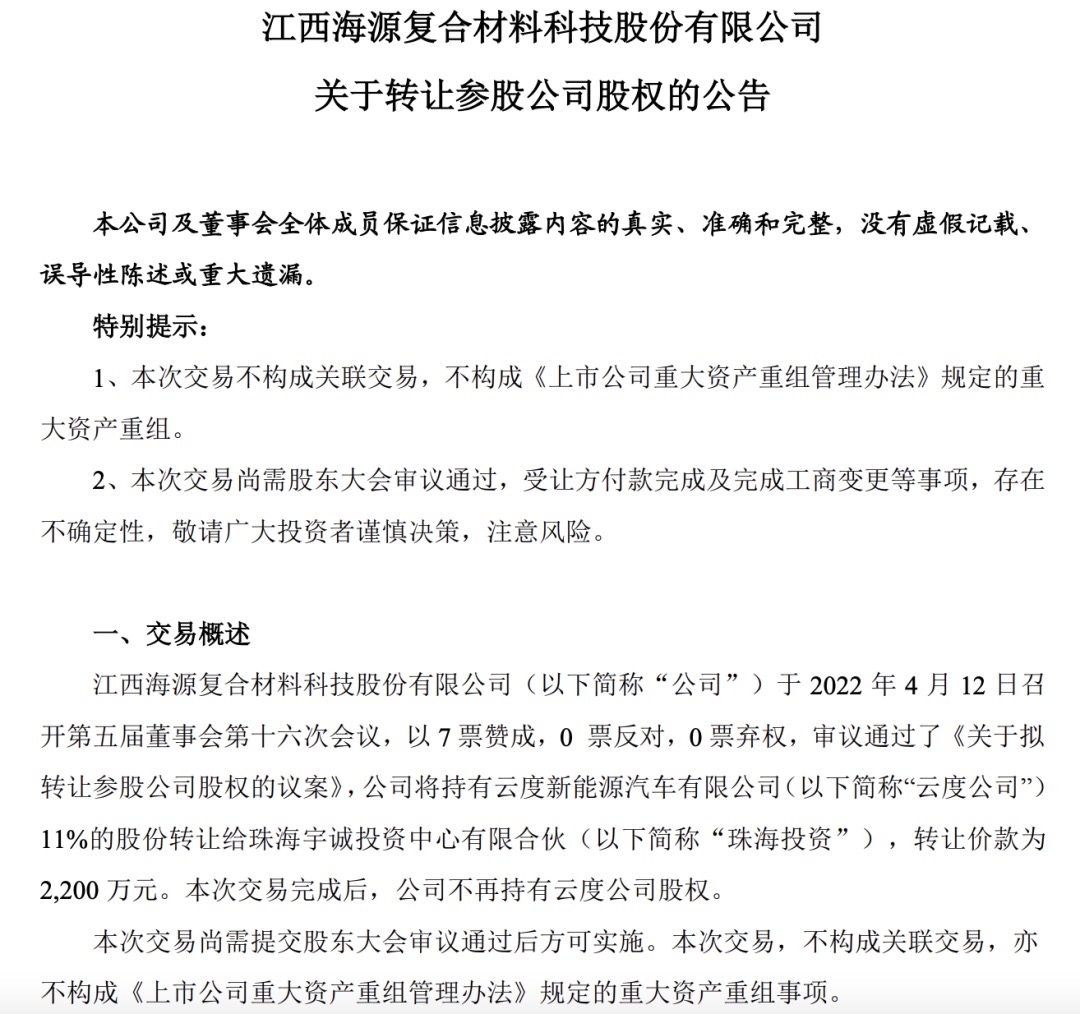

Recently, according to a notice issued by Haiyuan compound Materials, it will transfer 11% of its shares in Yundu New Energy Automobile Co., Ltd. to Zhuhai Yucheng Investment Center Co., Ltd., with a transfer price of 22 million yuan. After the completion of this transaction, Haiyuan compound materials no longer hold shares in Yundu company. In addition, Haiyuan compound material announcement also revealed that "Yundu New Energy Automobile Co., Ltd. and its subsidiaries consolidated statement of each year's net profit is negative, and the loss situation is more and more serious." At present, because of the broken capital chain, Yundu has been in a state of suspension since February 2022. " In response to the above news, Yundu Automobile related sources responded: "the shutdown is mainly due to battery problems, and now the new supply has been determined, and production is expected to resume in two months."

According to relevant data, Yundu New Energy Automobile Co., Ltd. was established on December 4, 2015 with a registered capital of 900 million yuan. It was built by Fujian Automotive Industry Group Co., Ltd., Putian State-owned assets Investment Co., Ltd., Fujian Haiyuan Automation Machinery Co., Ltd., and Liu Xinwen, which contributed 351 million yuan, 310 million yuan, 99 million yuan and 140 million yuan respectively.

Looking back on the time when Yundu Automobile entered into new energy vehicles, it has been ahead of many new car-building forces. Yundu launched its first all-electric SUV π 1 as early as 2017, followed by its second all-electric SUV π 3 in March the following year. The selling price of Yundu π 1 is 12.78-179800 yuan, and that of Yundu π 3 is 17.08-204800 yuan. The comprehensive maximum service life is 426km and 401km respectively. In 2018, Yundu also ushered in a highlight period, with sales of 9300 vehicles. But the good times did not last long, and since 2019, Yundu Motors has been in a state of low sales due to changes in core shareholders, executive departure, product problems and subsidies.

According to the latest data, Yundu π 1 sold 185 vehicles in February and 3748 in 2021. The latest sales of Yundu π 3 were 31 in March, with a cumulative sales of 155 from January to March. Cumulative sales in 2021 were 1613. Judging from its sales data, its cumulative sales in one year is less than that of the head car-building new power in one month. Due to low sales, Yundu Motor is also in a state of loss all the year round. According to relevant data, the net loss of Yundu Automobile in the five years from 2017 to 2021 was 95 million yuan, 138 million yuan, 177 million yuan, 204 million yuan and 213 million yuan respectively, with a revenue of 6.6025 million yuan and a net loss of 0.56 billion yuan in the first quarter of 2022.

It is worth noting that in 2020, Yundu Automobile released its strategic layout, saying that in the next five years, the product layout would be based on pure electricity, with the release of strategic models of A00, A0, A, and A+; and hatchback, hatchback, SUV, cross-border cars and logistics models, which boasted that they would be among the top three domestic pure electric car brands in 2025. With the continuous influx of market competitors and the sharp decline in new energy subsidies, the outlook for Yundu cars with a single product is not optimistic.

In recent years, due to the epidemic, subsidies for new energy vehicles and rising upstream costs, car-building forces are not comfortable. As many technology giants join the new energy vehicle market, the competition in the future market will be more fierce, and the survival of the fittest will be further accelerated. Some people in the industry have pointed out that at present, China's automobile industry is in a period of integration. China's automobile industry will go through a relatively tragic process of integration like home appliances and mobile phones, and leading car enterprises will have more competitive advantages under the effect of scale. weak brands cannot escape the fate of being eliminated.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.