In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/21 Report--

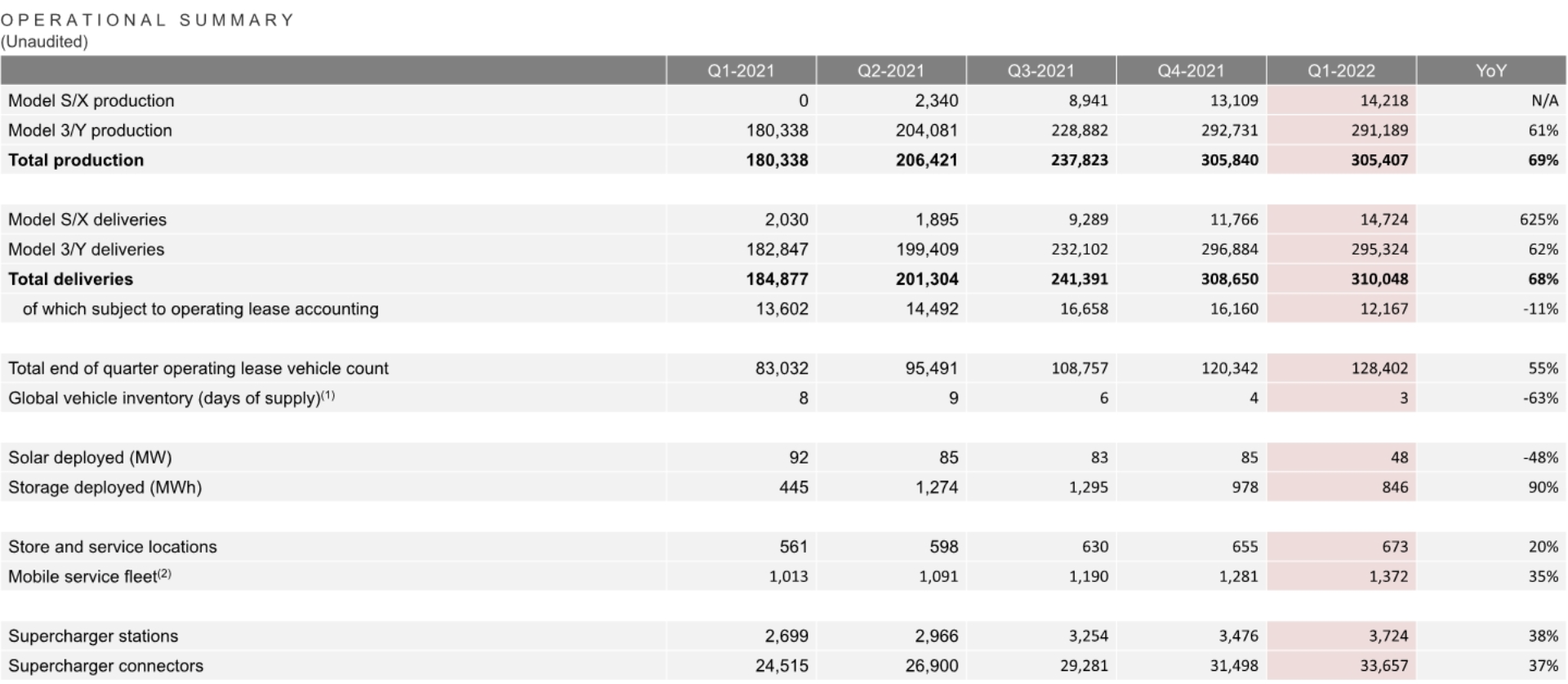

Tesla released its financial report for the first quarter of 2022 after the U.S. stock market closed. Tesla's total revenue in the first quarter was $18.756 billion, up 81 percent from a year earlier, according to data. Net profit attributable to shareholders was $3.318 billion, up 658% year-on-year. Auto gross margin was 32.9%, a record high.

Tesla said the increase in revenue was partly due to an increase in the number of cars Tesla delivered and an increase in average selling prices. According to the financial report, Tesla delivered 310048 vehicles in the first quarter, up 68% year-on-year, of which Tesla Shanghai Super Factory delivered 182174 vehicles (59846 vehicles in January, 56515 vehicles in February and 65814 vehicles in March), accounting for 58.76% of Tesla's total global market share, making Tesla the world's largest single market.

The increase in the price of new products is also an important factor in Tesla's net profit surge, helping Tesla avoid the impact of supply chain problems and rising costs, allowing Tesla to earn more. In China, for example, Tesla raised prices three times a week. On March 10, the price of the Model 3 all-wheel drive high-performance version rose from 339,900 yuan to 349,900 yuan, the Model Y all-wheel drive version rose from 347,900 yuan to 357,900 yuan, and the Model Y all-wheel drive high-performance version rose from 387,900 yuan to 397,900 yuan. On March 15, the rear wheel drive of Model 3 rose from 265,652 yuan to 279,900 yuan, the price of Model 3 all-wheel drive high-performance version rose from 349,900 yuan to 367,900 yuan, the price of Model Y all-wheel drive version rose from 357,900 yuan to 375,900 yuan, and the price of Model Y all-wheel drive high-performance version rose from 397,900 yuan to 417,900 yuan. On March 18, the price of the Model Y rear-wheel drive version rose to 316900 yuan from 301840 yuan.

Musk said on the conference call that the price increase a while ago was mainly due to serious inflation problems, and some parts suppliers raised prices by 20% to 30%. However, Tesla will not raise prices in the near future, and the current price already includes Tesla's expectations for future cost increases. Of course, if subsequent component prices rise more than expected, Tesla prices may continue to rise.

Tesla's bright market performance is the result of many efforts, but in the face of uncertainty caused by the environment, Tesla also made a risk expectation analysis in the earnings conference call. Tesla CEO Musk said he thought the Shanghai superplant would set a new production record in the second quarter, but production in the second quarter could be flat or slightly lower than in the first quarter due to the shutdown.

According to previous reports from the auto industry, Tesla's super factory in Shanghai's port area stopped production twice in March due to the epidemic. It stopped production for two consecutive days on March 16 and 17, and for four consecutive days from March 28. However, due to the escalation of epidemic prevention and control, Tesla had stopped production for three weeks. Although Tesla's Shanghai plant resumed production on April 19, there is still about a week's inventory of vehicle parts. If the parts supply is not timely or will lead to Tesla stopping production again, Tesla will also need to go through a production ramp period in the short term, and there is a certain lag in production. According to Tesla's official website in China, the current delivery cycle for each version of Model Y ranges from 10 weeks to 20 weeks, and the delivery cycle for each version of Model 3 ranges from 16 weeks to 24 weeks, with the delivery cycle for the rear-wheel drive version of Model 3 ranging from 20 weeks to 24 weeks. Musk made it clear that Tesla's factories have been undercapacity for several quarters in a row amid shortages of parts and semiconductor chips, and this is expected to continue for another year. "If consumers order cars now, they may need to be prepared to wait a year."

Tesla shares fell $50.95, or 4.96 percent, to close at $977.20 in regular trading Wednesday on the Nasdaq Stock Market. Over the past 52 weeks, Tesla's lowest share price was $546.98 and its highest share price was $1,243.49. At Wednesday's closing price, Tesla has a market value of about $1.01 trillion.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.