In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/24 Report--

After Guanxuan stopped producing fuel cars, BYD once again issued a major announcement: it plans to buy back the shares of the company with its own funds of no more than 1.85 billion yuan and no less than 1.8 billion yuan for the employee stock ownership plan, and the participating employees only need to complete the performance appraisal. You can get the company stock for free. As of the latest close, BYD closed at 235.4 yuan per share, with a total market capitalization of 634.6 billion yuan, ranking first among domestic auto companies.

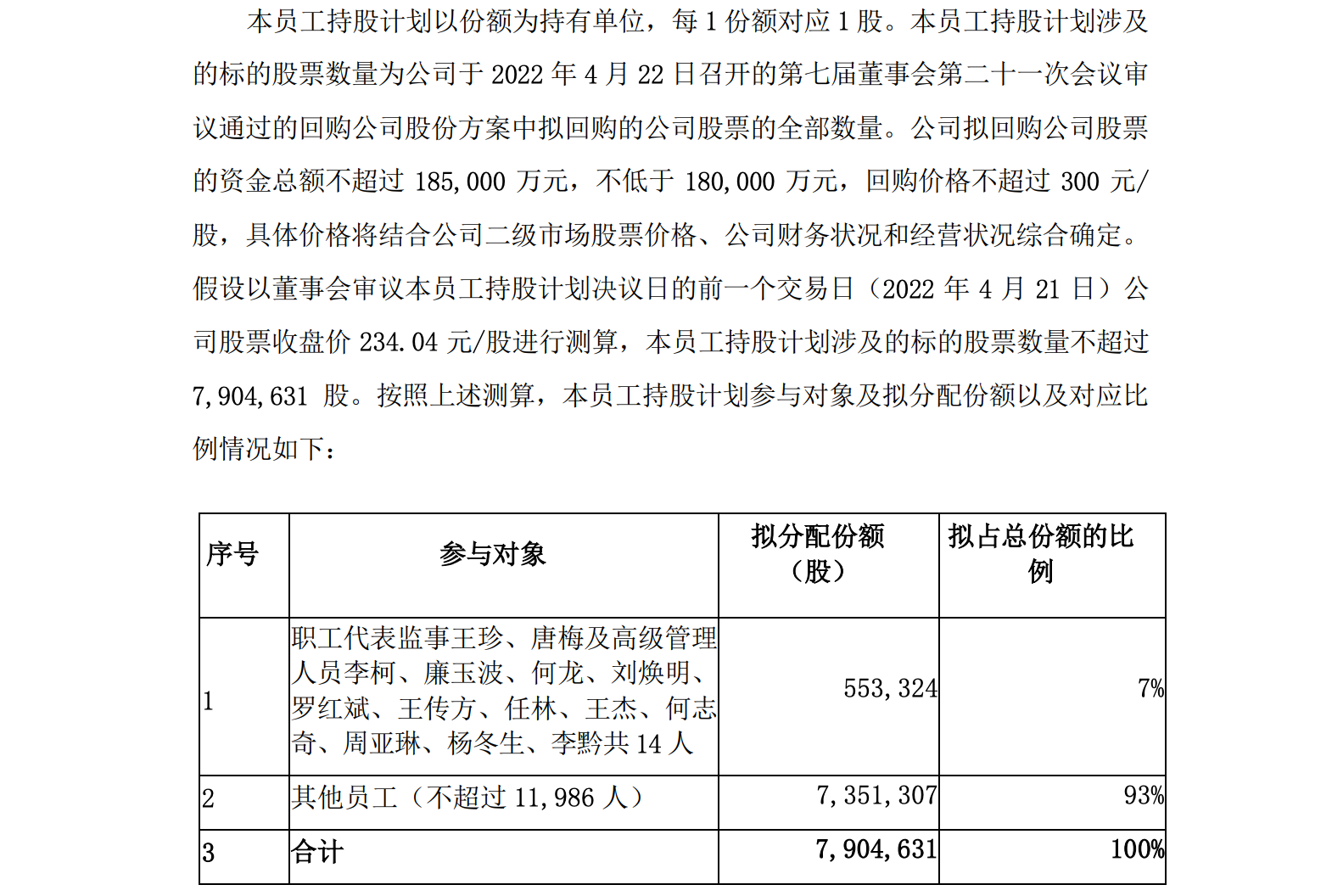

According to the announcement, the participants of the employee stock ownership plan include the company's employee supervisors Wang Zhen, Tang Mei and senior managers Li Ke, Lian Yubo, he long, Liu Huanming, Luo Hongbin, Wang Chuanfang, Ren Lin, Wang Jie, he Zhiqi, Zhou Yalin, Yang Dongsheng and Li Qian. a total of 14 senior executives plan to allocate 7%, and no more than 11986 other employees. The announcement shows that under the condition that the price of the repurchased shares does not exceed RMB300 per share, according to the upper limit of the repurchase amount of RMB 1.85 billion, BYD expects the number of repurchased shares to be no less than 6.1667 million shares, accounting for about 0.212% of the company's total issued share capital. According to the lower limit of the repurchase amount of RMB 1.8 billion yuan, it is estimated that the number of repurchased shares is not less than 6 million shares, accounting for about 0.206% of the company's total issued share capital. The specific number of repurchased shares shall be based on the actual number of shares repurchased at the expiration of the repurchase period.

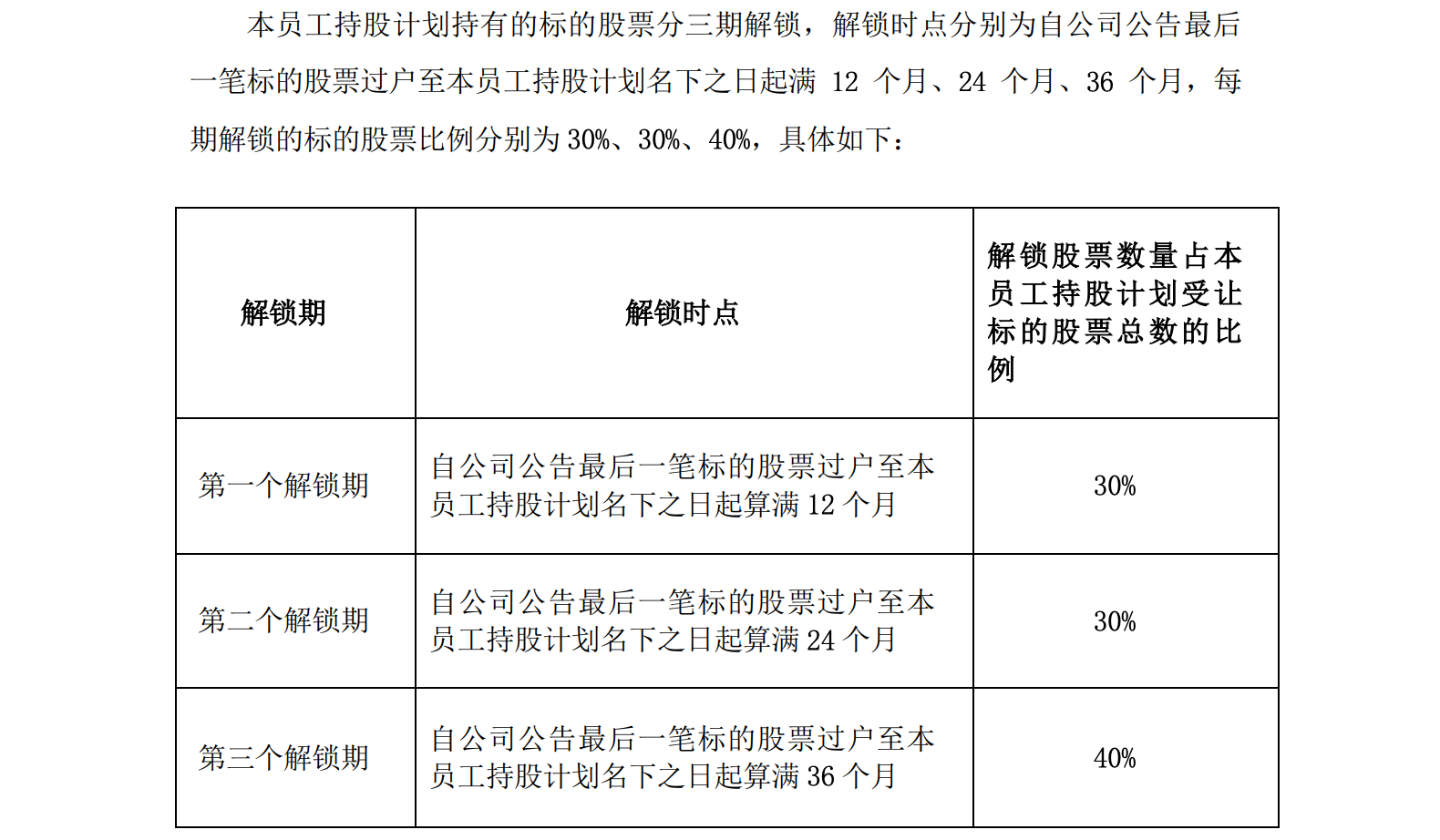

Of course, it is not easy to get the company's stock for free. BYD has set a three-year unlocking period for this. The unlocking time is 12 months, 24 months and 36 months from the last transfer of the underlying stock announced by the company to the date of the employee stock ownership plan, and the proportion of the underlying stock unlocked in each period is 30%, 30% and 40%, respectively. The announcement shows that the first unlocking period is based on business income in 2021, which increases by no less than 30% in 2022 compared with the same period last year; the second unlocking period is based on operating income in 2022, and operating income in 2023 increases by no less than 20% compared with the same period last year; the third unlocking period is based on operating income in 2023, which in 2024 is no less than 20% year-on-year growth.

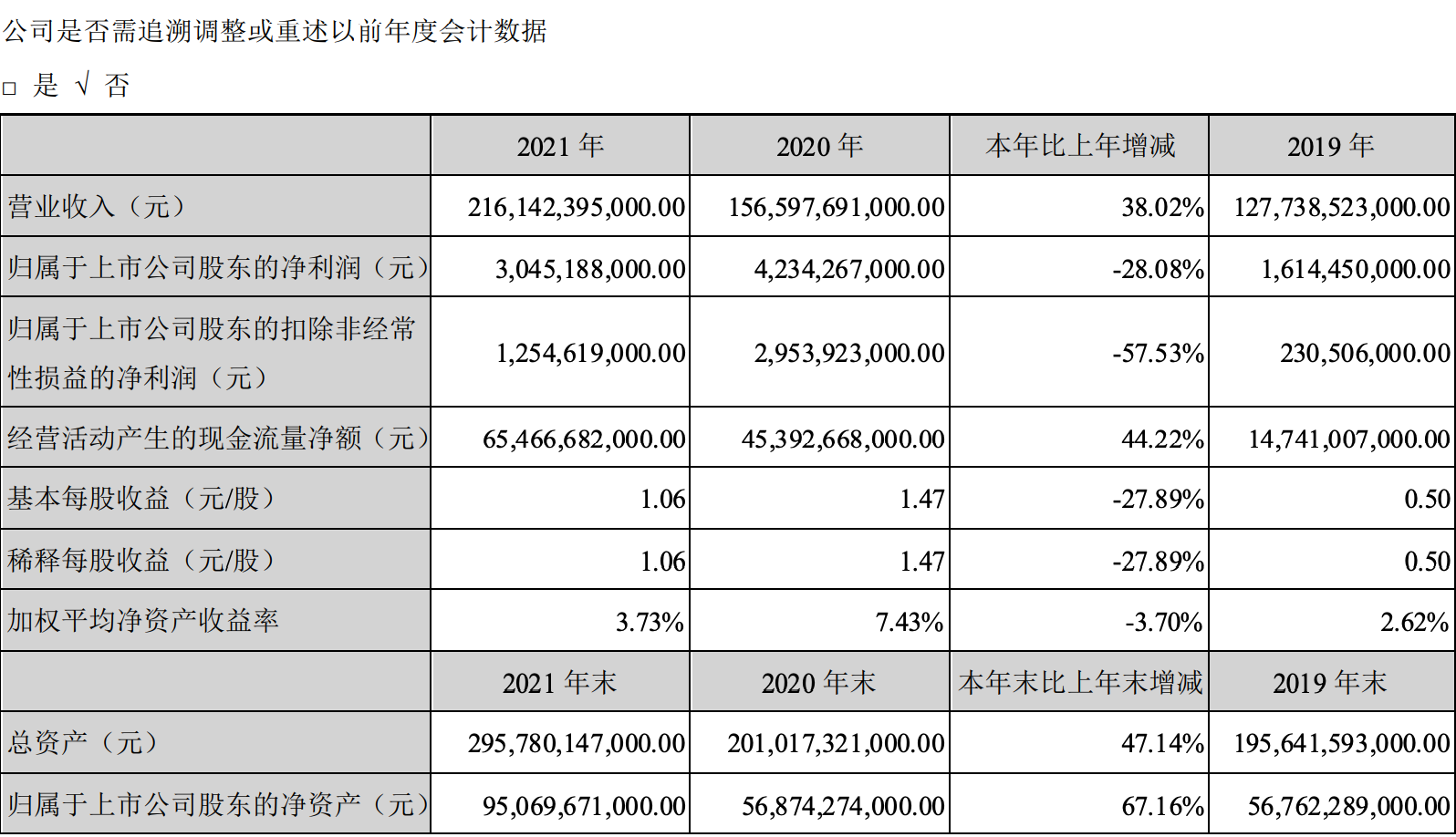

In other words, employees can get shares of the company for free as long as they meet the performance targets set by BYD, but the three unlock periods set by BYD are still very challenging. The data show that from 2017 to 2020, BYD's operating income increased by 2.36%, 22.79%,-1.78% and 22.59% respectively over the same period last year. In 2021, BYD achieved an increase of 38.02% to 216.142 billion yuan over the same period last year. According to this calculation, BYD needs to achieve operating income of no less than 280.985 billion yuan in 2022 to achieve the first unlocking target. In response, BYD said that the setting of performance evaluation indicators is challenging, can fully convey the company's vision for future performance growth, and help enhance employees' enthusiasm for work, sense of responsibility and sense of belonging, and form a positive linkage in which the interests of the company, shareholders and employees promote each other, so as to promote the reliable realization of the company's development goals. At the same time, BYD made it clear that if the company's performance evaluation indicators are reached, the underlying stock rights and interests corresponding to each period of the employee stock ownership plan can be unlocked. If the company performance evaluation index corresponding to a certain unlocking period is not reached, the underlying stock rights and interests corresponding to the unlocking period shall not be unlocked.

Cui Dongshu, secretary general of the Federation of passengers, said, "this year is the first year of BYD's comprehensive transformation of new energy vehicles. The market performance is outstanding, and it is easier to achieve a 30% year-on-year increase in operating revenue." However, in the later stage, due to the difficult changes in the market, coupled with the large base of the previous year, it is very difficult to maintain a year-on-year growth rate of no less than 20% every year. " Cui Dongshu believes that the performance target set by BYD is too high to achieve. If it is not achieved later, it will have an impact on the enthusiasm of employees, but not conducive to the development of the company.

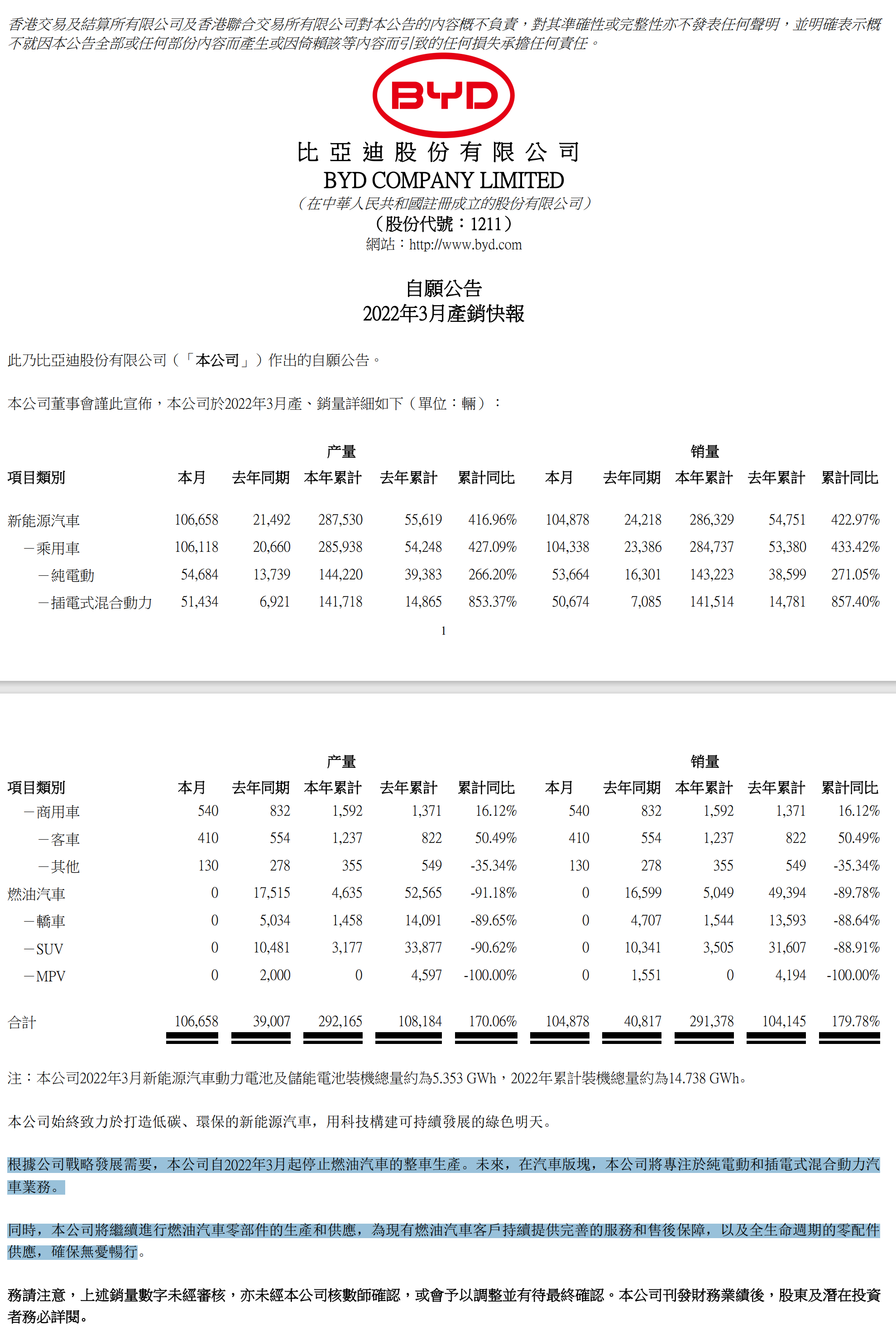

On April 3, BYD announced that it would stop production of fuel-fueled vehicles from March and that the company would focus on pure electric and plug-in hybrid vehicles in the future. According to the data, BYD sold 291400 vehicles in the first quarter, up 179.78 percent from the same period last year, including 284700 new energy passenger vehicles, up 433.42 percent from the same period last year, and 5049 fuel vehicles, down 89.78 percent from the same period last year. For BYD, stopping production of fuel vehicles is not only in line with the development of the market, but also the inevitable trend of the transformation of BYD's automobile sector. compared with fuel cars, BYD's new energy vehicles continue to sell well in the market, and the problem of "not mentioning cars" continues to haunt car buyers.

On April 18, BYD released a forecast of first-quarter results, showing that the company's net profit belonging to shareholders of listed companies in the first quarter of this year is expected to be about 650 million yuan to 950 million yuan, an increase of 174% to 300% over the same period last year. Galaxy Securities said that BYD's advantages of the whole industrial chain are gradually emerging, superimposed on the completion of mid-and high-end product matrix and the scale effect brought by product volume, the loss of its new energy vehicles has been basically reversed, and the company's profitability is expected to continue to improve. Performance improvement is expected. According to the forecast of Cinda Securities, BYD achieved revenue of 375.6 billion yuan, 482.8 billion yuan and 586 billion yuan from 2022 to 2024, an increase of 74%, 29% and 21% over the same period last year, and its net profit was 7.33 billion yuan, 12.76 billion yuan and 19.47 billion yuan respectively, up 141%, 74% and 53% respectively.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.