In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/24 Report--

On April 24, Russia's special military operation against Ukraine entered its 60th day. On February 24, Russia officially launched an attack on Ukraine. at present, the situation between Russia and Ukraine is still very tense. The two sides have started negotiations on number theory, but no consensus has been reached. Russian Defense Ministry spokesman Konashenkov reported that since the special military operation, the Russian army has destroyed a total of 141aircraft, 110helicopters, 541drones, 264 anti-aircraft missile systems, 2479 tanks and other armored vehicles, 278multiple rockets, 1081 field artillery and mortars and 2321 special military vehicles.

Affected by the war, car sales in Russia and Ukraine plummeted. New car sales in Ukraine rose 20.8 per cent year-on-year to 103245 in 2021, while new car sales in Russia rose 4.3 per cent to 1666780, according to bestsellingcarsblog. Although the share of Russian-Ukrainian cars is not high, due to the layout of auto parts products by a number of vehicle manufacturers and parts suppliers here, the conflict between Russia and Ukraine will also affect automobile production. According to the latest figures, Ukrainian car sales plunged 93.9 per cent to 546 units in March from a year earlier, while Russian car sales plunged 62.9 per cent to 55129 vehicles.

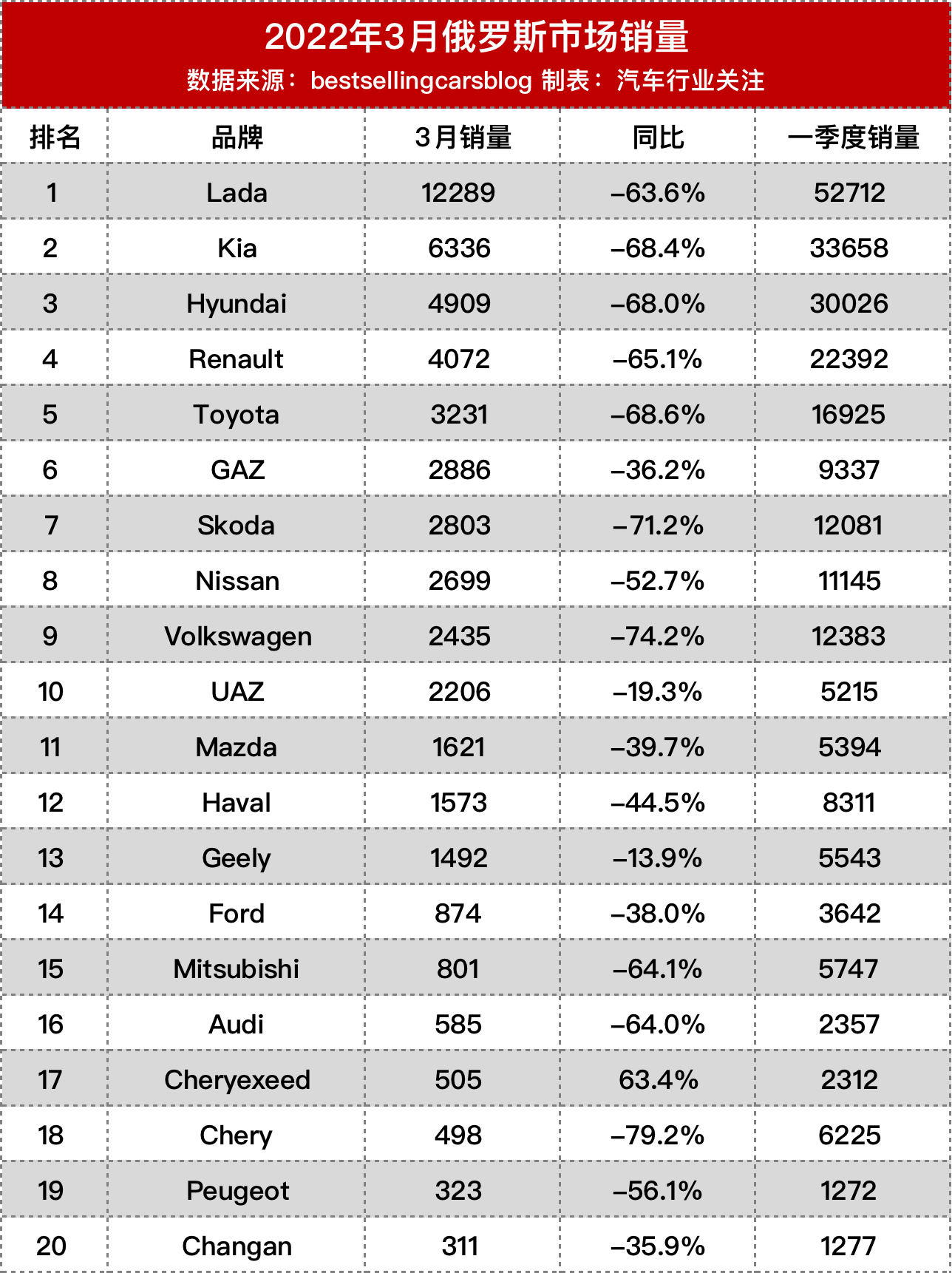

According to the list of Russian and Ukrainian automobile market sales in March, which is concerned by the automobile industry, the sales of more than 90% of the car brands are in a state of decline. In the Russian market, for example, Lada Motors is the only company with more than 10,000 sales, but fell 63.6 per cent to 12289 vehicles compared with the same period last year, with the top five car companies including Kia, Hyundai, Renault and Toyota all down more than 60 per cent. In the Ukrainian market, the highest sales of Renault were only 108, down 91.4% from a year earlier, while other brands, including Toyota, Skoda and Mitsubishi, also fell by 90%.

However, Russia is one of the most important markets for Chinese car brands to export overseas. Specifically, the most popular independent brands in the Russian market are Great Wall, Chery and Geely. In 2021, the sales of the three brands in Russia were 39000, 37000 and 25000 respectively, up 125%, 224% and 59% respectively over the same period last year. Russia ranks 12th, 13th and 17th in terms of car sales. However, affected by the situation in Russia and Ukraine, exports of independent brands to Russia were also affected, with Harvard sales down 44.5 per cent year-on-year to 1573 vehicles, Geely sales down 13.9 per cent to 1492 vehicles and Chery down 79.2 per cent to 498 vehicles.

Under the situation in Russia and Ukraine, Western countries announced various sanctions against Russia, and all car brands announced that they would stop production and sales in the Russian market, which was the main factor leading to the sharp drop in Russian car sales. Since February 24, a number of car companies around the world have announced their withdrawal or suspension of operations in Russia. Volkswagen, for example, said it would stop exporting vehicles to Russia in addition to suspending production at its two Russian factories, a decision that affects its Volkswagen, Skoda, Audi, Porsche and Bentley brands. On March 3, Japan's Toyota Group said in a statement that production in Russia would be suspended due to supply chain disruptions and that cars would no longer be exported to Russia until further notice. It is understood that Toyota makes Camry cars and Rongfang models at its St. Petersburg plant and produces as many as 80,000 cars a year, most of which are sold in Russia.

In addition to the closure of Toyota's St. Petersburg plant, most European brands, including Honda, Volvo, Mercedes-Benz, BMW and Jaguar Land Rover, have announced that they have stopped exporting and selling to Russia. Volvo also announced a moratorium on exports to Russia. It is understood that Volvo carmakers export cars to Russia from factories in Sweden, China and the United States, and sold about 9000 cars in Russia in 2021.

Although Russia and Ukraine do not have a high share of the car market, many automakers have layout of auto parts and key products, and the conflict between Russia and Ukraine has also spread to global car production. It is understood that Ukraine is a wire harness supplier to all European automakers, but at present, many factories in Ukraine have suspended production, resulting in an urgent shortage of wiring harness for European automakers. In addition to automotive wire harnesses, key products provided by Ukraine include neon gas for chips and palladium for catalytic converters. The same is true of Russia, which accounts for about 9 per cent of global nickel production, which has a significant impact on the development of the automotive industry. In addition, Russia is the world's largest palladium producer, accounting for about 40% of global production.

According to the statistics of car sales in 14 countries concerned by the automobile industry, car sales in 11 countries showed a downward trend, and 70% of them fell by double digits. China, which is developing steadily, has also been affected. In the statistical market, only India, the Netherlands and Norway achieved small growth.

Wholesale sales in China, the world's largest market, fell 11.7 per cent in March from a year earlier to 2.234 million vehicles, including commercial and passenger cars. The decline was mainly due to the impact of the epidemic in many parts of the country, and as the epidemic broke out on a large scale, the production and logistics of related parts and components stagnated, and the difficulties of the main body of the market increased significantly. As a result, although the Chinese market was the only market to achieve growth in the first quarter, its growth rate dropped significantly, and in addition to the impact of the epidemic, the shortage of chips and the rise in raw material prices were also factors restricting the development of car companies, and the production and operation activities of car companies were affected, resulting in a situation that was less than expected.

In the US market, the auto industry is not only affected by semiconductor shortages and the COVID-19 epidemic, but also faced with challenges such as escalation in Russia and Ukraine, rising raw material prices and shortage of spare parts. March sales fell 24 per cent year-on-year to 1.22 million vehicles. First-quarter sales fell 15.7 per cent year-on-year to 3.319 million vehicles, almost the lowest level in the past decade.

Judging from the list, this is not only the case in the United States, but also in the European market. France, for example, is one of Europe's five mainstream car markets, with sales falling 20.0 per cent year-on-year to 147000 in March and 17.3 per cent to 365000 in the first quarter. Similarly, UK car market sales fell 14.3 per cent in March from a year earlier to 243000 and 1.9 per cent to 418000 in the first quarter. Judging from the data, sanctions against Russia by Europe and the United States are in fact a lose-lose.

Judging from the list, only the Netherlands and Norway have achieved large sales growth. Although tight supply and rising costs also affect car sales in both countries, because the market share of these two countries is not very large, relatively affluent consumers may be able to afford higher prices, so car sales will not fluctuate much.

In order to reduce the negative impact in the post-conflict era between Russia and Ukraine, relevant automobile companies should deepen strategic cooperation with large domestic shipping companies to ensure smooth transport routes and price stability on key routes, according to the Automotive Industry Policy Research Department of Sinochem Zhengyan. At the same time, we should seize the opportunity of the development of the automobile industry in Russia and Eurasia, and on the basis of full demonstration, we can consider purchasing high-quality assets such as local factories, enterprises and brands.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.