In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/26 Report--

According to the Daily Business News, a person close to Yundu New Energy Automobile Co., Ltd. (hereinafter referred to as "Yundu Automobile") said that Junyao Group signed an agreement with Yundu Motors before April 20, which will formally take over Yundu Motors and become the actual controlling shareholder of Yundu Motors. In response to the above news, Yundu Automobile staff responded to the Daily Economic News: "the company does have contact with Junyao Group, but there is no definite news yet. Wait for the official announcement!" The relevant staff of Junyao Group said: "at present, the group mainly spends its energy on epidemic prevention and protection in Shanghai, and only senior leaders of the company can know whether it has acquired Yundu Automobile."

According to the official website of Junyao Group, Junyao Group, founded in July 1991, is a modern service enterprise based on industrial investment, and has formed five major business sectors: air transport, financial services, modern consumption, educational services, and scientific and technological innovation. At present, Junyao Group has four A-share listed companies, namely, auspicious Airlines, Aijian Group, Great Oriental and Junyao Health. Among them, Junyao Health, formerly known as Junyao dairy products, the main product is milk, and then began to enter the lactic acid bacteria beverage market, listed in A shares in August 2020, known as the "first share of lactic acid bacteria drinks".

Yundu Automobile was founded on December 4, 2015. Fujian Automotive Industry Group Co., Ltd., Putian State-owned assets Investment Co., Ltd., management team (individual shareholders), Fujian Haiyuan Automation Machinery Co., Ltd. (Haiyuan compound material formerly used name) jointly contributed 900 million yuan to set up mixed operating enterprises, accounting for 39%, 34.44%, 15.56% and 11%, respectively.

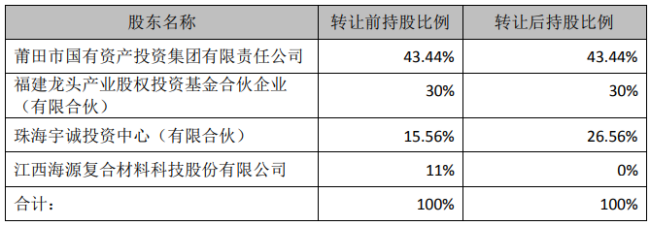

At present, the shareholders of the company are Putian State-owned assets Investment Group Co., Ltd., Fujian leading Industry Equity Investment Fund Partnership (limited partnership), Zhuhai Yucheng Investment Center (limited partnership), and Haiyuan compound materials. The shareholding ratio is about 43.44%, 30%, 15.56% and 11%, respectively.

In terms of product launch, according to the official website of Yundu Automobile, there are three models on sale: π 1 PRO, π 3 PRO and π 3 E-SHOCK, with a vehicle price range of 10-150000 yuan. The first model, the small pure electric SUV Yundu π 1, was launched in October 2017, and the second pure electric SUV π 3 was launched in March 2018. From the point of view of the product line, Yundu Automobile is extremely fast in terms of product layout, and it took only more than a year from the establishment of the company to the launch of the product. After the launch of the second product, Yundu Automobile ushered in a short "highlight moment". In 2018, the cumulative sales of Yundu Automobile was 9300, ranking second in the ranking of new car-building forces after Lulai (delivery volume of about 11300). However, after a short "highlight", Yundu car began to fall. According to the data, the cumulative annual sales of Yundu Automobile from 2019 to 2021 were 2566, 4470 and 5361 respectively, compared with only 516 from January to March this year, including zero in March.

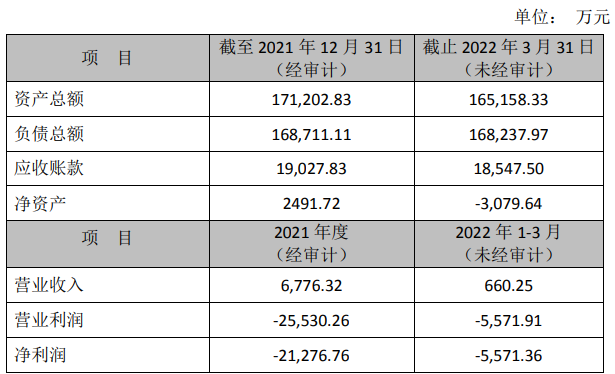

In August 2020, Lin Mi, CEO of Yundu Automobile, said publicly: "in 2025, Yundu will become one of the top three domestic pure electric car brands and participate in the global market competition on behalf of Chinese new energy brands. In the future, the models of Yundu New Energy will no longer be limited to the field of passenger vehicles, but will also cover the product line of commercial vehicles, adopting a two-line layout of 'both commercial and passenger cars', while the marketing channel will sink completely. " According to its product plan, Yundu Automobile will focus on developing modified models in 2020 and mass production in 2021, and mass production of new models in 2023. However, judging from the development state of Yundu Automobile in recent years, Yundu Automobile has run counter to the above goals. Public data show that the net losses from 2017 to 2021 are 95 million yuan, 138 million yuan, 177 million yuan, 204 million yuan and 213 million yuan respectively. As a new energy car company that has only been established for more than six years, Yundu Automobile has been in a state of loss from 2017 to 2021, and the extent of the loss continues to expand. The latest data show that Yundu Motors is also mired in losses in the first three months of this year, with revenue of only 6.6025 million yuan from January to March this year and a further loss of 55.7136 million yuan. As of March 31 this year (unaudited), Yundu Automobile had total assets of about 1.652 billion yuan, total liabilities of 1.682 billion yuan and net assets of-30.7964 million yuan.

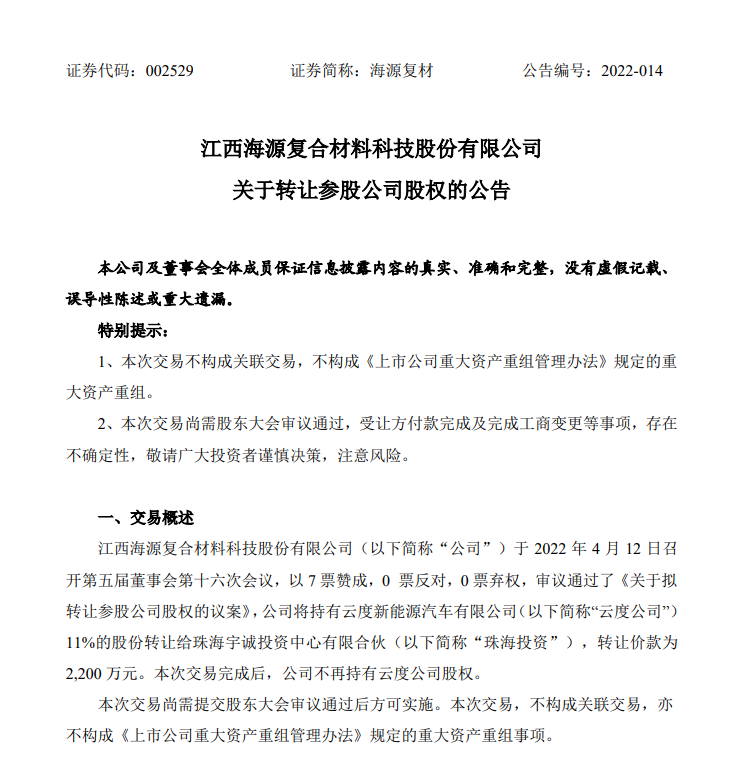

In mid-April, Haiyuan Fucai, one of Yundu's shareholders, announced that it would transfer its 11% stake in Yundu New Energy Automobile Co., Ltd. to Zhuhai Yucheng Investment Center Co., Ltd., for a transfer price of 22 million yuan. After the completion of this transaction, Haiyuan compound materials no longer hold shares in Yundu company. As for this move, Haiyuan compound Materials said, "this transaction will help to promote the withdrawal of the company's financial investment and non-core business assets, recover investment funds and increase the company's working capital." If this transaction can proceed smoothly, it is expected to have a positive impact on the company's net profit of about 16 million yuan. " Haiyuan compound material decided to transfer the stake in Yundu Automobile is actually to stop the loss.

In addition, Haiyuan compound material announcement also revealed: "Yundu New Energy Automobile Co., Ltd. and its subsidiaries consolidated statement of each year's net profit is negative, and the loss situation is more and more serious." At present, because of the broken capital chain, Yundu has been in a state of suspension since February 2022. " In response to the above news, Yundu Automobile related sources responded: "the shutdown is mainly due to battery problems, and now the new supply has been determined, and production is expected to resume in two months."

In fact, with the sharp decline of new energy subsidies, there have been some new energy vehicle manufacturers facing survival difficulties due to the lack of product competitiveness. The relevant assessment points out that due to the decline of state subsidies in the new energy vehicle industry year by year, the subsidy income has a significant impact on the operation of Yundu Company and is difficult to predict. For Yundu Motors, which is also facing the problem of insufficient product competitiveness, Cui Dongshu, secretary general of the Carriage Association, said that the slow iteration of product technology, inadequate construction of sales channels and inadequate user services have made the already "fragile" Yundu Motors more and more difficult, and if Junyao Group, which has strong funds, joins Yundu Automobile, it will be a great benefit for Yundu Motors, which is in dire need of funds.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.