In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/27 Report--

On Tuesday, U.S. stocks Faraday's future plunged quickly after resuming trading, triggering a fuse suspension twice and falling more than 40% in intraday trading. At the close, Faraday Future was down 12.92 percent at $3.10.

On the morning of July 22,2021, Faraday Future was officially listed on the NASDAQ Stock Exchange and held a bell ringing ceremony to start official public trading under the stock code "FFIE". The issue price of FFIE was US $13.78, which closed up 1.45% on the first day to close at US $13.98, with a total market value of US $4.535 billion. However, FF shares have fallen more than 80% by the end of the latest day, with a total market capitalisation of just $1.006 billion.

Faraday's smooth listing in the future is the first step for Jia Yueting to realize the reversal, but the doubts surrounding Faraday's future and Jia Yueting have not decreased since the listing. On October 7, U.S. time, J Capital Research, a U.S. short-selling agency, released a short-selling report on FF Company. The report has 28 pages and expresses its doubts about FF Company from many angles such as FF Company's production capacity, capital operation performance, R & D investment status and Jia Yueting's own punishment in China. Sources include field research visits, company financial report data and public information, etc., questioning FFIE's ability to build cars from various aspects. It also listed a series of 10 items including embezzlement, factory delay, false orders, etc., and bluntly said that FF could not sell a car.

In early February, a special committee of Faraday's future independent board of directors said there was no evidence to support the short report of J Capital Research, but acknowledged that only a few hundred of Faraday's future 14,000 orders had been paid, a statement that misled investors. To this end, Faraday Future demoted or suspended several responsible persons at the request of the board of directors, reduced the basic salary of CEO Carsten Breitfield and founder Jia Yueting, and required them to report to Susan Swenson, the newly appointed executive chairman of the board of directors.

In March, FF's filing with the Securities Commission showed that Faraday Future admitted that certain members of the company's management team and company employees had received preservation notices and subpoenas from SEC staff, and that Faraday Future was suspected of publishing inaccurate information to investors. Faraday Future said it was fully cooperating with the SEC investigation. At present, the investigation into the incident has been concluded. This is not the first time Faraday has adjusted the position of the responsible person in the future. In February, a special committee of Faraday Future's independent board admitted that only a few hundred of Faraday Future's 14,000 orders had been paid for, misleading investors. Subsequently, Faraday's future responsible persons were demoted or suspended. Faraday CEO Bi Fukang and Jia Yueting will both reduce their annual base salaries by 25%.

On April 14, according to a document released by the Securities and Exchange Commission, Faraday Future's board of directors adjusted the position of founder Jia Yueting. Jia Yueting no longer served as CEO, retained his position as Chief Product Officer and will continue to report to the Executive Chairman.

In addition, Faraday Future has fallen into business difficulties. FF had net losses of $147.1 million and $142.2 million in 2020 and 2019, respectively, and accumulated losses of $2,391.1 million and $2,244.1 million, respectively; net cash used in operating activities was $41.2 million and $189.8 million, respectively;FF had working capital deficits of $835.3 million and $688.2 million, respectively. FF expects an annual operating loss of $345 million to $385 million as of December 31,2021, and a net loss of $510 million to $550 million in 2021, up 247% year-on-year, Securities Daily reported.

As for the increase in operating and net profit losses, FF explained that this was mainly due to the full commercial production of the company's Hanford, California plant, increased costs, increased expenses for developing and producing future electric vehicle models, additional accrued expenses for litigation and asset disposal losses related to the abandonment of certain FF91 program assets (mainly supplier tools, machinery and equipment).

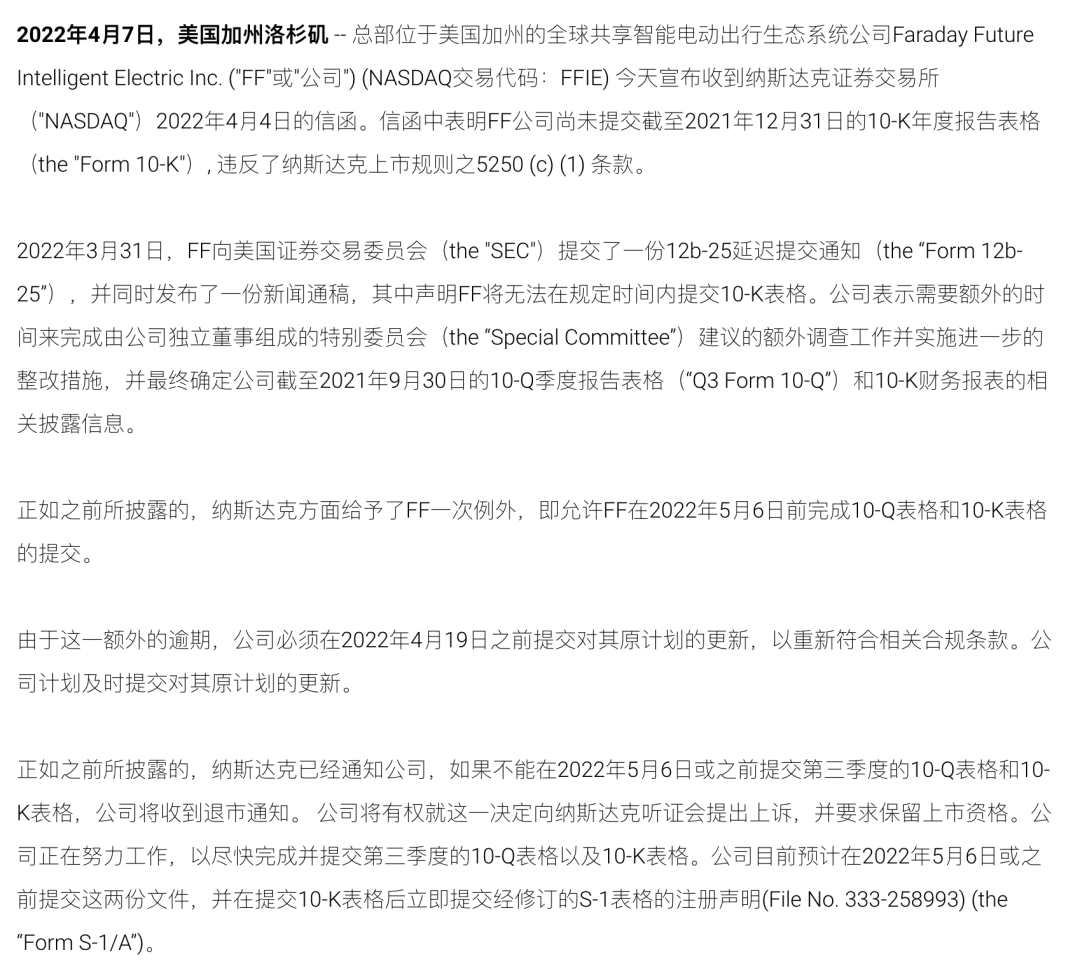

More seriously, Faraday's future may be forced to delist, leaving little time for Faraday's future. Previously, FF had received a regulatory letter from Nasdaq on April 4 for failing to submit its 2021 earnings report (Form 10-K) on time, and the company may receive a delisting notice if it fails to submit the required documents by May 6. FF revealed that it is currently not expected to meet the deadline to submit its annual report to the end of December 2021, requiring more time to complete additional investigative work, implement additional appropriate remedial actions, and finalize the company's financial statements and related disclosures, including the company's third quarter earnings report for the year ended September 30, 2021.

FF came with the question at the beginning of its launch,"Suffocation for dreams or storytelling?" Now, this question was once again in front of FF.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.