In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/30 Report--

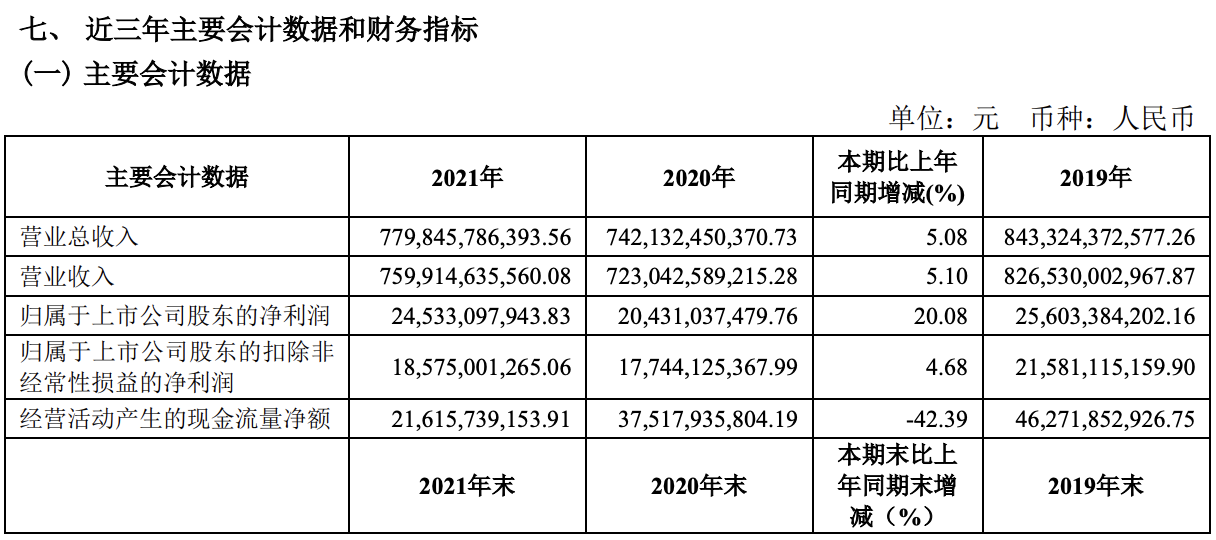

On the last working day of April, SAIC disclosed its annual financial report as scheduled. According to the data, the total operating income of SAIC in 2021 was 779.85 billion yuan, an increase of 5.1% over the same period last year; the net profit belonging to shareholders of listed companies was 24.53 billion yuan, an increase of 20.1% over the same period last year; the net profit belonging to shareholders of listed companies after deducting non-recurrent profits and losses was 18.58 billion yuan, an increase of 4.7% over the same period last year.

This is the first time that SAIC has achieved growth in recent years! Data show that SAIC's net profit from 2018 to 2020 was 36.01 billion yuan, 25.6 billion yuan and 20.43 billion yuan, respectively, showing "three consecutive declines", while SAIC's net profit in 2021 was 24.53 billion yuan, an increase of 20.1 percent over the same period last year, but still below the level of 2019.

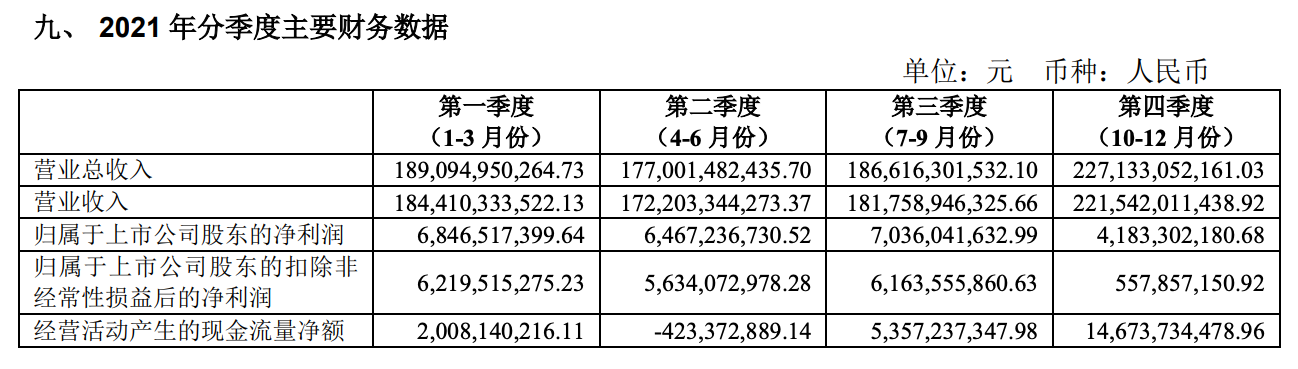

From the market point of view, 2020 of the domestic auto market temporarily stagnated due to the impact of the epidemic, and in 2021 it was affected by the epidemic, the supply of spare parts and the rising prices of raw materials, which dealt a heavy blow to the profitability of major car companies. Take SAIC as an example, its operating income is 189.09 billion yuan and net profit is 6.85 billion yuan in the first quarter of 2021, 177 billion yuan and 6.47 billion yuan in the second quarter, 186.62 billion yuan and 7.04 billion yuan in the third quarter, 227.13 billion yuan in operating income and 4.18 billion yuan in net profit in the fourth quarter. Judging from the data, while SAIC's operating income increased in the first three years, its net profit also increased, but when its operating income reached 227.13 billion yuan at the highest level in the fourth quarter, the net profit fell to the lowest of 4.18 billion yuan in the year.

At the beginning of the year, SAIC said that it expected to achieve the operating target of 6.17 million vehicle sales in 2021, with an estimated operating income of 830 billion yuan and operating cost of 720 billion yuan, but in fact, SAIC did not achieve its performance target. During the reporting period, SAIC's cumulative car sales in 2021 were 5.464 million, down 2.45% from the same period last year. If calculated in terms of sales success rate, it is still 706000 behind the target of 6.17 million, with a gap of more than 11%.

Relying on performance and sales, SAIC's performance in the capital market is also not satisfactory. Its share price has started a sharp downward trend since it hit a high of 23.45 yuan in November last year. SAIC shares closed at 15.95 yuan as of the last trading day, the lowest since July 12, 2016.

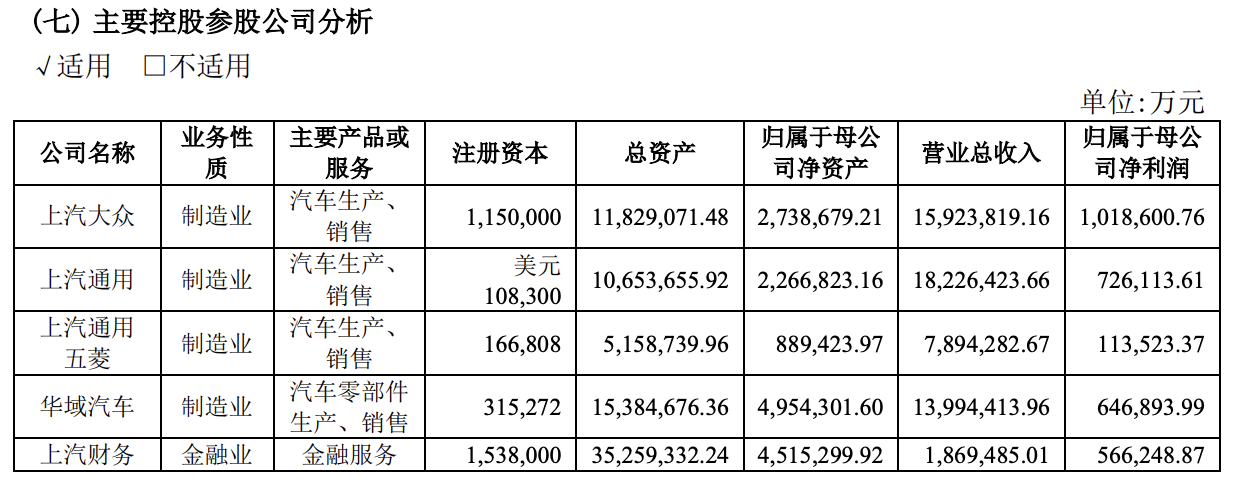

Shanghai Automotive Group Co., Ltd. is the largest automobile group in China, which was established on April 16, 1984. It has joint venture brands SAIC Volkswagen, SAIC General Motors, SAIC GM Wuling and independent brands SAIC Chase, SAIC passenger cars (including SAIC Roewe / Shangqi Mingjue), Feifan Automobile, Zhiji Automobile and so on. According to the financial report, SAIC-Volkswagen sales fell 17.5 per cent year-on-year to 1.242 million vehicles in 2021, SAIC GM fell 9.26 per cent to 1.331 million vehicles, SAIC GM Wuling increased 3.76 per cent to 1.66 million vehicles, and SAIC passenger car sales rose 21.72 per cent to 807000 vehicles. According to the financial report, the net profit in 2021 is 15.49 billion yuan for SAIC-Volkswagen, 410000 yuan for SAIC-GM and only 140 million yuan for SAIC-GM Wuling. As a result, SAIC Volkswagen sales fell by double digits compared with the same period last year, which has a great impact on the group's net profit, while SAIC GM Wuling and SAIC passenger cars have achieved growth, but the overall profit margin is not high.

Of course, the situation of SAIC this year is not optimistic. Affected by the epidemic in Shanghai, many factories under SAIC have stopped production for more than half a month. At a press conference on epidemic prevention and control in Shanghai this morning, Zhang Hongtao, chief engineer of the Shanghai Municipal Economic Informatization Commission, said that the resumption rate of the first batch of "whitelist" enterprises exceeded 80%. The whole vehicle factories of SAIC Group and Tesla Company have steadily realized the mass off-line of the whole vehicle. In theory, the epidemic in Shanghai affects not only SAIC, but also China's automobile industry. with the repetition of Russia-Ukraine problems, the supply of chips, wire harness and other spare parts is still insufficient, and the cost of raw materials in the industry is still high in the short term. there is great pressure on the operation of the industrial chain.

Now, the era of "market capitalization" and "earning 100 million a day" has also changed. SAIC is constantly strengthening the development of its own brand, but the elephant "turn around" is bound to be very difficult.

On November 26, 2020, SAIC announced that the SAIC "L" project was officially named "Zhiji Automobile", a joint venture between SAIC, Shanghai Pudong New area and Alibaba. The brand was announced on January 13, 2011. the first model, the Zhiji L7, has been on the market with a price range of 368800 yuan to 408800 yuan. On October 29, 2021, SAIC officially announced that the original R brand of SAIC passenger car Branch will officially carry out market-oriented operation in the way of an independent company, which is called Feifan Automobile in Chinese. In the future, Feifan Automobile will focus on 200000 to 400000 yuan of middle and high-end new energy intelligent products, and Zhiji Automobile will jointly assume the important task of SAIC Group's breakthrough in the high-end electric intelligence new track. However, although the action is very intensive, but under the attack of Tesla, NIO, ideal, Xiaopeng and so on, SAIC is obviously unable to take the lead. Some people commented that SAIC "got up early in the morning and caught an evening set" on the new energy track.

According to objective analysis, as a large vehicle manufacturer, more than 90% of SAIC's sales rely on traditional fuel vehicles, especially traditional joint venture brands such as SAIC-Volkswagen, SAIC-GM and SAIC-GM Wuling. In this context, it is difficult to give up the huge market of fuel vehicles, so SAIC launched new energy vehicle brands such as Feifan Automobile and Zhiji Automobile. Its transformation motivation and determination will be far less resolute and thorough than those who subvert the industry. In the joint venture new energy vehicle market, Volkswagen ID. The family is also faced with the problem of "disobedience to soil and water", and it may be difficult to contribute to SAIC's performance in the short term.

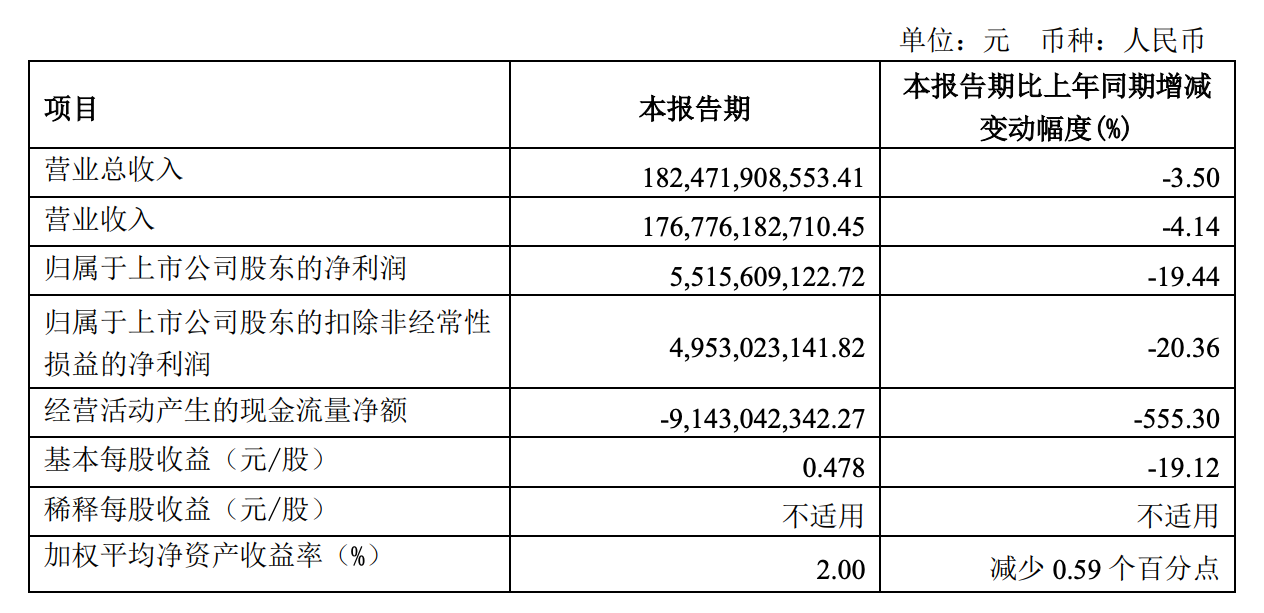

According to the first quarter report, the total operating income of SAIC was 182.47 billion yuan, down 3.5% from the same period last year; the net profit belonging to shareholders of listed companies was 5.52 billion yuan, down 19.4% from the same period last year; the net profit belonging to shareholders of listed companies after deducting non-recurring gains and losses was 4.95 billion yuan, down 20.36% from the same period last year. During the reporting period, SAIC sold 1.221 million vehicles, an increase of 6.84% over the same period last year, of which SAIC-Volkswagen sales increased by 32.0% to 331000 vehicles, SAIC GM fell 18.2% to 275000 vehicles, SAIC GM Wuling increased 5.7% to 326000 vehicles, and SAIC passenger vehicles increased by 33.7% to 194000 vehicles.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.