In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/02 Report--

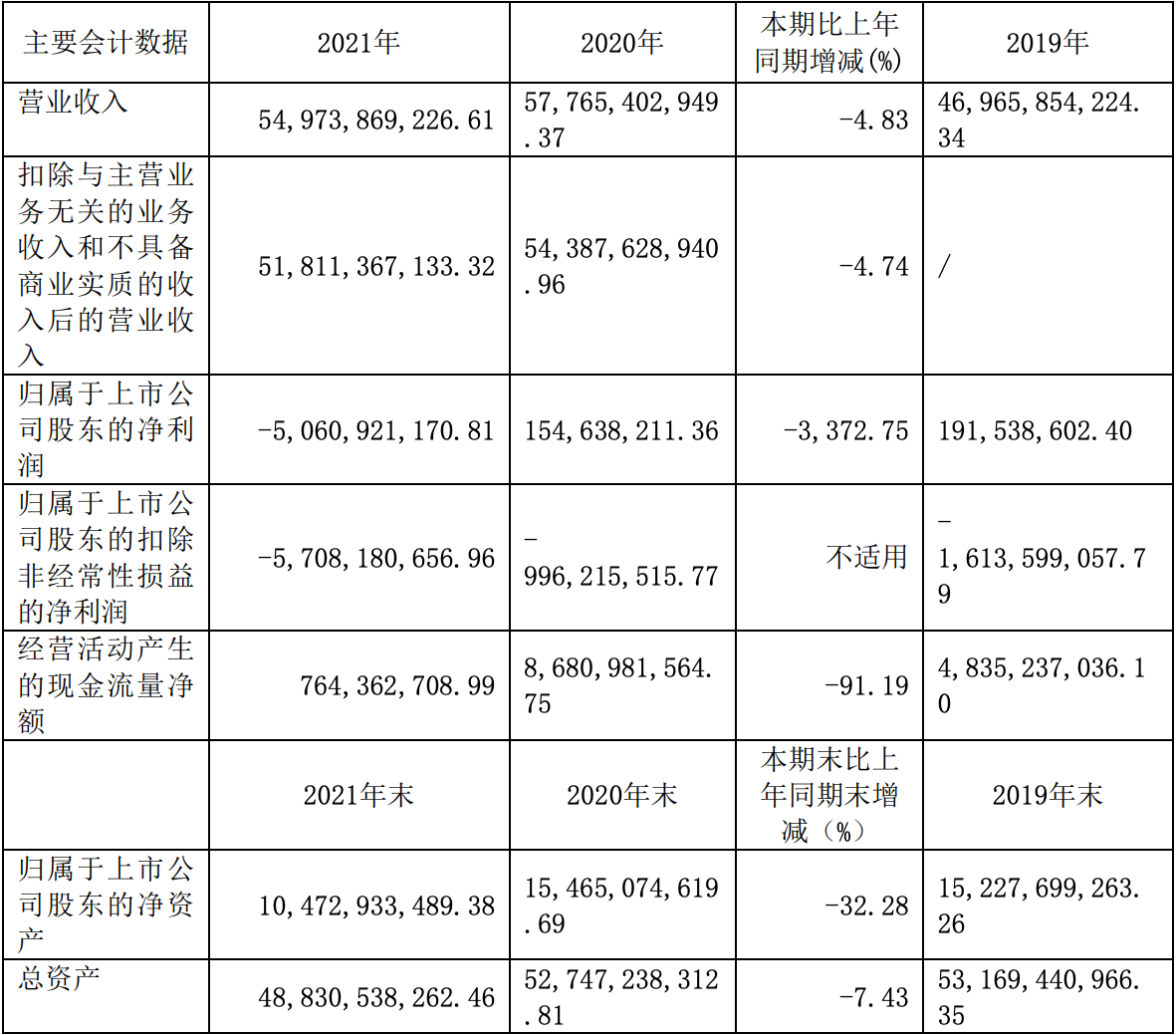

BAIC Foton Motor Co., Ltd. (hereinafter referred to as "BAIC Foton") released its annual report on April 30, showing that its operating income reached 54.97 billion yuan in 2021, down 4.83% from the same period last year. The net loss was 5.06 billion yuan, down 3372.75% from the same period last year.

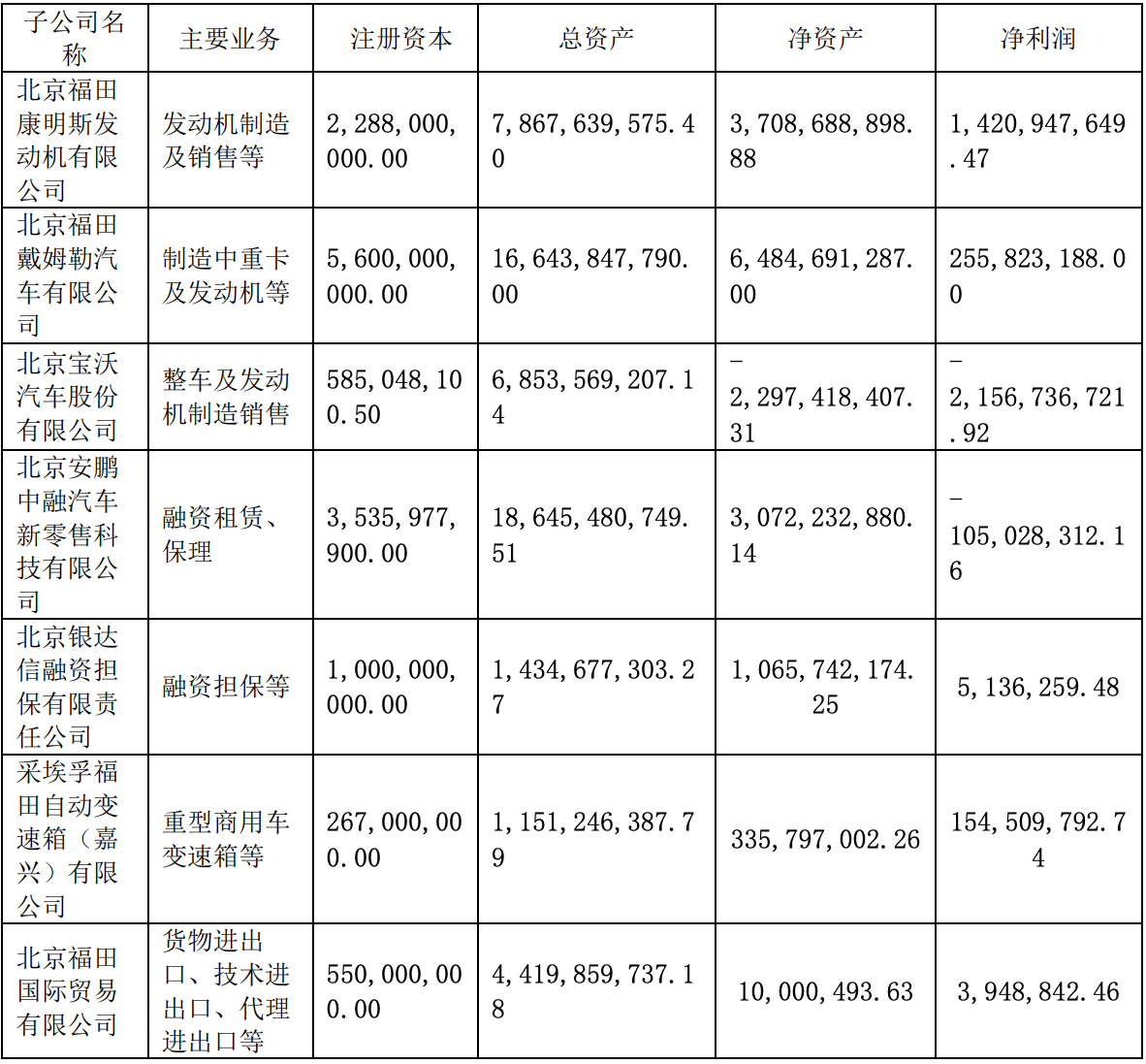

In view of the performance from profit to loss. BAIC Foton said that the loss in 2021 is mainly due to the impairment impact of related matters of Beijing Baowo Automobile Co., Ltd. (hereinafter referred to as "Beijing Baowo"), which affects the total profit is expected to be-4.656 billion yuan. in addition, it is estimated that the total profits of listed companies will be affected by the total investment income recognized by the company due to its shareholding in Beijing Baowo. According to the financial report, among the major holding companies, Beijing Baowo is the only company with a net loss of 2.157 billion yuan and net assets of-2.297 billion yuan.

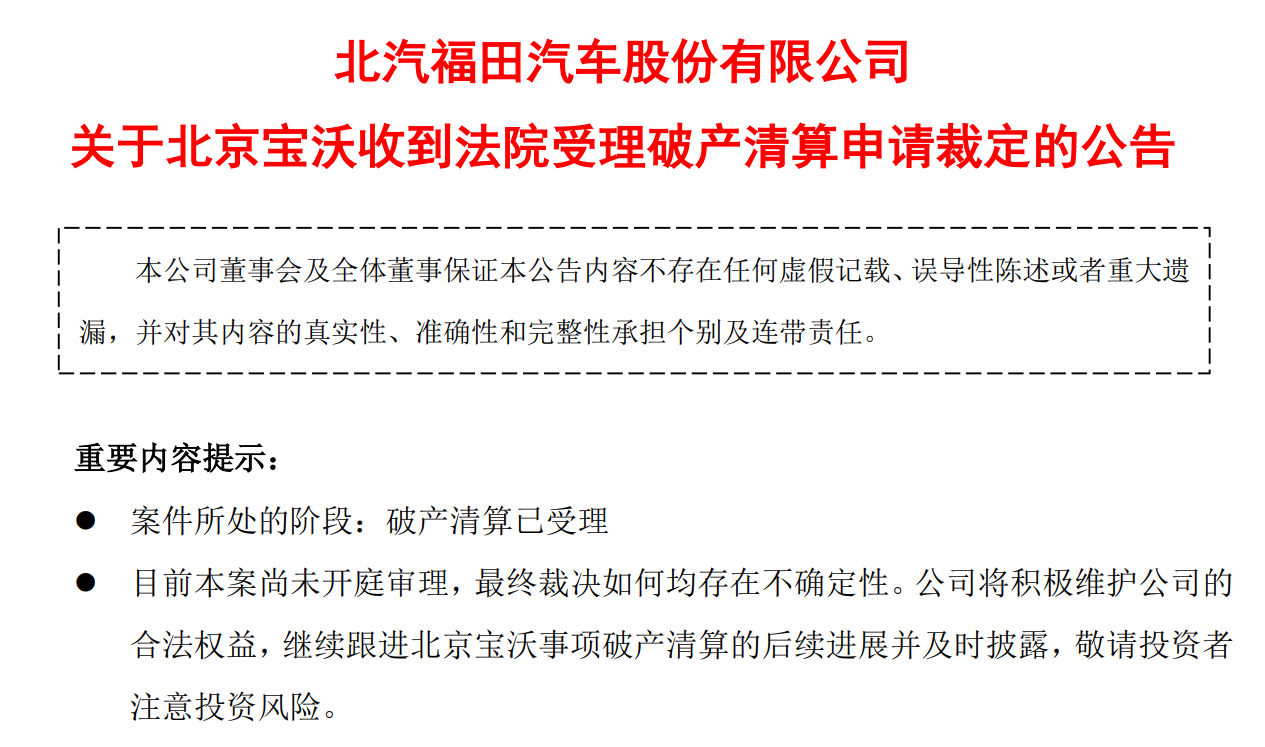

On April 8, BAIC Foton announced that it had submitted an application for bankruptcy liquidation to the Beijing No. 1 Intermediate people's Court. On April 22, BAIC Futian issued another announcement saying that the Beijing No. 1 Intermediate people's Court had ruled to accept Beijing Baowo's application for bankruptcy liquidation. According to the announcement, according to the Beijing No. 1 Intermediate people's Court, Beijing Baowo is unable to pay off its due debts, and the audit report shows that its assets are not sufficient to pay off all its liabilities. Beijing Baowo is a qualified bankruptcy subject and already has a reason for bankruptcy, so the application for bankruptcy liquidation of Beijing Baowo should be accepted. In other words, from the resurrection of Foton to filing for bankruptcy, the self-proclaimed "German top four BBBA" car brand finally failed to save itself in the Chinese market.

Of course, there is a certain basis for Bowo to claim to be the "German top four BBBA". According to the official introduction, Bowo car, which has a history of 100 years, was founded by German engineer Karl Bowo in 1919 and belongs to German luxury brand. the product line gradually covers cars, sports cars, buses, fire engines, boats, trucks, and even tanks and helicopters. In the first few decades, the overall development of Bowo cars was quite good, and by the end of the 1950s, Bowo cars reached their own peak. Used to be the third largest carmaker in Germany. It was a turning point for Bowo in 1961, when Bowo was the first to take the lead in getting the millionth vehicle off the line, ahead of Mercedes-Benz and BMW. In that year, Bowo experienced a fall from the peak of the market to the bottom and was officially declared bankrupt in 1961 because of cash flow problems.

It has been more than half a century since we returned. In 2014, Chinese commercial vehicle brand Foton Motor spent 5 million euros to buy Bowo. BAIC Foton found a breakthrough into the passenger car market through Beijing Baowo. Beijing Baowo Automobile Co., Ltd. was established in January 2016, and launched the first product BX7 in the domestic market, followed by BX5, BX6 and other models.

According to the data, BAIC Foton was founded on August 28, 1996 and listed on the Shanghai Stock Exchange in June 1998. It has been ranked first in domestic commercial vehicles for many years in a row, and is a solid leading enterprise of commercial vehicles. However, although BAIC Foton has achieved the first place in the industry, it has not cultivated much brand awareness in the passenger car market. Although Bowo used to be ahead of BMW and Mercedes-Benz, this is the story of the last century and in the foreign market. For most domestic consumers, Bowo, which claims to be the "German top four BBBA", does not have much recognition in the passenger car market. Therefore, in the case of not focusing on product power and brand power, the over-emphasis on the so-called German DNA has in fact been doomed to future development. Since then, due to the fact that Bowo's technology and product power have been unable to keep up with the development of the times for a long time, Beijing Bowo lost 4.014 billion yuan in three years from 2016 to 2018. Futian Motor, which cannot make ends meet, finally listed to transfer 67% of Beijing Baowo's shares. Shenzhou Youche finally bought Bowo Motor for 4.109 billion yuan, becoming a holding company under Shenzhou Youche.

It was originally thought that Beijing Baowo could shine after entering the "Shenzhou system", but it was more like falling into another quagmire. Affected by Luckin Coffee's financial fraud, coupled with the long-term sluggish performance of the "China Department", the relevant companies fell into a financial crisis and it was difficult to repay the remaining equity transfer and loans to Foton Motor. In January 2022, Futian Motor announced that Beijing Baowo had entered a shutdown because it was unable to maintain its operation due to the depletion of funds. The assets deposited in the Miyun factory have been seized by the court as a whole, the foreign liabilities are basically overdue, and Beijing Baowo has become insolvent. On April 8, BAIC Foton announced that it had submitted an application for bankruptcy liquidation to the Beijing No. 1 Intermediate people's Court. On April 22, BAIC Futian issued another announcement saying that the Beijing No. 1 Intermediate people's Court had ruled to accept Beijing Baowo's application for bankruptcy liquidation.

With regard to the court's acceptance of the bankruptcy liquidation of Beijing Baowo, BAIC Foton has always said that the relevant matters will not affect the company's existing main business and will not have a significant impact on the company's continued operation. However, from the perspective of financial data, BAIC Foton, as one of the shareholders, has always been influenced by Beijing Baowo. Recently, BAIC Foton has not only issued additional shares, but also carried out a number of assets. From this point of view, Beijing Baowo bankruptcy liquidation is not only a stop loss, but also imminent.

Bowo Automobile has come to the current stage, the result of stock competition in the domestic automobile market, but also the result of market competition and consumer choice. Perhaps, for such a brand, even if it falls down, there is nothing wrong with it, but such an outcome also sounds a wake-up call to domestic automobile brands. All cooperation and acquisitions should be based on the premise of synergy, need to seek the complementarity of technology and superior resources, and try to achieve car-building shortcuts through the acquisition of endangered brands, leaving only a place of chicken feathers.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.