In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/04 Report--

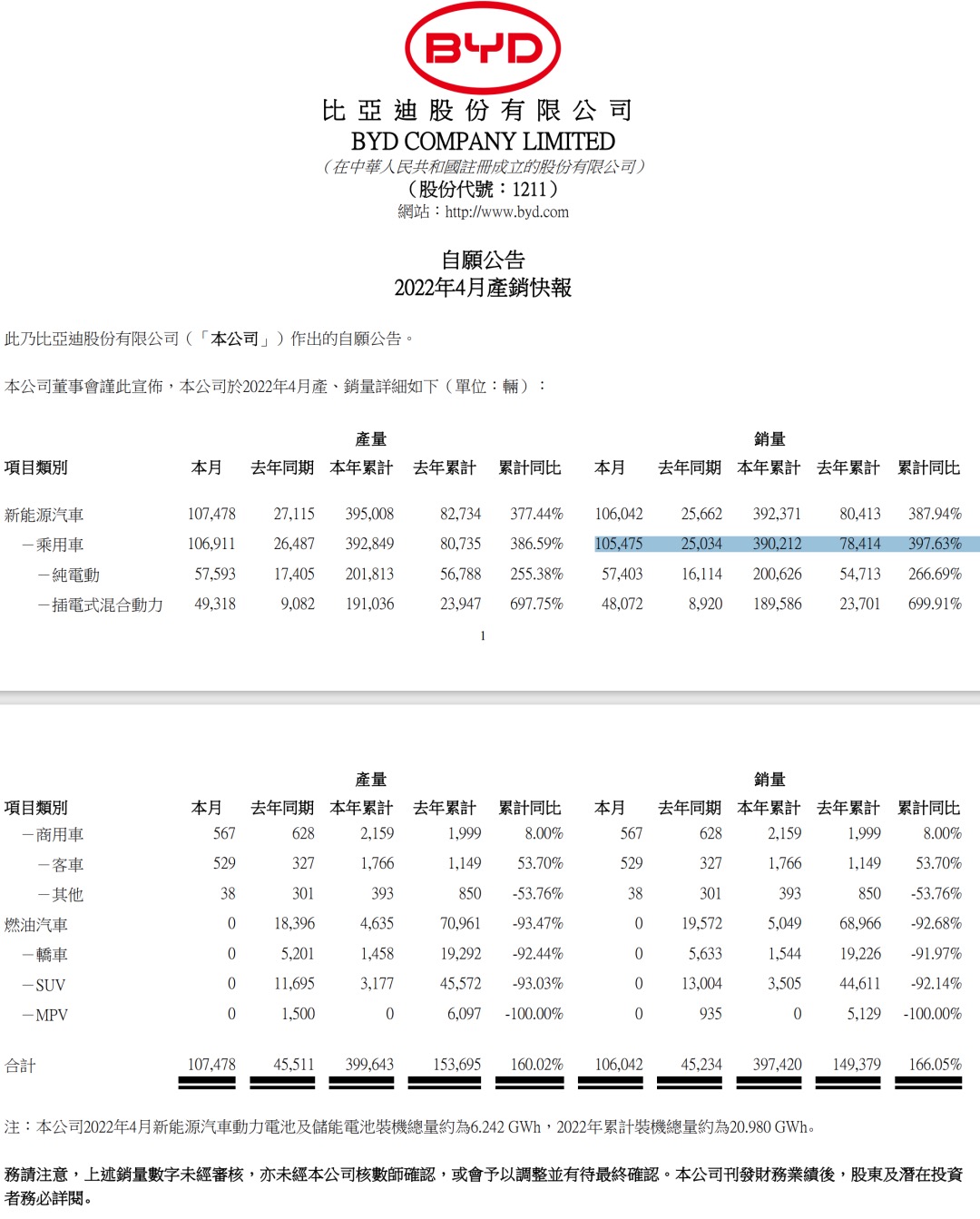

On May 3, BYD released production and sales figures showing that new energy vehicle sales in April were 106042, up 313.2% from a year earlier. Of which 105475 were new energy passenger vehicles, an increase of 321.3% over the same period last year. In addition, cumulative car sales from January to April were 392371, an increase of 387.94 percent over the same period last year, of which 390212 were new energy passenger vehicles, an increase of 397.63 percent over the same period last year. Previously, BYD conservatively forecast sales of 1.5 million vehicles in 2022, which would have achieved 26% of its sales target of 1.5 million vehicles by April. For BYD, meeting its sales targets depends largely on the quality of the supply chain.

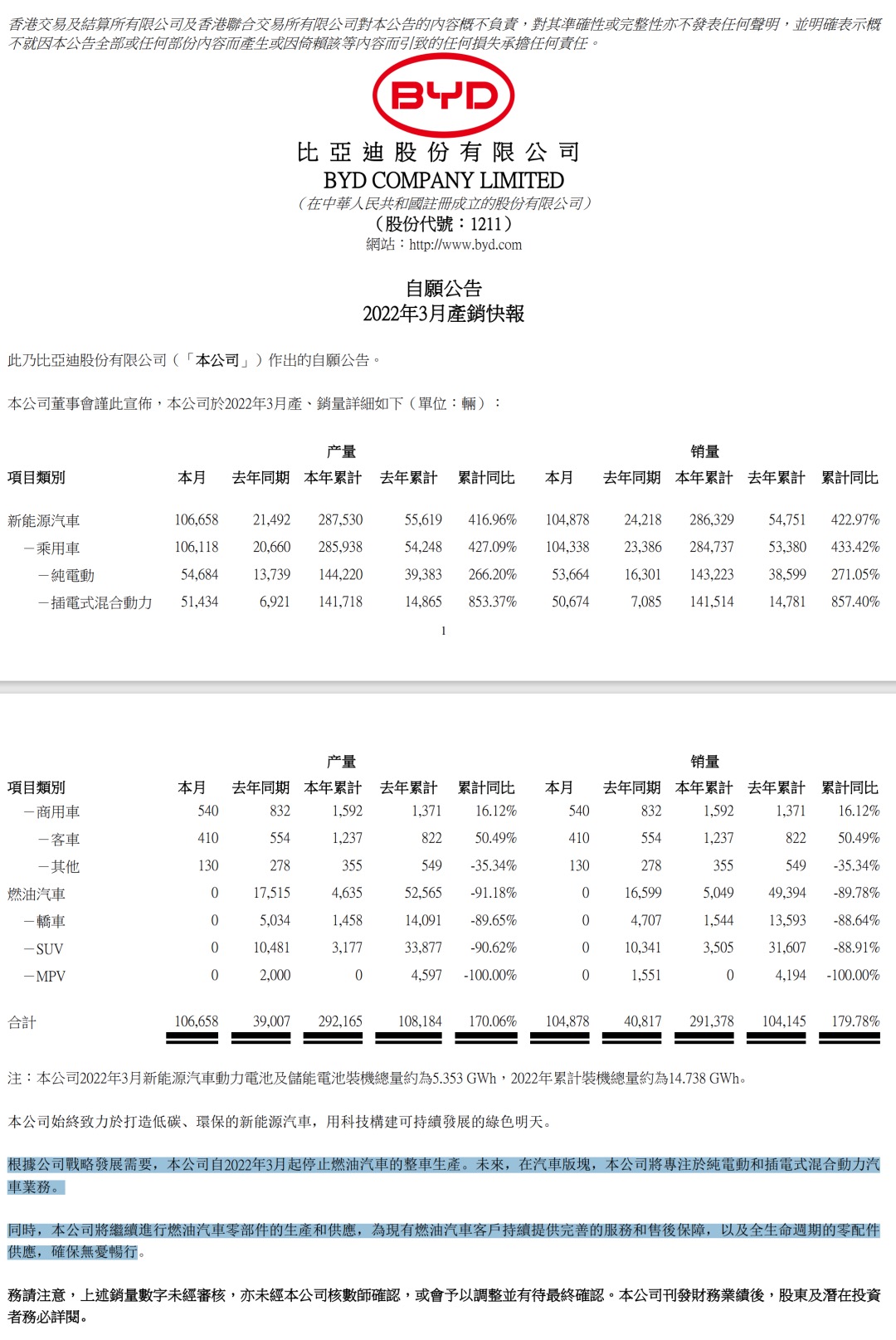

On April 3, BYD announced that according to the company's strategic development needs, the company will stop the production of fuel-fueled vehicles from March 2022. In the future, in the automotive sector, the company will focus on pure electric and plug-in hybrid vehicles. Taking the April sales data as an example, under the influence of the suspension of production of fuel vehicles and limited supply of spare parts, BYD's sales of new energy vehicles did not decline, but soared against the backdrop of rising prices of new energy vehicles. For BYD, stopping production of fuel vehicles is not only in line with the development of the market, but also the inevitable trend of the transformation of BYD's automobile sector. compared with fuel cars, BYD's new energy vehicles continue to sell well in the market, and the problem of "not mentioning cars" continues to haunt car buyers. According to previous reports, BYD still has 400000 orders yet to be delivered, and as BYD's new energy vehicles continue to sell well, it can be speculated that BYD's orders are also increasing.

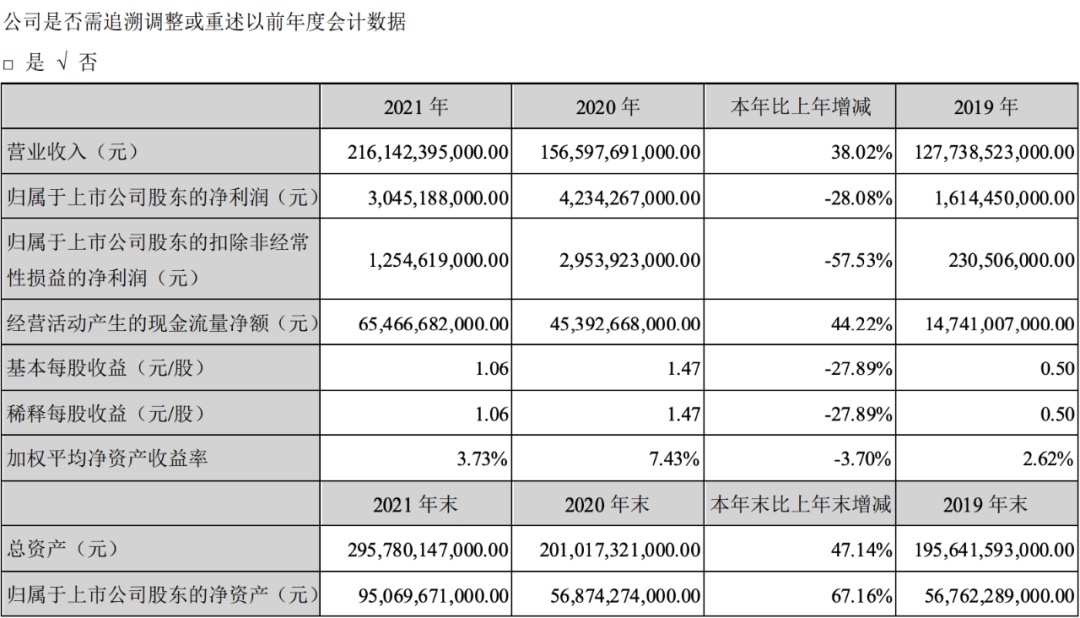

According to data, BYD was founded in 1995, listed on the Hong Kong Stock Exchange in 2002 and listed on the Shenzhen Stock Exchange in 2011. BYD first started with the battery business and officially entered the automobile industry by acquiring Qinchuan Automobile in 2003. It should be noted that BYD is not just an automobile company, it has three business segments: automobile business, mobile phone parts and assembly business, rechargeable battery and photovoltaic business. According to the annual report, BYD achieved an operating income of 216.142 billion yuan in 2021, an increase of 38.02% over the same period last year, and realized a net profit of 3.045 billion yuan belonging to shareholders of listed companies, a decrease of 28.08%. The cumulative car sales for the whole year was 740100, an increase of 73.34% over the same period last year. Among them, the sales of new energy passenger vehicles was 593700, an increase of 231.60% over the same period last year. According to the first-quarter results, BYD achieved an operating income of 6.68 billion yuan in the first quarter of 2022, an increase of 63.02% over the same period last year. The net profit attributed to shareholders of listed companies was 808 million yuan, up 240.59%, and cumulative car sales were 291400, an increase of 179.78% over the same period last year. Among them, the sales of new energy passenger vehicles was 284700, an increase of 433.42% over the same period last year.

Unlike in 2021, BYD achieved an increase in revenue and net profit as car sales increased. From the market point of view, BYD's newly launched Qin PLUS DM-i, Song PLUS DM-i, Tang DM-i and other DM-i super hybrid models are widely sought after by the market, but the above models are only launched in the second quarter, so BYD's performance in the same period in the first quarter of 2022 is relatively poor, which is due to the growth of BYD's new energy vehicle sales in January 2021. As for the increase in net profit, BYD announced two price increases for products in the first quarter, the first because of the decline in subsidies for new energy vehicles, and the second because of the rise in raw material prices. For BYD, the whole industry chain self-research can make BYD's cost control better, while the price increase will share the cost pressure with consumers. Galaxy Securities said that BYD's advantages of the whole industrial chain are gradually emerging, superimposed on the completion of mid-and high-end product matrix and the scale effect brought by product volume, the loss of its new energy vehicles has been basically reversed, and the company's profitability is expected to continue to improve. Performance improvement is expected.

It is worth mentioning that according to the statistics of domestic automakers in April 2022 (as of April 17), BYD is far ahead of other automakers in sales, with 12 companies selling only 10,000 vehicles. Specifically, as of April 17, BYD had insured 35743 vehicles, the only car company to achieve growth, a year-on-year increase of 89% in sharp contrast to other automakers, including SAIC Volkswagen, FAW-Volkswagen, Beijing Mercedes-Benz and other car companies, the main reason is due to the short-term shutdown of the supply chain in Jiangsu, Shanghai and Zhejiang. Based on the above, due to the sharp decline in mainstream automakers, coupled with the large difference between the insurance data of many manufacturers and BYD during the period, while BYD is currently in short supply, wholesale sales are basically equal to the number of risks. Therefore, if nothing happens, BYD will continue to win the top spot in China's passenger car market.

As for BYD, why can it soar? Unlike other automakers, BYD is both a carmaker and a battery supplier, and its self-developed and produced blade batteries can at least avoid the problem of "sticking neck" because it has a relatively complete supply chain. In addition, BYD has built factories in Shenzhen, Xi'an, Changsha and other places, where the epidemic is less serious than in Jilin and Shanghai, which restricts more local sales rather than BYD's production.

At present, China is the largest new energy vehicle market in the world, while BYD is the largest manufacturer in the domestic new energy vehicle market. Cui Dongshu, secretary general of the Federation, said that in 2022, China's new energy accounted for 59% of the world's new energy, and its performance was excellent. This is mainly due to China's strong demand for new energy, while Europe's production and sales of traditional cars and new energy vehicles are low, so China's development is very strong. "China's drive to increase the world's growth is mainly driven by the shift of China's new energy vehicle market to marketization, forming a strong endogenous growth force."

In addition, statistics disclosed by the Ministry of Public Security show that the number of new energy vehicles reached 8.915 million, with 1.11 million newly registered in the first quarter. By the end of March, the number of new energy vehicles in the country had reached 8.915 million, accounting for 2.9 percent of the total. Among them, there are 724.5 pure electric vehicles, accounting for 81.27% of the total number of new energy vehicles.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.