In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/05 Report--

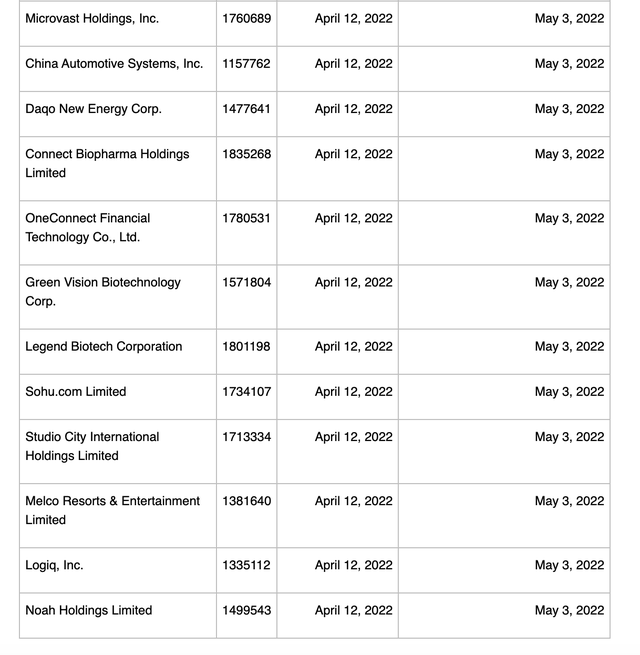

On May 4, 2022, the Securities and Exchange Regulatory Commission (SEC) added 88 Chinese stocks to the "pre-picked" list, including Huaneng International, Chinalco, bilibili, pinduoduo, 36 Krypton, Tencent Music, Ctrip, Xiaopeng Automobile, JD.com, China Mobile, NetEase, Lulai, PetroChina, Sinopec, China Eastern Airlines, China Southern Airlines and other companies. SEC explained that it was "unable to check the audit papers of these companies" and asked them to submit their defences by May 25.

According to the details of the Foreign Company Accountability Act published by SEC in December 2021, foreign listed companies have failed to submit the reports required by the Accounting Supervisory Board of American listed companies for three consecutive years, and SEC has the right to delist them from the exchange. These companies can provide evidence to SEC before the application deadline to prove that they are not eligible for delisting, and the companies concerned have 15 working days to appeal against SEC's decision, and if the appeal is rejected, the first year of inspection will eventually determine non-compliance. Of course, if it cannot be proved, it will be included in the definite delisting list.

In response to the US SEC's inclusion of 88 Chinese stocks in the "pre-delisted" list, Chinese Foreign Ministry spokesman Zhao Lijian said at today's regular press conference that China's securities regulatory authorities communicated with US securities regulatory authorities in this regard. The inclusion of Chinese enterprises in the relevant list is a step for the United States to implement the relevant domestic laws, and does not represent the delisting of relevant enterprises, whether these enterprises are delisted and whether they are listed in the United States. It depends on the progress and results of Sino-US audit regulatory cooperation.

According to the auto industry concern statistics, this is the sixth time that the SEC of the United States has issued a list of "pre-picked cards", and it is also the largest in number. So far, a total of 128 enterprises have been added to the blacklist, including the new car-building forces listed in the United States, such as Lai, Xiaopeng and ideal. It is understood that at present, 23 Chinese stocks have changed from a "pre-delisted list" to a "confirmed delisting list". There are 105 Chinese stocks left on the "pre-delisted list", of which 17 are required to submit their arguments before May 12, including Zhihu.

In early March, after the US SEC announced five "pre-picked" Chinese stocks for the first time, the relevant listings fell sharply in the secondary market. Affected by the news, the share prices of the relevant Chinese companies also fell sharply, with the US stock market down 4%, JD.com down 2.5% and Xiaopeng Motor down 3.67%. However, JD.com Group, Xiaopeng Motor, bilibili and NetEase, which are listed in Hong Kong today, closed up 0.83%, 2.33%, 1.53% and-1.67% respectively.

How will the Chinese companies listed on the "pre-extracted list" respond? NIO said it has been actively exploring possible solutions to protect the interests of stakeholders and will continue to abide by applicable laws and regulations. strive to maintain listing status on the Hong Kong Stock Exchange / New York Stock Exchange. Previously, the ideal car, one of the new power car companies, was also included in the "pre-removed" list, which said that being included was not the same as delisting in the United States. according to relevant regulations, companies will be restricted from trading in US stocks only if they have not opened their audit papers to the United States for three consecutive years. Ideal Automobile said: "as a company responsible to investors, we have been actively looking for solutions and actively cooperate with the work related to the audit manuscript in accordance with the regulatory requirements at home and abroad." In addition, the company completed its major listing in Hong Kong last year, and the shares of the two places can be exchanged, and investors in US stocks can be converted to hold in Hong Kong at any time. The listing status of major listings in Hong Kong will not be affected by the relevant regulation of US stocks (unlike the secondary listing in Hong Kong). The above will not have any impact on the actual business operation of the company.

Many Chinese stocks listed on the "pre-picked list" hope to do everything possible to retain their dual listing status in Hong Kong and the United States. In this context, dual major listing has become a new trend for US-listed stocks to return to Hong Kong. According to statistics, since March, well-known enterprises such as Shell, Zhihu, Jin Shanyun, bilibili, Mingchuang quality products, and Zaiding Pharmaceutical have expressed their dual major willingness to list, among which Lailai landed in Hong Kong stocks in March by way of introduction to listing, becoming the third new car-building company to be listed in Hong Kong.

As to why dual listing has become a new trend for Chinese stocks to return to Hong Kong under the threat of SEC "pre-delisting", the main reason is that dual listing means that both markets are major listing places, and even delisting on one exchange will not affect the listing status on another exchange, which can better protect the interests of shareholders, and may also enter Hong Kong Stock Connect in the future. In addition, the introduction form does not involve new share financing, so it will be faster and easier to log on to the Hong Kong Stock Exchange for trading, which is suitable for enterprises with abundant cash flow. At the same time, dual listing will provide investors with more choice of trading location and more flexible trading time, which will help to introduce more investors and improve liquidity.

On the evening of May 4, an article on the official website of the China Securities Regulatory Commission entitled "the CSRC conscientiously implements the spirit of the meeting of the political Bureau of the CPC Central Committee to study the policies and measures for the implementation of the capital market" said that it will steadily expand the institutional opening up of the capital market. We will expand the scope of market connectivity at home and abroad, deepen cooperation between the capital markets of the mainland and Hong Kong, and promote the landing of the regulatory system for the overseas listing of domestic enterprises.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.