In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/12 Report--

Rivian, a US electric car company, closed down 9.61 per cent at $20.60 on May 11, with a total market capitalization of $18.553 billion, ranking 22nd among global car companies.

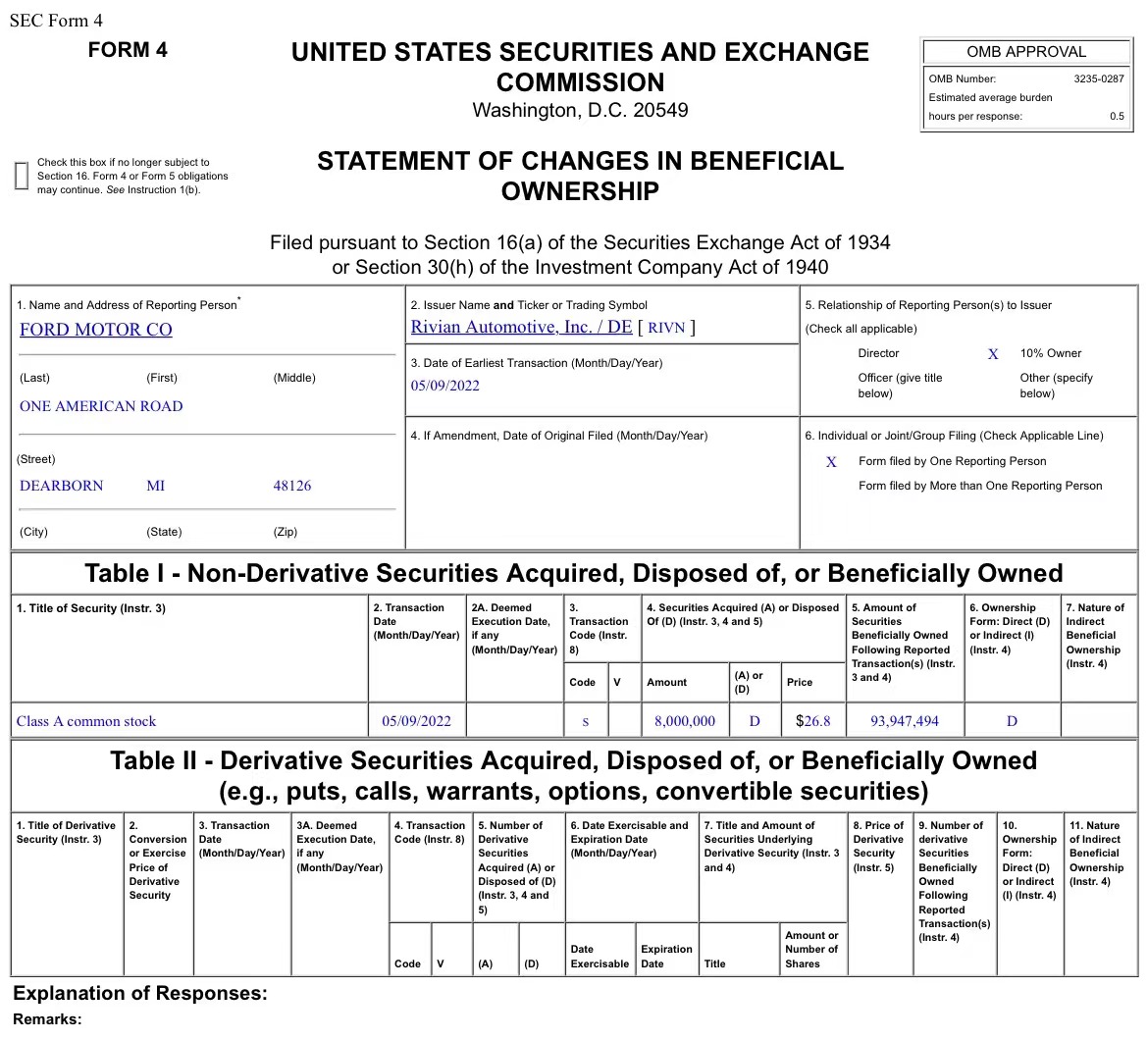

As Rivian's share price continues to hit record lows, Ford can no longer handle it. Ford sold 8 million shares in electric car maker Rivian for $214 million, while Ford still owns 93.9 million shares in Rivian, according to regulatory filings. As a result, Rivian shares fell 20.88 per cent on Monday.

Ford's reason for selling Rivian shares is simple, because it's too bad to hold it. Ford sales fell 9 per cent year-on-year to 970000 vehicles in the first quarter of 2022, revenue fell 4.7 per cent to $34.5 billion and adjusted pre-tax profit fell 41 per cent to $2.3 billion, according to Ford earnings. Ford posted a net loss of $3.1 billion in the first quarter as its stake in electric car company Rivian continued to shrink.

Data show that Rivian is an American pure electric car manufacturer, founded in 2009, headquartered in Irvine, California. Founder RJ Scaringe graduated from the Rensselaer Institute of Technology in the United States, because he is also a car fan, and eventually received a doctorate in mechanical engineering from the Massachusetts Institute of Technology. After graduating in 2009, RJ Scaringe founded the Mainstream Motors car factory, which specializes in sports cars. In 2010, Mainstream Motors was renamed Rivian and transferred from sports cars to pure electric pickups. However, it was not until 2018 that Rivian launched pure electric pickup R1T and pure electric SUV R1S, in which pure electric pickup R1T was widely favored by the market, as the United States was very favored by pickups, so the market once thought that Rivian could compete with Tesla in its heyday, which is why Rivian is known as the "Tesla killer".

In addition, Amazon founder Bezos and Tesla CEO Musk are bitter enemies, perhaps because they see the development prospect of electric vehicles and can restrict Tesla's position, so Bezos invested in a number of automotive companies in 2019, including Rivian, and other institutions raised additional financing for Rivian. Rivian's popularity in the US market has also risen.

On November 1, 2021, Rivian was listed on NASDAQ with an offering price of $78. It rose to $119.46 in intraday trading and closed at $100.73, with a total market capitalization of $85.9 billion. On the same day, founder RJ Scaringe revealed in an interview that Rivian must grow rapidly to produce at least 1 million electric vehicles a year by 2030. Rivian's long-term plan is to build four assembly plants around the world, with a second plant in the United States in addition to the existing one in Normal, Illinois, and one in Europe and one in China.

Since then, Rivian's share price has soared, from $100.73 on November 1 to $172.01 on November 16, with its market capitalization rising from $85.9 billion on November 1 to $149.4 billion on November 16. As of November 16, Rivian's market capitalization is second only to Tesla's US $1.0592 trillion and Toyota's US $261.8 billion, surpassing Volkswagen and BMW to become the third car company in the world by market capitalization. However, Rivian shares have continued to pullback since Nov. 16, and Rivian shares have fallen to $20.60 a share in the last session, and with results and prospects under pressure, reports suggest that JPMorgan plans to sell $13 million to $15 million worth of Rivian shares for an anonymous seller at $26.90 a share.

Bloomberg commented that Rivian shares fell this year mainly because of market dissatisfaction with riskier growth stocks, as rising inflation and Fed interest rate hikes increased investors' preference for safe-haven assets. In addition, new electric car companies have been hit by supply chain shortages and soaring raw material costs, forcing them to lower production targets.

It is understood that Rivian's Normal plant in Illinois currently has an annual production capacity of about 150000 vehicles, but the global chip shortage has had a significant impact on the normal production and delivery of Rivian. According to the annual financial report, Rivian produced a total of 10515 vehicles and delivered a total of 920 vehicles in 2021. Due to supply chain constraints, Rivian expects planned production in 2022 to be halved to 25000 vehicles. Even if the goal is lowered, there is still a big gap in reality. Rivian released its quarterly report on May 12th, showing that Rivian produced 2553 cars and delivered 1227 vehicles in the first quarter of this year.

In fact, electric vehicles have been popular in US capital markets since the second half of 2021, but after 2022, the global car market continues to struggle with the supply chain crisis, and the life of electric car companies is becoming more and more difficult. At the same time, the highly valued bubble began to burst. Tesla's shares tumbled 8.25% to $734.00 on May 11, falling to levels last seen on September 20, 2021.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.