In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/15 Report--

On May 13, Honda and Mazda released their results for fiscal year 2021 (April 1, 2021 to March 31, 2022). So far, the four major Japanese car companies, including Toyota and Nissan, have handed over their performance papers for the 2021 fiscal year. By comparison, Toyota is still the most profitable Japanese car company, with revenues and profits reaching record highs, while Nissan reversed losses for the first time in three consecutive years after the Ghosn incident and high-level turmoil. Honda's revenue and profits also grew, but car business growth slowed, and Mazda seems to be experiencing a crisis. At the same time, behind the gratifying transcripts, the above-mentioned car companies expressed concern about their performance in fiscal year 2023, due to tight supply of spare parts, rising raw materials and logistics costs, the crisis in Ukraine, the rebound of the epidemic, inflation and other effects, making the car market environment more severe.

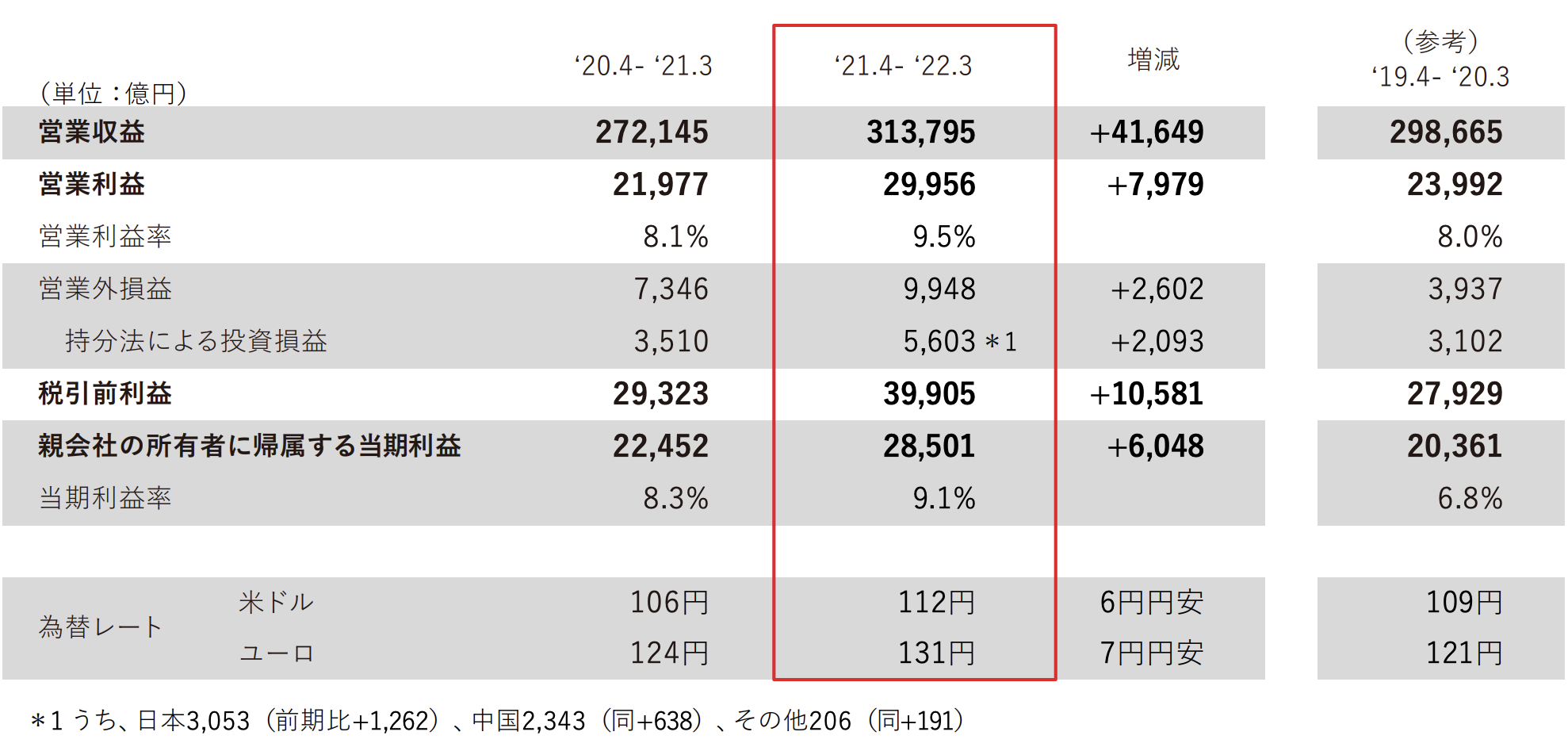

According to the financial report, Toyota (including Hino / Daihatsu) had sales of 30.38 trillion yen in fiscal 2021, up 15% from the same period last year; operating profit was 2.99 trillion yen, up 36% from the same period last year; and net profit was 2.85 trillion yen, up 27% from the same period last year. It is worth mentioning that Toyota's operating profit in fiscal 2021 has exceeded the high of 2.85 trillion yen in fiscal 2015, the highest level in six years and the highest level in the history of domestic companies.

In terms of sales, Toyota sold 10.38 million vehicles worldwide in fiscal 2021, up 4.7 per cent from a year earlier, of which Toyota and Lexus brands sold 9.51 million vehicles, up 4.7 per cent from a year earlier. Affected by the supply chain and the epidemic, Toyota's factories in Japan have repeatedly cut production or stopped production, resulting in a "double drop" in production and sales in Toyota's home market in fiscal 2021, with Japanese market production falling 5.4 per cent year on year to 2.76 million vehicles, the lowest since 1976, and local sales down 9.3 per cent year on year to 1.39 million vehicles, the lowest since 2008. In other words, although Toyota's global sales are growing, it is largely due to contributions from other markets.

Despite the impressive results of the 2021 fiscal year, Toyota is still under pressure from rising raw material prices, global supply chain disruptions caused by outbreaks and geopolitics, and a shortage of chips into 2022. Toyota's operating profit fell 33 per cent year-on-year to 463.86 billion yen in the fourth quarter (January 31, 2022 to March 31, 2022), while global sales fell 3.3 per cent to 2.134 million vehicles, according to the data. In Japan's home market, Toyota was forced to cut production under the influence of the earthquake, with sales falling 18.7 per cent year-on-year to 498000 vehicles.

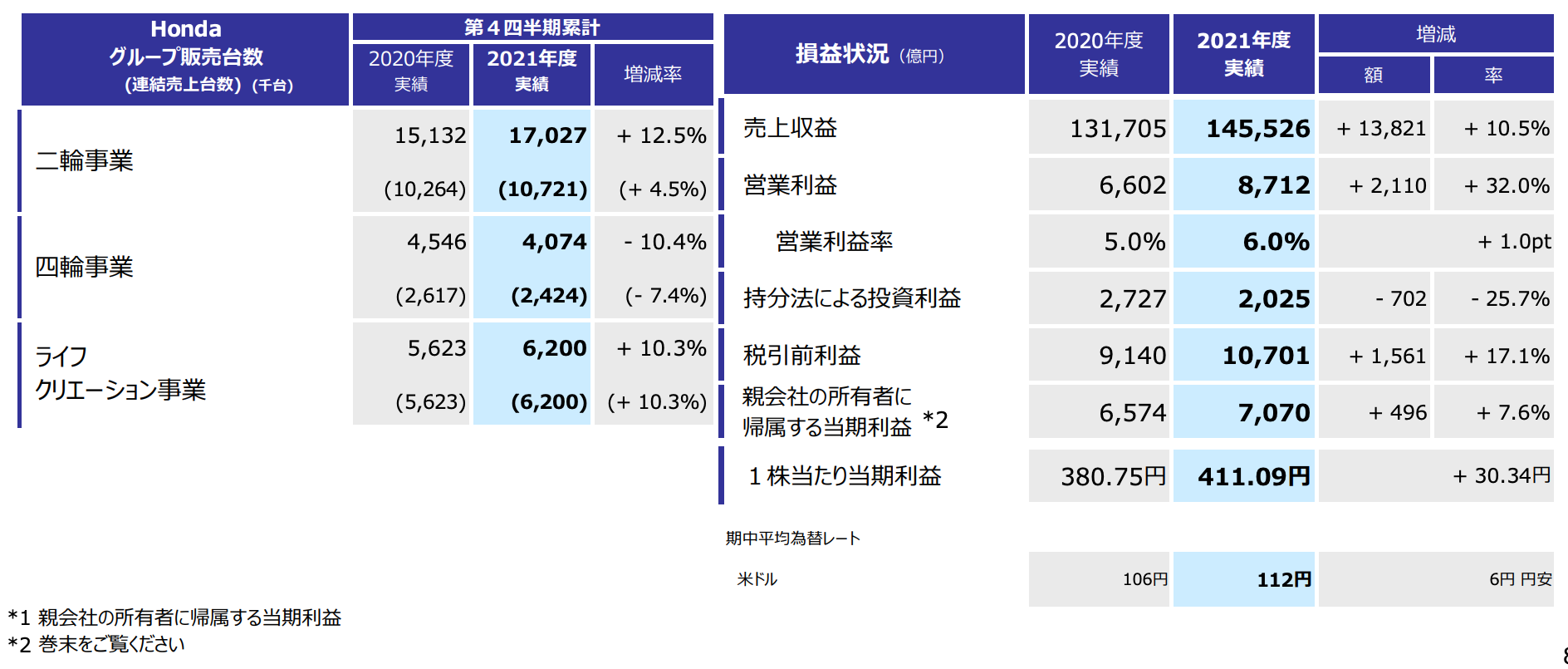

On May 13, Honda released its results for the fiscal year 2022. For the fiscal year ended March 31, 2022, the company realized revenue of 14.55 trillion yen (about 764 billion yuan), an increase of 10.5% over the same period last year, and operating profit of 871.2 billion yen, up 32.0% over the same period last year. Net profit was 710 billion yen, up 7.5% from the same period last year According to the financial report, Toyota's motorcycle business sales revenue in fiscal 2021 was 2.18 trillion yen, up 22.3% from a year earlier, compared with 9.36 trillion yen from the automotive business, up 6.6% from the same period last year. "the slowdown in car business growth is largely due to higher Honda research and development costs and falling sales in some areas, especially in the US," said Seiji Kakashi, president and head of Honda's China operations. "

Honda sold 4.074 million vehicles worldwide in fiscal 2021, down 10.4 per cent from a year earlier, according to the data. In terms of specific markets, Honda sales have declined in many markets around the world, particularly in China, where sales fell 15 per cent to 1.525 million vehicles in fiscal 2021 compared with the same period last year, but China is Honda's largest single market in the world.

Honda has become a carmaker supported by the motorcycle business, while the decline in profitability of the car business has forced Honda to change. On October 13, 2021, Honda China released its electrification strategy, launching a new pure electricity brand "EVOR N" and a new intelligent and efficient pure electricity architecture "ERO N Architecture". Honda China announced at the press conference that it will launch 10 pure electric vehicles in the Chinese market in the next five years, and will sell only pure electric and hybrid models in China from 2030, instead of new fuel vehicles.

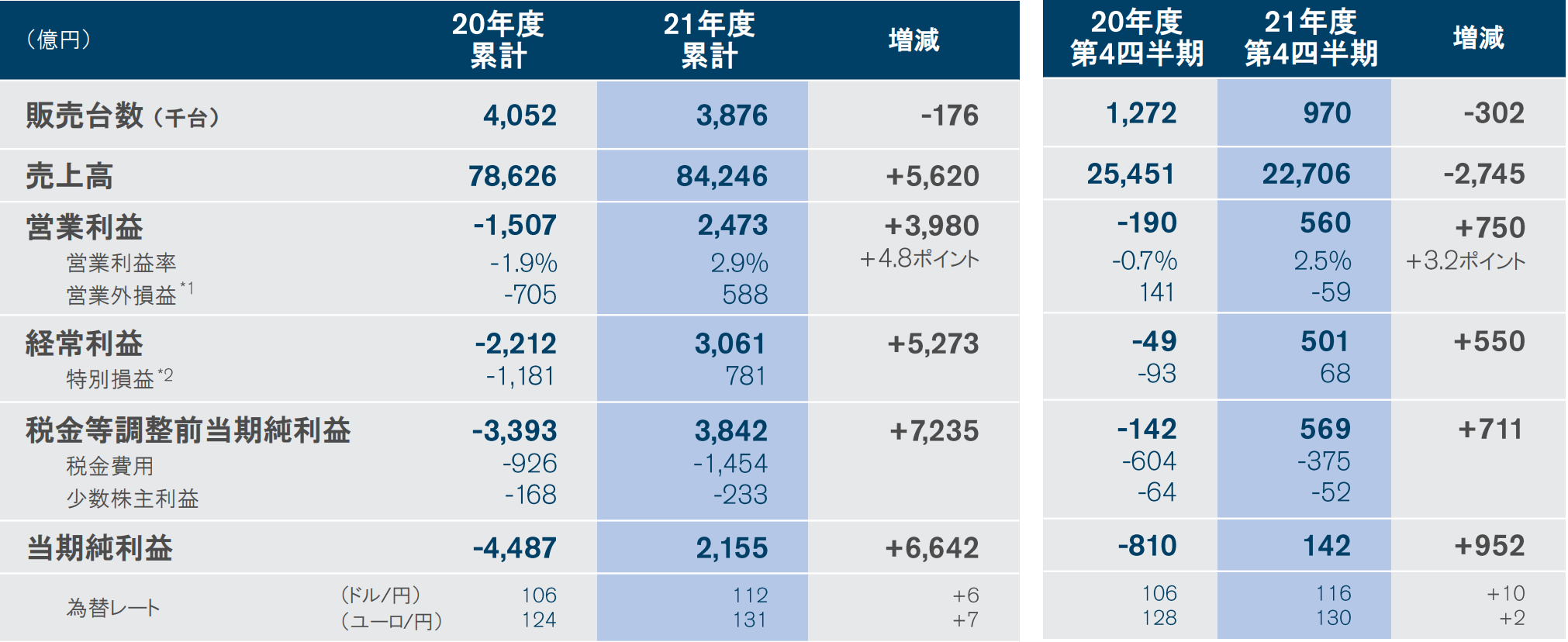

Honda's results came a day after Nissan also reported results for fiscal 2021, returning to profit for the first time after the "Ghosn incident", high-level turmoil and three consecutive fiscal years of losses. Nissan sold 3.876 million vehicles worldwide in fiscal 2021, down 4 per cent from a year earlier, according to the data. Although sales declined, revenue profit increased. In fiscal 2021, Nissan achieved a consolidated net income of 8.42 trillion yen, an increase of 7.1% over the same period last year; operating profit of 247.3 billion yen, while a loss of 150.7 billion yen over the same period; at the same time, Nissan's net income for fiscal year 2021 was 215.5 billion yen, compared with a loss of 448.7 billion yen last fiscal year.

Nissan said in its financial report that "due to the continued spread of the COVID-19 epidemic, chip supply shortages, rising raw material prices and other external factors, the operating environment in fiscal 2021 is full of challenges." At the same time, Nissan is still beset with difficulties in fiscal year 2022 due to a variety of factors. Nissan expects sales to grow 18.8 per cent in fiscal year 2022 (April 2022-March 2023), but operating profit will grow by just 1 per cent.

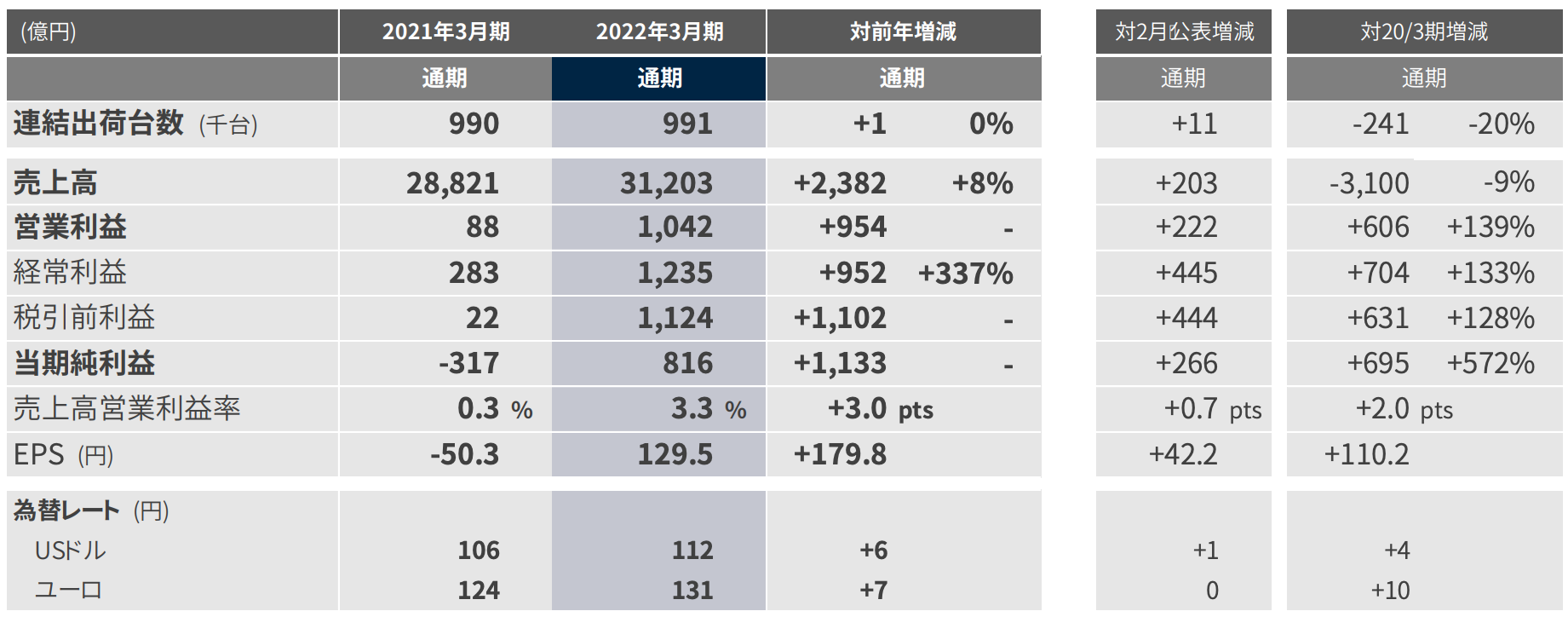

As for Mazda, its sales in fiscal 2021 were 3.12 trillion yen, up 8.4% from the same period last year; net profit was 80 billion yen, up 157.7% from the same period last year; in terms of sales, global sales of Mazda in fiscal year 2021 were 1.251 million, down 2.8% from the same period last year. Among them, the Chinese market was 170000, down 26% from the same period last year.

Compared with Toyota, Honda and Nissan, Mazda's survival crisis in the Chinese market is very significant. At present, Mazda has only one joint venture company in Changan Mazda in the Chinese market. The new Changan Mazda will inherit the related business of Changan Mazda and Mazda. The original FAW Mazda will be changed into a joint venture jointly funded by Mazda and Changan Mazda to continue to undertake the related business of Mazda brand cars. It seems that the new Changan Mazda, which combines the original two channels and businesses, has ushered in a turning point in its development in China, but it is not widely expected to improve in the short term. According to the data, Mazda sold 184000 vehicles in China in 2021, down 14.3% from the same period last year, of which Onksera sold 90700 vehicles, accounting for half of Mazda's total performance in China. Although the epidemic and supply chain shortages have led to a general decline in the market, Mazda's performance is still declining compared with other Japanese brands.

Although affected by the epidemic, the current sales of the four major Japanese car companies have all declined to varying degrees, but thanks to improved costs and good performance in the Chinese market, Toyota and Honda have achieved double-digit growth in net profit. Nissan and Mazda, on the other hand, are not optimistic in the future due to the decline in sales revenue caused by exchange rate fluctuations and weakness in major markets, including China.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.