In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/22 Report--

2022 will be another difficult year for Korean brands. Hyundai Motor Group is responsible for the development of Korean brands in the Chinese market, but whether it is Beijing Hyundai, Dongfeng Yueda Kia or Genisse, which has just returned to the market, the performance in the domestic market is getting less and less optimistic.

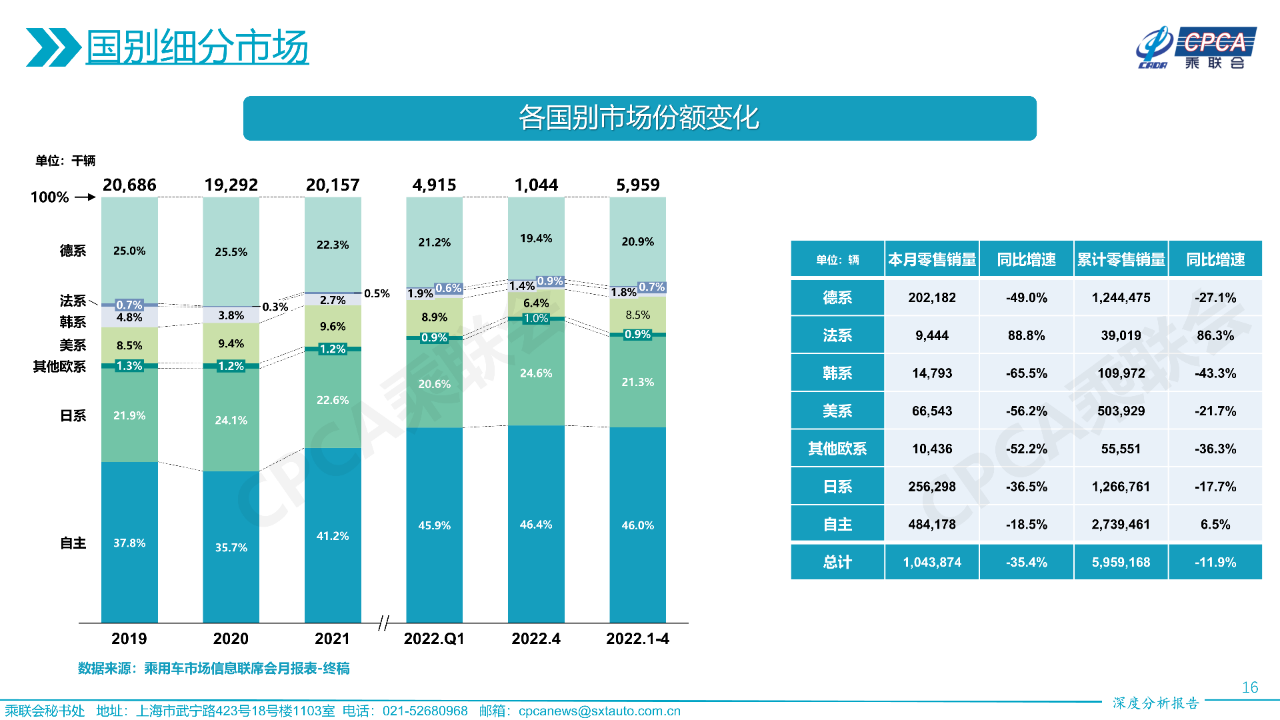

On May 22nd, the Korea Automobile Industry Association (KAMA) released first-quarter figures showing that car sales in China were 6 million in the first quarter, up 6.2 per cent from a year earlier. Among them, Korean car sales were 94000, down 39.3% from the same period last year. According to other data, according to data released by the China passenger car Market Information Association, sales of Korean cars in China from January to April in 2022 were 110000, down 43.3% from a year earlier, and its market share in China has fallen to 1.8% from 2.7% in 2021. After 20 years in China, Korean cars seem to have reached a dark moment.

Get up early in the morning and catch the evening collection! In 2002, Korean Hyundai Motor Group entered the Chinese market and successively set up three vehicle manufacturing enterprises, namely, Beijing Hyundai, Dongfeng Yueda Kia and Hyundai commercial vehicles. then, for more than a decade, Korean cars gradually overtook German and Japanese car brands. ushered in the highlight moment of the Chinese market. In 2013, China overtook South Korea for the first time to become the largest car exporter of Hyundai and Kia. In 2016, Beijing Hyundai and Dongfeng Yueda Kia both set historical peaks, with Beijing Hyundai selling 1.14 million vehicles and Dongfeng Yueda Kia selling 650000 vehicles. However, after that, the policy friction between China and South Korea, coupled with increasing market factors, gradually squeezed the survival space of Korean brands, and the market performance of the two car companies entered a downward channel. The cumulative sales of Hyundai and Kia in China in 2021 were 385000 and 163000, respectively, and their sales have declined for five consecutive years, with a combined 2.4 per cent market share of the two major brands, according to the Federation of passengers.

Korean cars used to be the most cost-effective choice in the Chinese market, and there are few competitors in the price range, but with independent brands up and joint venture brands down, consumers have more choices, and the market space of Korean cars is squeezed into necessity. Whether Beijing Hyundai or Dongfeng Yueda Kia, it initially relied on the low-price advantage to obtain the market, but long-term reliance on low-price strategy ignored and brand image improvement will hinder the high-end development of its market. What's more, against a backdrop of declining sales, Hyundai is still trying to regain the market at lower prices, which not only fails to achieve significant results, but further exacerbates the cheapness of the brand.

Sell the factory to stop loss, have no choice but to act. As sales continue to decline, Beijing Hyundai capacity utilization is seriously idle. It is understood that Beijing Hyundai has the first, second and third factories in Beijing Shunyi, as well as five major passenger car production bases in Cangzhou and Chongqing, Hebei Province, with an annual output of 1.65 million vehicles. Among them, the first factory in Beijing was resold to the New Power brand ideal car in 2021. Its current plant in Beijing, Chongqing and Hebei has a total design capacity of 1.35 million vehicles, with a sales volume of 385000 vehicles in 2021. Its capacity utilization rate is only 18.5%. A few days ago, the relevant media reported that the factory in Beijing Hyundai Chongqing is about to close, and the factory has offered a layoff compensation plan for "N", where "N" means the number of years of service, "1" means monthly salary, and "8" means 8000 yuan in compensation. Data show that the Chongqing factory is the fifth factory built by Beijing Hyundai in China, mainly producing Festa and brand-new Renna models. Beijing Hyundai and Hyundai have not yet responded to the matter.

Cut off the robe and cut off righteousness and desire for a new life. According to the data, Dongfeng Yueda Kia was established on September 12, 1992 and is jointly established by Dongfeng Automobile Group Co., Ltd., Jiangsu Yueda Investment Co., Ltd., and Kia Co., Ltd., with a stake of 25%, 25% and 50% respectively. In November 2021, Dongfeng Automobile Group put up for sale its 25% stake in Dongfeng Yueda Kia, which was taken over by Jiangsu Yueda Automobile Group Co., Ltd. In March 2022, Dongfeng Yueda Kia Automobile Co., Ltd. changed its name to "Kia Automobile Co., Ltd.". According to the plan, this year is the first year for Kia to start electrification. In addition to introducing HEV hybrid models, the pure electric model EV6 will soon be introduced into China. By 2027, starting with the new pure electric vehicle EV6, Kia will launch new electric models in the Chinese market every year and gradually build a new EV matrix for six electric vehicles. In the next decade, Kia has set the goal of producing and selling more than 4 million vehicles in China. In addition, in order to further create high-quality products and accelerate the introduction of more competitive global models, Kia will gradually stop producing models below 100000 yuan.

From selling millions of cars a year to less than 2% of the market today, the biggest change in Korean cars is their mindset. At present, Korean cars can not hide their embarrassment, some of its factories in China have been sold, and Chinese partners have withdrawn their shares. Under the circumstances, it is still a question mark whether the high-end brands and hydrogen vehicles that Hyundai Motor Group is trying to promote can help it change its fate in today's Chinese market.

Hyundai Motor Group seems to be more sensitive to the needs of European and American consumers than the Chinese market. Sales in the US market fell 15.8 per cent year-on-year to 3.28 million vehicles in the first quarter, with Korean cars down 3.7 per cent to 320000, according to the Korea Automobile Industry Association (KAMA). Sales in Europe fell 10.6 per cent year-on-year to 2.75 million, with Korean cars rising 21.3 per cent to 270000 and ranking third in the European market for the first time with a market share of 9.8 per cent.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.