In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/25 Report--

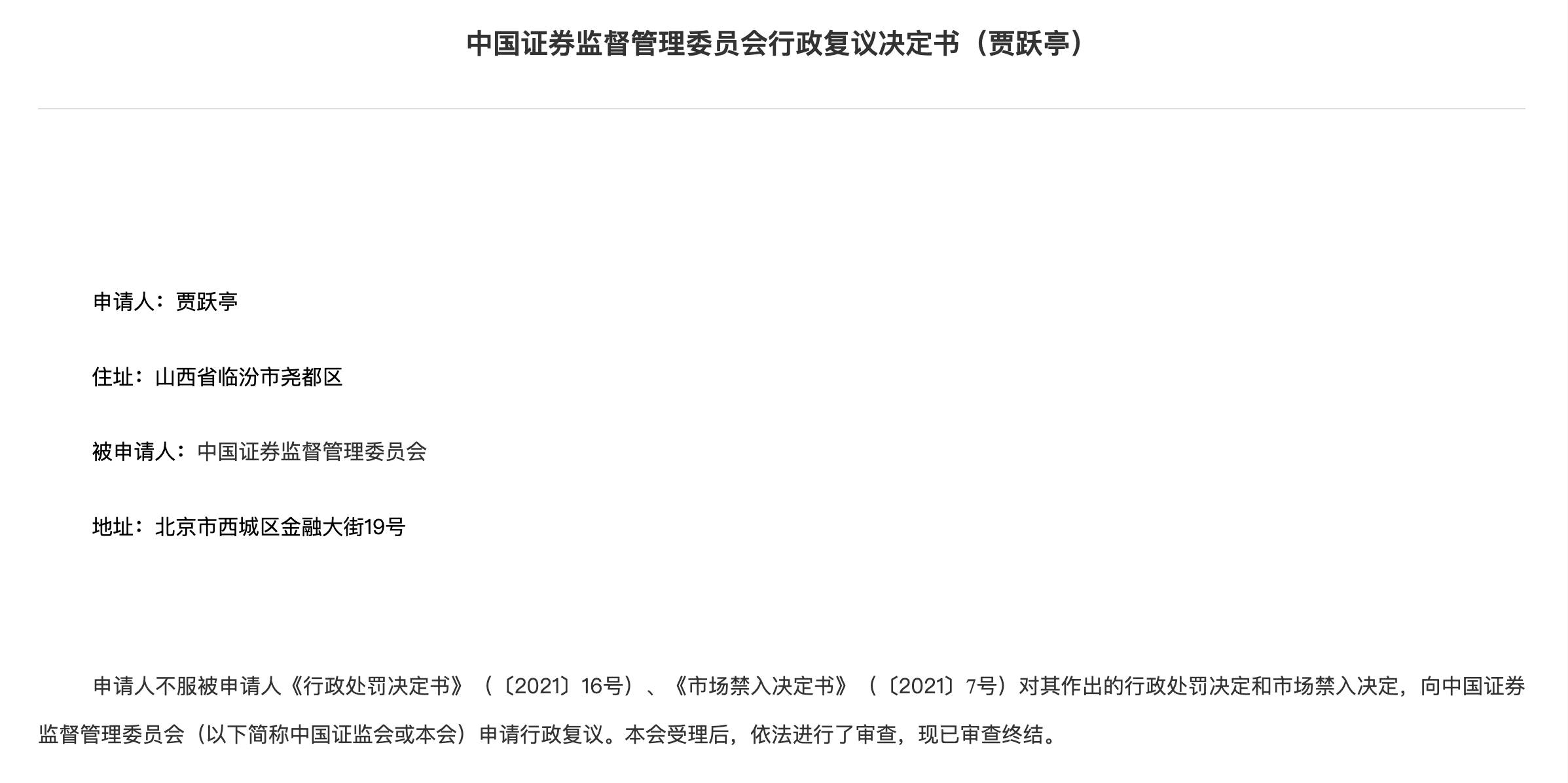

According to the information on the website of the China Securities Regulatory Commission, the applicant Jia Yueting refused to accept the administrative penalty decision ((2021) No. 16) and the market ban decision ((2021) No. 7) made by the applicant, and applied to the China Securities Regulatory Commission for administrative reconsideration. After the acceptance by the Association, the examination has been carried out in accordance with the law, and the examination has now been concluded. Maintain the administrative penalty decision ((2021) No. 16) and the market ban decision ((2021) No. 7) on the applicant and the market ban decision.

According to previous reports from the auto industry, the China Securities Regulatory Commission decided to ban Jia Yueting from the securities market for life on April 13, 2021, and disclosed a large number of illegal details such as financial fraud and false performance of Leeco for 10 consecutive years. Jia Yueting defended the decision made by the China Securities Regulatory Commission, saying that "there is insufficient evidence" and "it should be given a lighter punishment."

Ten consecutive years of financial fraud can be called the only time in A-share history! According to the China Securities Regulatory Commission, Leeco inflated revenue and profits during the decade from 2007 to 2016, and the repeatedly inflated profits even significantly exceeded the company's own net profits, such as 2008, 2009, 2010, 2014, 2015 and 2016. the proportion of the company's inflated profits to that year's net profit was 136.00%, 186.22%, 470.11%, 516.32% and-131.66%, respectively. In other words, if you deduct the false increase in profit, in fact, Leeco net's annual net profit is a loss.

Leeco financial fraud runs through all the time from listing to thunderstorm! In the initial stage, Leeco falsely increased its performance through fictitious business and false payback to meet the listing conditions, and continued until after listing. After listing, in addition to using its own capital circulation and collusion to fabricate business income, Leeco continues to falsely increase its performance by forging contracts, not actually implementing framework contracts or unilaterally confirming swap contracts.

According to the data, Leeco was founded by Jia Yueting in November 2004 and listed on the gem in August 2010. it is the first IPO listed company in the world and the earliest A-share video company in China. In April 2019, because Leeco and Jia Yueting were suspected of illegal information disclosure, the CSRC decided to file a case against Leeco and Jia Yueting. In May 2020, Leeco, which is mired in financial fraud, was terminated from listing, with a total market capitalization of only 718 million yuan, a far cry from its peak. In April 2021, Leeco announced that the Beijing Securities Regulatory Bureau fined it a total of 240 million yuan for ten consecutive years of financial fraud from 2007 to 2016. In January 2022, the Beijing Financial Court launched a lawsuit against 21 defendants, including Leeco, involving more than 4.5 billion yuan.

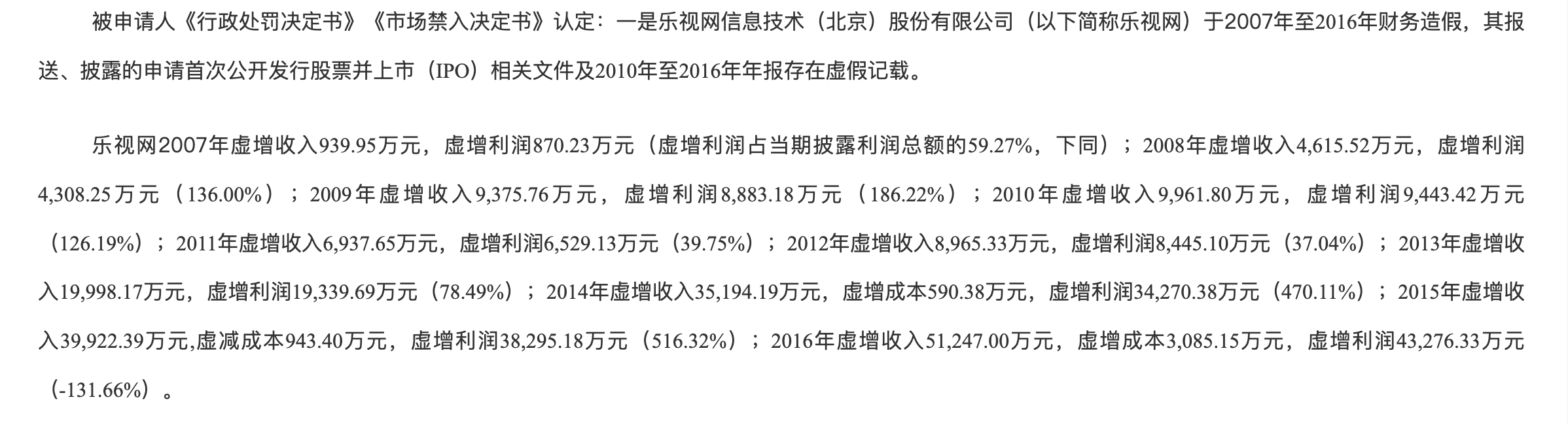

In July 2017, Jia Yueting's turning point in life! Jia Yueting resigned as chairman of Leeco on July 6, 2017. after his resignation, he no longer held any position at Leeco, and at the same time became the global chairman of Letv Automobile Ecology. In the same month, Jia Yueting went to the United States to finance Faraday Future (FF), saying that he would return home two weeks later, but he never came back.

According to the data, Faraday Future was founded in May 2014, when Letv was still at his peak. At that time, two new forces of making cars on the Internet in China were set up at the same time, one was jointly founded by Li Bin and others, and the other was Letv supercar, dominated by Jia Yueting. At the end of 2014, Jia Yueting announced Letv's "SEE plan". According to officials, Letv supercars make China's auto industry bend to subvert the traditional giants of Europe, the United States, Japan and South Korea, effectively solve urban haze and traffic congestion, while electric vehicles have high hopes for almost zero emissions compared with traditional fossil fuel vehicles. After the establishment of Letv Automobile, it attracted many senior leaders in many industries to join, and received investment from many investors and Internet enterprises, which made people look forward to the birth of Letv Automobile.

Letv supercar LeSEE, which locates a D-class Internet unmanned electric vehicle, unveiled its first concept car on April 20, 2016. "when I saw this car, I wanted to cry and burst into tears," Jia Yueting said at the press conference. "few people understand the ups and downs, storms and even tribulations we have experienced. Although it is not yet a mass production car, we promise that the day of mass production will not be too far away. In December 2016, the Letv Super Automobile Factory project was officially launched in Mogan Mountain High-tech Industrial Development Zone, Deqing County, Huzhou City, Zhejiang Province, with a total investment of 20 billion yuan. The mass production of Letv's car seems to be just a foot in the door, but this year has also become a turning point for Letv's car.

From the point of view of time, Faraday will be established earlier than Chinese new power companies such as NIO and Xiaopeng, but now the sales of new car-building forces are hitting new highs, and Faraday is still on the brink of life and death in the future. After entering 2021, the process of FF car building continues to accelerate. Faraday will be listed on Nasdaq in the future on July 22, 2021. The stock, marked "FFIE" and priced at $13.78, barely rose 1.45% on the first day of trading to close at $13.98, with a total market capitalization of $4.535 billion. As of the last trading day, FFIE shares had fallen to $2.60, with a total market capitalization of just $786 million.

Faraday's future is seen as the key to the turnaround of Jia Yueting and Leeco. FF said that as of the end of the first quarter, the number of FF91 bookings was 401, and it will make every effort to promote the mass production delivery of the first model, the FF91, in the third quarter. It should be noted that mass production and delivery are two different things. In the long history of automobiles, there are numerous cases of suspension of production and bankruptcy of car companies due to too high cost and too little output. Of course, according to FF91 pricing, more or less sales may not be the most important. For Faraday's future, the deeper significance of FF91 mass production is to let investors have confidence in Faraday's future and let the market see hope for survival. However, if FF91 underperforms in the market, what should investors think of Faraday's future?

Jia Yueting once said, "A friend advised me to give up FF, sell my equity and 'hide' in the United States through bankruptcy liquidation, but he still doesn't know me well enough, and giving up and running away will never be an option for me."

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.