In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/27 Report--

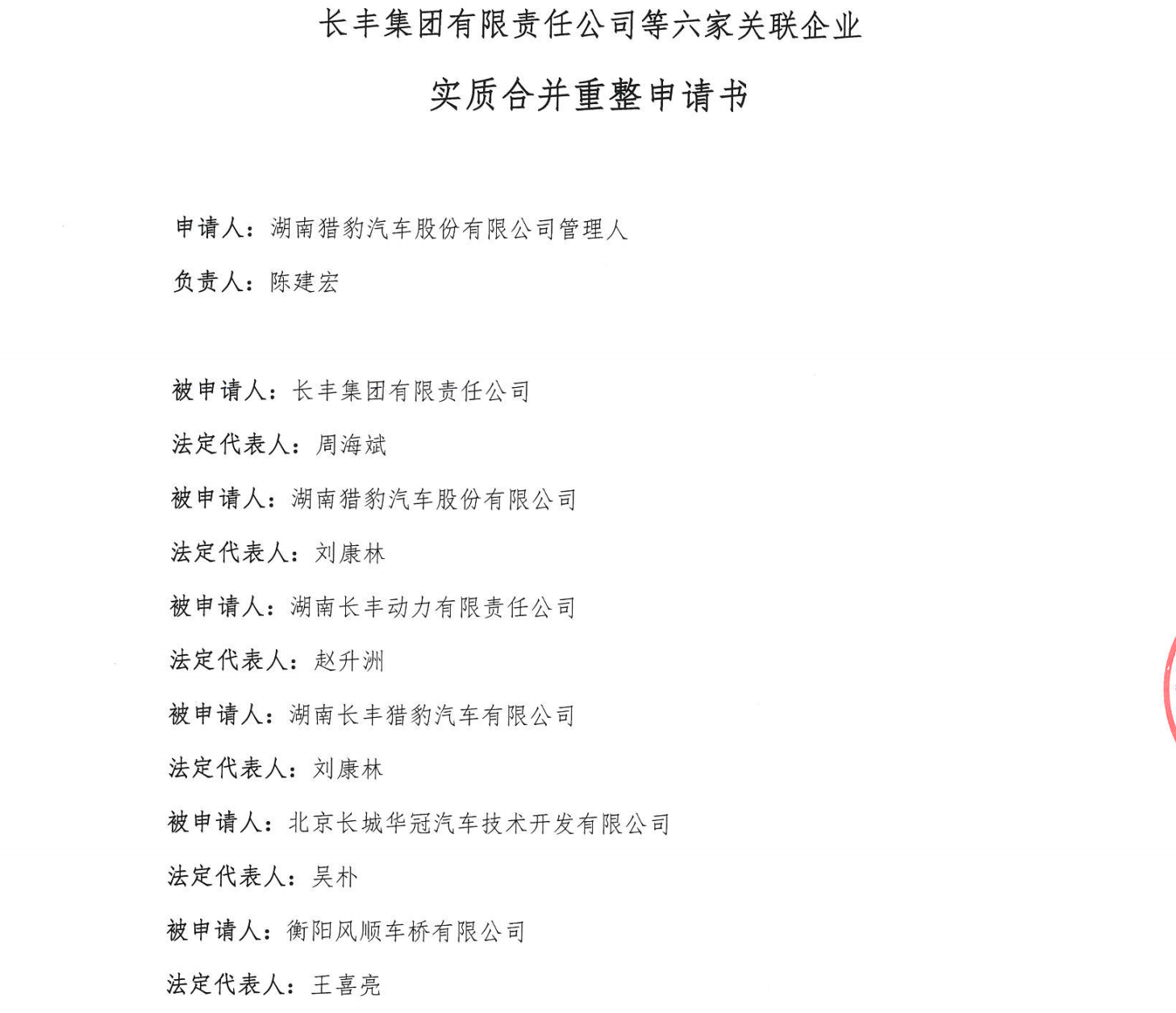

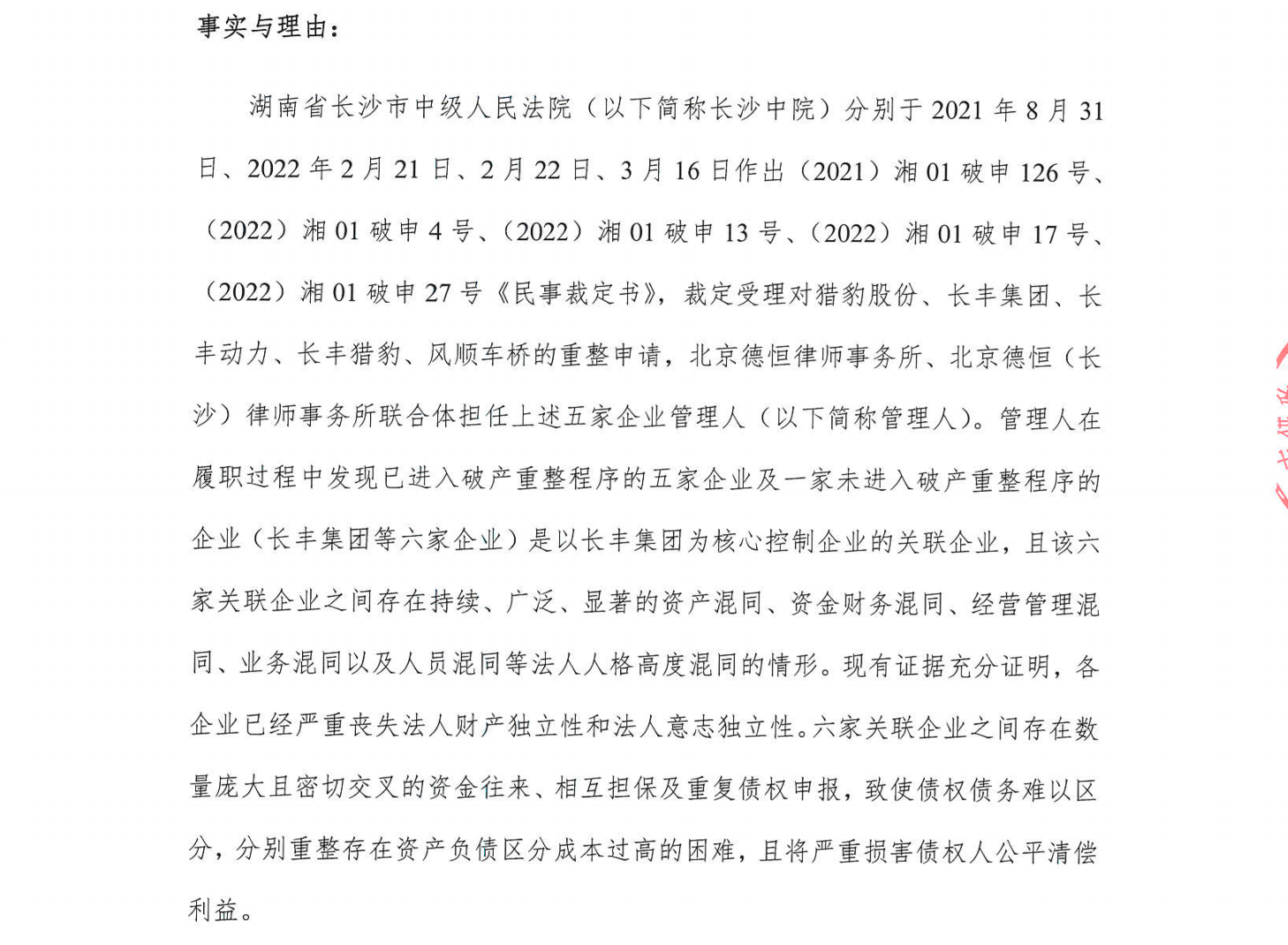

A few days ago, the Intermediate People's Court of Changsha City, Hunan Province (hereinafter referred to as Changsha Intermediate People's Court) has ruled against Changfeng Group Co., Ltd. according to the application of Hunan Liebao Automobile Manager.(hereinafter referred to as Changfeng Group), Hunan Liebao Automobile Co., Ltd.(i.e. Liebao Automobile), Hunan Changfeng Power Co., Ltd.(hereinafter referred to as Changfeng Power), Hunan Changfeng Liebao Automobile Co., Ltd.(hereinafter referred to as Changfeng Liebao), Beijing Great Wall Huaguan Automobile Technology Development Co., Ltd.(hereinafter referred to as Great Wall Huaguan Technology Development Company) and Hengyang Fengshun Axle Co., Ltd.(hereinafter referred to as Fengshun Axle) shall be substantially merged and restructured.

It is worth mentioning that the above six companies belong to the "Changfeng system". According to the documents concerned by the automobile industry, Changsha Intermediate People's Court believes that the core control enterprises of the six affiliated enterprises are Changfeng Group, and the main business of the six enterprises constitutes a complete industrial chain of automobile production. There are significant, extensive and continuous confusion in operation decision-making, enterprise management, operation business, assets, finance, personnel appointment and dismissal, etc., which has constituted a high degree of confusion of legal personality. The existing evidence fully proves that each enterprise has seriously lost the independence of corporate property and corporate will. At the same time, the assets of the six enterprises are seriously mixed, the internal transactions are complex, the amount of cross-guarantee of enterprise financing is huge, the internal transfer of financing funds is random, and the capital flow is frequent, the amount of mutual guarantee is huge, and it is difficult to distinguish the creditor's rights and debts. If the reorganization is carried out separately, it will lead to double or multiple compensation of some creditors, which actually infringes on the fair compensation rights and interests of all creditors. The substantial merger and reorganization is beneficial to maintain and improve the reorganization value of the enterprise and enhance the possibility of successful reorganization.

Cheetah cars, which have gone through rough times, have no lack of highlights. According to the data, Changfeng Group, the parent company of Liebao Automobile, formerly known as Guangdong Military Region Armament Repair Factory founded in 1950, moved from Guangzhou to Yongzhou, Hunan Province in 1965 and renamed PLA 7319 Factory. In 1984, the factory trial-produced and assembled Xiangling brand 212 light off-road vehicles. In 1987, the factory successfully developed and produced the Cheetah Light Off-Road Command Vehicle. In 1995, the factory cooperated with Mitsubishi Motors of Japan to introduce Mitsubishi Pajero automobile technology. In 1996, Changfeng Group was reorganized. In 2001, Changfeng Group was transferred from the army to the People's Government of Hunan Province and is now managed by the SASAC of Hunan Province.

Cheetah Automobile, with deep foundation, once owned two research institutions of Beijing Automobile Research Institute and Changsha Engineering Institute, three key parts companies, and four vehicle manufacturing bases including Yongzhou Company, Chuzhou Company, Changsha Company and Jingmen Company, once occupying more than 43% market share of China's domestic light off-road market. In 2004, Changfeng Group was listed on the Shanghai Stock Exchange with stock code 600991. After 2009, Changfeng Group took out core assets for strategic cooperation with GAC Group twice according to the decisions of senior officials of Hunan Province, introduced GAC Fiat and GAC Mitsubishi to settle in Changsha Economic Development Zone, helping Hunan to build automobile industry chain cluster. In 2012, GAC Group realized curve listing through absorption and merger of Changfeng, with the new stock code of 601238, while the original stock code of GAC Changfeng 600991 withdrew from Jianghu.

As the head of Changfeng Group, Li Jianxin obviously has unwillingness. He finally takes back the cheetah brand from GAC Group and re-registers Hunan Cheetah Automobile Co., Ltd. to seek to revive cheetah automobile. Cheetah sales are climbing thanks to the SUV boom. Data show that in 2017, the sales volume of cheetah cars was 125,000, realizing sales revenue of 11.32 billion yuan. In the same year, Li Jianxin, then chairman of Changfeng Group, announced that he would restart the IPO process, planned to go to the capital market again, and set the goal of "achieving annual production and sales of 400,000 vehicles by 2020, sales revenue of 40 billion yuan and net profit of 2 billion yuan" for Cheetah Automobile.

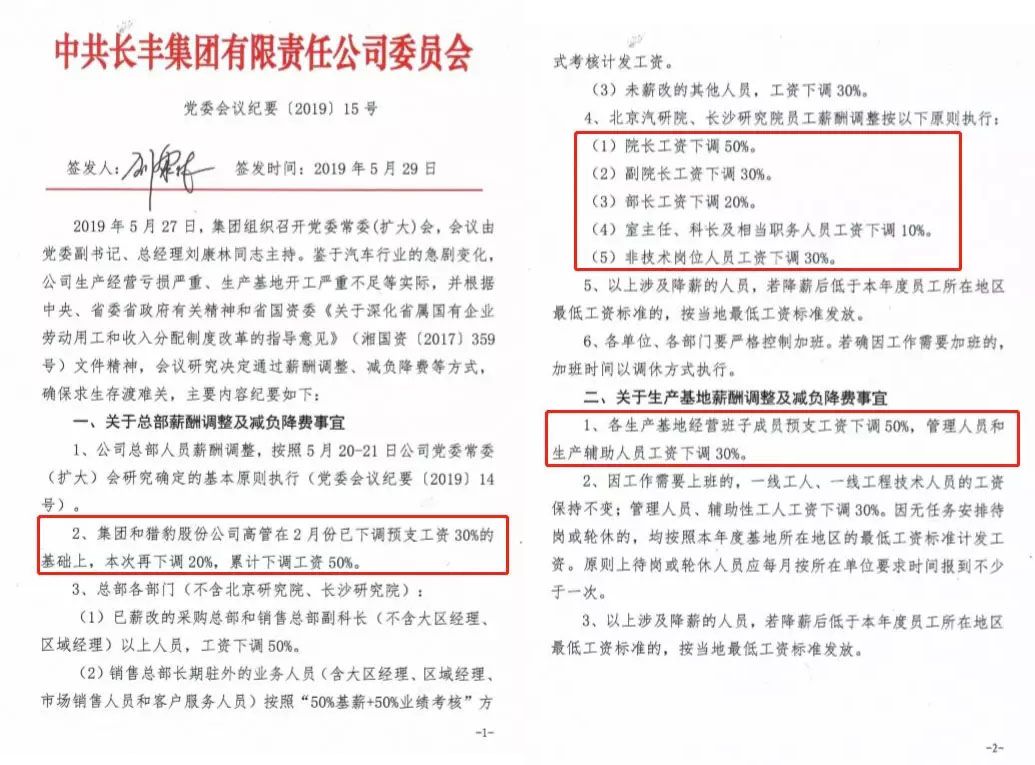

Success is so close and so far away. Data show that sales of cheetah cars fell to 77,600 in 2018, nearly halving year-on-year. Cheetah car sales continued to fall in 2019 to just 32,500 units. In the same year, Li Jianxin, an automobile veteran who had been in charge of Changfeng Cheetah for more than 30 years, announced his resignation, and Zhou Haibin became secretary of the Party committee and chairman of Changfeng Group. After entering 2020, the situation of Cheetah cars has not improved, with annual sales of only 1043 vehicles. Parallel to the decline in sales, there are rumors of fund breaks, layoffs, pay cuts and dealer withdrawal from the network from time to time.

In April 2020, Geely Holding Group formally signed a strategic cooperation agreement with Hunan Province Government and Changsha City Government in Changsha to host Cheetah Automobile Changsha Factory. Relevant information shows that Geely Holdings has been used to produce new energy vehicles after custody of the cheetah factory, but custody is not an acquisition, and cheetah cars have not been turned around in operation. In April 2021, Cheetah Automobile applied for bankruptcy review in Changsha Intermediate People's Court. In August 2021, Cheetah was ruled bankrupt and restructured. Since then, Cheetah car managers issued three auction announcements, part of the assets of Cheetah car public auction.

Under the elimination competition of the automobile market, there are more "cheetah cars" that are saving themselves, such as future cars. It is worth mentioning that Future Automobile has a deep relationship with Changfeng Group.

After graduating from university in 1990, Lu Qun joined Beijing Jeep Automobile Co., Ltd., China's first automobile joint venture, and successively held the positions of engine test engineer, product planning section chief and product engineering department manager. In 2003, after careful consideration of the current situation of China's automobile industry, Liu Qun decided to join hands with several long-term tacit cooperation partners to establish Beijing Great Wall Huaguan Automobile Technology Co., Ltd. However, due to the long cycle of automobile design business, the company's capital operation is limited, so Great Wall Huaguan accepted the investment of Changfeng Group at the end of 2003 and merged into Changfeng Group while maintaining independent operation. However, since then Changfeng Group decided to include the Great Wall Huaguan under its banner. In 2012, Great Wall Huaguan was split into two parts. The original company was renamed Cheetah Automobile Research Institute and left to Changfeng Group. The equity of Liuqun and other founders was transferred to Changfeng Group. Meanwhile, Beijing Great Wall Huaguan Automobile Technology Co., Ltd. was established. The assets and liabilities of the original Great Wall Huaguan were all undertaken by Cheetah Automobile Research Institute.

In February 2015, Great Wall Huaguan established its wholly-owned subsidiary Future Automobile. In the same year, Great Wall Huaguan was listed on the New Third Board. However, the performance of Great Wall Huaguan after landing on the New Third Board was not ideal, with losses of 98 million yuan and 226 million yuan in 2016 and 2017 respectively, and a net loss of 606 million yuan in 2018, down 168.15% year-on-year. Finally, Great Wall Huaguan applied for termination of listing on February 20,2019 and announced its withdrawal from the New Third Board on April 19, while the continued losses of parent company Great Wall Huaguan aggravated the plight of Future Automobile.

As one of the few enterprises holding the "double qualification" of new energy passenger vehicles among the new forces in China, the future automobile starts not too late, but the development is difficult to say smoothly. In August 2018, the first electric super-running prospect K50 of Future Automobile was listed. After subsidy, the national unified selling price was 686,800 yuan, which can be said to be the most expensive automobile of the new domestic car-making force. However, the future K50 has no obvious bright spots except for the appearance of a super-run. The NEDC comprehensive range is only 380km, and the 100-mile acceleration time is 4.6s. For an electric super-run with a price of 700,000 yuan, it is not eye-catching. Relevant data show that the cumulative sales volume of the future K50 in one and a half years is only 131.

In February 2019, Future Auto began to get into trouble, and the parent company Great Wall Huaguan also owed wages and supplier payments. Future Auto said at the time that the company did have problems with funding, but it did not affect the payment of employees 'salaries. At the end of 2019, Future Auto and its parent company Great Wall Huaguan Thunderstorm, netizens exposed that Future Auto/Great Wall Huaguan owed employees 'salaries and even used employee information for loans, but the actual loans did not pay employees. In November 2020, Future Auto was exposed to a broken capital chain, its first store in Sanlitun in China has been withdrawn, and the delivery center in Jingang Auto Park is empty. Since then, Future Auto/Great Wall Huaguan began to fade out of the market, and was once considered to have been trapped in the quagmire and difficult to return to the market. To this day, under the official micro blog of Future Auto, there are still netizens leaving a message "asking for salary".

On May 2, Beijing Great Wall Huaguan Automobile Technology Co., Ltd.(hereinafter referred to as "Great Wall Huaguan") signed a formal merger agreement with SPAC(Special Purpose Acquisition Company) Mountain Crest Acquisition Corp., which is expected to complete the reorganization, merger and listing by the end of 2022. At that time, Future Automobile will be listed overseas as an important asset component of Great Wall Huaguan, with a pre-investment valuation of USD 1.25 billion. On May 26, Future Auto Weixin Official Accounts released a message saying that the future K20 will be pre-sold in the near future.

Industry insiders believe that future cars use SPAC to achieve listing is no problem, but financing may not be easy. At present, the model of Future Automobile is similar to FF. Future Automobile takes high-end as the starting point, which means that the annual sales scale will not be too large, and its future profit level is worrying, which will affect the production and operation of the company.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.