In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/01 Report--

After the failure of Ji Kechuang board listing, Weimar decided to list in Hong Kong. On June 1st, the attention of the automobile industry learned from the Hong Kong Stock Exchange's disclosure of a new batch of IPO application lists that Weima Motors formally submitted applications for listing of Hong Kong shares, with Haitong International, China Bank International and Bank of China International as sponsors. If nothing happens, Weimar will be on the market in the next few months.

Long way to go public! In December 2015, Shen Hui, former vice president of Geely Holdings Group, founded Weima, headquartered in Shanghai, China. Before founding Weimar, Shen Hui held management positions in core auto parts companies such as BergWarner, Fiat, Volvo and Geely, and the company's founders were all from traditional car companies. Therefore, compared with Li Bin, he Xiaopeng and Li Xiang, Shen Hui has accumulated a lot of experience in automobile manufacturing. Different from the contract production mode of Weima and Xiaopeng, Weima held Zhongshun Automobile Holdings Co., Ltd. in January 2018 and successfully obtained valuable production qualifications. In September 2018, Weima's first production car, EX5, was officially put on the market, with a price of 14.68-198800 yuan, positioning as a compact pure electric SUV, corresponding to the largest automobile consumer market in China.

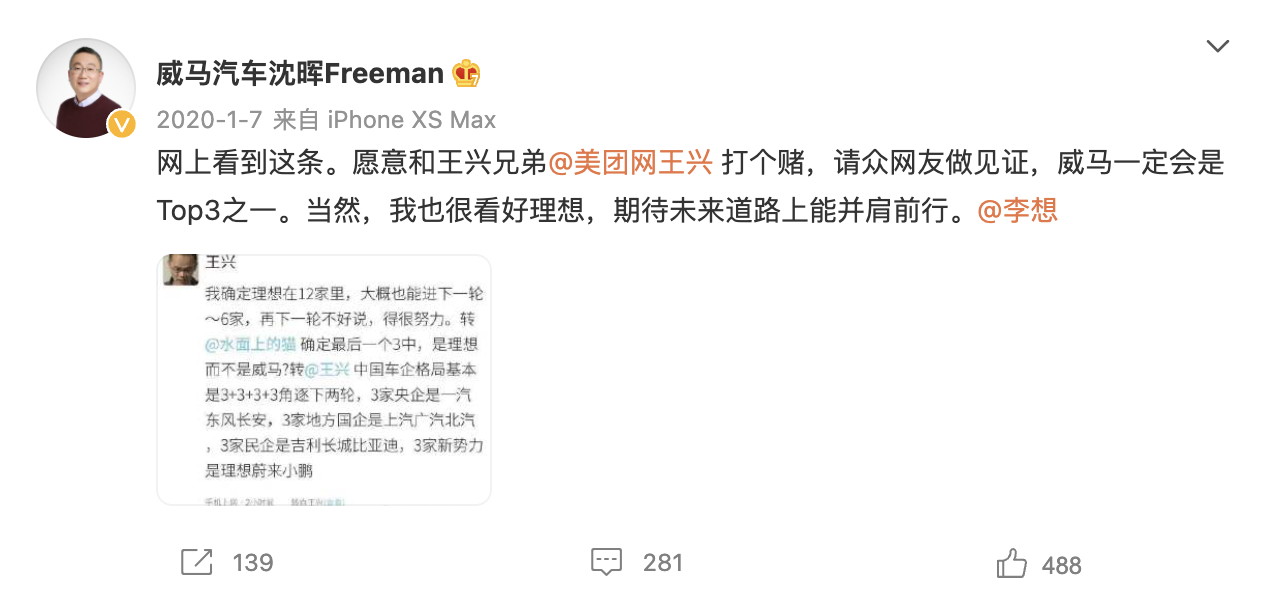

Does the prophecy come true when sales fall behind? In 2019, Meituan founder Wang Xing predicted on social media: "the pattern of Chinese car enterprises is basically the next two rounds of competition. In addition to three central enterprises, three local state-owned enterprises and three private enterprises, the three new forces are ideal, Lulai and Xiaopeng." In response to the relevant comments, Shen Hui immediately launched a bet on Weibo: "if Weima is in the top three in 2020, Wang Xing will send me a takeout. If Weima is not in the top three, I will give him a car. He can also want Weima. Of course, it's okay to give him an ideal, or any other car." Data show that in 2019, Weimar delivered 16900 vehicles, NIO delivered 20600 vehicles, and Xiaopeng delivered 16700 vehicles, ranking second in the new power car company.

When the time comes to 2020, Weimar delivers 22500 vehicles for the whole year, while Weimar delivers 43700 vehicles, Xiaopeng delivers 27000 vehicles, ideal delivers 32600 vehicles, by this time Weimar has fallen out of the top three. In 2021, Weimar fell behind again. Xiaopeng delivered 98200 vehicles for the whole year, 91400 vehicles for NIO, 90500 vehicles for ideal delivery, 69700 vehicles for Nahu, and 44200 vehicles for Weimar for the whole year, obviously lagging behind in sales.

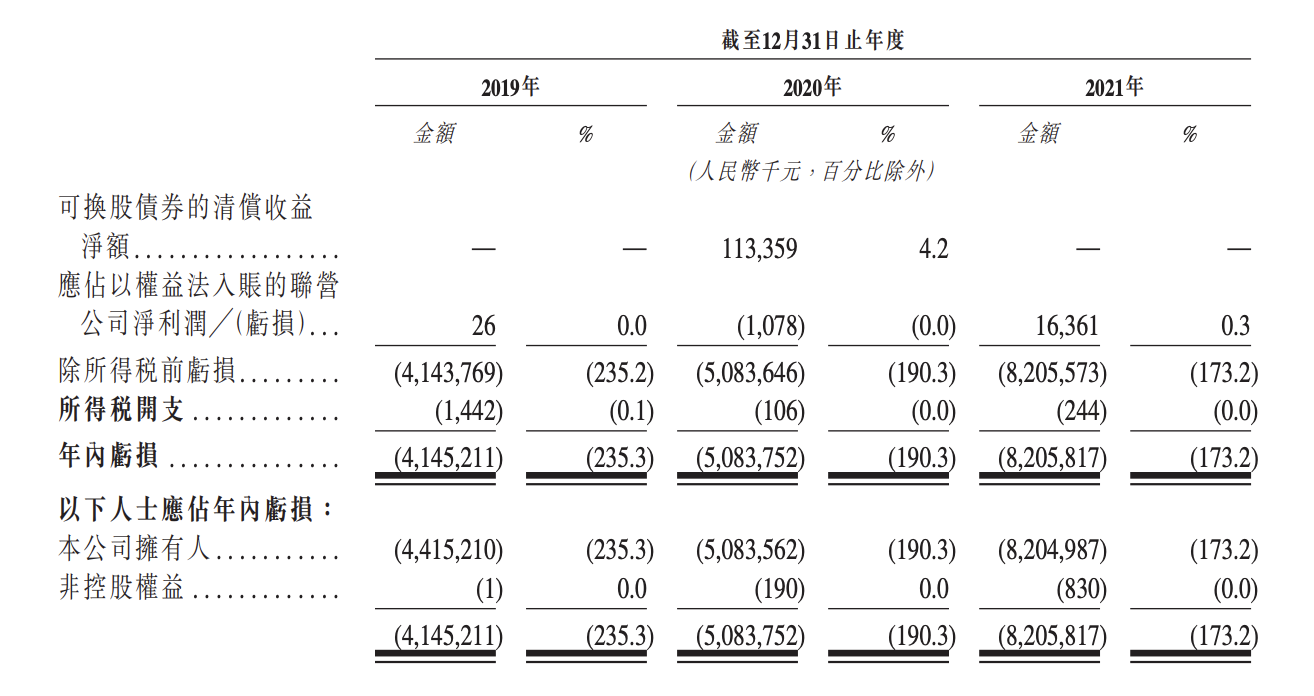

The loss in five years is more than 20 billion! According to the prospectus, Weima's revenue from 2019 to 2021 was 1.7621 billion yuan, 2.6717 billion yuan and 4.7425 billion yuan respectively, with net losses of 4.145 billion yuan, 5.084 billion yuan and 8.206 billion yuan respectively, with a cumulative loss of 17.435 billion yuan over three years. At the same time, according to the previous summary report on Weima's automobile tutoring work disclosed by CITIC Construction Investment, Weima's revenue from 2017 to 2018 was 14.8717 million yuan and 722 million yuan respectively, with net losses of 1.696 billion yuan and 2.452 billion yuan respectively, with a cumulative loss of 4.148 billion yuan over the past two years. In other words, Weimar lost 21.583 billion yuan in the five years from 2017 to 2021.

In early 2020, Wei Ma founder Shen Hui said confidently: "We will not disclose how much money we have burned, because we are definitely not in the top two, we are relatively low." At present, we are very confident that we will become the first new car manufacturer in the world to make a real profit for the whole year. We hope to be ahead of Tesla and firmly believe that we can do so. "

Product defect query! In October 2020, Weimar had three fires in succession, including not only private cars, but also Weima taxis operated locally in Fujian. After the incident, Weimar filed a recall plan with the State Administration of Market Supervision and Administration, recalling 1282 Weima electric vehicles because of quality defects in power batteries. Impurities mixed by battery suppliers in the production process may lead to abnormal lithium evolution of batteries. However, the recall measures did not completely solve the hidden danger of spontaneous combustion. According to the Interface News, Weimar burned three EX5 vehicles in December 2021, including two spontaneous combustion accidents when the vehicles stopped, but after many fires, Weima officials did not respond to the incident.

Related to the spontaneous combustion accident, the Weima electric car is frequently exposed to "power lock". On March 15, Guangdong 315 evening party exposed Weimar "Lock electricity". According to feedback from several car owners, their Weima experienced problems such as reduced service life and slow charging speed after maintenance and upgrading, and car owners suspected that the authorities had secretly waited for the vehicle to "lock up" on the grounds of maintenance and upgrade. So far, officials have turned a blind eye to the continuing fires and power locks, and it is not clear whether the above incidents will affect Weimar's listing.

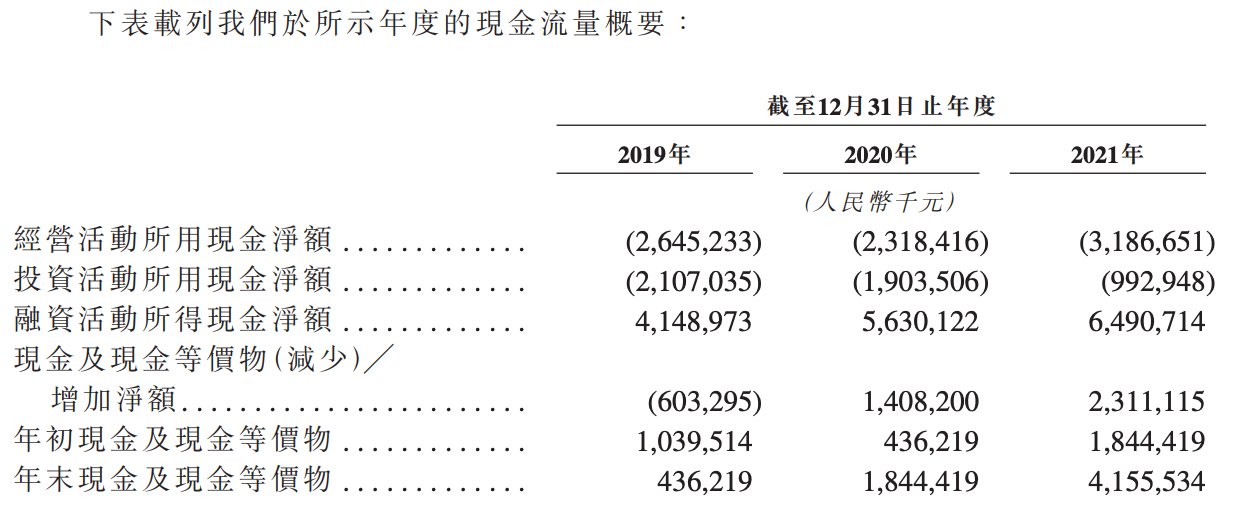

Go public to save your life? According to the prospectus, by the end of 2021, Weimar, with a balance of 2.155 billion yuan in cash and cash equivalents and an average annual loss of 4.743 billion yuan, has become the key to life and death whether it can find financiers to list and land in the secondary market.

Data show that Weima Motor has experienced a total of 11 times of financing since its establishment. In round A financing in August 2016, the investors were Yuema Capital, raising a total of US $1 billion; in December 2017, investors included Baidu Capital and Baidu Group, raising a total of US $1 billion; and in March 2019, round C financing, investors including Baidu Capital, Sequoia, Kuipai, etc., raised a total of 3 billion yuan D-round raised a total of 10 billion yuan in September 2020, with investors including Shanghai State-owned Investment, SAIC, Baidu and Hainer Asia. The D1 round of financing in October 2021 was led by PCCW and Shun Tak Group, and participated by Guangfa Sindh's US dollar investment institutions, with a financing amount of more than US $300 million.

Why is the performance of Weima not as good as that of Wei Xiaoli? It is generally believed that the price range of 10-200000 yuan is the largest market for automobile consumption, but the market in this range is not easy to fight, because most consumers buy the first car at home, mainly to solve the travel problem, and most consumers will give priority to fuel cars, so whether it is Weimar's EX5 or Xiaopeng G3, sales in the market are not very good. In this context, new car-building forces will avoid this price range. For example, Xiaopeng P7, the second model of Xiaopeng car, has reached a market of more than 200000 yuan, while Ulai and ideal mainly focus on the 300000-yuan market to avoid market conflicts.

Financing listing has become a ticket for car-building enterprises in the second half, and Weimar Motor continues to be listed to survive. However, although the new energy vehicle market is still hot in 2021, including Baidu and Xiaomi, the market sentiment will gradually calm down, and the market value of "Wei Xiaoli" will shrink sharply after 2021, and all three car brands will return to Hong Kong for listing. In addition, there is no shortage of car brands in the car market, and if Weimar is not competitive enough, it must not be easy to get financial support from the market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.