In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/02 Report--

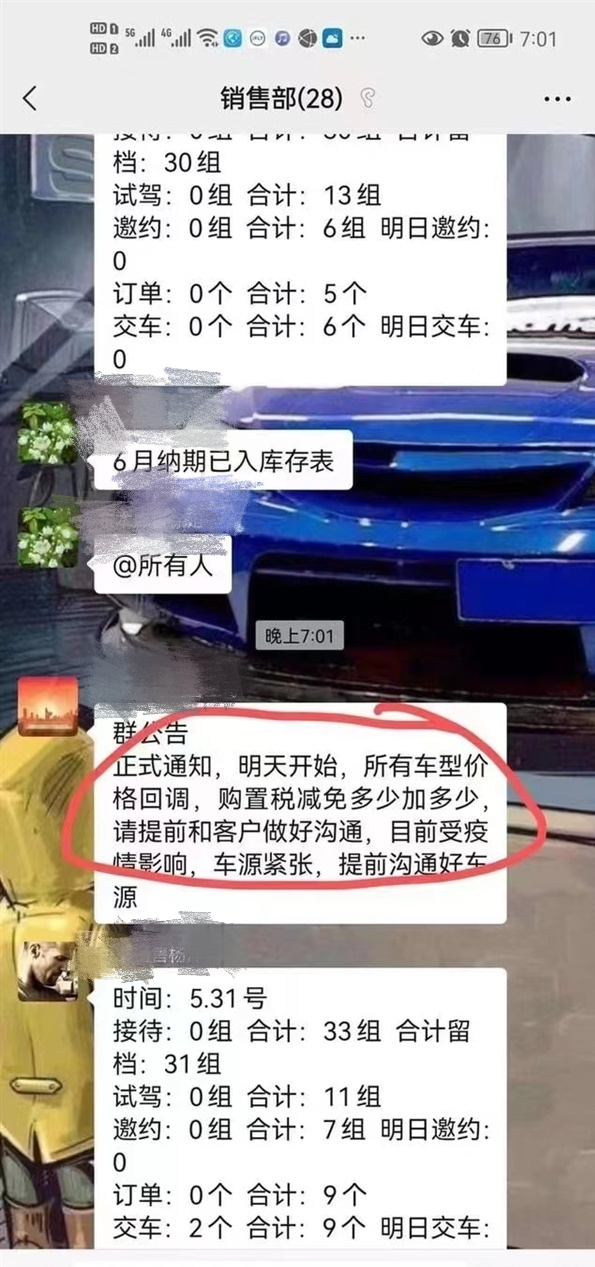

Recently, the Ministry of Finance and the State Administration of Taxation issued a notice on reducing the purchase tax on some passenger vehicles on May 31. After the good news that the purchase date is between June 1, 2022 and December 31, 2022, and the bicycle price (excluding VAT) does not exceed 300000 yuan for passenger cars with engines of less than 2 liters (9 seats or less), the vehicle purchase tax will be halved. A screenshot of the sales department of a 4S store flowed out on the network, according to the picture: formal notice, price callback of all models, purchase tax reduction and increase, please communicate with customers in advance, affected by the epidemic, car sources are tight, communicate with car sources in advance.

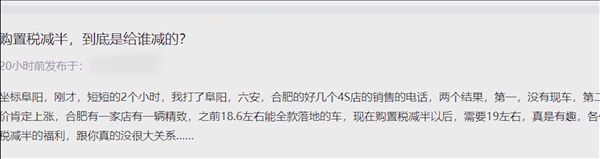

In addition, some netizens said in a post on the social platform: coordinate Fuyang, he called several 4S stores in Fuyang, Lu'an and Hefei for two hours and was told that there were no existing cars, or the price must have gone up. It said that a car that could be fully landed at a Hefei store before 186000 yuan needed about 190000 yuan after the purchase tax was halved.

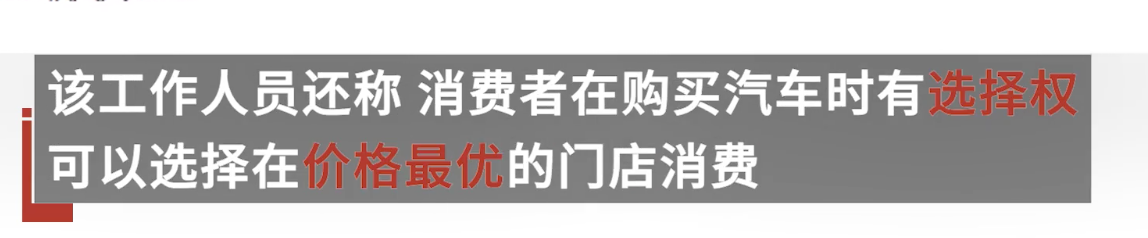

A staff member of the consumers Association of Hubei Province responded to the media that pricing cars is a market behavior of enterprises, and it is difficult to define whether the pricing is reasonable. Consumers have the right to choose to spend in the store with the best price. After all, there is a national policy to enjoy deductions only after car prices, and some enterprises will think that the state is going to give tax cuts to consumers and add money to this competitive price, which itself is very difficult to define as unreasonable, it said.

It is understood that the purchase tax is the tax levied by the tax authorities on the behavior of related property and property within the scope of the tax system. Such as vehicle purchase tax and so on. Vehicle purchase tax is a kind of tax levied on units and individuals who purchase prescribed vehicles in our country. it evolves from the vehicle purchase surcharge. When we buy a car, there are two kinds of taxes: one is in-price tax and the other is out-of-price tax. Intra-price tax refers to the tax that has been included in the car price and does not need to be paid separately, mainly a value-added tax of 13%. The other is extra tax, which means that after buying a car, take the invoice issued by the 4S store and go to the local tax department to pay the fee separately, that is, the purchase tax.

Of course, under the promotion of this policy, it is bound to revitalize the automobile market and improve the purchasing power of the automobile market. Under the guidance of this policy, many car companies have responded. According to incomplete statistics, more than 20 car brands have launched the subsidy policy, among which many car brands have proposed the purchase tax-free subsidy program.

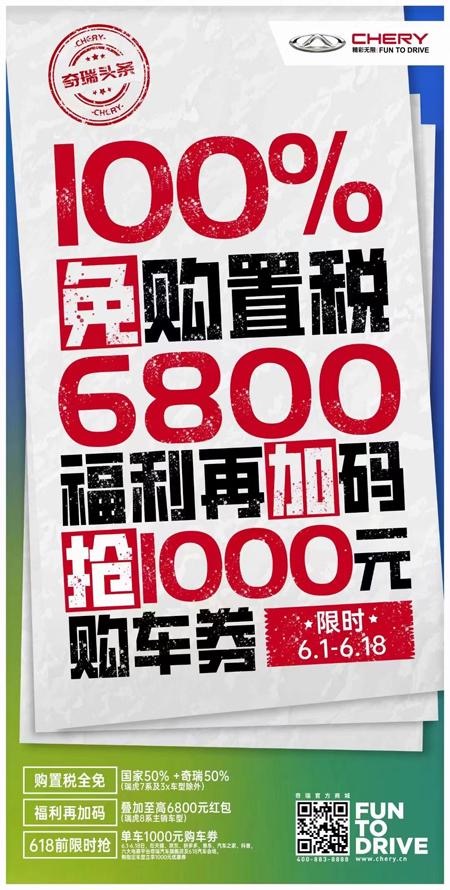

Many car companies have made preferential policies to the outside world, for example, Mingjue offers 618 time-limited purchase concessions, 125% special subsidy for the highest purchase tax, and Roewe more than 0 purchase tax. What's more, 0 burden, 0 first slogan, shortcut car said purchase tax 0 plus 5000 yuan, Chery also offered 6800 free purchase tax, welfare plus code to buy car coupons, FAW Pentium offered a reduction in purchase tax, plus pine commercial insurance, Dongfeng Fengshen said that 0 purchase tax, up to 11300 yuan plus 0 down interest 5-year ultra-long-term mileage warranty, SAIC Volkswagen also introduced 100% tax exemption. I covered the activities for your tax.

In addition, there are many car brands have also played duty-free activities, such as Star Motor, Geely Motor, SAIC GM Wuling, Changan Automobile and so on. It is worth noting that the purchase tax halving policy is between 2.0L and less than 300000 yuan for passenger cars, which also brings some entry-level models of luxury brands into the scope of the policy. In terms of scope, it is indeed a good policy for consumers.

Cui Dongshu, secretary general of the Federation of passengers, said: this is expected to boost the demand of all independent brand models, all the mainstream models of joint venture brands, as well as some entry-level luxury car market, with great potential for growth. Especially for independent brands of the Great Wall, Geely, Changan, Red Flag, on the car, GAC MOTOR and so on have a very good pull. In addition, it is pointed out that the policy will lead to an increase of up to 2 million new car sales. Chen Shihua, deputy secretary-general of the China Association of Automobile Manufacturers, also said that the policy of halving the purchase tax is expected to boost vehicle sales of more than 2 million vehicles and car consumption of more than 300 billion yuan, or even 350 billion yuan, this year. The overall pull on automobile consumption this year will exceed 500 billion yuan. However, some people in the industry say that although a halving of the purchase tax can promote consumption in the automobile market, if, like a 4S store, the price of the car will be increased as much as the purchase tax is reduced, users will not get a discount in its real sense. this may affect the effect of policy implementation.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.