In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/10 Report--

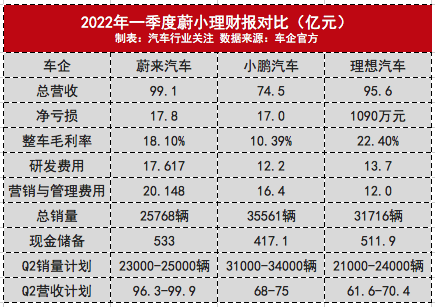

June 9, Xilai Automobile announced the first quarter of 2022 results, so far "Wei Xiaoli" three new car-building brands first-quarter results have been released. According to the data, the revenue of Lai Automobile in the first quarter was 9.91 billion yuan, an increase of 24.2% over the same period last year, of which automobile sales revenue was 9.24 billion yuan, an increase of 24.8% over the same period last year. The net loss in the first quarter was 1.78 billion yuan, an increase of 295.5% compared with 450 million yuan in the same period last year. Vehicle sales gross profit margin was 18.1%, the cumulative delivery volume in the first quarter was 25768, an increase of 28.5% over the same period last year. As of the end of the first quarter, the cash reserve was 53.3 billion yuan, almost the same as Q4 in 2021.

On May 23, Xiaopeng announced its first-quarter results that Xiaopeng's revenue in the first quarter was 7.45 billion yuan, an increase of 152.6% over the same period last year, of which the revenue from automobile sales was 6.99 billion yuan, and the net loss in the first quarter was 1.7 billion yuan, an increase of 116.2% over the same period last year. The gross profit margin of vehicle sales was 10.39%, and the cumulative delivery volume in the first quarter was 34561 vehicles. As of the end of the first quarter, the cash reserve was 41.7 billion yuan.

On May 10, ideal Automobile announced its first-quarter results that its revenue in the first quarter was 9.56 billion yuan, an increase of 167.5% over the same period last year, of which the revenue from automobile sales was 9.31 billion yuan, an increase of 168.7% over the same period last year. The net loss in the first quarter was 10.9 million yuan, down 97% from the same period last year; the gross profit margin on vehicle sales was 22.4%, and the cumulative delivery volume in the first quarter was 31716, an increase of 152.1% over the same period last year. As of the end of the first quarter, the cash reserve was 51.19 billion yuan.

Judging from the financial report of Wei Xiaoli in the first quarter of 2022, NIO has the largest revenue of 9.91 billion yuan, but the sales volume is the least; Xiaopeng sells the best for 34561 vehicles, but its gross profit is less than half of that of the ideal car; and the gross profit margin of the ideal car is the highest, and the product is also the single, but the sales volume is not low. As for the reason for the increase in gross profit margin in the first quarter compared with the same period last year, ideal said that the increase in delivery volume has increased its average selling price since the launch of the new ideal ONE in May 2021.

In contrast, NIO Motors, its vehicle gross profit margin in the first quarter was only 18.1%, down from 21.2% in the same period last year. Ulai said that the year-on-year decline in vehicle gross profit margin was mainly due to a drop in the average selling price due to changes in the proportion of the company's product portfolio, and the month-on-month decline was mainly due to an increase in the cost of bicycle batteries. As for when the gross profit margin will return to growth, at the first-quarter earnings report, Li Bin, chairman of Xilai Automobile, said that the linkage between battery prices and raw material prices is basically determined by last month's raw material prices. The increase in battery costs in the second quarter is much higher than that in the first quarter, although there is a certain decline in May compared with April, but it is true that the gross profit pressure is relatively large in the second quarter. The car with the price increase will not be delivered until the third quarter, and the order delivered now is basically before the price increase. According to it, Xilai signed a new agreement with the Ningde era in April. According to the new agreement, the cost of batteries purchased in the future will be linked according to the price of raw materials. This month's battery price is determined based on the price of raw materials last month. Li Bin said that from the second quarter, the cost of NIO battery will be "much higher" than in the first quarter.

At present, "Wei Xiaoli" has not been able to get rid of losses, of which the ideal car net loss is 10.9 million yuan, a loss reduction of more than 90% compared with the same period last year. As of the end of the first quarter, the cash reserve of Lulai Automobile was the highest, mainly from the first quarter revenue, but by comparison, it had the largest revenue and the smallest increase. Lulai Motor increased by only 24.2% in the first quarter compared with the same period last year, while ideal car increased by 167.5% compared with the same period last year. Xiaopeng Motor increased by 152.6% compared with the same period last year, which is mainly related to the delivery of new cars by car companies. In the first quarter of this year, the delivery volume of Lulai cars was 25768, while the ideal car delivery volume was 31716. By comparison, there is a big gap between the two.

Compared with Xiaopeng Automobile and ideal Automobile, Xilai Automobile is currently the new power car company with the largest number of planned products, but its sales figures are no better, with only 25768 vehicles in the first quarter. In addition, even if the ideal car has more products and the average bicycle price is more than 400000 yuan, while the ideal car has only one product and the bicycle price is only 349800 yuan, the ideal car delivery volume is more. The sales income of ideal cars (9.31 billion yuan) is also higher than that of Xilai cars (9.244 billion yuan). In response, Li Bin said that the repeated epidemic caused supply chain fluctuations and vehicle delivery challenges. According to previous reports from the automobile industry, since March, supply chain partners in Jilin, Shanghai, Jiangsu and other places have stopped production one after another for more than a month. Li Bin explained: "the increase in product prices will be reflected in the gross profit margin of cars in the third quarter, because we are still delivering cars before price adjustment." Battery costs were higher in the second quarter than in the first quarter, but the impact is still uncertain. Specifically, we believe it is higher than 10,000 yuan. Now the battery cost of the product is actually based on raw material trends and indices. This means that in the third quarter, we may see some downward trend in raw material costs, because battery costs are now very difficult to predict and determine. "

In addition, compared with ideal car and Xiaopeng car, Xilai Automobile has higher revenue from other sales and services. Specifically, in terms of marketing and management expenses, the cost of Lulai Automobile is 2.0148 billion yuan, Xiaopeng Automobile is 1.64 billion yuan, and the ideal car is 1.2 billion yuan. From intuitive data, the cost of Lulai Automobile is about twice that of the ideal car. Xilai said it was mainly due to the increase in the cost of sales and service personnel and the expansion of the sales and service network. In terms of R & D expenses, Lailai spent 1.761 billion yuan, an increase of 156.6 percent over the same period last year, Xiaopeng 1.22 billion yuan, an increase of 128.2 percent, and an ideal car of 1.2 billion yuan, an increase of 128.2 percent. Overall, the ideal is the lowest in sales, while R & D expenditure is in the middle.

For the following second quarter plan, Xilai is expected to deliver 23000 to 25000 new cars, an increase of 5 percent to 14.2 percent over the same period last year, and total revenue is expected to reach between 93.4 and 10.09 billion yuan, an increase of 10.6 percent over the same period last year. Xiaopeng delivered 31000 to 34000 new cars, with total revenue expected to reach between 96.3 and 9.99 billion yuan. Ideal car delivers 21000-24000 new cars, with total revenue expected to reach between 61.6-7.04 billion yuan.

In terms of product planning, ideal car CEO Li wanted to reveal that there will be three new products from this year to next year, including a flagship SUV, an all-electric model, and a medium-sized car with 200000-300000 yuan, of which the flagship SUV is the ideal L9, which will be officially launched on June 21. As for Xiaopeng, according to the plan, the Xiaopeng G9 will be pre-sold in the third quarter of this year and delivered on a large scale in the fourth quarter. Xiaopeng will also launch a new car on each of the newly built B-class and C-class car platforms in 2023, fully covering products in the price range of 150000 yuan to 400000 yuan.

As for NIO, as the company with the lowest sales among Weixiaoli, it will launch a number of products this year, including ES7, ET7 and ET5, among which ET7 positioning medium and large flagship sedan, which began delivery on March 28 and competes with BMW7; ES7 positioning large SUV, which is expected to debut in June, will start delivery in late August and compete with domestic BMW X5 ET5 positioning medium-sized luxury sedan, positioning lower than ET7, the pre-subsidy price is 328000 yuan and 386000 yuan respectively, is expected to be delivered in September, after the launch will be with Tesla Model 3.

As for the longer-term new car planning, Li Bin said on the phone that according to the plan, the new brand model will be delivered in the second half of 2024. The model will be equipped with third-generation NT3.0 technology, power exchange structure, and configuration will come from self-made battery packs. As for the vehicle price, Li Bin pointed out that the price of the main products will be in the range of 20-300000 yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.