In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-25 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/13 Report--

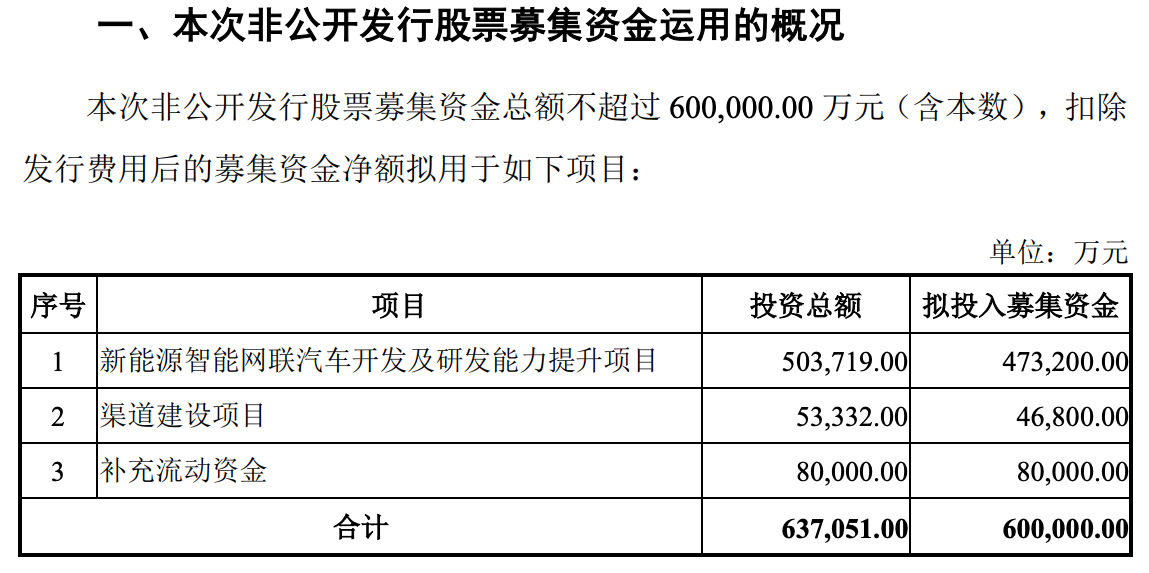

On the evening of June 10th, ST Zhongtai announced that after the completion of the restructuring, the company hopes to seek the help of the capital market and plans to raise no more than 6 billion yuan, which will be used for new energy intelligent network automobile development and R & D capacity enhancement projects, channel construction projects and supplementary liquidity after deducting issuance costs. Among them, the development of new energy intelligent network joint car is a major event. Zhongtai Automobile plans to invest 4.723 billion yuan to raise 4.723 billion yuan to develop four new energy and intelligent network connected passenger cars based on three platforms, including three pure electric large and medium-sized SUV models and a pure electric car model.

Zhongtai believes that through past accumulation, the company has complete vehicle design, trial production, test and parts development capabilities of new energy vehicles, and has mastered the technologies of vehicle networking, intelligent headlights, night vision system, automatic parking, traffic signal and sign recognition, fatigue driving early warning, electric four-wheel drive, steering wheel shift, etc., and developed the first generation of Level4 intelligent driving "DEMO prototype" as early as 2017. Has the foundation to enter the smart car.

Affected by the news, ST Zhongtai opened by the daily limit, closing at 3.82 yuan per share, with a total market capitalization of 19.364 billion yuan.

Zhongtai, formerly known as Huangshan Golden Horse Co., Ltd., established in 1998, was listed on May 19, 2000. As a member of its own brand, it not only has the dual production qualification of "traditional fuel vehicle + new energy vehicle", but also has production bases in Zhejiang, Hunan, Hubei, Shandong, Chongqing and other places, and its products cover sedan, SUV, MPV and new energy vehicle market segments. In terms of products, it became famous after launching a number of models in 2016, such as the T600 sports version, SR9, New Damai X5 and so on. In particular, SR9 became Zhongtai's "star" product after its listing, with cumulative sales of 333100 vehicles that year, an increase of 50% over the same period last year, which is the peak sales since Zhongtai Automobile was founded. However, Zhongtai Motors, which became popular because of imitation, was not destined to go very far, and then because of product problems, word-of-mouth declined, and sales began to plummet. After a decline in 2017, sales fell to 154800 in 2018 and only 116600 in 2019. After entering 2020, Zhongtai Automobile production and operation business almost stagnated, many of its subsidiaries and parent companies were liquidated.

In December 2020, Zhongtai Motor said that its parent company, Tieniu Group, was ordered by the court to terminate the reorganization process and declare bankruptcy liquidation because it was seriously insolvent and unable to continue its operation. From October 2020 to June 2021, eight Zhongtai companies were successively accepted by the people's court because of their debt crisis. On September 30, 2021, according to the results of the review vote, Jiangsu Shenshang holding Group Co., Ltd. (hereinafter referred to as "Jiangsu Shenshang") was finally determined as the restructuring investor. On October 9, the investor of Zhongtai Automobile restructuring was finally identified as Jiangsu Shenshang. On October 27th, Zhongtai announced that 2 billion yuan of restructuring funds have been put in place, the funds will be used to pay restructuring costs, pay off debts, and take advantage of industrial synergy to help Zhongtai Automobile restore the national sales network as soon as possible. On December 28, Zhongtai received the Civil order of Jinhua Intermediate people's Court, which confirmed the completion of the implementation of Zhongtai Automobile restructuring Plan. On December 29, Zhongtai issued an announcement that Huang Jihong signed the entrustment Agreement with Jiangsu Shenshang and other parties, agreeing that within 36 months from the date of signing, Jiangsu Shenshang and other shareholders will entrust 24.22% of their total shares to Huang Jihong to exercise their voting rights. At this point, the controller of Zhongtai has officially changed to Huang Jihong, chairman of Zhongtai Automobile Co., Ltd., manager of Zhejiang Zhongtai Automobile Manufacturing Co., Ltd., and manager of Yongkang Zhongtai Automobile Co., Ltd.

According to the data, Jiangsu Shenshang Holdings, the parent company of Jiangsu Shenzhen Merchants, is the controlling shareholder of a huge group of A-share listed companies. The company was once the largest car dealer in China. After poor management, it went bankrupt and reorganized. Founder Pang Qinghua was out, and Shenshang Holdings participated in the restructuring. And finally got a controlling stake. At present, although the huge group Gao Guang is not there, there are still intensive dealer network channels in China.

Let's take a look at Zhongtai Automobile. After entering 2021, since 2021, due to the company's liquidity drying up, bankruptcy restructuring, vehicle production and operation basically stagnated. According to the financial report, Zhongtai achieved an operating income of 825 million yuan in 2021, with a net loss of 706 million yuan belonging to shareholders of listed companies, and a net loss of 2.109 billion yuan after deducting non-recurrent gains and losses. By the end of 2021, the net assets belonging to the shareholders of listed companies were 3.442 billion yuan, compared with-3.964 billion yuan at the end of 2020.

The reason why Zhongtai chose to enter the new energy vehicle market stems from the rapid growth of new energy vehicles in recent years. According to the latest retail data released by the Federation of passengers, the number of new energy passenger vehicles in China from January to May in 2022 was 1.712 million, an increase of 119.2% over the same period last year. The China Automobile Association predicts that total sales of new energy vehicles in China will reach 5 million this year, an increase of 47 per cent over the same period last year.

From the perspective of historical development, Zhongtai is indeed one of the earliest manufacturers to develop new energy vehicles. It is understood that Zhongtai began to develop new energy vehicles as early as 2005, successively launching 2008EV, Yun100, Sesame E30, E200 and Damai A3 and other new energy vehicles. In October 2014, Zhongtaiyun 100 went on sale, selling 2224 vehicles in the first month. In 2015, Zhongtai sold 22900 electric vehicles, with a market share of 9.25%. In 2016, Zhongtai sold 32800 electric vehicles, with a market share of 12.75%.

Unfortunately, new energy vehicles were not the audience at that time, traditional fuel vehicles were the absolute main force of development, and most car companies were only strategic layout for new energy, and Zhongtai Automobile was no exception. Since then, Zhongtai Motor began to fade out of the market and get stuck in a quagmire. At present, although new energy vehicles are developing rapidly, they belong to the development of some brands, and even joint venture brands are difficult to obtain market recognition, while Zhongtai Motors, which is in crisis, has a good chance of winning when it chooses to enter the game at this time.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.