In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/18 Report--

According to relevant reports, the 2022 Phoenix New Media Finance (Summer) Cloud Summit, sponsored by Phoenix New Media, undertaken by Phoenix New Media and exclusively strategic cooperation by Qinghualang, was held on June 16-18, during which some experts suggested abolishing the car purchase tax. Yu Zhuoping, a professor at Tongji University and director of the National Center for Collaborative Innovation of Intelligent New Energy vehicles, said in the keynote speech on "New Energy, the New decade: opportunities and challenges" at the summit: "there is a very important thing in the subsidy policy now. That is, the purchase tax on new energy vehicles is abolished, and the purchase tax is abolished during the subsidy period. But with the withdrawal of subsidies, the purchase tax will come back. " Yu Zhuoping believes, "if it is a national car, there should be no vehicle purchase tax." Cars used to be used by families for private use are positioned as luxury goods, and luxury goods have a special luxury tax. The purchase tax on vehicles is compared from the luxury tax category. If it is a car that ordinary citizens can afford, it is an ordinary item, and there can be no purchase tax. It is reasonable for high-end ones to charge luxury goods tax, but ordinary national cars should not. If there are such a series of policies, I believe that the base of the national car will form a larger market. "

The so-called "car purchase tax" refers to the tax to be paid when buying a car, which is derived from the vehicle purchase surcharge. The basic norm of the current automobile purchase tax law is the interim regulations of the people's Republic of China on vehicle purchase tax, which has been implemented since January 1, 2001.

In recent years, the abolition of taxes and fees and some relief measures have also been carried out at the national level. Among them, in terms of abolishing taxes and fees, on November 28, 2014, the Ministry of Finance and the State Administration of Taxation announced that, with the study and approval of the executive meeting of the State Council, China will adjust the consumption tax on some products such as oil products from November 29, 2014, including gasoline consumption tax by 0.12 yuan per liter and diesel consumption tax by 0.14 yuan per liter. This is the first time that the consumption tax of refined oil has been adjusted since the tax and fee reform of refined oil in 2009. In addition, according to reports, this consumption tax adjustment is a set of "combined punches". In addition to appropriately increasing the consumption tax on gasoline, diesel and refined oils such as naphtha, solvent oil, lubricating oil, fuel oil, aviation kerosene, etc., it also includes abolishing the consumption tax on small displacement motorcycles, automobile tires and alcohol with a cylinder capacity of less than 250ml (excluding); abolishing the consumption tax on leaded gasoline for vehicles and leviing the consumption tax on unleaded gasoline in a unified manner. Stop levying refined oil price adjustment fund and so on, this measure will be implemented from December 1, 2014.

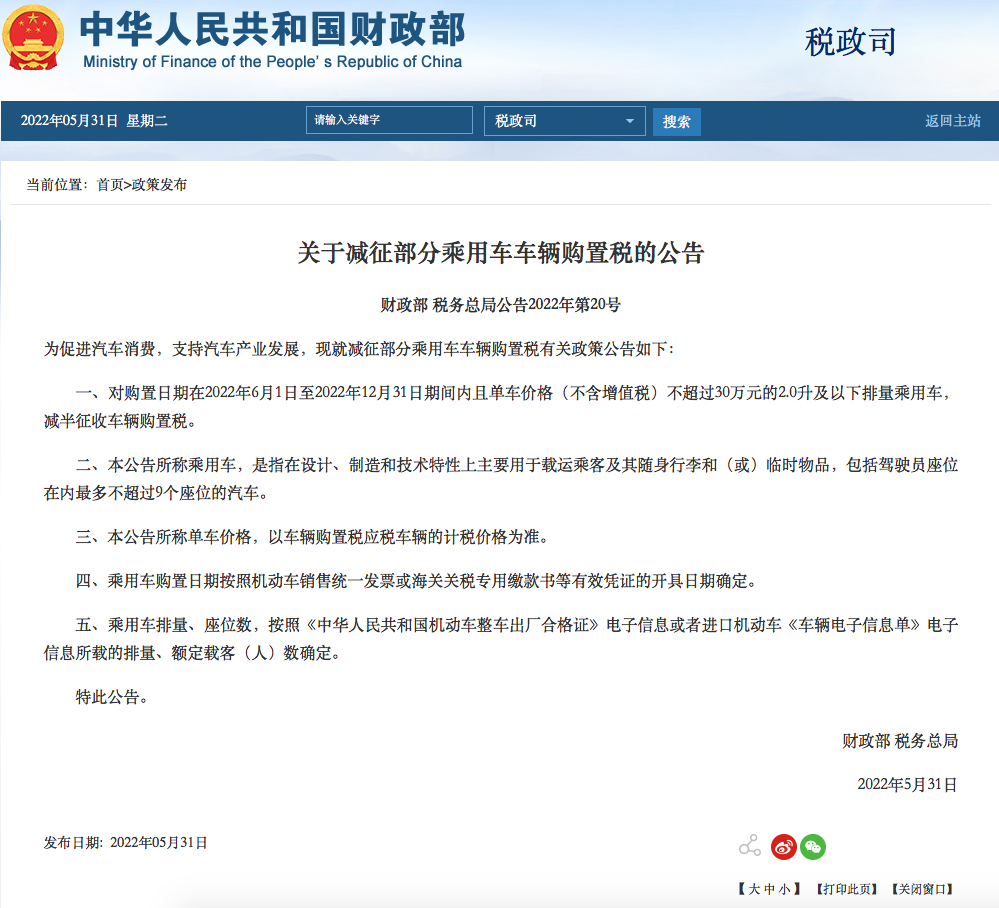

In terms of relief measures, the latest concession was at the end of last month. On May 31 this year, the State Administration of Taxation of the Ministry of Finance issued a notice on the reduction of purchase tax on some passenger vehicles, pointing out that the vehicle purchase tax will be halved for passenger cars with engines of less than 300000 yuan (excluding VAT) during the period from June 1, 2022 to December 31, 2022.

According to incomplete statistics, since the purchase tax halving policy was launched, more than 30 car companies have responded to this policy, most of which are independent brands and joint venture brands, such as Volvo, FAW-Volkswagen Audi, Infiniti and so on. Joint venture brands Dongfeng Nissan, SAIC-Volkswagen, FAW-Volkswagen, Dongfeng Peugeot, Changan Mazda, Changan Ford, FAW Toyota, Guangzhou Auto Honda and so on. Independent brands such as Wuling Baojun, Geely Automobile, Harvard Brand, Beijing Automobile, Sihao Automobile, Ruifeng Automobile, GAC MOTOR, SAIC Chase, Changan Auchan, Chery Automobile, FAW Pentium, Jetway Motor, MG Mingjue, SAIC Roewe, Dongfeng Fengshen and other brands have successively responded to the policy of halving purchase tax.

According to the concern of the automobile industry, similar measures mentioned above have been implemented by the automobile industry before, including two rounds of "relief measures", which were implemented on July 9, 2014 and December 27, 2017 respectively. On July 9, 2014, Premier Li Keqiang presided over an executive meeting of the State Council, which made arrangements to speed up the development of modern insurance services and decided to exempt new energy vehicles from purchase tax. The meeting decided that from September 1, 2014 to the end of 2017, three types of new energy vehicles, pure electric vehicles (including imports) and qualified plug-in hybrids and fuel cells, which are licensed to be sold in China, will be exempted from vehicle purchase tax. On December 27, 2017, the exemption of new energy vehicles from purchase tax was extended for another three years, and four departments, including the Ministry of Finance, announced that new energy vehicles purchased would be exempted from purchase tax from January 1, 2018 to December 31, 2020.

In response to the latest reduction in the purchase tax on some passenger vehicles this year, Cui Dongshu, secretary general of the passenger Union, said in an article that by implementing the 60 billion car purchase tax halving measure, the consumer side is a policy guide for consumers to upgrade consumption, promote mainstream consumer groups to restore consumer confidence, and effectively reduce the purchase pressure of mainstream consumer groups, which is bound to effectively pull automobile consumption payment to the normal track. We expect the effect of this policy to increase by 2 million. Sun Shaojun, founder of the national automobile sales and service platform "car fans", also said that the most prominent feature of this round of policy is the speed of introduction and short implementation cycle, and the 60 billion yuan purchase tax reduction can stimulate consumer confidence to a certain extent.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.