In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/20 Report--

If it wasn't for bankruptcy, you might not know much about Electric Last Mile Solutions (ELMS), an American commercial electric vehicle start-up, and getting to know ELMS in this way is really dramatic.

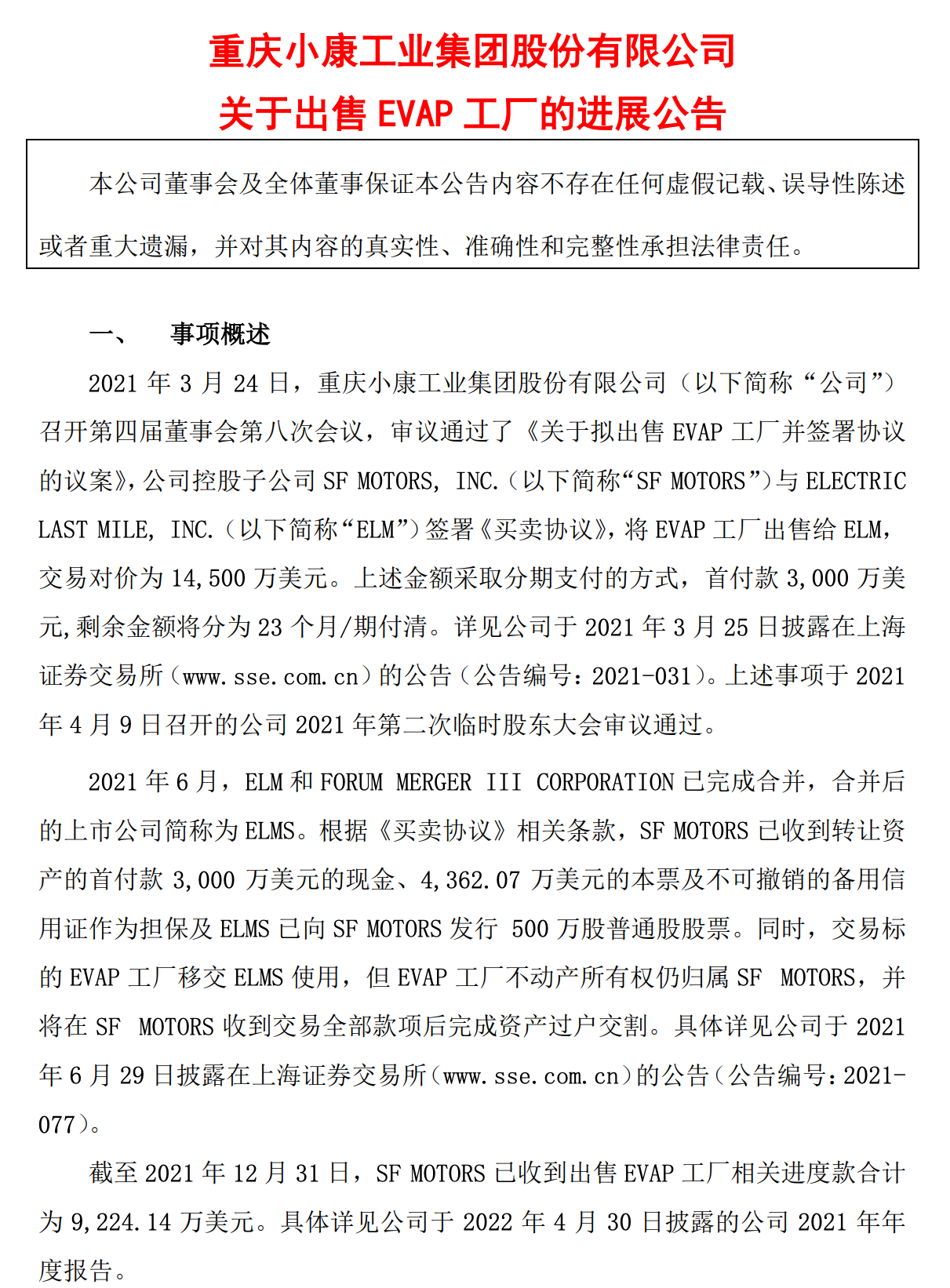

Us commercial electric vehicle maker Electric Last Mile Solutions (ELMS) said it was planning to file for bankruptcy protection under Chapter 7 of the US bankruptcy law after reviewing its products and commercialization plans, the Financial Associated Press reported. It is understood that Electric Last Mile Solutions went public in the form of SPAC merger in June 2021, becoming the first electric vehicle start-up company to file for bankruptcy after listing in the form of SPAC merger.

For Chinese people, Electric Last Mile Solutions (ELMS) is a very strange automobile company, but its founder, Jason Luo, is no stranger to people who are familiar with the automobile industry. According to the data, Luo Guanhong, former chairman of the board and CEO of Ford Motor (China) Co., Ltd., was responsible for managing Ford's business operations in the Chinese market in 2018, including Changan Ford, Jiangling Ford, Ford Import, Lincoln brand and the company's business management in Taiwan. However, he has been at Ford for only five months.

ELMS was registered in the United States in June 2019. In December 2020, ELMS announced that it was working with special acquisition purpose (SPAC) company Forum Merger III Corp. To negotiate the merger and listing. In June 2021, ELMS was listed in Nadusk through SPAC merger. The listing was completed only one year after its establishment, which is extremely rare in the field of electric vehicles and even in the field of automobiles. After the IPO, ELMS's share price soared, peaking at $14, while Tesla's share price was also protected that year, and investor enthusiasm for electric start-ups was at an all-time high. However, its share price has plummeted since then, falling below $1 on April 27, 2022, almost worthless. Surprisingly, as early as February this year, the then CEO James Taylor and founder Jason Luo both resigned because of the stock behavior investigation, and the current bankruptcy mess of the company has been attributed to the interim CEO Shauna McIntyre.

Incredibly, the American commercial electric vehicle start-up still has a relationship with Chinese car company Xiaokang. In 2016, Xiaokang spent $30 million to create a new energy brand, SF MOTORS, in Silicon Valley. In 2017, Xiaokang spent $160 million on the acquisition and transformation of the EVAP plant, with Cyrus in the United States operating crisis, and plans to sell the American factory. In 2019, SF MOTORS approached Luo Guanhong and asked him to find a suitable CEO for the company, while Luo Guanhong gave priority to his old friend James Taylor and became SF MOTORS CEO through introduction in May 2019. Since then, Xiaokang announced that its US subsidiary SERES signed an intention agreement with ELMS to sell the EVAP factory to ELMS at a low price of $145 million. It stipulates that ELMS pays $30 million in cash and $43.6207 million in promissory notes to SF MOTORS; ELMS issues 5 million common shares to SF MOTORS.

In order to bring the product to market quickly, ELMS imports an unassembled van directly from China, assembles it at the EVAP factory and sells it in the US market, which is in full compliance with US standards and laws and regulations. ELMS said the first car it plans to produce is the "urban freight commercial vehicle", which is suitable for delivery, as well as utility and other service fleets. After enjoying a $7500 tax rebate provided by the US government, the car sells for $25000 and can drive 150,200 miles in two hours of charging. ELMS believes that its advantage is that the operating cost of electric cars is lower than that of gasoline cars of the same class.

In October 2021, ELMS released an official picture of its pure electric animal mobile car coming off its US factory. Although the car carries ELMS's LOGO, it is actually a new standard car of Wuling EV50, while in the PPT before the launch of ELMS, the concept car directly changed the standard of EC35 produced by Chongqing Ruichi New Energy, a subsidiary of Xiaokang Co.

For this operation, the company CEO James Taylor said it signed a supply agreement on spare parts with Wuling in Liuzhou at the beginning of its establishment. In addition, when ELMS took over the Selis factory, Xiaokang signed a product license and supply agreement with ELMS: for EC35 and D51 electric vehicle products developed and owned by SERES and its affiliated companies, in addition to the product license royalty fee of US $5 million per vehicle for the first 100000 vehicles, it also paid a product license entry fee of US $5 million.

At the time, ELMS caught up with the investment enthusiasm of electric startups, and its share price continued to soar after its IPO, peaking at $14. Perhaps, for ELMS, the process of the story is not important, what matters is how to make investors believe the story.

On June 14, Xiaokang shares announced, "the company has been informed by the holding subsidiary SF MOTORS that it has learned from the official website of ELMS and the website of SEC that ELMS plans to file for bankruptcy in accordance with Chapter 7 of the US bankruptcy Law on June 12, 2022 local time." After the ELMS formally filed for bankruptcy, SF MOTORS will declare its claims to the ELMS custodian and participate in the ELMS bankruptcy proceedings in accordance with relevant laws and regulations. Xiaokang shares said that ELMS still has $37.2414 million left to be paid, and that 5 million shares of ELMS common shares held by SF MOTORS are at risk of impairment.

Recently, the Securities and Exchange Commission concluded a 60-day public consultation period with a number of proposed guidelines for SPAC, particularly on disclosure, marketing practices and third-party oversight. If approved, the barriers to entry for SPAC will be raised, and the gap between its regulatory rigor and that of traditional IPO will be narrowed, which is likely to mean that this wave of SPAC ebbs.

One of the main targets of the new policy is American electric car start-ups. Since 2020, there has been an explosive growth in the listing of SPAC. At present, more than 300 companies have been listed through merger with SPAC, among which the most popular field is the electric vehicle industry. Nikola, Lordstown Motors, Lucid Motors, Karma, Fisker, Canoo, Hyliion, Proterra, Faraday Future and so on are all listed through SPAC.

Through the SPAC merger, you can quickly go public and raise a lot of money, but if all the startups fail to live up to their original performance promises, it is easy to cause the share price to plummet and cause investors to suffer huge losses. Since 2021, six companies, including Faraday Future, Lordstown Motors and Nikola and Lucid, have disclosed that at least three car or battery makers have issued continuing warnings under SEC investigation in the US, while their share prices have fallen more than 70 per cent since their peak.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.