In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/29 Report--

A term about the response of Xilai car to being shorted by a grizzly bear went viral on Weibo today. It is understood that Grizzly Research, a US short seller, released a report yesterday pointing out that Xilai Motor has exaggerated its income and net profit margin by accounting to achieve its goal. In response to the short report, the person concerned said: "the company has observed this report." The report is full of false information and misreading of the information disclosed by Xilai. NIO has been strictly abiding by the relevant standards of listed companies, and relevant procedures have been launched for the report, please pay attention to the follow-up announcement. "

Xilai also issued a notice on the Hong Kong Stock Exchange today that the allegations made by the short seller Grizzly Research LLC in a short selling report are unfounded and that its information about the company contains many errors, unfounded speculation and misleading conclusions and interpretations. The company's board of directors, including the audit committee, is reviewing these allegations and considering appropriate action to protect the interests of all shareholders. Further disclosures will be made in due course in accordance with the applicable rules and regulations of the Securities and Exchange Commission of the United States, the New York Stock Exchange, the Stock Exchange of Hong Kong Limited and the Singapore Exchange Stock Exchange Limited.

With regard to the origin of the short seller Grizzly, according to its website: Grizzly is committed to providing differentiated research insights for listed companies through in-depth due diligence, founded and served as CEO by Siegfried G.Eggert. It is understood that Siegfried G.Eggert graduated from the Department of International Business from Groningen Hans University in the Netherlands. During his master's degree, he received a degree in finance from the University of Rochester. Before establishing Grizzly Research, he worked as an analyst and Forensic Economics Inc at GeoInvesting LLC, a short selling institution. He worked as an assistant analyst and served as Grizzly CEO in February 2020. So far, Grizzlies have issued a total of 24 short reports, including financial payment company Intelligent Systems Corporation. (INS), American beverage company New Age (MAVI), American medical marijuana company Trulieve Cannabis Corp. (TCNNF) and a number of Chinese companies, including who to learn from, 58.com, Douyu, Ruineng New Energy and so on.

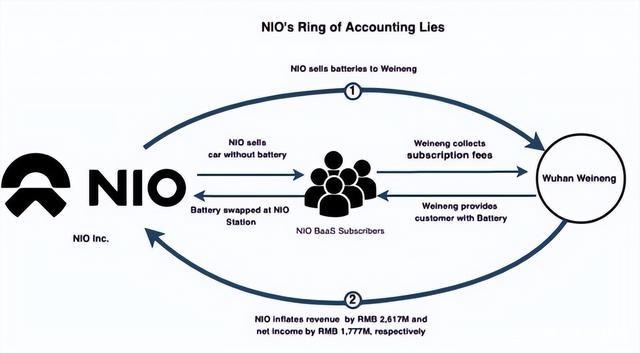

In the report of the short seller Grizzly Bear, it mentioned that through its battery business company, NIO used accounting methods to exaggerate income and net profit margin, and helped Lai Motor to generate performance in the form of related party transactions. as a result, the share price of Xilai has risen by more than 450% since 2020. It clearly points out the role that Wuhan Wei can play in it. It is said that in August 2020, companies such as NIO, Industrial Fund and Ningde Times established Wuhan Ulergy Battery Asset Co., Ltd., starting from the four quarters report in 2020, NIO's financial results began to significantly exceed the average market expectations. Wuhan NIO helped NIO continue to achieve high growth and profit expectations, generating billions of dollars in revenue and increasing NIO's income and net profit by about 10% and 95%, respectively.

According to the agency's analysis, according to the business model, Wuhan Weineng, as an entity providing BaaS battery rental services, provides subscription services to car owners after purchasing batteries from Xilai. In the four months after its establishment in 2020, Weineng contributed 290 million yuan in revenue to NIO, which soared to 4.14 billion yuan by 2021. Grizzly Bear believes that not only will it be able to recognize additional revenue from the BaaS business, but it will also be able to transfer the costs and expenses associated with the battery replacement business off the balance sheet. In doing so, Xilai deceived Wall Street and investors with financial results that were out of touch with reality.

It also points out that since the fourth quarter of 2020, NIO's net income has exceeded average expectations by 33% and revenue by 5%. For fiscal year 2021, Wall Street expects a loss of 5.947 billion. NIO reported a net loss of 3.007 billion yuan, 50% higher than expected, a difference of 2.94 billion yuan. Grizzly Bear said that due to the lack of regularity of the financial report, it can only infer the true effect of the financial engineering between the two companies in the nine months to September 2021. From these figures, it can be seen that Weineng is crucial to the upside of this income.

According to public information, Wuhan Weineng, a battery business company under Ulai, was established in August 2020 as its legal representative, Shen Fei. The company's brief introduction is the battery business company of Lulai Automobile, which is committed to building a battery asset management business based on the "vehicle-electricity separation" mode, providing comprehensive services of car power separation, battery rental, rechargeable and upgradeable through battery rental service BaaS. When purchasing a car, users do not need to buy battery packs, but choose to rent battery packs with different capacity according to their actual use needs, pay monthly service fee, and enjoy power exchange service and flexible battery upgrade service just like battery buyers. In terms of shares, Ningde Times is also one of the important shareholders of the company.

In addition to pointing out that the company's financial data were falsified, the agency's report also revealed some secret transactions by Li Bin and the close relationship between Li Bin, chairman of the company, and joyful Capital, the core party involved in Luckin Coffee's performance fraud, and its founder, Liu Erhai. It said that according to documents retrieved in the British Virgin Islands, Li Bin mortgaged the User Trust to UBS without any disclosure, and pointed out that Li Bin used the User Trust fund for personal gain, exposing shareholders to potential margin calls and the risk of stock falls.

It also pointed out that investors should be very cautious when a listed company or management gets too close to pleasure Capital and Liu Erhai, given that Mr Liu was previously involved in Hong Kong-listed 0699.HK (which has been delisted) and US-listed Luckin Coffee. According to relevant information, Liu Erhai has been a director of the board of directors of the change car since 2005 and an independent director since 2011. The barter has been controlled by Li Bin, and Liu Erhai was appointed as one of the independent directors of the special committee to evaluate the barter's privatisation deal in September 2019.

It is worth noting that after the grizzly bear released the short report, the markets of both Ulai US stocks and Hong Kong stocks were affected. On June 29th, NIO shares plummeted, falling more than 4% from 2% to 2.57% at the close of trading, closing at $22.36 per share. As for Hong Kong stocks, as of today, NIO closed down 11.36% at HK $166.5 per share. In addition, Ulai also issued an announcement on the Singapore Stock Exchange today to apply for a suspension of trading.

In response to this incident, some industry insiders said: for the time being, I don't know who is right in this matter, and Grizzlies, you can't say he's wrong. The key is to return to the nature of business competition, product power and service power. Whether the innovative power exchange business can provide services that really meet the needs of users, promote product sales and enhance brand value. If possible, it is valuable business innovation, and the actual increase in final revenue and profit will greatly exceed the reduced costs; if not, the financial game will not be played for long.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.