In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/17 Report--

After a rough time, Cheetah finally saw a glimmer of hope.

On July 15, the first creditors' meeting of the merger and reorganization of six enterprises, including Hunan Cheetah Automobile Co., Ltd. (hereinafter referred to as "Cheetah Automobile"), was officially held, at which the Cheetah Automobile restructuring Manager announced the draft merger and reorganization Plan. Hengyang Hongdian New Energy Technology Co., Ltd. (hereinafter referred to as "Hongdian New Energy") has been identified as the only restructuring investor, and Hongdian New Energy will invest 800 million yuan to pay off debts. To obtain the corresponding vehicle production qualification, vehicle production base, engine production base, automobile R & D base, axle production base and other assets of 6 companies of "Changfeng Department". According to the relevant agreement, the main bodies of the six "Changfeng system" companies involved in the restructuring will be retained, and all corporate shares will be transferred to Hongdian New Energy for free.

Data show that Cheetah parent company Changfeng Group, formerly known as the Guangdong military region Ordnance repair Factory, which was founded in 1950, moved from Guangzhou to Yongzhou, Hunan Province in 1965 and renamed the people's Liberation Army 7319 Factory. In 1984, the factory trial-produced and assembled Xiangling 212 light off-road vehicle. In 1987, the factory successfully developed and produced a cheetah light off-road command vehicle. In 1995, the factory cooperated with Japan's Mitsubishi Motors to introduce Mitsubishi Pajero automobile technology. In 1996, the factory was restructured to form Changfeng Group. In 2001, Changfeng Group was handed over from the army to the Hunan Provincial people's Government and is now an enterprise managed by Hunan SASAC.

Deep-rooted Cheetah once owned two research institutions of Beijing Automobile Research Institute and Changsha Institute of Engineering, three key parts companies, and four vehicle manufacturing bases, including Yongzhou Company, Chuzhou Company, Changsha Company and Jingmen Company. Once occupied more than 43% of China's domestic light off-road market share. In 2004, GAC Changfeng was listed on the Shanghai Stock Exchange under the stock symbol "600991". After 2009, Changfeng Group, in accordance with the high-level decision of Hunan Province, has twice put forward its core assets to carry out strategic cooperation with GAC GROUP, introducing two major vehicle projects of GAC Fiat and GAC-Mitsubishi to Changsha Economic Development District to help Hunan build an automobile industry chain cluster. In 2012, GAC GROUP achieved a curvilinear listing by absorbing and merging GAC Changfeng, with the new stock symbol "601238", while the original stock code "600991" has since withdrawn.

As the head of Changfeng Group, Li Jianxin was obviously unwilling. He withdrew the cheetah brand from GAC GROUP and re-registered to establish Hunan Cheetah Automobile Co., Ltd., seeking to revive Cheetah. With the help of the boom in the SUV market, cheetah car sales are rising. Data show that Cheetah sold 125000 cars in 2017, with a sales revenue of 11.32 billion yuan. In the same year, Li Jianxin, then chairman of Changfeng Group, announced that he would restart the IPO process, planned to land in the capital market again, and set the goal of "achieving annual production and sales of 400000 vehicles by 2020, sales revenue of 40 billion yuan and net profit of 2 billion yuan" for Cheetah.

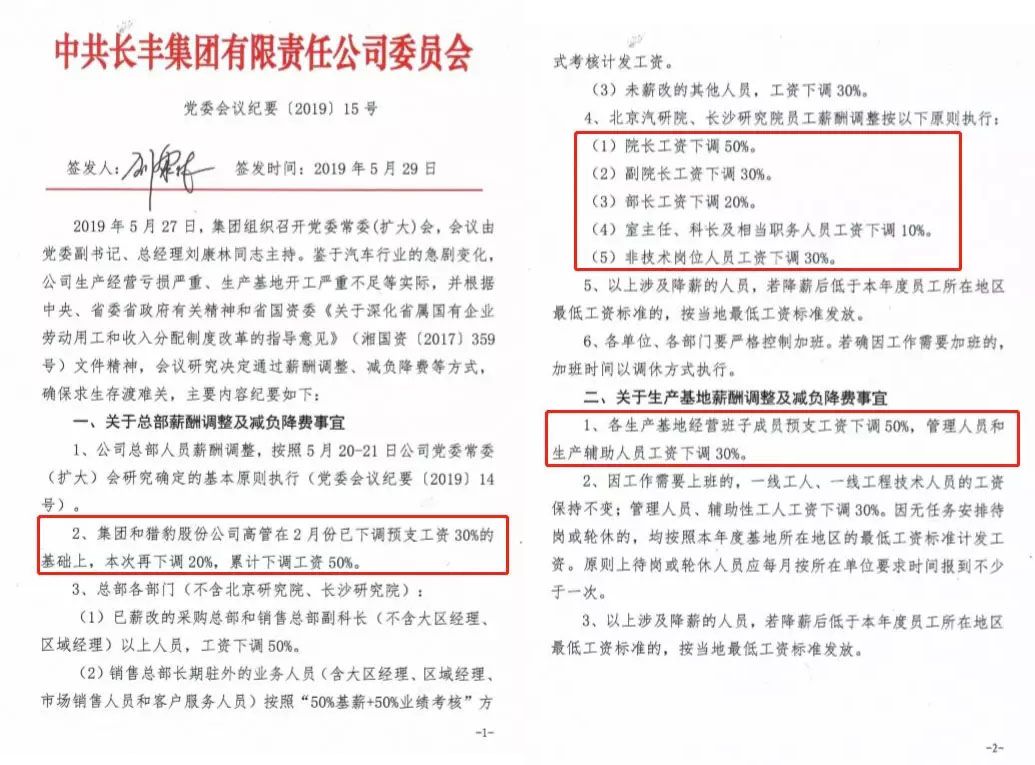

However, success is so close and so far away. Cheetah sales fell to 77600 in 2018, nearly halving from a year earlier, according to the data. Cheetah sales continued to fall in 2019, to just 32500. In the same year, Li Jianxin, an automobile veteran who has been in charge of Changfeng Cheetah for more than 30 years, announced his resignation, and Zhou Haibin became party committee secretary and chairman of Changfeng Group. After entering 2020, the situation of Cheetah has not improved, with annual sales of only 1043 vehicles. In parallel with the decline in sales, there are rumors of broken funds, layoffs, salary cuts and dealers withdrawing from the net from time to time.

In April 2020, Geely Holdings Group formally signed a strategic cooperation agreement with Hunan provincial government and Changsha municipal government in Changsha to host Cheetah Changsha factory. Relevant data show that Geely Holdings's managed cheetah factory is used to produce new energy vehicles, but the trusteeship is not an acquisition, and Cheetah has not taken a turn for the better. In April 2021, Cheetah filed for bankruptcy review in Changsha Intermediate people's Court. In August 2021, Cheetah was ruled bankrupt and restructured. Since then, Cheetah car managers issued three auction announcements to hold public auctions on some of Cheetah's assets, but no one was interested.

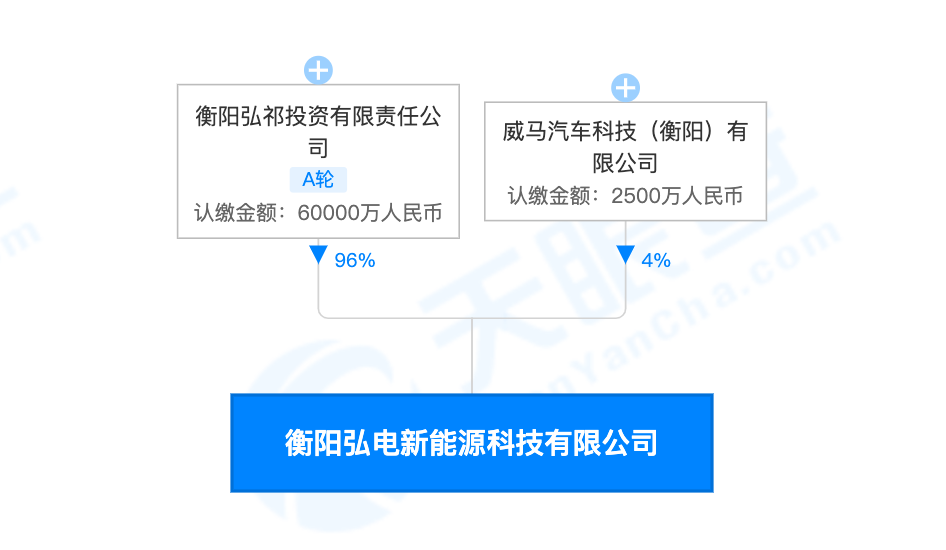

According to Tianyan check, Hongdian New Energy was established on October 31, 2019, in which Hengyang Hongqi Investment Co., Ltd. holds 96% and Weima Automotive Technology (Hengyang) Co., Ltd. holds 4%. Equity penetration shows that the former is controlled by Hengyang SASAC, while the latter is wholly owned by Weima Motor.

Although Weimar's shareholding ratio is not high, it is an important role in this restructuring case. Data show that in December 2015, Shen Hui, former vice president of Geely Holdings Group, founded Weima, headquartered in Shanghai, China. In January 2018, Weima acquired Zhongshun Automobile holding Co., Ltd., and successfully obtained the production qualification. In September 2018, Weima's first production car, EX5, was officially put on the market, with a price of 14.68-198800 yuan.

Data show that in 2019, Weimar delivered 16900 vehicles, NIO delivered 20600 vehicles, and Xiaopeng delivered 16700 vehicles, ranking second in the new power car company. When the time comes to 2020, Weimar delivers 22500 vehicles for the whole year, while Weimar delivers 43700 vehicles, Xiaopeng delivers 27000 vehicles, ideal delivers 32600 vehicles, by this time Weimar has fallen out of the top three. In 2021, Weimar fell behind again. Xiaopeng delivered 98200 vehicles for the whole year, 91400 vehicles for NIO, 90500 vehicles for ideal delivery, 69700 vehicles for Nahu, and 44200 vehicles for Weimar for the whole year, obviously lagging behind in sales. The latest data show that Weima delivered a total of 21700 vehicles in the first half of 2022, while Xiaopeng, Nezha, ideal and NIO were 69000, 63100, 60400 and 50800 respectively.

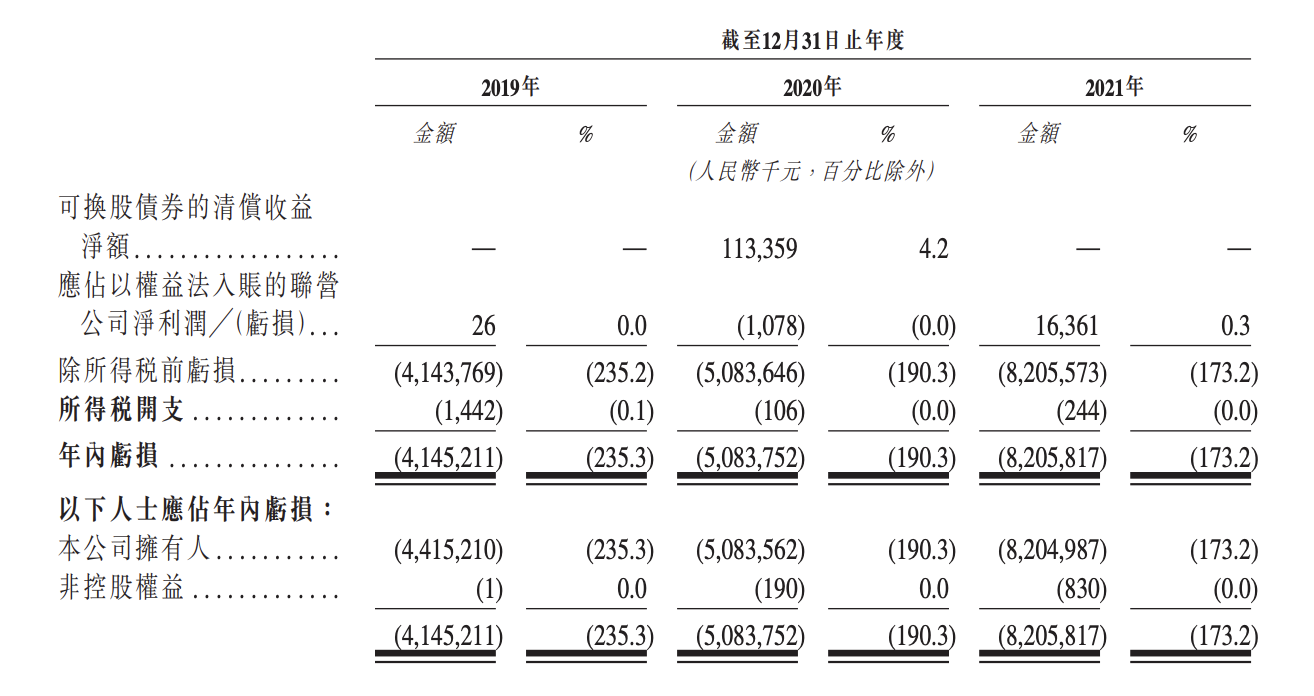

In addition to the delivery volume is not as good as Wei Xiaoli, the speed of financing is also the same. On June 1, Weimar formally submitted its application for listing of Hong Kong shares, with Haitong International, China Bank International and Bank of China International as sponsors. According to the prospectus, Weima's revenue from 2019 to 2021 was 1.7621 billion yuan, 2.6717 billion yuan and 4.7425 billion yuan respectively, with net losses of 4.145 billion yuan, 5.084 billion yuan and 8.206 billion yuan respectively, with a cumulative loss of 17.435 billion yuan over three years.

In early 2020, Wei Ma founder Shen Hui said confidently: "We will not disclose how much money we have burned, because we are definitely not in the top two, we are relatively low." At present, we are very confident that we will become the first new car manufacturer in the world to make a real profit for the whole year. We hope to be ahead of Tesla and firmly believe that we can do so. " However, from the current point of view, Weima not only did not run in front of Tesla, but has already lost to the second-tier new power brands such as Nashi, Zero and so on.

As for whether Weima can drive Cheetah cars and make full use of resources to achieve counterattack, it is also unknown. According to the draft merger and reorganization Plan, Hongdian New Energy will focus on the mass market of pure electric passenger cars worth 150000 to 250000 yuan after acquiring "Changfeng system". Weimar will provide technical support from Sandian to vehicle calibration, intelligent cockpit and intelligent driving, and consider selling through the channels already established by Weimar.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.