In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/27 Report--

A "investment promotion message" once again pulled Dongfeng Yulong Motors, which had not been seen for a long time, back into public view. On July 12, Dongfeng Yulong manager and Zhejiang Liuhe Law firm issued the Investment Promotion announcement of Dongfeng Yulong Automobile Co., Ltd. (hereinafter referred to as the "announcement"), which showed that Dongfeng Yulong conducted a public investment promotion in accordance with the relevant provisions of the reorganization procedure.

According to relevant media reports, the person in charge of investment promotion in Dongfeng Yulong said that the investment project is still in progress, but it is not convenient to disclose the details. According to the reorganization judicial process, Dongfeng Yulong will re-recruit car companies as the main target of investors for automobile companies. Dongfeng Yulong's relevant investment person said, "now the investors we are considering are mainly automobile companies. Dongfeng Yulong's reorganization belongs to judicial reorganization, according to the reorganization requirements, the need for car companies to enter, even if there are investors in other industries are willing to come in, but also to pull a car company as the main body. After the car companies enter, they can import their own products. "

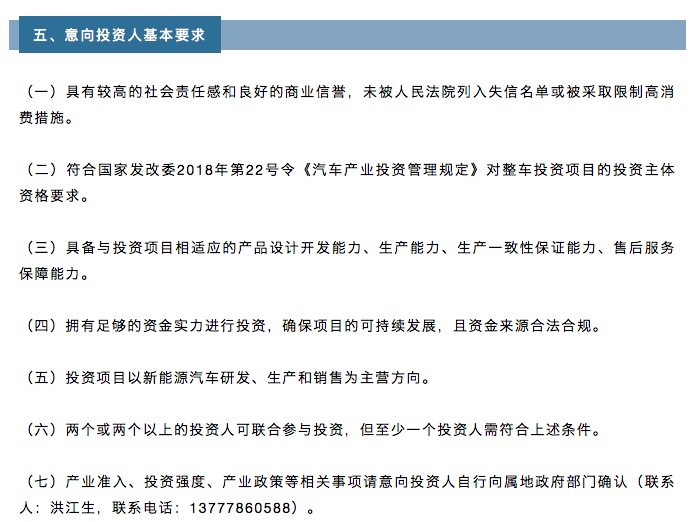

The announcement puts forward seven basic requirements for prospective investors, among which it is clear that "the investment project will focus on the research and development and sales of new energy vehicles" and "two or more investors can jointly participate in the investment, but at least one investor must meet the above conditions."

According to public information, on April 29 this year, the Intermediate people's Court of Hangzhou, Zhejiang Province ruled to accept the bankruptcy reorganization application filed by Dongfeng Yulong. According to the appointment of Hangzhou Intermediate people's Court, Zhejiang Liuhe Law firm serves as the manager of Dongfeng Yulong Company (previously acting manager). According to the Daily Business News, Dongfeng Yulong managers said that if the recruitment work goes well, the restructuring work is expected to be completed by the end of October, and if not, it will be postponed for three months to January next year. Because according to the relevant laws, the general time limit for bankruptcy reorganization is "6-3" months. However, considering that it may be affected by the epidemic and other related factors, this time is not certain. In addition, the manager of Dongfeng Yulong pointed out: "at present, our requirement for recruiting investors is car companies, but we do not rule out the possibility that if we cannot recruit car companies, we will not retain the qualifications of car companies and conduct open recruitment."

In fact, this is not the first time Dongfeng Yulong has sought investors. It is reported that Dongfeng Yulong manager issued an investment promotion announcement in March this year, but Dongfeng Group insiders revealed that Dongfeng Yulong is still in the restructuring stage and there is no clear restructuring investor. Earlier, in November 2021, there were rumors that Yulong might cooperate with Foxconn, which took a fancy to Dongfeng Yulong's production qualifications, hoping to develop in the field of electric vehicles. In the end, however, Foxconn did not become an investor in Dongfeng Yulong, and Foxconn parent company Hon Hai Group responded that Hon Hai Group or Foxconn had nothing to do with Dongfeng Yulong's pre-restructuring and would not be involved.

According to public data, Dongfeng Yulong Automobile Co., Ltd. was established in December 2010. the registered capital is about 3.544 billion yuan. Dongfeng Yulong is a joint venture between Dongfeng Motor and Taiwan Yulong Group, each of which accounts for 50% of the shares of the company. In 2011, the first model of Dongfeng Yulong, Nazhijie 7SUV, was listed on the market. Taking advantage of the dividend period of the outbreak of growth in the domestic SUV market, Dongfeng Yulong quickly opened the market and reached the peak of development. In 2012, Dongfeng Yulong sold a total of about 31100 vehicles and made a profit, with annual sales revenue of 6.485 billion yuan. In 2013, Dongfeng Motor and Yulong Motor once again formed a joint venture with 50:50 shares to form Dongfeng Yulong sales Company, which is responsible for selling Na Zhijie automobile products produced by Dongfeng Yulong. In this context, Dongfeng Yulong successively launched large 7 MPV, Quan Xinrui 3 and other models to expand the product series, and shouted out the goal of "sales of more than 200000 vehicles within five years, and sales revenue of 25 billion yuan." however, with more models on the market, Dongfeng Yulong's sales have declined one after another.

According to the data, the annual sales of Dongfeng Yulong were 6917 in 2013 and 31200, 52200 and 60300 in 2011-2015, respectively, but since 2016, Dongfeng Yulong's sales have declined sharply, including 40500 in 2016. in response to the decline in sales, both shareholders of Dongfeng Yulong increased their capital respectively in 2017 and planned to invest 2 billion yuan in Nazhijie brand and product development. But a series of measures have not improved sales, and even if famous star Jay Chou was invited to endorse the brand in 2015, Dongfeng Yulong sold 18100 vehicles in 2017, 9361 in 2018 and plummeted to 1947 in 2019. In December 2019, Dongfeng Yulong tried again to save itself, launching the URX medium-sized SUV model, which sells for 14.36-155600 yuan, with a 1.8T engine and an Ericsson 6-speed manual gearbox, but failed. In June 2019, there were media reports that the production of Dongfeng Yulong Hangzhou production base was at a standstill, resulting in the car not being put on the market, but it was still in the national five model after it was put on the market, and the car could not be sold because it did not meet the national six emission standards and other reasons. After entering 2020, Dongfeng Yulong gradually lost its "sense of existence" in the Chinese market, with annual sales of only 77 vehicles. Finally, Dongfeng Yulong fell into bankruptcy and reorganization.

Judging from the development process of Dongfeng Yulong, it is not too late for Dongfeng Yulong to enter China, and its early products are also attractive. For the serious decline in sales of Dongfeng Yulong, it is generally believed that the Nazhijie model was destroyed by "excessive fuel consumption" and "a gas station for 100 kilometers". Quality problems such as engine flameout, broken shaft and damaged water tank also emerge one after another. From the perspective of brand product renewal speed, Dongfeng Yulong evolved slowly from engine technology to vehicle products, so it was difficult to keep up with the pace of market development, and finally went bankrupt and reorganized. Cui Dongshu, secretary general of the Federation of passengers, once pointed out that Dongfeng Yulong will go bankrupt and reorganize mainly because there is no core technology and lack of quality awareness, so the products do not have a competitive advantage.

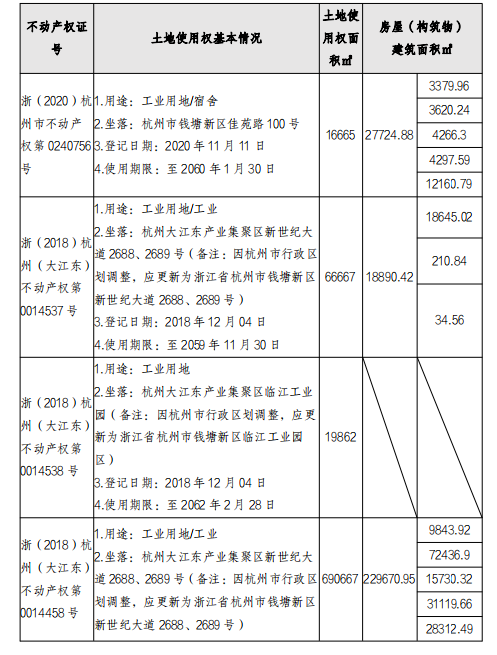

According to the latest announcement, Dongfeng Yulong's remaining assets include land, factories and other real estate, traditional fuel and new energy production qualifications for passenger cars, perfect vehicle verification capability, and built a test runway, emission performance laboratory, regulatory power laboratory, vehicle VOC testing laboratory, vehicle preparation room, new energy laboratory, new car trial production workshop, three coordinate rooms, etc. Six major workshops, R & D centers and bonded warehouses have been built, with an annual production capacity of 120000 vehicles. Judging from the existing resources of Dongfeng Yulong, it is not unattractive, but at the same time, Dongfeng Yulong is also burdened with high debts. According to media reports, so far, Dongfeng Yulong's debt has reached 7 billion yuan, and the valuation of assets is still uncertain. Dongfeng Yulong's profitable sales revenue is only 6.485 billion yuan, that is to say, Dongfeng Yulong's debt has exceeded its one-year sales income. In a sense, the manager's public investment promotion according to the relevant provisions of the pre-reorganization procedure is to achieve the effective integration and sustainable development of Dongfeng Yulong's high-quality assets, but with a debt of 7 billion yuan, it is really difficult for Dongfeng Yulong to turn around.

The market has always been fair, only to follow the needs of the market to launch products in line with the current, consumers are more willing to buy it, the brand can naturally go on for a long time. From this point of view, Dongfeng Yulong sales "rollover" is also expected, from the latest investment information, new energy vehicles will be the main direction of Dongfeng Yulong in the future. As for the trend of Dongfeng Yulong's products and brands after the introduction of investors, there are still a lot of uncertainties.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.