In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/08 Report--

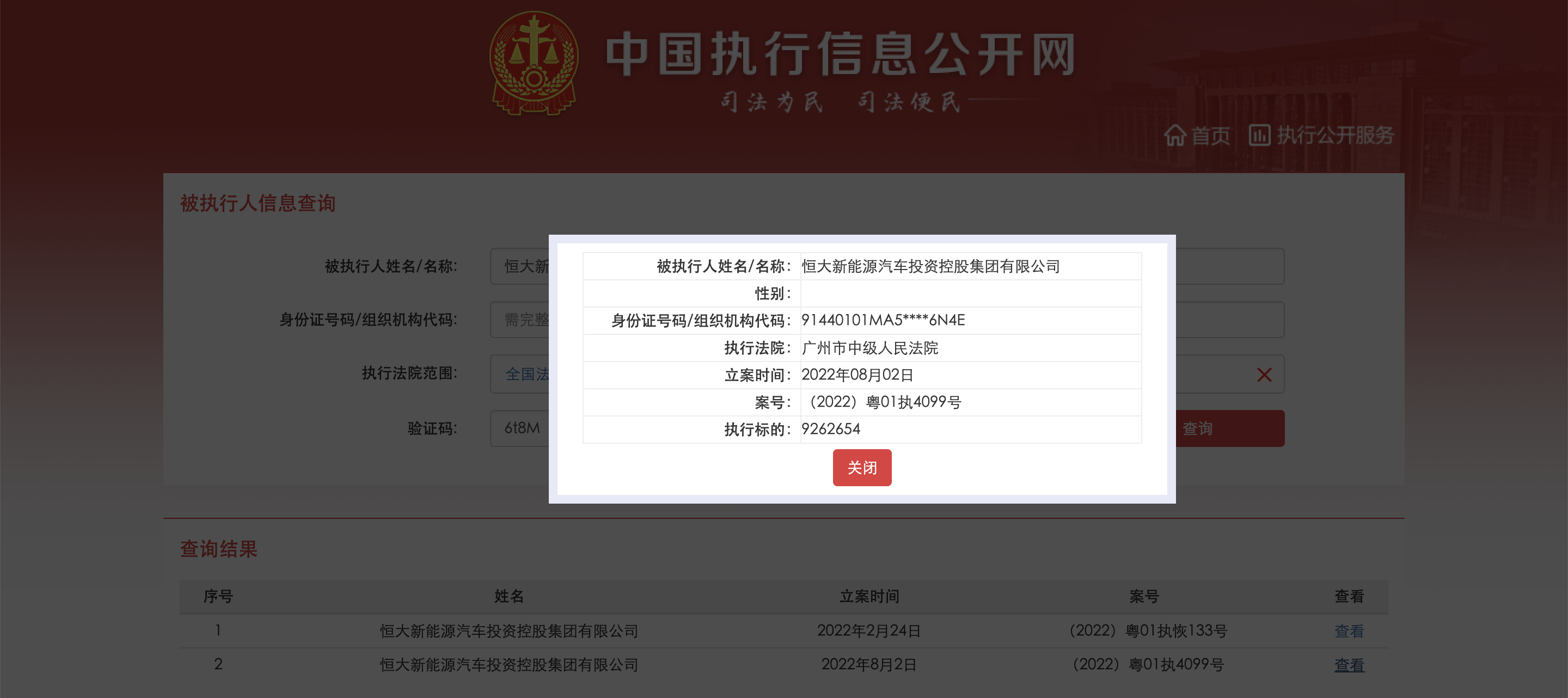

According to the China Executive Information publicity Network, Evergrande New Energy Automobile Investment holding Group Co., Ltd. added information on the person subject to execution, case number (2022) Yue 01 holds No. 4099, the object of execution is 9262654 yuan, the enforcement court, the Guangzhou Intermediate people's Court.

This is the second time that Evergrande new energy vehicles have been enforced. On February 24, 2022, Evergrande New Energy Automobile Investment holding Group Co., Ltd. was listed as the person subject to execution by the Guangzhou Intermediate people's Court, case number (2022) Yue01 Zhihui 133, the target of execution is 95290176 yuan. According to statistics, Evergrande new energy vehicles have been executed a total of 105 million yuan twice.

According to Tianyan check, Evergrande New Energy vehicle Investment holding Group Co., Ltd. was established in January 2019, headquartered in Guangzhou, Guangdong Province, with registered capital / paid-in capital of 3.5 billion US dollars. It is a subsidiary of Evergrande New Energy vehicle Holdings (Hong Kong) Co., Ltd., with a stake of 99.4% and 0.6% by Hengda Hengchi New Energy vehicle (Guangdong) Co., Ltd. The company is also a wholly owned subsidiary of Evergrande New Energy vehicle Holdings (Hong Kong) Co., Ltd.

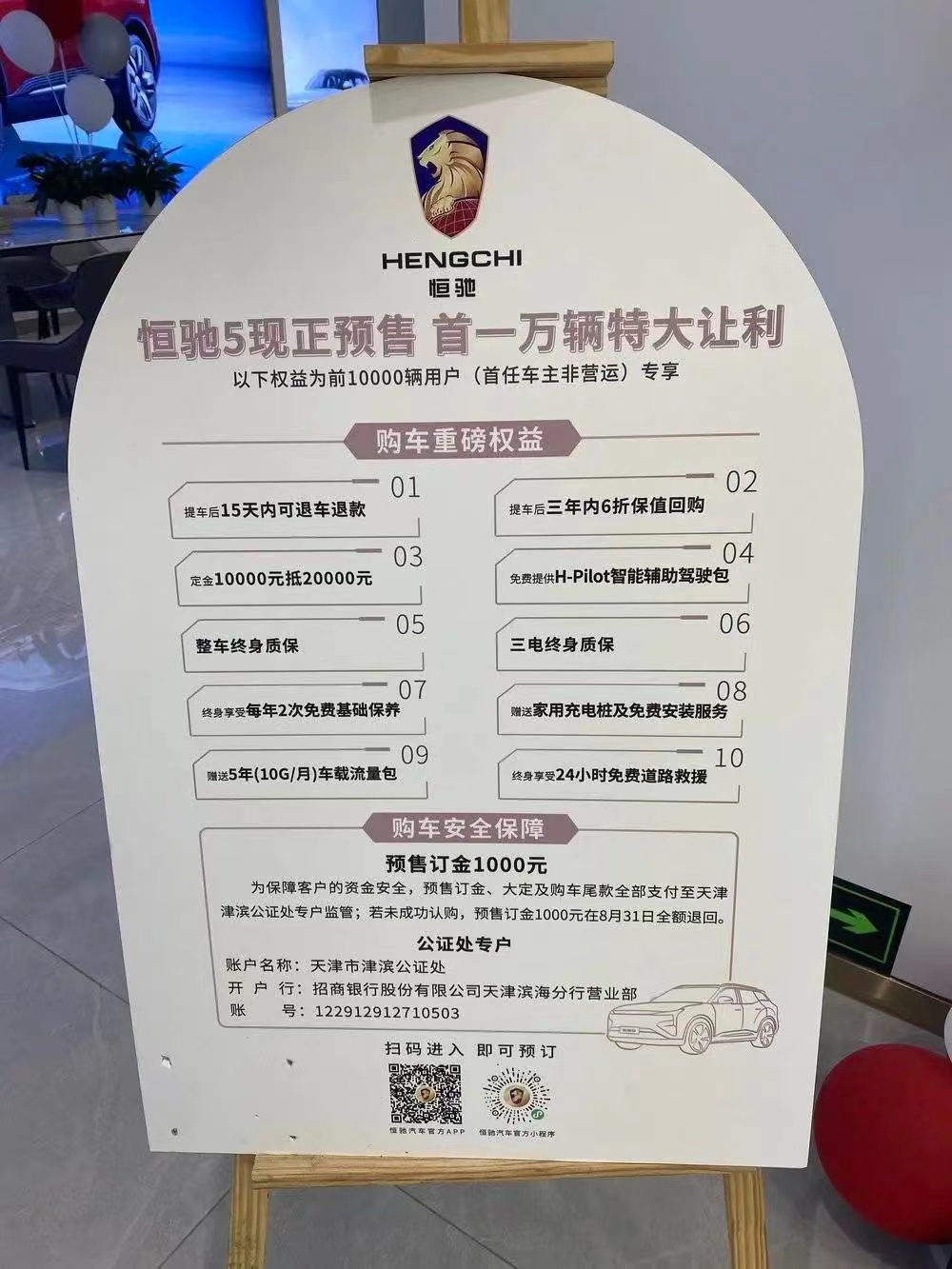

Hengchi, which is part of Evergrande New Energy vehicle Investment holding Group, officially announced the pre-price of Hengchi 5 on July 6. the new car only launched one model, and the pre-price of the deluxe version is 179000 yuan. Consumers can pay a deposit of 1000 yuan directly through Hengchi APP. At the pre-sale conference, Liu Yongzhao stressed many times that "Hengchi 5 is the best pure electric SUV within 300000". Liu Yongzhao said that Hengchi 5 uses parts from top manufacturers in the supply chain, including Bosch, mainland, Amboft, Ningde era and many other well-known supply chain enterprises have participated in the production process of Hengchi 5.

Hengchi announced at its first 720th Hengchi Festival on July 20 that the number of pre-sale orders for Hengchi 5 had reached 37000 as of around 18:04 that day. On August 1, Hengchi 5 fixed opened, and consumers who have completed the small fixed can make up the deposit and turn it into a big fixed. The first 10,000 consumers who turn to Dading enjoy the preferential activity of deducting 20,000 car payments with a deposit of 10,000. The deposit will be remitted to a special account set up by the Tianjin Binbin notarization Office in Tianjin, and the refund can be made within 15 days. Enjoy 10 benefits, including 40% discount repurchase within three years and 24-hour free road rescue for life. It can be said that Hengchi car is also afraid of being treated as a liar by the market, and the car payment directly into the notary office account is also the first move of the automobile industry.

Xu Jiayin, chairman of the board of directors of Evergrande, attended the meeting on July 11, and encouraged employees to actively participate in the sales of Hengchi 5. On the same day, Evergrande property also held an internal meeting to issue Hengchi 5 sales assessment tasks, the specific assessment tasks are subdivided from each region to each project, and the specific sales assessment indicators will be determined according to the number of owners in the community. At present, consumers are still skeptical about Hengchi. As for how many Hengchi 5 units have been sold, how much the terminal market accounts for, and how many Evergrande owners account for, I am afraid only Hengchi knows inside!

According to the plan, Hengchi 5 will be in mass production in September, deliver in October, and complete the delivery target of 10,000 vehicles by the first quarter of 2023. As a result, Hengchi 5 needs to deliver an average of 1667 vehicles per month. Of course, no matter how good the configuration is, no matter how attractive the price is, the problem of mass production cannot be avoided after all. Today, Evergrande has no more than two months left. It is understood that at present, the exhibition car in the Hengchi experience store is still trial-produced, which is still different from the final production car.

If Hengchi wants to produce in large quantities, it must burn money, and what Evergrande needs most is money. Recently, Evergrande Group has begun to seek funds to ease the pressure. On July 28, Evergrande is auctioning the whole commercial building of China Evergrande Centre in Wan Chai, with a market valuation of about HK $9 billion. Li Ka-shing's Changshi Group has submitted a tender for the property. It is understood that the Hong Kong Evergrande Center was acquired by Evergrande for HK $12.5 billion from Chinese land in 2015. Since then, there has been news that Yuexiu Real Estate may be offered HK $10.5 billion, but the deal was not completed.

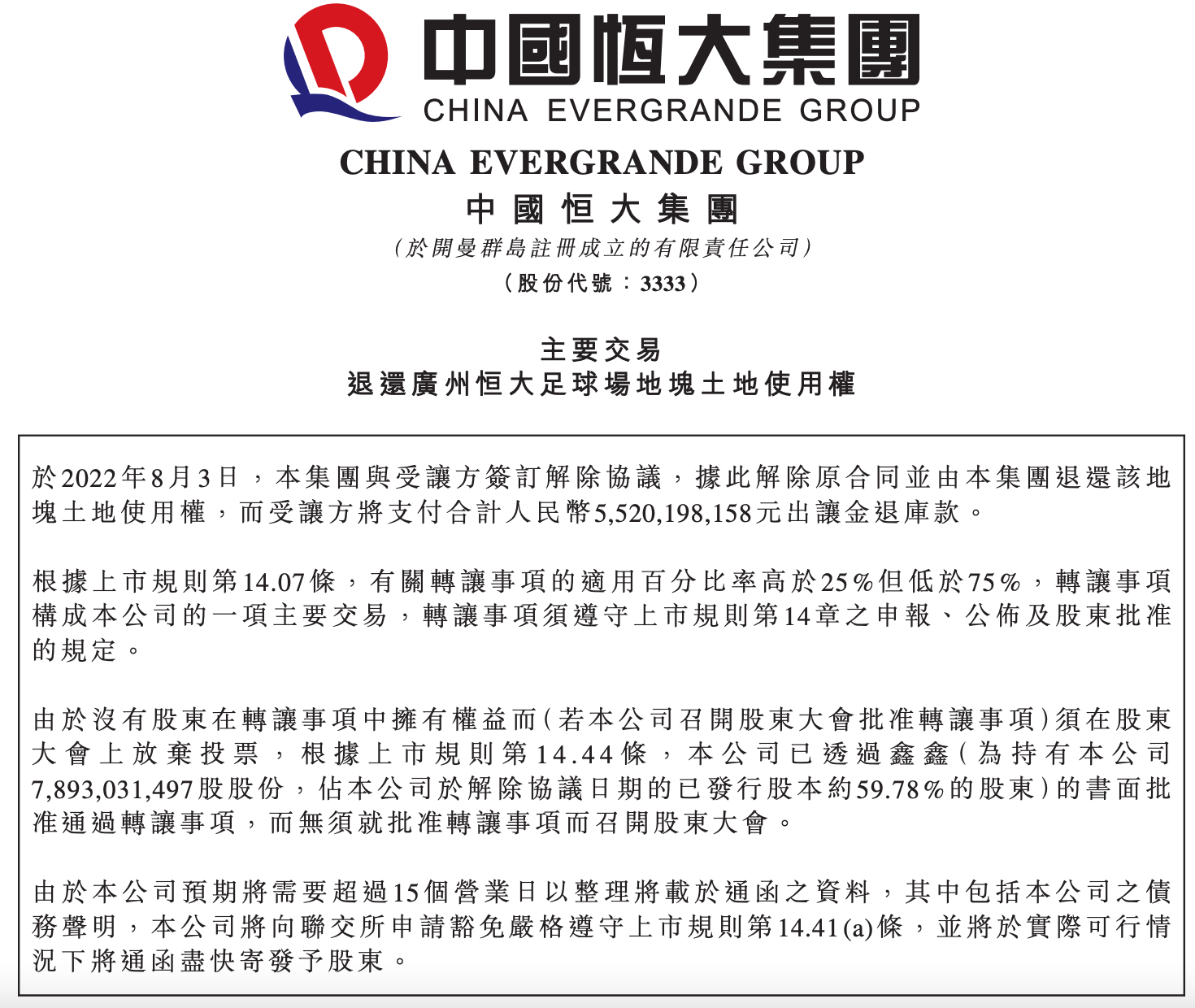

China Evergrande announced on Aug. 4 that it would return the land use right to the Guangzhou Evergrande Football Stadium and terminate the original contract with the transferee on Aug. 3, and the transferee would pay a total of 5.52 billion yuan. It is understood that Evergrande won the land of sports facilities and supporting industries in Xie Village, Panyu District, Guangzhou City, with a total area of 500000 square meters and a construction area of more than 300000 square meters in April 2020. Evergrande announced that it will invest 12 billion yuan to build a professional football field that can accommodate 100000 spectators, which is scheduled to be completed and put into use in 2022, but it has not been under construction for a year, and now the weeds are growing wildly.

According to the Alibaba auction platform on August 8, the Shenyang Intermediate people's Court of Liaoning Province will auction 1.282 billion shares (domestic shares) of Shengjing Bank held by Evergrande Group (Nanchang) Co., Ltd. from 10:00 on September 6 to 10:00 on September 7, with an estimated price of 7.563 billion yuan, with a starting price of 7.307 billion yuan, with a price increase of 2 million yuan. It is understood that Evergrande Nanchang is the first shareholder of Shengjing Bank. In order to deal with the debt crisis, Evergrande Nanchang reduced its stake in Shengjing Bank to the second shareholder twice last year, and if all the shares of Shengjing Bank held by Evergrande Nanchang are sold, the "relationship" between the two sides will end here.

On the evening of July 29, China Evergrande issued an announcement disclosing the progress and basic principles of recent business development and overseas debt restructuring. According to the announcement, China Evergrande realized contract sales of about 12.26 billion yuan in the first half of 2022, 356.79 billion yuan in the same period in 2021, with a contract sales area of 1.193 million square meters and 43.014 million square meters in the same period in 2021.

On August 3, Fortune magazine released the list of the world's top 500 companies in 2022. China Evergrande, once the big brother of the real estate company, has been kicked out!

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.