In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/20 Report--

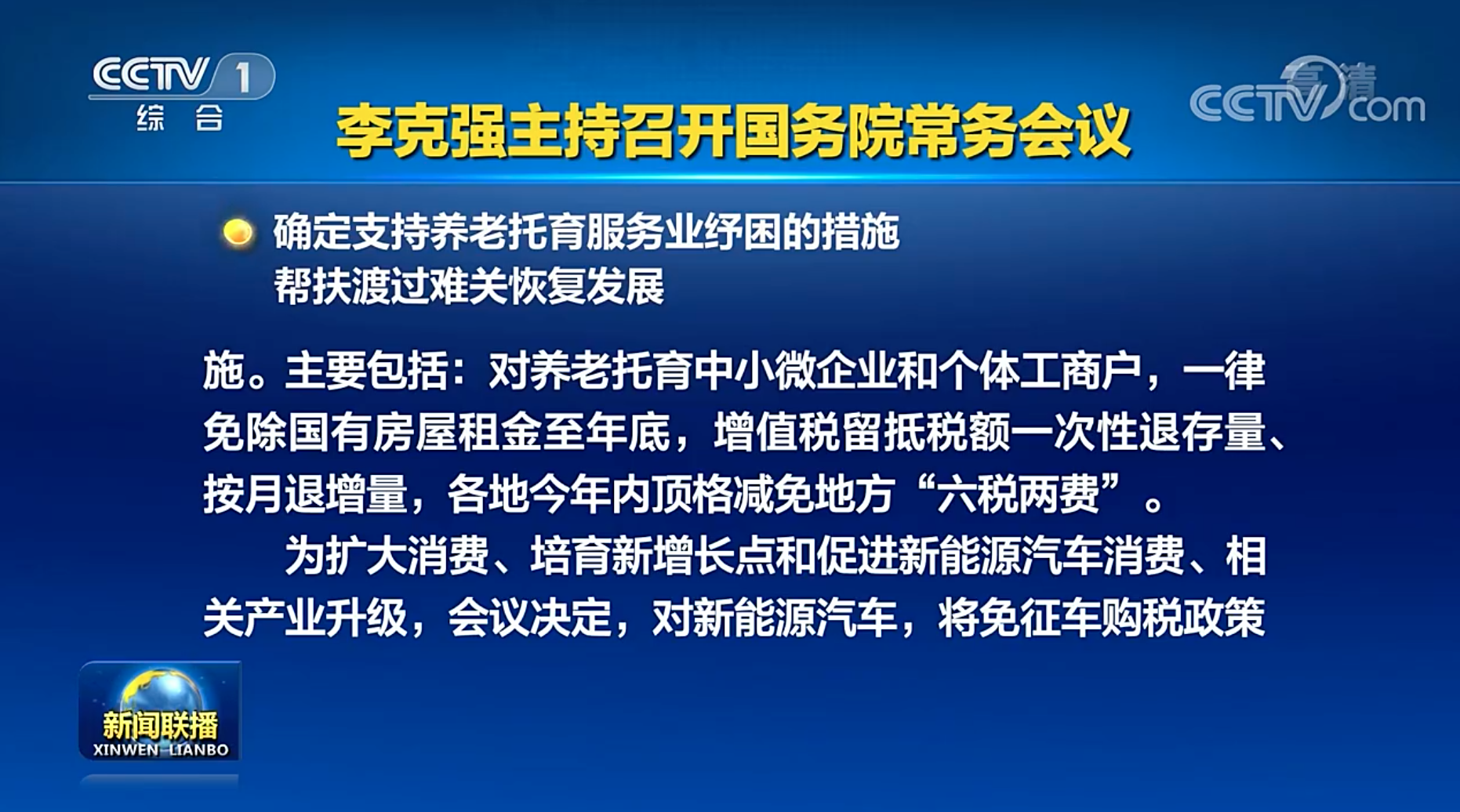

On August 19, Premier Li Keqiang presided over an executive meeting of the State Council and decided to continue the implementation of purchase tax exemption for new energy vehicles until the end of 2023, and continue to be exempted from vehicle and vessel tax, consumption tax, road rights, license plates and other support. At the same time, establish a coordination mechanism for the development of new energy automobile industry, promote the survival of the fittest and the development of supporting industries by market-oriented methods, vigorously build charging piles, and support them with policy-oriented development financial instruments.

On July 29, at the executive meeting of the State Council, it was clearly proposed to continue the purchase tax exemption policy for new energy vehicles, but it was not clear at that time when the purchase tax exemption policy for new energy vehicles would be extended. The vehicle purchase tax exemption policy would be extended to the end of 2023, i.e. for one year. This policy is the third extension of the new energy vehicle purchase tax exemption policy in China.

The automobile industry pays close attention to sorting out and understanding. This policy was implemented as early as 2014 and was originally scheduled to expire at the end of 2017. In view of the positive effect of this policy on the rapid growth of the new energy vehicle market, this policy has been extended twice before this policy, extending the implementation time of this policy in 2017 and 2020 respectively. According to the Announcement on the Continued Implementation of Preferential Policies for Vehicle Purchase Tax issued by the Ministry of Finance and the State Administration of Taxation, from January 1,2018 to December 31,2020, the purchase of new energy vehicles will be exempted from vehicle purchase tax, and this policy will be extended for three years. The executive meeting of the State Council held on March 31,2020 pointed out that in order to promote automobile consumption, it was determined to extend the purchase subsidy and purchase tax exemption policy for new energy vehicles for two years until the end of 2022.

From the perspective of relevant tax reduction policies, consumers can enjoy preferential treatment ranging from thousands of yuan to tens of thousands of yuan when purchasing most mainstream new energy models. The calculation method of vehicle purchase tax is: reduction amount =10%*[invoice price/(1+ VAT rate 13%)], which is simply understood as "vehicle invoice price/11.3". Take a new energy vehicle with an invoice price of 150,000 yuan as an example, the vehicle purchase tax can be reduced to 13,200 yuan.

According to the data of the Association, from January to July this year, the cumulative sales volume of domestic new energy vehicles was 2.733 million, an increase of 21.5% year-on-year. Among them, the sales volume of new energy vehicles in May was 360,000 vehicles, up 91.2% year-on-year; the sales volume of new energy vehicles in June was 502,000 vehicles, up 28.2% year-on-year; and the sales volume of new energy vehicles in July was 593,000 vehicles, up 1.2 times year-on-year. 5-7 One of the reasons for the rapid year-on-year growth of the domestic new energy vehicle market in September is that the Ministry of Finance and the State Administration of Taxation issued measures to reduce the purchase tax on some passenger cars and issued new policies to promote automobile consumption, etc., and the extension of the exemption from vehicle purchase tax for new energy vehicles will further stimulate the growth of sales of new energy vehicles.

Cui Dongshu, secretary-general of the Association, believes that the continuation of preferential tax policies for new energy vehicles is conducive to promoting the continued growth of the new energy vehicle market. The annual exemption of several hundred yuan of vehicle and vessel tax has little impact on the sales of new energy vehicles, but the introduction of the vehicle and vessel tax exemption policy is a kind of encouragement for the development of new energy vehicles and energy-saving vehicles. In addition, Cui Dongshu predicted that the total sales volume of new energy vehicles this year is expected to reach 6.5 million vehicles, an increase of more than 100% year-on-year; the China Automobile Association said it expected to maintain 5.5 million domestic sales of new energy vehicles throughout the year.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.