In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/24 Report--

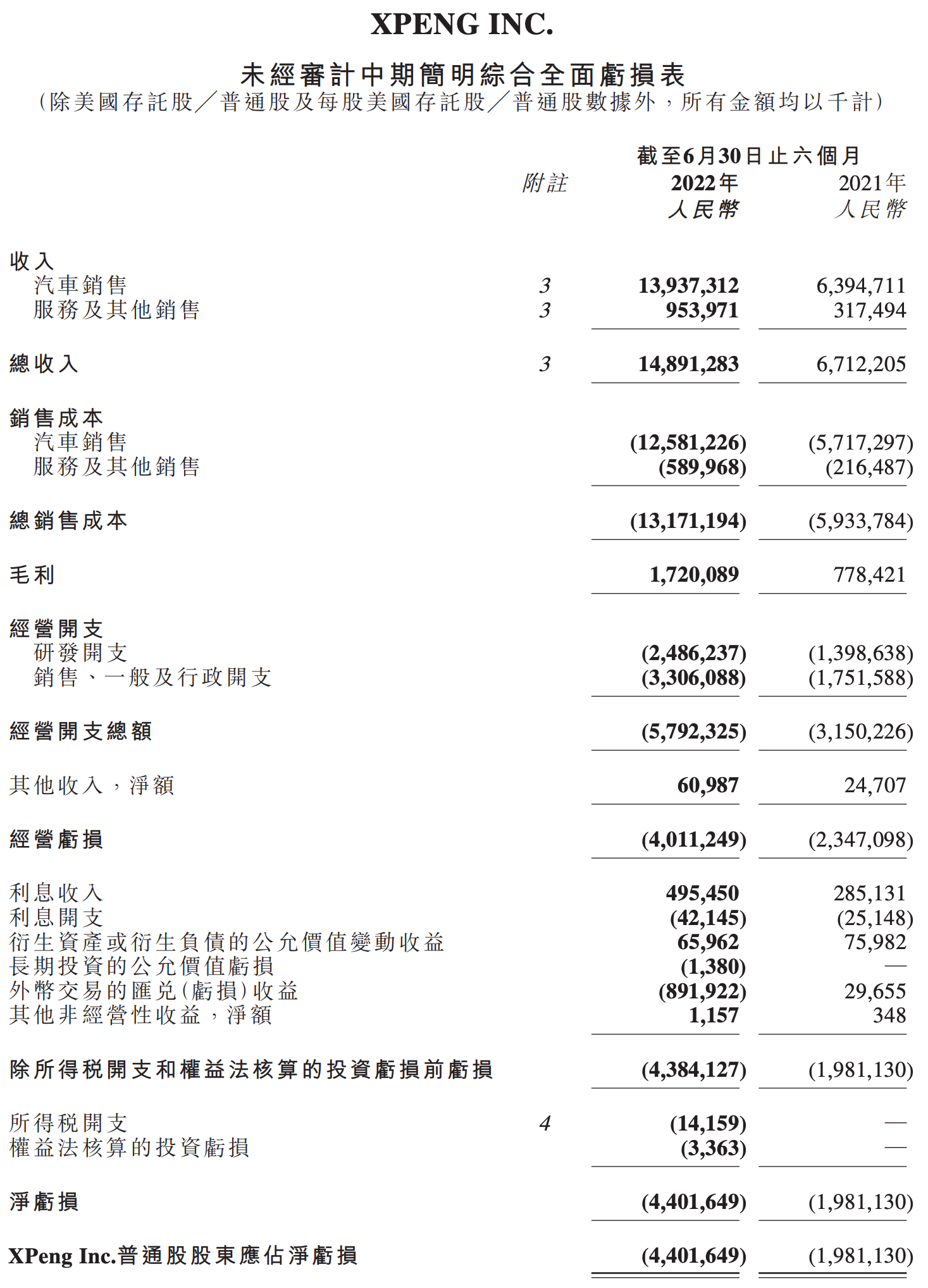

Before the US stock market opened on August 23, Xiaopeng Motor, a new force in Chinese car-making, released its second-quarter and first-half results. According to the report, Xiaopeng's total revenue in the first half of the year was 14.89 billion yuan, an increase of 121.9 percent over the same period last year, of which car sales revenue was 13.94 billion yuan, up 118.0 percent from the same period last year. Xiaopeng's cash and cash equivalents, restricted cash, short-term deposits, short-term investments and long-term deposits were 41.34 billion yuan as of June 30.

After the announcement of the results, Xiaopeng's US shares fell 10.81% to close at US $18.73, with a total market capitalization of 16.121 billion yuan.

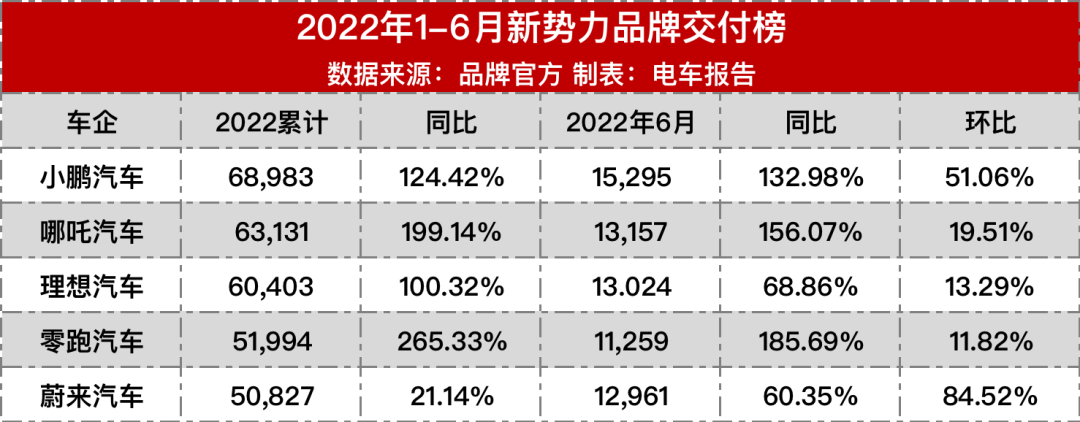

Affected by the epidemic and spare parts supply, Xiaopeng car delivery rhythm has also been disrupted, but is still ahead of the ideal, NIO. Data show that Xiaopeng delivered a total of 68983 cars in the first half of 2022, an increase of 124.4% over the same period last year, while ideal cars increased by 100.3% to 60403, and Lulai increased by 21.1% to 50827. In terms of specific models, Xiaopeng P7 delivered 35410 vehicles and Xiaopeng P5 delivered 23334 vehicles in the first half of the year.

Xiaopeng car positioning to intelligent sales and brand, is doomed to continue to increase research and development to form and consolidate advantages, at the same time is in the stage of rapid expansion, need to increase the investment of sales network and service network. Based on this, Xiaopeng Automobile in the context of delivery growth, research and development and channel expansion will suppress profits. According to the financial report, Xiaopeng spent 2.486 billion yuan on automobile research and development in the first half of the year, an increase of 77.8 percent over the same period last year, while sales, general and administrative expenses totaled 3.306 billion yuan, up 88.8 percent from the same period last year. It was revealed that Xiaopeng's auto sales network continued to expand in the first half of the year, including a total of 388 stores, covering 142 cities.

Xiaopeng's business structure is very simple, and the overall gross profit margin depends on the gross profit margin of car sales. According to the financial report, Xiaopeng's gross profit margin was 11.6% in the first half of 2022, of which the gross profit margin was 9.7%, compared with 10.6% in the same period. For comparison, the ideal car that has been published in the interim report has a gross profit margin of 22.1% in the first half, of which the gross profit margin is 21.8%.

Compared with the ideal car, Xiaopeng's gross profit margin still has a lot of room for improvement, but the rising cost is difficult to deduce the trend of rising gross profit margin. In addition, Xiaopeng Motor has been listed on the market, including G3i, P5, P7 models, of which G3i and P5 profit level is very low, need to rely on scale advantages to enhance profits, but it is clear that the scale effect has not been brought into full play. Therefore, the G9 model, which Xiaopeng plans to launch in September, will directly affect Xiaopeng's gross profit margin, but it depends on the delivery of the G9.

Xiaopeng said it expected to deliver 2.90-31000 vehicles in the third quarter, an increase of 13.0% Mel 20.8% over the same period last year, and expected total revenue of 68-7.2 billion yuan, an increase of 18.9-2.59 billion yuan. According to the announced July delivery volume, Xiaopeng is expected to deliver an average of 8738-10738 vehicles per month in August and September, which can be achieved by the P7 model, which shows that the current sales situation is really not optimistic.

It is understood that the price of power batteries generally rose in the second quarter, and the battery pricing method was changed to a linkage of metal prices, and even if the lithium price in 2022 has been revised back, the probability will remain at a higher position, and the cost pressure faced by new energy vehicle companies will continue, and price increases have become a way for major car companies to transform pressure.

As the head enterprise of the new power of domestic car building, Xiaopeng car delivery volume has increased greatly, but the gross profit margin is the lowest among the three car companies. Increasing delivery volume, raising gross profit margin and getting rid of losses are not only Xiaopeng's task. It is also an unavoidable problem for other new power brands.

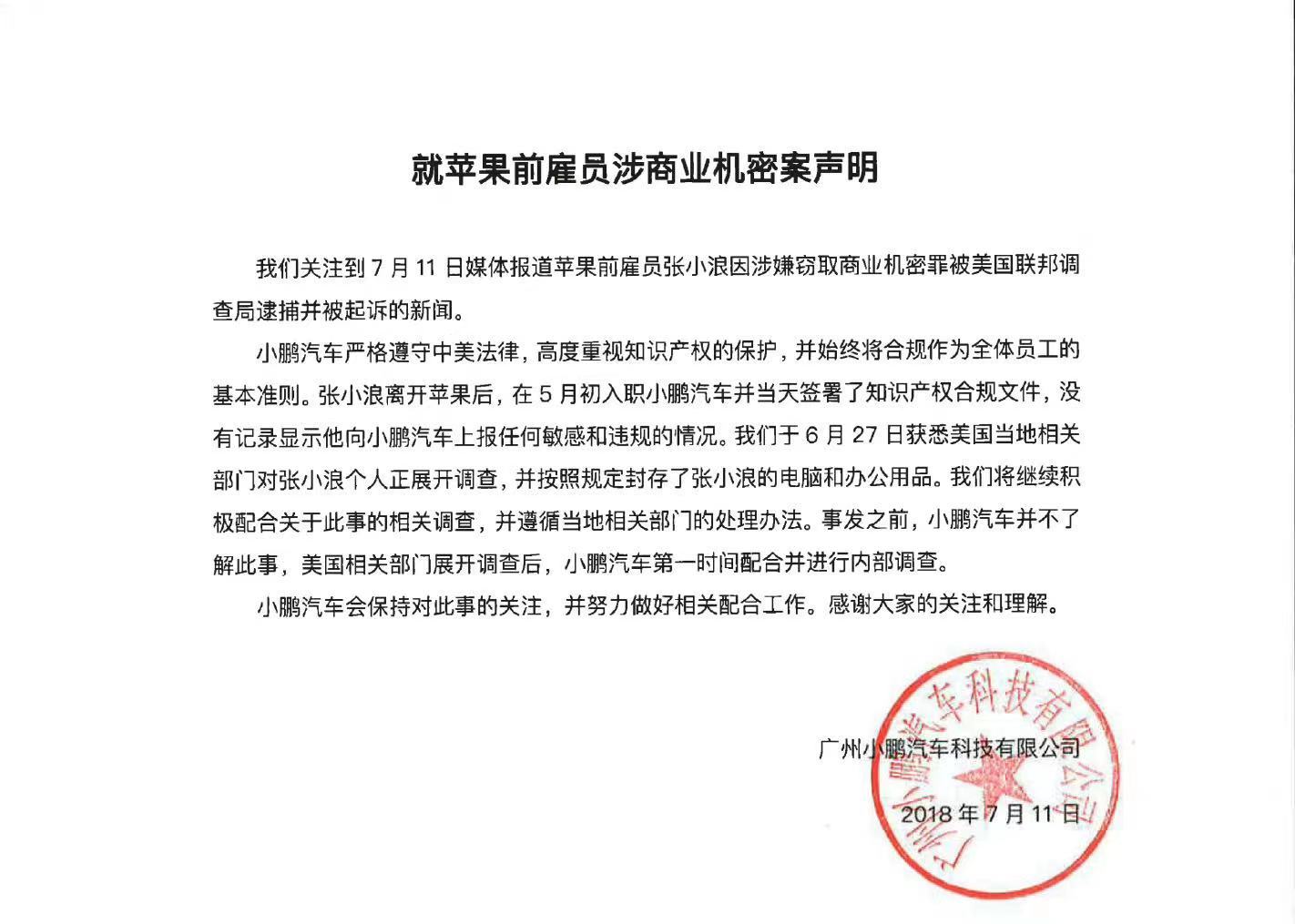

In other news, Phoenix New Media reported that Zhang Xiaolang, a former Apple engineer, pleaded guilty to a criminal charge in federal court in San Jose, California, after he was accused of stealing Apple's self-driving trade secrets before jumping ship. The judge has ordered his plea agreement to be sealed and a verdict will be delivered on November 14. Xiaopeng Automobile official issued a statement in response to whether Zhang Xiaolang, a former Apple employee, was suspected of stealing Apple's trade secrets before joining Xiaopeng Automobile, as well as the latest disclosure of the case.

In addition, some bloggers exposed information that Xiaopeng Motor has stopped the examination and approval of new energy quotas for P7, P5 and other models produced by Xiaopeng since July because it violates the policy of Shanghai New Energy Office, and the specific recovery time has yet to be determined. In this regard, Xiaopeng car customer service responded that it has been a period of time, the relevant materials have not been submitted. It is understood that this incident is due to the relocation of the Shanghai service center, the relevant information was not uploaded to the system in time, so the approval of the quota order of some customers failed, and now it has been fully restored.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.