In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/27 Report--

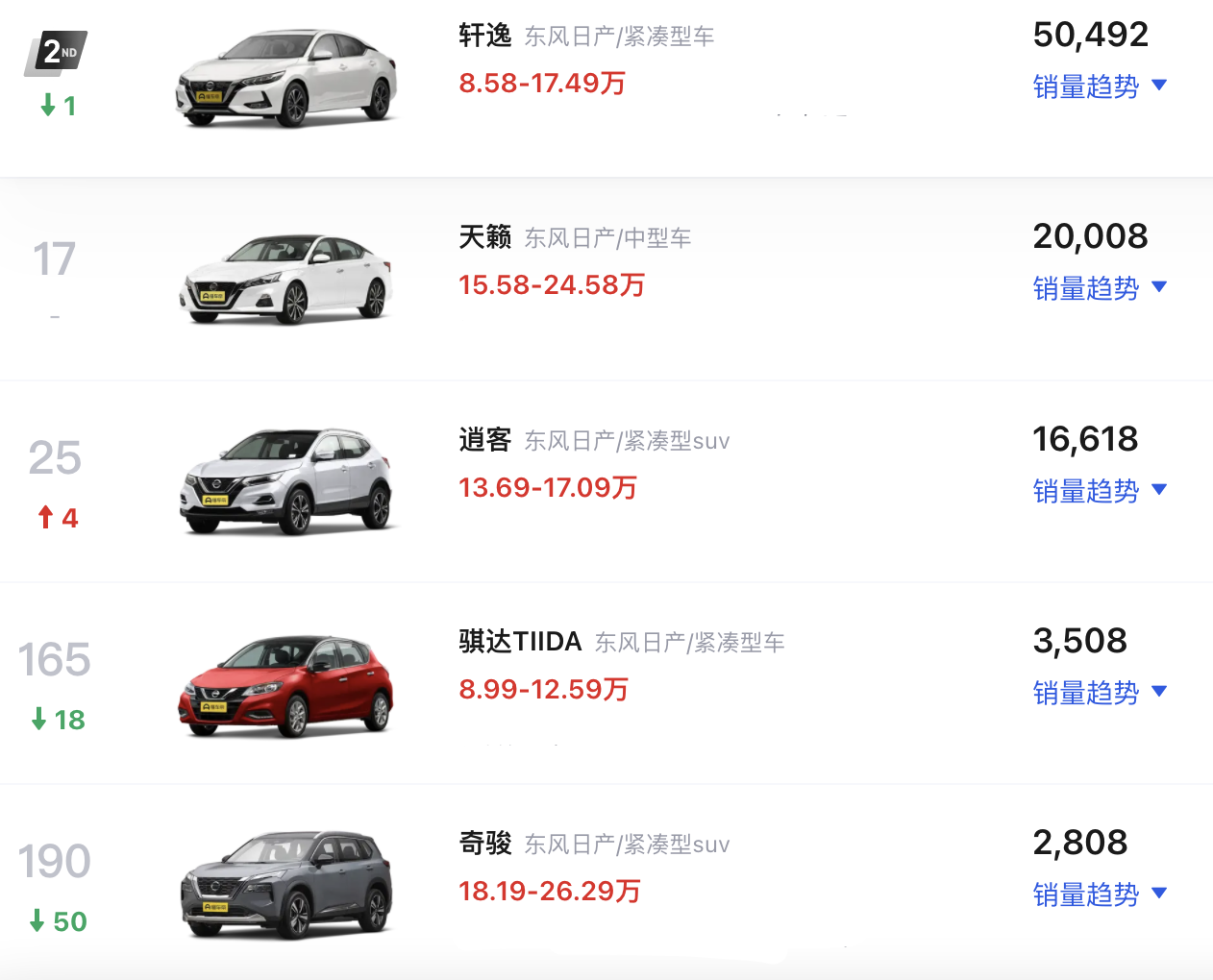

Xiaomi Group and BAIC are discussing cooperation in the production of electric vehicles, and the two companies are studying different options, including Xiaomi's purchase of a stake in the Beijing Hyundai No.2 plant, which holds a license to produce cars in China, according to media reports citing people familiar with the matter. The two sides are exploring ways to cooperate because of delays in obtaining a license to produce cars independently. Xiaomi may take over the production base of BAIC New Energy in Laixi, Qingdao, according to the Financial Associated Press.

Affected by the news, Hong Kong shares of Beijing Automobile rose rapidly in the afternoon, closing up 14.78%, with a total market capitalization of HK $18.68 billion. Beiqi Blue Valley rose sharply after noon and closed until the close, with a total market capitalization of 34.48 billion yuan. Xiaomi is in talks with BAIC to build electric cars, BAIC said: "I have not heard of it". BAIC Blue Valley Investment Relations Department responded: "have not received the relevant exact news." As for the relevant parties, the person in charge of Beijing Hyundai said he did not know, while Xiaomi Group did not respond to the rumors.

On March 30th, 2021, Xiaomi Group officially announced that it would set up a wholly-owned subsidiary in charge of intelligent electric vehicle business, with an initial investment of 10 billion yuan and an estimated investment of US $10 billion in the next 10 years. At the launch of Xiaomi's new products in spring, Lei Jun said that Xiaomi will make every effort to build Xiaomi cars with its existing cash reserves of 108 billion yuan, a research and development team of more than 10000 people, the top three mobile phone business in the world and the best smart ecology in the world.

On September 1st, 2021, Xiaomi Automobile Co., Ltd. was officially established with a registered capital of 10 billion yuan. Lei Jun, chairman and CEO of Xiaomi, served as the legal representative. On November 18, 2021, Xiaomi Automotive Technology Co., Ltd. was established with Lei Jun as its legal representative with a registered capital of 1 billion yuan. Its business scope includes vehicle manufacturing of new energy vehicles, technical research and development of vehicle parts and components, etc. The company is registered in Beijing. On November 27, 2021, the management committee of Beijing Economic and technological Development Zone signed a contract with Xiaomi Science and Technology, officially announcing that Xiaomi Motor had settled in Beijing Economic Development Zone. According to the plan, the Xiaomi automobile project will build Xiaomi automobile headquarters, sales headquarters and R & D headquarters, and will build a vehicle factory with an annual output of 300000 vehicles in two phases, with a production capacity of 150000 vehicles in the first and second phases respectively. The first car is expected to be offline and mass produced in 2024. It is reported that Xiaomi plans to launch its first model in 2024, selling 100000 in the first year and delivering a total of 900000 in the following three years.

Since Xiaomi announced the construction of cars, its crazy layout of smart cars, involving chips, lidar, self-driving, batteries and other fields. In February, Hubei Xiaomi Changjiang Industrial Fund participated in RoboSense, an intelligent lidar system technology company, in February. In the same month, Hubei Xiaomi Changjiang Industrial Fund led a round of financing in Suzhou Zhilu Environmental Protection Technology Co., Ltd. (Zhilu chilye), which is a supplier of electrical systems for new energy vehicles. In March, industrial and commercial changes took place in Kangzhi Integrated Circuit (Shanghai) Co., Ltd., and shareholders added Hubei Xiaomi Yangtze River Industrial Fund Partnership (limited partnership) and other partnerships. The company is mainly engaged in integrated circuit, chip research and development, design. In May, the industrial and commercial change occurred in Hunan Farnlet New Energy Technology Co., Ltd., adding Beijing Xiaomi Zhizhao Equity Investment Fund Partnership (Limited Partnership) and Hubei Xiaomi Yangtze River Industrial Fund Partnership (Limited Partnership) as shareholders, the company's business scope includes the development, production and sales of lithium-ion battery materials. Earlier, Xiaomi wholly-owned acquisition of self-driving start-up company Shen Shen Technology, and invested in more than a dozen upstream and downstream companies in the field of self-driving, involving self-driving, core sensors, core actuators and domain controllers, with a total investment of more than 2 billion yuan.

On August 11, Xiaomi's autumn press conference was held in Beijing. Lei Jun, chairman of Xiaomi Group, made an annual public speech for the third time to share the entrepreneurial story through the trough of life. Lei Jun said at a press conference that Xiaomi had invested a total of 3.3 billion yuan in building cars over the past 500 days.

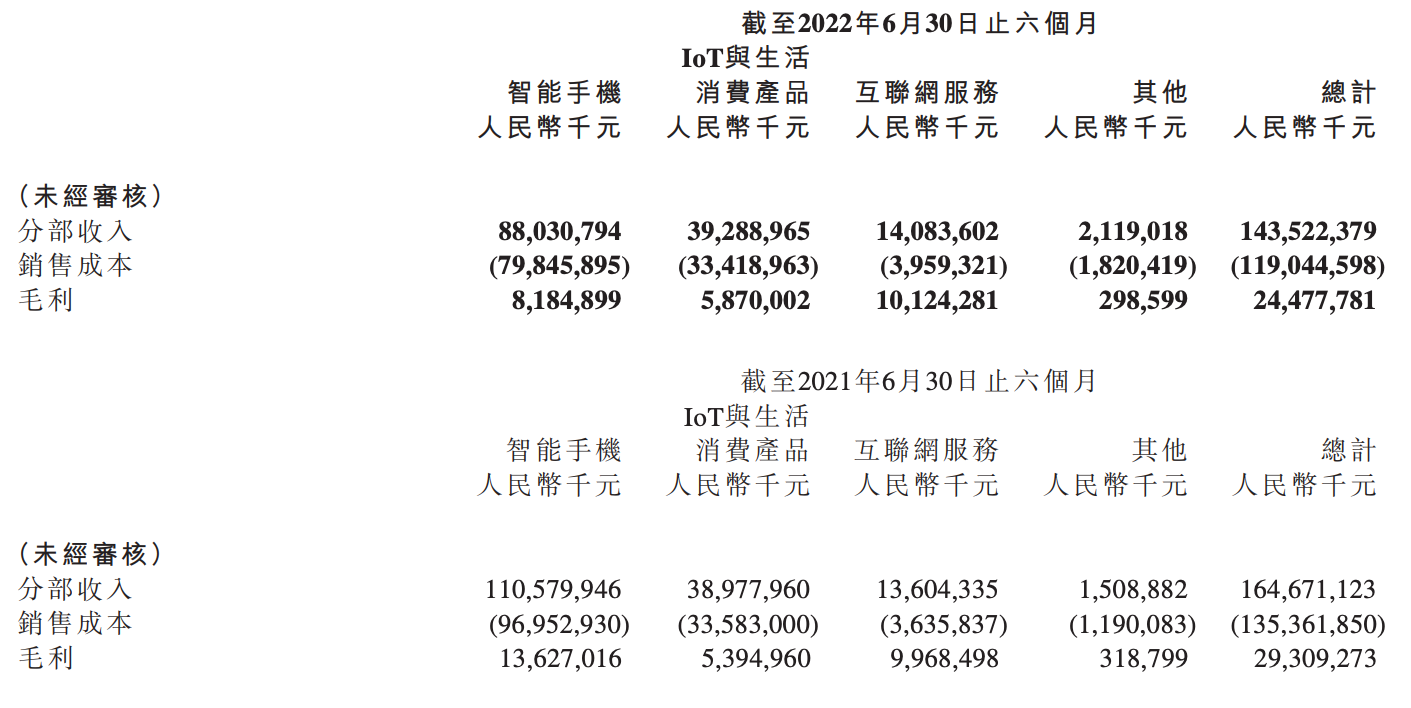

This figure shows that Xiaomi is very cautious in building cars. According to the interim report, Xiaomi spent 7.26 billion yuan on R & D in the first half of 2022, of which 3.76 billion yuan was spent in the second quarter and 3.49 billion yuan in the first quarter. In other words, compared with 3.06 billion yuan in the same period in 2021, the increase in R & D spending of 700 million yuan is less than 1/4 of the research and development of Xiaomi's mobile phone, IoT and Internet departments.

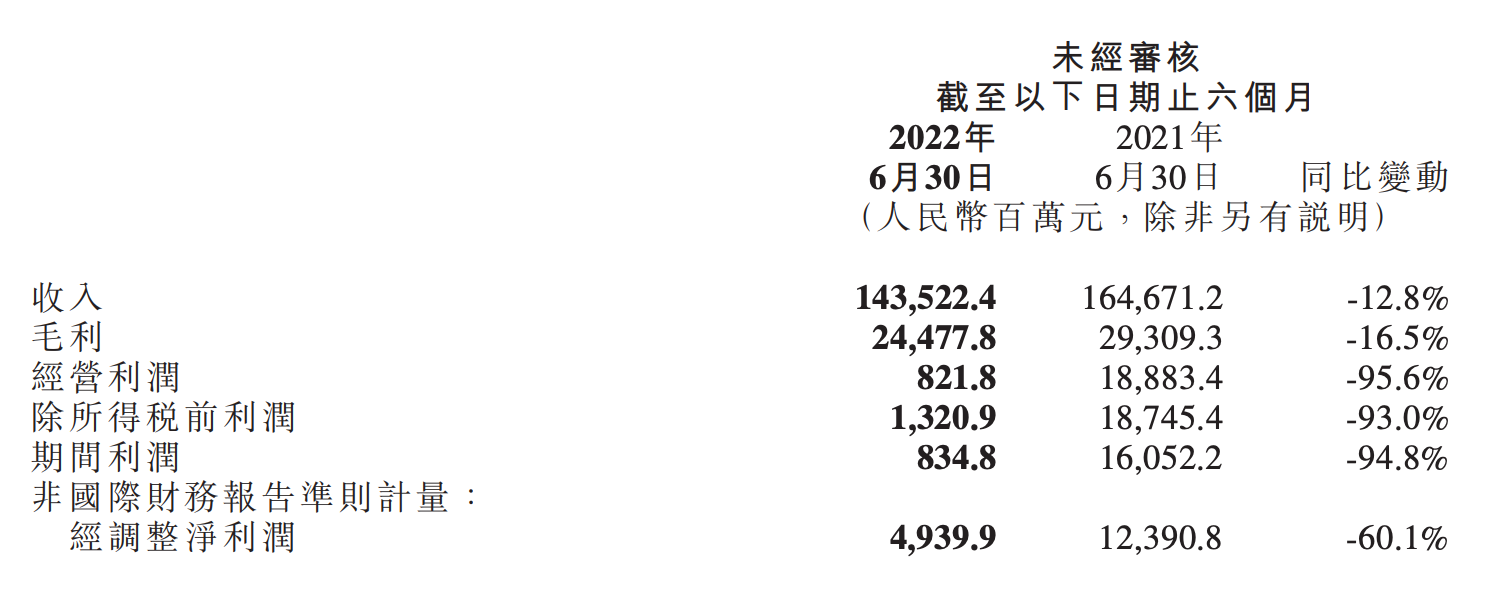

The strength and cash flow of Xiaomi car-making comes from the continuous positive cash flow of mobile phone business, while the decline in volume and price of mobile phone business makes Xiaomi car-making less confident. According to the financial report, Xiaomi's operating income in the first half of 2022 was 143.52 billion yuan, down 12.8 percent from the same period last year, and its adjusted net profit was 4.94 billion yuan, down 60.1 percent from the same period last year. It is understood that Xiaomi's revenue is mainly composed of mobile phones, IoT business and Internet services, which contributed 61.3%, 27.4% and 9.8% respectively in the first half of the year.

Judging from the results, Xiaomi is indeed at a low ebb. According to the financial report, the cost of sales of Xiaomi fell 22% in the second quarter compared with the same period last year, of which sales and promotion expenses decreased by 6.1% year-on-year, and publicity and advertising decreased by 14%. In order to reduce labor costs, the total number of Xiaomi employees fell by 924 this quarter. However, the cost savings have been transferred to the auto business, which brought in more than 600 million fees this quarter. Revenue and profits fell, expenses did not decrease, and the cash reserves on Xiaomi's account declined. As of the second quarter, Xiaomi's cash reserves stood at 28.2 billion yuan, down 6.1 billion yuan from the previous quarter.

A year ago, Lei Jun also set up Flag: this is the last major start-up project in his life, and he is willing to bet all his reputation to lead the team to fight for Xiaomi cars.

On January 4, 2021, Xiaomi Group closed at HK $35.3, the highest since its listing. On that day, Lei Jun seriously said to his employees, "Futu, Tiger, flush, Snowball, Big Wisdom, and optional stocks. All these stock software can be uninstalled. I don't have to care about the stock price anymore!" However, it was also from that day that Xiaomi Group's share price began to decline. As of the latest trading day, Xiaomi shares closed at HK $11.80, with a total market capitalization of HK $295.35 billion, down 66 per cent from its peak.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.