In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/01 Report--

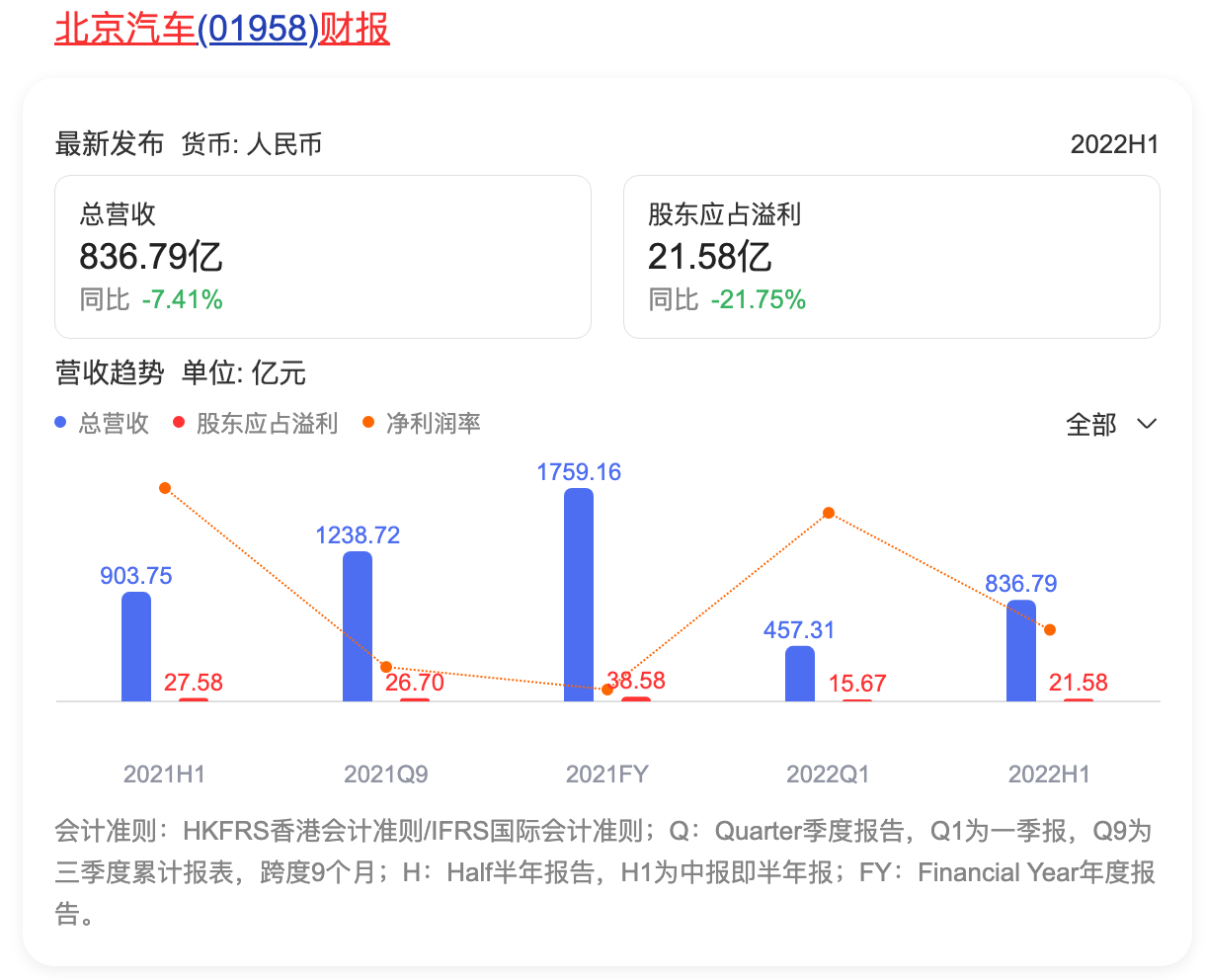

Recently, Beijing Automobile Co., Ltd.(hereinafter referred to as "Beijing Automobile") released its semi-annual performance report for 2022. The report shows that in the first half of the year, Beijing Automobile realized revenue of 83.679 billion yuan, down 7.41% year-on-year; profit attributable to shareholders was 2.178 billion yuan, down 21.75% year-on-year;

In the past six months, due to the supply of parts, rising prices of raw materials and the impact of the epidemic, the production, operation and profitability of all large vehicle enterprises have been affected to varying degrees. As a profit cow owned by Beijing Automobile, the sales volume of Beijing Mercedes-Benz declined significantly in the first half of the year, which affected the performance of Beijing Automobile.

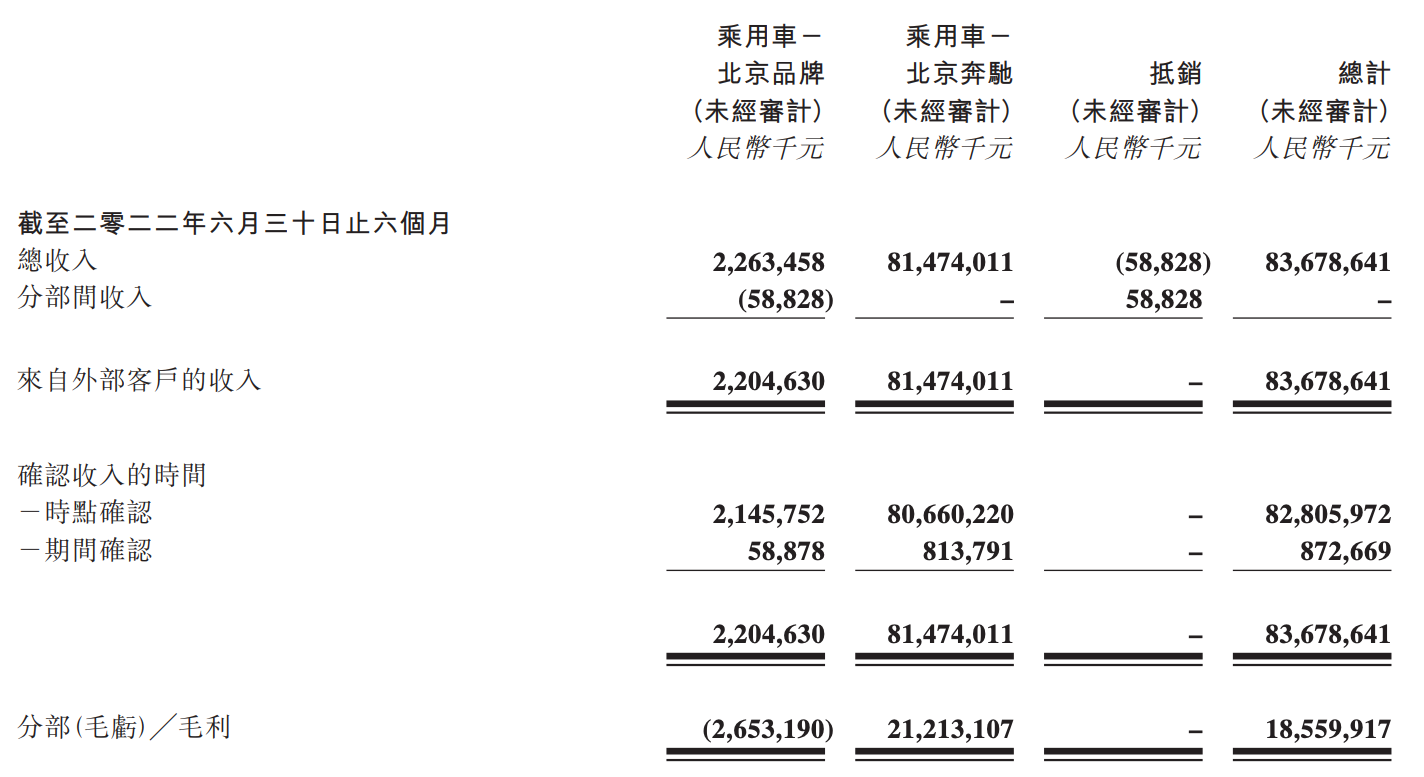

For example, Beijing brand automobile and Beijing Benz, the independent brands of Beijing Automobile, accounted for 2.64% and 97.36% of the total revenue of the company respectively. In the first half of 2022, the revenue of Beijing brand from external customers was CNY 2.205 billion and that of Beijing Benz was CNY 81.474 billion. The income gap between the two segments was huge. In addition, from the gross profit contribution, Beijing brand gross loss in the first half of 2022 was 2.653 billion yuan, while Beijing Benz contributed gross profit of 21.213 billion yuan. From the financial report to see, In the first half of Beijing car revenue basically comes from Beijing Benz, And if exclude Beijing Benz, Beijing car is in the loss state, Enough to see Beijing Benz to Beijing car importance.

Beijing Automobile is one of the five largest automobile groups in China, mainly engaged in passenger car R & D and manufacturing, parts manufacturing, automobile service trade, R & D, education and investment and financing, among which passenger car business is carried out through Beijing Benz, Beijing Hyundai, Fujian Benz and Beijing brands.

According to the data, Beijing Benz is a joint venture company formally established between Mercedes-Benz Group and Beijing Automobile on August 8,2005. Its headquarters is located in Beijing Economic and Technological Development Zone, of which Beijing Automobile holds 51%, Mercedes-Benz Greater China Investment Company and Mercedes-Benz Group hold 49% in total. Data show that Beijing Mercedes-Benz sales in the first half of the year 266,700 vehicles, Year-on-year decline of 15.54%.

Beijing Auto is deeply bound to Beijing Mercedes-Benz, and the decline in sales leads to a decline in revenue, which will further affect Beijing Auto's performance. However, as long as Beijing Benz is still there, Beijing Auto can lie down and make money. In order to improve profitability, BAIC Group announced on December 13,2021 that it increased its stake in Mercedes-Benz Group to 9.98%, becoming the largest shareholder of Mercedes-Benz.

At present, BAIC Group relies on Beijing Benz blood transfusion as a whole, Beijing Benz is responsible for making money, and other sectors are responsible for spending money. Beijing brand is an independent brand of Beijing automobile, with more than ten models on sale. The products cover fuel models of cars and SUVs and new energy models. The revenue in the first half of the year is 2.205 billion yuan, down 4.8% year-on-year, mainly due to the year-on-year decline in sales volume of Beijing brand and adjustment of product structure.

In addition, Beijing Hyundai, a 50:50 joint venture between Beijing Automobile Investment Co., Ltd. and Hyundai Auto Co., Ltd., sold 93,900 vehicles in the first half of the year, down 51.55% year-on-year. However, both shareholders placed high hopes on it, adding $942 million (about 5.993 billion yuan) to Beijing Hyundai on March 18, maintaining the 50:50 share ratio unchanged. As for the purpose of capital increase, it will provide fund guarantee for the introduction of new products in the future, increase the layout of new energy vehicles and expand exports.

For Beijing Auto, Beijing Benz is a profit cow, and for Mercedes-Benz, it is also an important channel in the global market. However, blindly relying on joint venture brands to generate revenue is also a common problem of major domestic joint venture manufacturers. Taking Brilliance Group as an example, from 2015 to 2019, Brilliance Automobile Group realized net profits of 3.494 billion yuan, 3.682 billion yuan, 4.376 billion yuan, 5.876 billion yuan and 6.763 billion yuan respectively. Excluding Brilliance BMW, it realized net losses of 334 million yuan, 316 million yuan, 862 million yuan, 424 million yuan and 863 million yuan. In the first half of 2020, the net profit of Brilliance Group increased by 25.24% year-on-year to 4.045 billion yuan, but the net loss after excluding Brilliance BMW was 340 million yuan.

This kind of joint venture automobile enterprise independent brand performance is not good, many years ago to market for technology assumption did not meet expectations, industry reform also began to test the water. At present, BMW Group's shareholding ratio in Brilliance BMW has increased from 50% to 75%, gaining more say. Predictably, BMW and Brilliance are the first in the industry to adjust their share ratios, and once Mercedes-Benz Group wants to increase its stake in Beijing Benz, Beijing Auto's days of lying and making money are coming to an end.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.