In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/02 Report--

Recently, according to the announcement issued by the huge Group on receiving the notice of the auction of the shares of the original controlling shareholder, it said it had received a notice from the Beijing No. 3 Intermediate people's Court. In the civil enforcement case between Guokai Securities Co., Ltd. and Pang Qinghua, Tangshan Jidong material Trade Group Co., Ltd., the Beijing No. 3 Intermediate people's Court will dispose of 253.228 million shares of huge group shares held by Mr. Pang Qinghua. The first online judicial auction will be held on Taobao from 10:00 to 10:00 on September 26th.

According to the announcement of the auction notice issued, the 1.8362666 billion shares held by Pang Qinghua and his associated natural persons have been transferred (accounting for 87.87% of the freely transferred shares), and the remaining 253.565 million shares held by Pang Qinghua (12.13% of the unpaid transferred shares) have not yet been transferred because the pledge has not yet been completed. According to an earlier announcement, the shares were pledged to Guokai Securities (stock pledge buybacks), and all the shares were frozen by its creditors and waiting for a freeze.

According to the relevant data: Pang Qinghua is the founder of the huge Group, the huge Automobile Trade Group Co., Ltd. was established in 2003, with a registered capital of 413 million yuan. Huge Group used to be a large domestic car dealer, with the title of "king of 4S stores". According to relevant data, the giant group once had 1035 distribution outlets across the country, including 834 specialty stores, 134 auto supermarkets and 69 shopping malls. In April 2011, the giant group was listed on the Shanghai Stock Exchange with a market capitalization of about 63 billion yuan, becoming the first domestic car dealer to enter the A-share market through IPO in 2011.

However, since 2018, the giant group has been hearing the news of business problems such as the closure of its distribution stores, layoffs, wage cuts, personnel turmoil, and the sale of some 4S stores to alleviate financial difficulties. By the end of 2018, there were 806 operating outlets nationwide, a decrease of 229 compared with 2017. In 2019, Pang Qinghua himself lost control of the company in 2020 after being applied for restructuring by creditors after failing to repay the maturing debt on time. Today, Huang Jihong is the actual controller of the company.

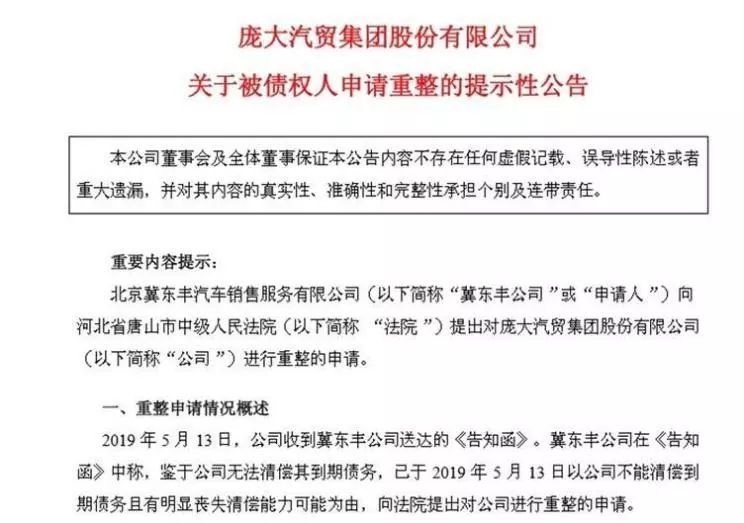

On May 14, 2019, the giant group issued an announcement called "indicative announcement on the application for restructuring by creditors". According to the announcement, the giant group borrowed 17 million yuan from Jidongfeng Company on May 4, 2017 for a period of one year, but failed to pay off its debts due to financial problems. Therefore, Jidong Feng Company applied to the court for bankruptcy reorganization of the huge group on the grounds that the huge group was unable to repay its debts. Pang Qinghua said at the time of the announcement: "it is not because of huge insolvency that bankruptcy restructuring is filed, the fundamental reason is that large groups have capital flow problems in repaying bank debts."

In September 2019, the Tangshan Intermediate people's Court ruled to accept the company's application for restructuring on the grounds that it was too large to pay off its maturing debts and that it was obviously insolvent. In December 2019, the bankruptcy reorganization of the huge group was completed, and the Shenzhen Commercial Group, Yuanwei assets and national transport capacity were formally identified as the restructuring investors of the huge group. However, it is difficult for the restructured large group to return to the glorious period of the past. According to the interim report released by the giant group recently, the operating income in the first half of 2022 was 12.63 billion yuan, down 13.9% from the same period last year, and the net profit was 240 million yuan, down 95.9% from the same period last year. According to the huge side, on the one hand, the reason for the performance pre-reduction is that operating income has declined compared with the same period last year, and the gross profit margin on sales has declined, resulting in a decline in non-net profit compared with the same period last year; on the other hand, the amount of non-recurrent profit and loss arising from the disposal of shares in subsidiaries has decreased compared with the same period last year.

When great changes have taken place in China's auto market, traditional car brands are facing a reshuffle, and car dealers can not avoid the fate of shuffling. Perhaps what happens to large groups is just a microcosm of the current auto market. According to relevant data, as of June 30, 2022, the giant group had only 281 outlets, including 40 luxury brand stores and 213 mid-and high-end 4S stores, a nearly four-fold reduction compared with the highlight period.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.