In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/10 Report--

On September 7, NIO finally released its semi-annual performance report. At this point, the non-performance transcripts of the three new power enterprises of "Wei Xiaoli" have all been handed over.

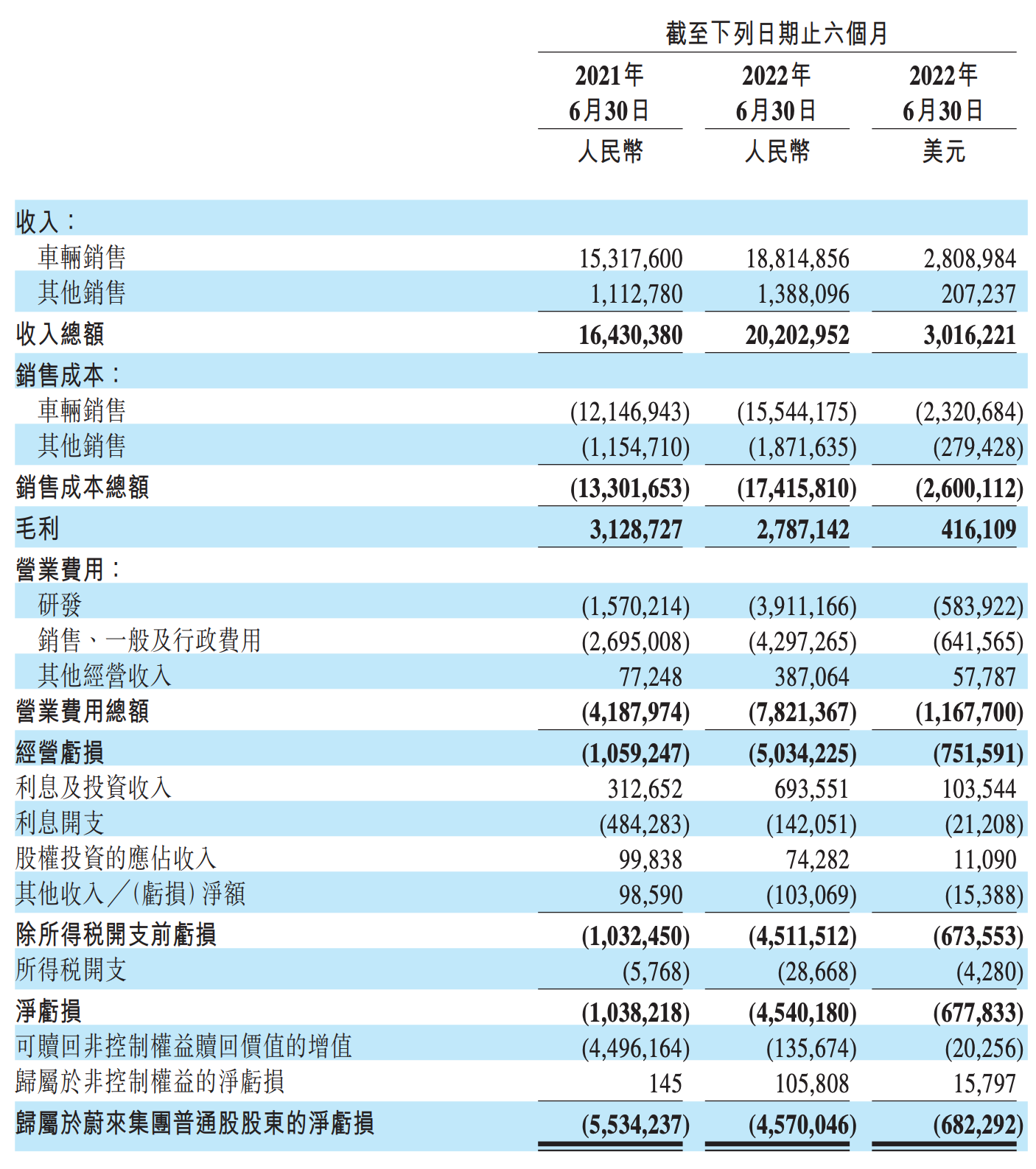

As the last car company to hand in its report card, NIO realized operating income of 20.2 billion yuan in the first half of the year, an increase of 23.0% over the same period last year, of which car sales were 18.82 billion yuan, up 22.8% over the same period last year, and a net loss of 4.57 billion yuan, down 14.4% from the same period last year. Judging from the data, while revenue is growing, losses are also decreasing, which is a good phenomenon, but in the second quarter, NIO posted a net loss of 2.75 billion yuan, an increase of 316.4 percent over the same period last year, and a 50.4 percent increase compared with a net loss of 1.825 billion yuan in the first quarter. Wei Lai said that the increase in expenses such as research and development and the rising cost of vehicle sales were the main reasons for the expansion of losses in the second quarter. According to statistics, from 2016 to the first half of 2022, the cumulative net loss attributed to common shareholders was about 66.6 billion yuan.

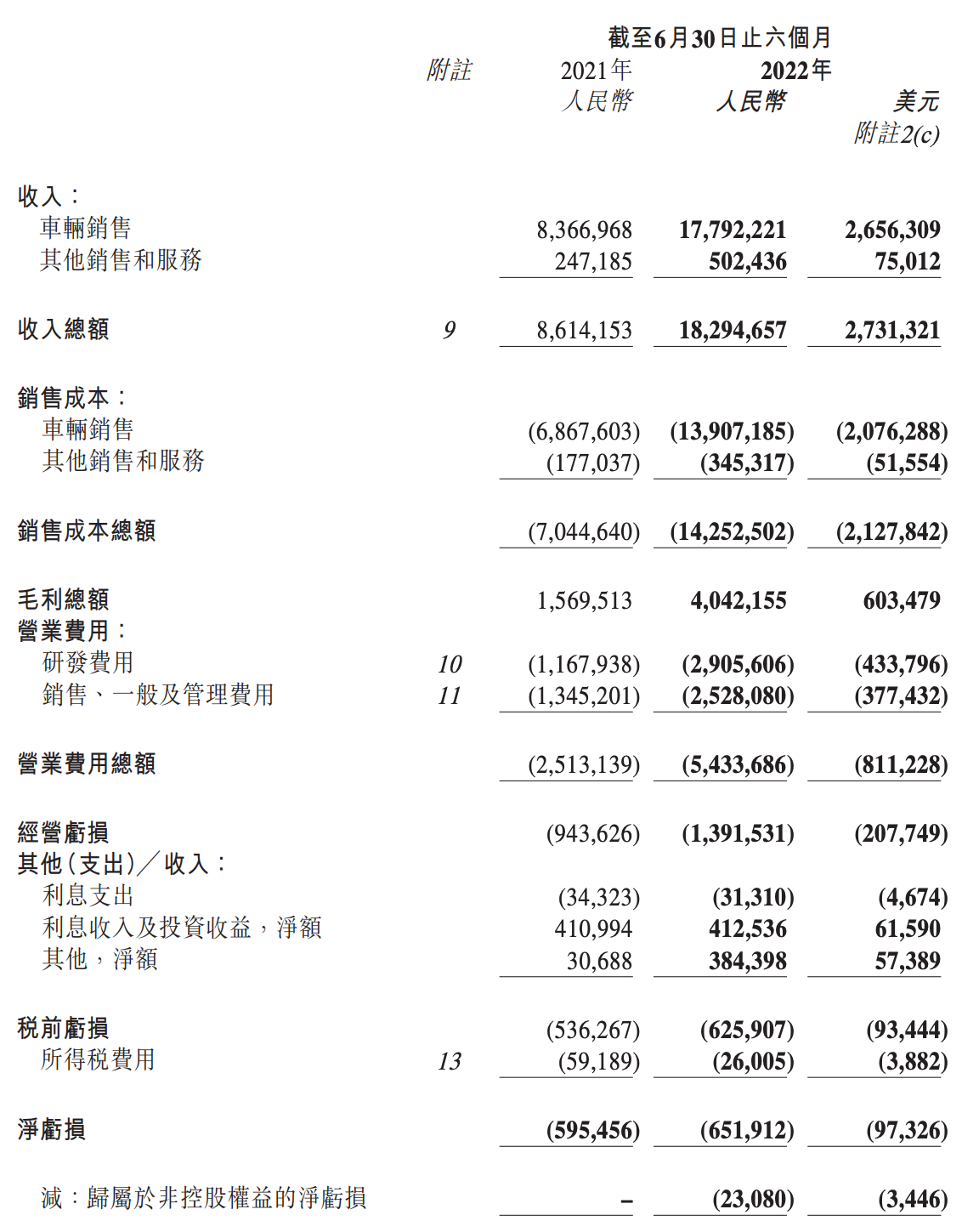

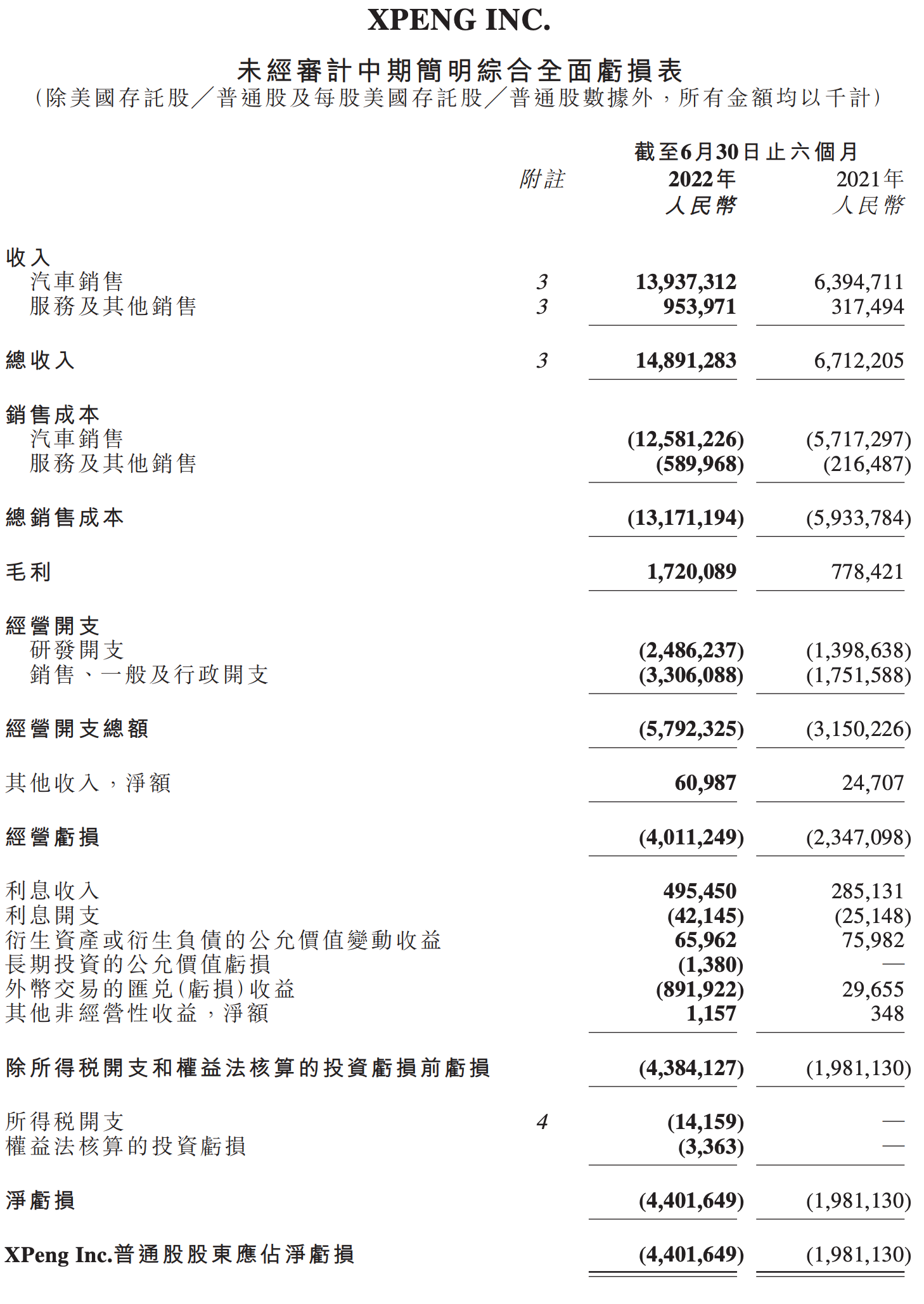

For the other two enterprises, Xiaopeng's total income in the first half of the year was 14.89 billion yuan, an increase of 121.9% over the same period last year, of which automobile sales revenue was 13.94 billion yuan, up 118.0% over the same period last year, and a net loss of 4.4 billion yuan, an increase of 122.2% over the same period last year. Ideal car is a relatively comfortable company, with an operating income of 18.3 billion yuan in the first half of the year, an increase of 112.4% over the same period last year, of which car sales were 17.99 billion yuan, up 112.6% over the same period last year, and a net loss of 650 million yuan in the first half, an increase of 9.5% over the same period last year.

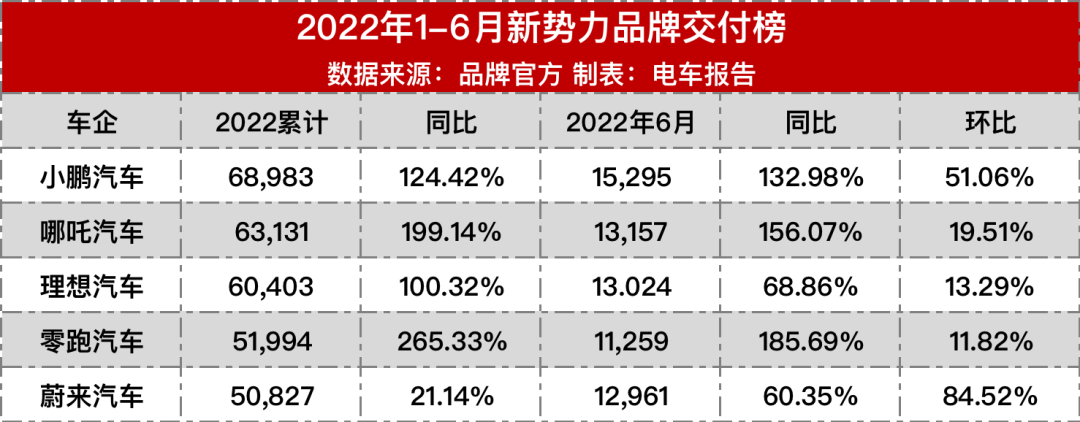

In terms of sales volume, Xiaopeng delivered far more than the other two car companies, with a total delivery volume of 68983 vehicles in the first half of the year, including 35410 for P7, 23334 for P5 and 10239 for G3. Although Xilai Motors has a wide range of models on sale, including ES8, ES6, EC6, ET7 and other models, the sales performance in the first half of the year is not considerable, with a total of 50827 new cars delivered, an increase of only 21.1% over the same period. Especially in the second quarter, due to the impact of the epidemic and spare parts supply, the delivery volume of ES8, ES6 and EC6 all dropped sharply compared with the same period. As for ideal car, although it has only the ideal ONE model on sale, its sales are not inferior, with a total of 60403 new cars delivered in the first half of the year, an increase of 100.3% over the same period last year.

Each company has a different product strategy, and high sales does not mean high income. In the first half of the year, Xiaopeng's total income was 14.89 billion yuan, of which the vehicle sales income was 13.94 billion yuan, while the ideal automobile product was single, and the price was relatively stable. The total income in the second half of the year was 18.29 billion yuan, of which the vehicle sales income was 17.79 billion yuan. As for Xilai Automobile, although the delivery volume is at the bottom, the product positioning is high and the price is expensive. The total income in the first half of the year reached 20.2 billion yuan, of which the vehicle sales income was 18.82 billion yuan, which was the best among the three enterprises.

Xiaopeng's new car is the most sold, but at the same time the loss is also further expanded. Specifically, the net loss of NIO in the first half of the year is 4.57 billion yuan, which has exceeded the amount of net loss for the whole year of 2021, while ideal car is the most comfortable, with a net loss of only 650 million yuan in the first half, while Xiaopeng Motor has a net loss of 4.4 billion yuan. Of course, the ideal car loss is at least for a reason, its first half of the R & D expenditure of 2.01 billion yuan, sales management expenditure of 2.53 billion yuan, are lower than Xiaopeng and NIO.

In addition, with the rise in the price of upstream raw materials, it will also restrict the overall profitability of the new power brand. Xiaopeng announced the price adjustment of its models on the evening of March 18. affected by the continuous sharp rise in the price of raw materials upstream, Xiaopeng will adjust the prices of models on sale, ranging from 10100 yuan to 20, 000 yuan before the subsidy. The price adjustment will take effect from 00:00 on March 21. Ideal Motors said on Weibo on March 23 that due to the continuous sharp rise in upstream raw materials, the ideal ONE price will be adjusted from April 1, 2022, and the national unified retail price will be raised to 349800 yuan from the current 338000 yuan, an increase of 11800 yuan. On May 10th, NIOguanxuan raised the price, raising the starting price of each version of ES8, ES6 and EC6 by 10000 yuan. On May 13, Xilai announced that due to the recent continuous rise in global raw material prices, the starting price of all Lailai ET7 models has been raised by 10, 000 yuan.

Although according to the sales data of new energy in China in 2021, both production and sales have exceeded 3.5 million, an increase of 1.6 times over the same period last year, but there are more and more competitors in the racetrack of new energy vehicles, accelerating the speed of reshuffling the head of the new energy industry. The former ranking of "Wei Xiaoli" no longer exists, the new energy vehicle market has begun the first round of elimination, and how to get out of losses has become a dilemma that major new energy vehicle companies have to face. Of course, focusing on the domestic market, besides Tesla and BYD, the brands with the best development in the field of new energy vehicles are also ranked among Ulai, Xiaopeng and ideal, but the ratio of new energy cars to manufacturing is a protracted war, which has long been recognized in the industry, while the three car companies are still in a state of loss, where is the turning point for turning losses into profits? This is also a difficult problem for long-term development.

The development of new energy vehicles is a long battle, and "Wei Xiaoli" has successively completed the listing of US stocks and Hong Kong stocks, storing a large number of "guns and ammunition" for the war. By the end of June this year, NIO, Xiaopeng and ideal had cash on hand of 54.4 billion yuan, 53.65 billion yuan and 41.339 billion yuan, respectively.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.